PolicyBazaar IPO Details:

IPO Date: Nov’1st to Nov’3rd 2021

Total Shares for subscription: ~5.74 Cr

IPO Size: ~Rs. 5,625 Cr

Lot Size: 15 shares

Price Band: Rs. 940-980/ share

Market Capitalization: ~44000 Cr

Recommendation: Subscribe for risk takers

Proceeds of the offer:

The net proceeds from the IPO will be paid out to existing shareholders up to Rs. 1,950 Cr and the remaining towards the following:

- For enhancing visibility and awareness of the company’s brands- “Policybazaar” and “Paisabazaar” – Rs.1,500 Cr;

- New opportunities to expand the company’s consumer base including offline presence – Rs.375 Cr

- Funding strategic investments and acquisitions – Rs.600 Cr;

- Expanding presence outside India – Rs.375 Cr and

- General corporate purposes.

About the PB Fintech Ltd

PB Fintech is India’s leading online platform for insurance and lending products. The company provides convenient access to insurance, credit, and other financial products and aims to create awareness in India about the financial impact of death, disease, and damage. Its brand Policybazaar.com is widely known.

Policybazaar was launched by PB Fintech in 2008 with an aim to cater to consumers who need more information, choice, and transparency in insurance policies. Policybazaar is an online platform for consumers and insurer partners to buy and sell insurance products. 51 insurer partners offered over 340 terms, health, motor, home, and travel insurance products on the policy bazaar platform, as of March 2021.

PB Fintech also launched Paisabazaar in 2014 intending to provide ease, convenience, and transparency in selecting a variety of personal loans and credit cards for the consumers.

Offerings of the PB Fintech Ltd

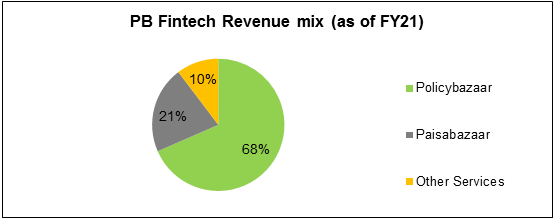

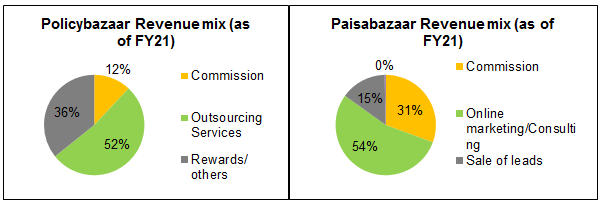

The insurance business forms a dominant part of the business. 68% of the revenue comes from Insurance web aggregator services.

Policybazaar offers its users with

- Pre-purchase research,

- Purchase, including application, inspection, medical check-up, and payment; and

- Post-purchase policy management, including claims facilitation, renewals, cancellations, and refunds.

The company’s technology solutions are focused on automation and self-service-driven consumer experiences requiring minimal human intervention. In FY20, Policybazaar was the largest digital insurance marketplace in the country with a market share of 93.4% based on the number of policies sold. In the same year, 65.3% of all digital insurance sales in India by volume were transacted through Policybazaar.

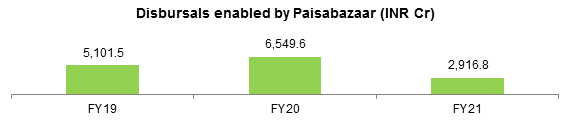

For Paisabazaar, the company has partnered with 54 large banks, NBFCs, and fintech lenders offering a wide choice of products to consumers across personal credit categories, including personal loans, business loans, credit cards, home loans, and loans against property. Paisabazaar was the largest digital consumer credit marketplace in the country with a market share of 51.4%, based on disbursals in FY20.

Financials:

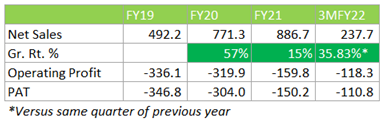

PB Fintech has been reporting stellar growth above 30% CAGR since FY19. However, at an operating level, the company is not profitable due to heavy expenditure on advertisement and promotion.

However, the company has been cutting down operating costs as operating expenditures & marketing costs as % of revenue have declined since FY19. Opex was 175% and marketing cost was 70.3% of revenue which came down to 122.7% and 41.5% respectively in FY21.

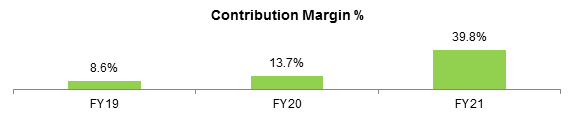

Cutting down on marketing costs can have a negative impact on brand visibility and visits. The contribution margin is a key metric to evaluate operating performance as it factors in the direct costs of operating the business, calculated as revenue from operations less employee benefits and advertisement and promotional costs.

Management:

Yashish Dahiya (Chairman, Executive Director, and CEO) is a B.Tech from IIT, Delhi, a post-grad diploma holder in management from IIM, Ahmedabad, and MBA from INSEAD, France. He was previously associated with ITW Signode India Limited, Bain & Company Inc. (London), eBookers PLC (UK), and CI2I Investments Limited.

Naveen Kukreja (Co-Founder and CEO, Paisabazaar) has been associated with the company since Feb’14. He is a B.Tech in engineering from DU and a post-grad diploma holder in management from IIM, Kolkata. He was previously associated with Citibank (India), Capital One (Europe), and Aviva Life.

Alok Bansal (Whole-time Director and CFO) is a B.Tech in technology from Kanpur and post-grad diploma holder in management from IIM, Kolkata. He was previously associated with Voltas, GE International Operations Co. Inc. (India), iGate Global Solutions, M&M, and FE Global Technology Services.

Moneyworks4me Opinion:

How is the business model? Good, bad, or gruesome?

Good (Potential to become great if it can make its customer base sticky). Policybazaar is an online insurance distributor of insurance products and similarly, Paisabazaar is a distributor of loans. There is no additional capital required to scale up the business once the platform is created.

However, the growth prospects are very dependent on its ability to attract traffic and conversation. Stream of cash flows can’t be assumed sticky.

Opportunity Size:

Policybazaar: Premiums via the online channel stand much lower at 1% for India versus 5.5% for China and 13.3% for the US. Penetration levels remain the lowest for India across most segments. The rise in urban population and rapid digital adoption, aided by a rise in smartphone users, would drive incremental growth.

Paisabazaar: The penetration of consumer loans stands much lower at 16.7% versus 80% in the US and 56% in China. Digital consumer lending disbursals form 22% of the total versus 56% in the US. Improving financial literacy and rising Internet penetration would support growth in online credit platforms. Consumer credit loans are expected to grow at a steady-state over FY20–30. This would be led by credit cards and personal loans which is likely to see a ~19% and ~12% CAGR, respectively, over this period.

Challenges:

- Increasing competition with multiple fintech entering the market that provides innovative solutions to cater to customer needs.

- Many insurers and lenders are coming up with their own digital platforms. Failing to attract partners or continue existing partnerships could impact the business.

Valuation – High Risk, High return?

PB Fintech’s proposed IPO valuation stands at ~Rs. 44,000 Cr for a sale of ~Rs. 900 Cr (annualized) implying a P/S of ~49x. Since the company doesn’t report profit yet, we can’t value it at the Price to Earning or P/E ratio.

At the operating profit level, current margins look subdued to the early stage of growth where it spends heavily on marketing and promotion. So let us assume steady-state 50% operating margins for the business like Naukri (Naukri is an established player in web aggregator, growth rate and quality of business not comparable but margins profile can be similar). Even on that assumption 3 years, forward Price to Earnings can range from 50-70x assuming 40% CAGR growth.

Despite the growth that the company can deliver such valuations are steep for a business that has a platform and is an aggregator for financial products. Online distribution business can grow without requiring much capital investment so the only saving grace is that business-wise the company doesn’t require additional capital.

Headline valuation looks quite steep, the upside risk with high-growth business is that growth can be exponential in the initial years or a company can expand the scope of its business by venturing into different products/markets or acquiring them. For example, Paisabazaar was an expansion into another addressable market of loans and financial products.

Because the company is a high growth, as well as it is present in an attractive sector, it is valued at very steep price. It will remain a high-risk and high-return investment for a small portion of a portfolio. Such high-risk ventures are usually funded by private equity players that manage smaller, “riskier” portions of HNI or institutional investors’ portfolios; in that case, why should it be any different for a retail investor?

If you like the business model or willing to accept high risk, for ‘potential’ high return (high risk doesn’t guarantee high return), you can SUBSCRIBE in IPO, restricting it to 1% of 2% of your portfolio

For others, Subscribe for a listing gain investment and later deploy the funds to more predictable, undervalued stocks. We understand that not everyone looks for the ‘best investment’ in the market but steady compounding.

| IPO Activity | Date |

| IPO Open Date | Nov 1, 2021 |

| IPO Close Date | Nov 3, 2021 |

| Basis of Allotment Date | Nov 10, 2021 |

| Refunds Initiation | Nov 11, 2021 |

| A credit of Shares to Demat Account | Nov 12, 2021 |

| IPO Listing Date | Nov 15, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 15 | ₹ 14,700 |

| Maximum | 13 | 195 | ₹ 191,100 |

| Date | QIB | NII | Retail | Total |

| Nov 01, 2021 | 0.56x | 0.06x | 1.18x | 0.54x |

| Nov 02, 2021 | 2.08x | 0.23x | 2.04x | 1.59x |

| Nov 03, 2021 | 24.89x | 7.82x | 3.31x | 16.59x |

When will the PolicyBazaar IPO open?

PolicyBazaar IPO will open for subscription on Monday, November 1st, and closes on Wednesday, November 3rd.

What is the price band of PolicyBazaar IPO?

The price band for PolicyBazaar IPO is Rs. 940-980/share.

What is the lot size for PolicyBazaar IPO?

Retail investors can subscribe to the IPO minimum lot size is 15 shares, up to a maximum of 13 lots i.e. Rs. 1,91,100/-.

What is the issue size of PolicyBazaar IPO?

The total issue size is Rs. 5625 Cr.

What is the quota reserved for retail investors in PolicyBazaar IPO?

The quota for retail investors in PolicyBazaar IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on November 10th and refunds will be initiated by November 11th. Shares allotment will be credited in Demat accounts by November 12th.

What is the listing date of PolicyBazaar IPO?

The tentative listing date of PolicyBazaar IPO is Monday, November 15th.

Where could we check the PolicyBazaar IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does PolicyBazaar do?

PB Fintech is India’s leading online platform for insurance and lending products. Its widely known brand Policybazaar provides convenient access to insurance, credit, and other financial products and aims to create awareness in India about the financial impact of death, disease, and damage.

Who are the peers of PolicyBazaar?

InsuranceDekho, Renewbuy, Coverfox, Turtlemint, Gramcover, Toffee Insurance, Symbo Insurance, Policyboss, PolicyX, OneAssist.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 5,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463