In our childhood, we all enjoyed Snakes and Ladders. Snakes and Ladders is a board game with 100 blocks numbered 1 to 100. Pointer is placed at 1st block. To win the game, one has to roll a dice to reach 100th block. Few Blocks in between have ladders and a few have snakes. Ladders help to skip multiple blocks and jump to a higher number. Snakes throw the pointer back to lower numbered block. But if one plays long enough, he would reach his goal i.e. 100th Block.

Play long enough in equities too…you will reach your goal.

We can draw an exact analogy in Equities. Markets are always volatile, going from new high to lows and lows to new highs. But what we believe is, if we hang around in equities for long term, you would certainly reach your goal.

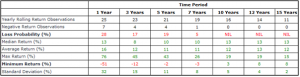

See the following table:

(Source: BSE Sensex; HDFC MF)

If we see rolling returns of Sensex since 1992, 1 year rolling returns are too volatile and have 28% loss making probability. So equity returns are negative approximately once in every 3 years. However, if we see 3 years and 5 years rolling returns, probability of a loss declines to 17% and 19%. It means if we stay invested for 3 years or 5 years, probably we will lose money only once in five such periods. But if we see results for 10 Years – 12 Years – 15 Years rolling returns, we would notice that probability of loss was ‘zero’. It means in any 10/12/15 years period, we wouldn’t have lost money in equities. Isn’t it an eye opening statistic?

We may have taken Index as an investment option held across cycle, which may not be the best portfolio combination. But at the same time, many stocks would have gone to ‘zero’. Though we have shown some median returns too, but we do not believe same returns can be considered going forward. The whole point of illustrating statistics is not to agree or challenge the returns but determine that odds are more favourable in long term investing.

Similar to Snakes and Ladders, Equities may make a loss or windfall gain in some years. But when several years are clubbed it will result in mouth-watering returns. We have to be rational and play the game long enough to reach the goal of equity investing. Most investors don’t stay invested in equities beyond 2 years. It would be wrong to judge potential of equities in such small time periods as even the statistics suggest. We therefore insist to stay invested in equities for longer term and enjoy the benefits of it.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

You are absolutely Right. over a 10 year period the risk is very less. However a caveat is at the first instance when we select a stock to invest we should be thoroughly convinced about the fundamentals of the company mainly its management.an annual monitoring of the performance of the company is also a must.