One 97 Communications Limited IPO details:

IPO Date: Nov’8th to Nov’10th 2021

Total Shares for subscription: ~8.5 Cr

IPO Offer Size: ~Rs. 18,300 Cr

Lot Size: 6 shares

Price Band: Rs. 2,080-2,150 / share

Market Capitalization: ~1,40,000 Cr

Recommendation: Subscribe for risk takers; Avoid for others

PayTm IPO Analysis Podcast

Subscribe Us On: Spotify | Google Podcast | YouTube

Proceeds of the offer:

- 50% of the offer value will be paid to existing shareholders.

- Growing and strengthening Paytm ecosystem, including through acquisition and retention of consumers and merchants and providing them with greater access to technology and financial services – ₹ 4,300 Crores

- Investing in new business initiatives, acquisitions, and strategic partnerships – ₹ 2,000 Crores

- General corporate purposes

About the One 97 Communications Ltd

Incorporated in 2000, One 97 Communications Ltd (“Paytm”) is India’s leading digital ecosystem for consumers as well as merchants. As of June’21, it offered payment services, commerce and cloud services, and financial services to 33.7 crore consumers and over 2.18 crore merchants registered with them. The 2-sided (consumer and merchant) ecosystem enables commerce, and provides access to financial services through their financial institution partners, by leveraging technology to improve the lives of their consumers and help their merchants grow their businesses.

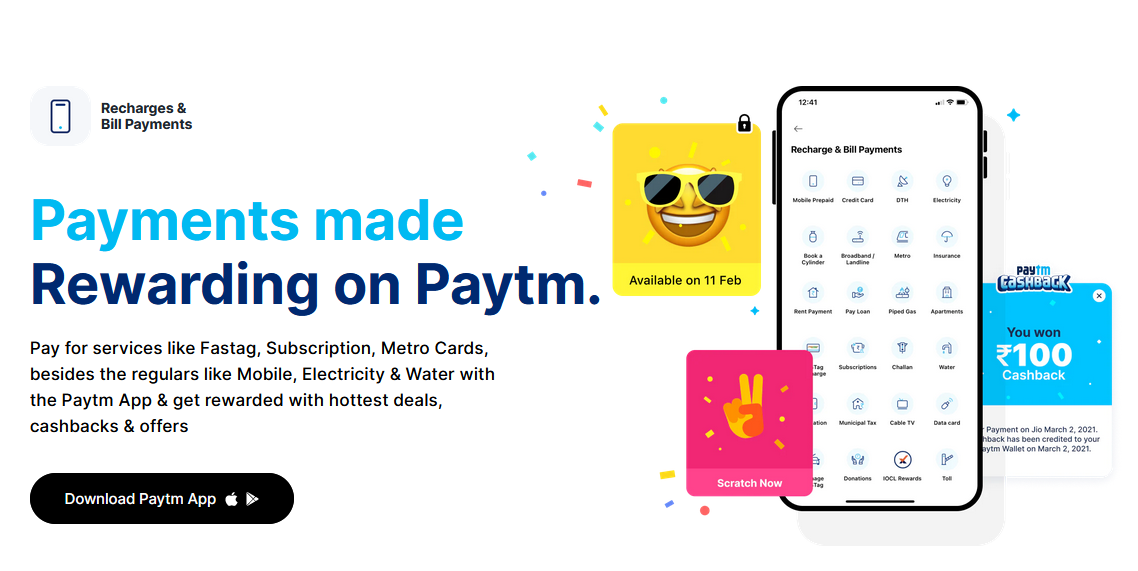

The company launched Paytm in 2009, as a “mobile-first” digital payments platform to enable cashless payments for Indians; giving them the power to make payments from their mobile phones. Starting with bill payments and mobile top-ups as the first use cases, and Paytm Wallet as the first Paytm Payment Instrument, they built the largest payments platform in India based on the number of consumers, number of merchants, number of transactions and revenue as of March’21. The company has been able to leverage its core payments platform to build an ecosystem with innovative offerings in commerce and cloud, and financial services.

They offer their consumers a wide selection of payment options on the Paytm app, which includes:

- Paytm Payment Instruments, which allow them to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later and wealth management accounts; and

- Major third-party instruments, such as debit and credit cards and net banking

Paytm app enables consumers to transact at in-store merchants, pay bills, make mobile top-ups, transfer money digitally, create and manage Paytm Payment Instruments, check linked account balances, service city challans and municipal payments, buy travel and entertainment tickets, play games online, access digital banking services, borrow money, buy insurance, make investments and more.

Business of the One 97 Communications Ltd

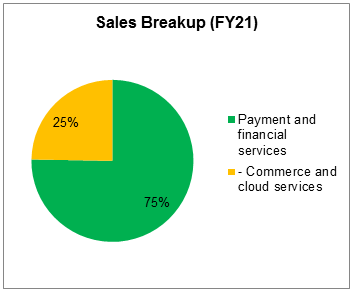

Paytm offers products and services across “payment services”, “commerce and cloud services” and “financial services”.

- Payment Services: Paytm has a full suite of payment services for both consumers and merchants which enables making and receiving payments in a convenient, seamless, and secure manner both online and in-store. They have an overall payments transaction volume market share of approximately 40%, and wallet payments transaction market share of 65% – 70% in India as of FY21. Paytm Wallet was launched in 2014, QR in 2015, which was then upgraded to All-in-One QR in Jan’20, which is the only source QR code that gives merchants the power to seamlessly accept payments from Paytm Payment Instruments, third party and all UPI instruments directly into their bank account. In 2020, Paytm Soundbox was launched. It is an IoT-enabled payment acceptance device, providing real-time audio confirmation for payment completion.

- Commerce and Cloud Services: Through their wide suite of commerce and cloud service offerings, merchants can connect with consumers to increase demand for their products and services such as ticketing (for entertainment and travel), deals, loyalty services, mini-apps, and advertising; and improve their business operations. Paytm for Business app provides merchants a comprehensive set of business management tools, including real-time bank settlement and analytics, reconciliation services, banking services, access to financial services, and business growth insight tools to measure their business performance.

- Financial Services:

- Mobile Banking Services: It offers a comprehensive suite of digital banking products and debit cards. As of June’21, Paytm Payments Banks had 6.54 crore savings accounts. For the quarter ended March’21, Paytm Payments Bank was the largest UPI beneficiary bank with a market share of 17.1%.

- Lending: Paytm operates a technology platform with capabilities across the entire loan cycle to provide credit access to consumers and merchants through their financial institution partners. It launched Paytm Postpaid, a buy-now-pay-later product, and merchant cash advance, through their financial institution partners.

- Insurance and Attachment Products: In collaboration with the insurance partners, Paytm offers, attachment products like movie and travel ticket cancellation protections based on user engagement on their platform and as a part of the payments flow, and its subsidiary, Paytm Insurance Broking Pvt Ltd offers an insurance marketplace with products across auto, life, and health insurance.

- Wealth Management: Paytm provides wealth management services to their consumers through the Paytm app and the Paytm Money App. Paytm Payments Bank launched fixed deposits on the Paytm app. They launched Paytm Gold, in collaboration with a partner. Paytm Money offers mutual funds, equity and futures, and options trading.

Financials:

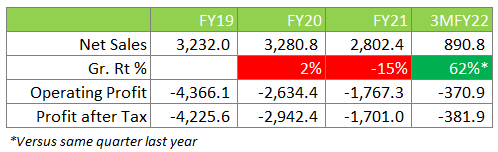

Paytm reported a decline in revenue in the past 3 years, however, they have managed to cut down the losses.

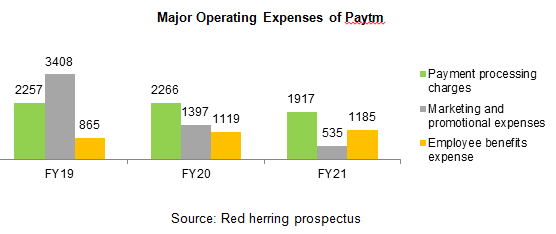

As seen in the above chart, the company has cut down on its marketing and promotional expenditure. This has led to a reduction in operating losses.

Management:

Vijay Shekhar Sharma is the Founder, MD, and CEO of the company and the Chairman of the Board. He oversees the Company’s key strategic efforts including engineering, design, and marketing. Vijay is an alumni of the Delhi College of Engineering.

Madhur Deora is the President and Group CFO of the company. He has been associated with the company since Oct’2016.

Manmeet Singh Dhody is the Chief Technology Officer, Payments. He has been associated with the company since April ‘20.

Munish Varma is the Non-Executive Director of the company and a nominee of SVF on the company Board. He currently serves as a managing partner at SoftBank Investment Advisers. He was also associated with Deutsche Bank AG.

Ravi Chandra Adusumalli is the Non-Executive Director of the company and a nominee of SAIF and Elevation Capital on the company Board. He is currently the managing partner of Elevation Capital.

MoneyWorks4me Opinion:

How is the business model? Good, bad, or gruesome?

Good (Potential to become great if it can make its customer base sticky). Paytm is a platform business and comes with a package of services like an online marketplace for shopping, financial services, and cloud services.

PayTM’s strength comes from around 33 Cr users on its platform to whom it can cross-sell. Paytm’s business heavily depends on its ability to cross-sell financial and eCommerce products and charge a small commission on the same.

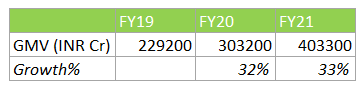

Scaling up

GMV growth

Opportunity Size:

With increasing smartphone penetration and internet usage, and the proliferation of digital products and services for consumers, India’s digital ecosystem is at an inflection point. Overall digital commerce in India is expected to grow over 3.3 times in the next 5 years to more than US$300 billion in FY’26 from approximately US$90 billion in FY’21.

Millions of young and aspiring consumers in India are underserved in payments and financial services products. This can benefit small businesses in the country to have increased access to affordable software, technology, and financial services. These consumers and small businesses can be served through technology-led, digital-first commerce. Paytm has a large addressable market in India and the market segments that they serve have large growth potential, due to significant under-penetration, and the ability of technology to grow the market.

Over the last decade, the emergence of mobile payments has transformed India into a cashless society, the creation of innovative and robust payment infrastructure, high consumer and merchant acceptance, and regulatory support. As a result of these factors, unique online transacting users transacting for services are expected to grow from 25-30 crore in FY’21 to 70-75 crore by FY’26.

Strengths:

- A strong brand with good brand recalls with robust market share.

Risks:

- Increasing competition in this space due to no barriers to entry

- Competition from large scales players like Google, Whatsapp, Amazon

Valuation – High Risk, High return?

Paytm today earns ~Rs. 3,600 Cr annualized based on Q1FY22 sales. This is almost 29% higher than last year. With competition coming in from existing umbrella products of Whatsapp and Google, the PayTM growth rate can moderate.

Payments and financial services is highly competitive with large banks investing heavily into payment and digital lending services.

PayTM mall faces huge risks from behemoths like Amazon, Flipkart which are backed by long term capital through their parent companies based out in US. PayTM on the other hand is owned by private equity players (relatively shorter time horizon) which may or may not infuse capital if the company doesn’t chalk out a profitable business model. Alibaba, one of the leading investors, may also back out if it faces regulatory hurdles in its own country.

The last decade of falling interest rates globally led to huge inflows into private equity. Private equity funds have been infusing funds into top 2-3 players irrespective of profitability and chasing higher and higher addressable markets. We have seen top 2-3 players in every industry becoming behemoth versus smaller peers. However, quite a few companies are yet to establish viable business models.

At the asking price, the market cap is around Rs. 1,40,000 Cr which is almost ~39x Price to sales. At the operating profit level, current margins look depressed to an early stage of growth where it continues to spend heavily on marketing and promotion. Even if we assume 20% operating margins for platform business, PayTM has to grow at 33% CAGR over the next 10 years for IPO investors to earn a return of 13% CAGR.

Just like other platform companies, PayTM’s headline valuation looks quite steep, the upside risk with a high growth business is that growth can be exponential in the initial years or a company can expand the scope of its business by venturing into products within the segments it operates into.

For example, Paytm’s expansion into payment services. Because of such possibilities linear forecasting, fundamental investing models do not work. And since it is an online platform business, it can grow without requiring much capital investment.

Because the company is a high growth, as well as it is present in an attractive sector, it is valued at a very steep price. It will remain a high-risk and high-return investment for a small portion of a portfolio. Such high-risk ventures are usually funded by private equity players that manage smaller, “riskier” portions of HNI or institutional investors’ portfolios; in that case, why should it be any different for a retail investor?

If you like the business model or willing to accept high risk, for ‘potential’ high return (high risk doesn’t guarantee high return), you can SUBSCRIBE in IPO, restricting it to 1% of 2% of your portfolio.

For others, we recommend AVOID and prefer more predictable, undervalued stocks. We are fundamental investors, where we invest in companies that report high profitability, trade at a reasonable price,s and earn consistent cash flows. The odds of succeeding in long-shot ideas like PayTM is very low. Only in hindsight, one would know which of the platform companies turned out a success.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business models and valuation.

| IPO Activity | Date |

| IPO Open Date | Nov 8, 2021 |

| IPO Close Date | Nov 10, 2021 |

| Basis of Allotment Date | Nov 15, 2021 |

| Refunds Initiation | Nov 16, 2021 |

| A credit of Shares to Demat Account | Nov 17, 2021 |

| IPO Listing Date | Nov 18, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 6 | ₹ 12,900 |

| Maximum | 15 | 90 | ₹ 193,500 |

| Date | QIB | NII | Retail | Total |

| Nov 08, 2021 | 0.06x | 0.02x | 0.78x | 0.18x |

| Nov 09, 2021 | 0.46x | 0.05x | 1.23x | 0.48x |

| Nov 10, 2021 | 2.79x | 0.24x | 1.66x | 1.89x |

When will the Paytm IPO open?

Paytm IPO will open for subscription on Monday, November 8th, and closes on Wednesday, November 10th.

What is the price band of Paytm IPO?

The price band for Paytm IPO is Rs. 2080-2150/share.

What is the lot size for Paytm IPO?

Retail investors can subscribe to the IPO minimum lot size is 6 shares, up to a maximum of 15 lots i.e. Rs. 1,93,500/-.

What is the issue size of Paytm IPO?

The total issue size is Rs. 18,300 Cr.

What is the quota reserved for retail investors in Paytm IPO?

The quota for retail investors in Paytm IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on November 15th and refunds will be initiated by November 16th. Shares allotment will be credited in Demat accounts by November 17th.

What is the listing date of Paytm IPO?

The tentative listing date of Paytm IPO is Monday, November 18th.

Where could we check the Paytm IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does Paytm do?

Paytm offers payment services, commerce and cloud services, and financial services to 33+ crore consumers and over 2+ crore merchants registered with them. Paytm app is available in 11 Indian languages and enables consumers to transact at in-store merchants, pay bills, make mobile top-ups, transfer money digitally, create and manage Paytm Payment Instruments, check linked account balances, service city challans and municipal payments, buy travel, and entertainment tickets, play games online, access digital banking services, borrow money, buy insurance, make investments and more such things.

Who are the peers of Paytm?

There are no direct peers of Paytm in the listed space. In unlisted space, Flipkart, Amazon India, Freecharge, Google Pay, come close to Paytm’s business model.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 5,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463