Tata Technologies Limited IPO Details:

Estimated Pre-listing Market Cap: ~20,283Cr

IPO Date: 22nd November to 24th November

Total shares: ~40.6 Cr

Price band: Rs. 475 – Rs. 500 per share

IPO Issue Size: ~ Rs. 3,042 Cr

Lot Size: 30 shares and multiples thereof

Purpose of Issue: Offer for Sale by Promoter and Investors

Recommendation: Subscribe for listing gains as well as long-term

About Tata Technologies Limited:

Tata Technologies Limited (TTL) operates globally in engineering, research, and development (ER&D) services, mainly focused on automotive, aerospace, and transportation and construction heavy machinery (TCHM) sectors. As a prominent engineering services provider, it delivers product development and digital solutions to global OEMs and suppliers. With 20+ years of experience, TTL holds significant expertise in the automotive domain, extending its services to the aerospace and TCHM sectors. Utilizing a globally distributed model, it maximizes employee skills globally, balancing client proximity and offshore efficiency for added client value. Tata Motors Limited, TTL’s promoter, contributes 40-50% of its revenues alongside Jaguar & Land Rover.

IPO Details:

The IPO comprises an Offer for Sale (OFS) by existing shareholders, as the company doesn’t seek additional capital for expansion. Tata Motors will offload 4.62 Cr equity shares worth Rs. 2,314 Cr in the OFS. Investors Alpha TC Holdings Pte Ltd will be selling 97 lakh shares worth Rs. 486 Cr and Tata Capital Growth Fund I will offload 49 lakh shares worth Rs. 243 Cr in the IPO. Post issue Tata Motors will still hold a 55.4% stake in the TTL.

About the ER&D Industry:

The global Engineering, Research, and Development (ER&D) industry saw a spending of $1.81 trillion in 2022, projected to reach $2.67 trillion by 2026. Outsourced spending hit $105-$110 billion in 2022, expected to grow at an 11-13% CAGR from 2022 to 2026. Key growth drivers include increased outsourcing, stricter regulations for safer products, shorter innovation cycles, and new product technologies. The ER&D market is dominated by the Z1000 enterprises, comprising the top 1000 global spenders as per Zinnov, contributing around 85% of the market. Within this, the top 100 spenders account for 48% of the total ER&D spend.

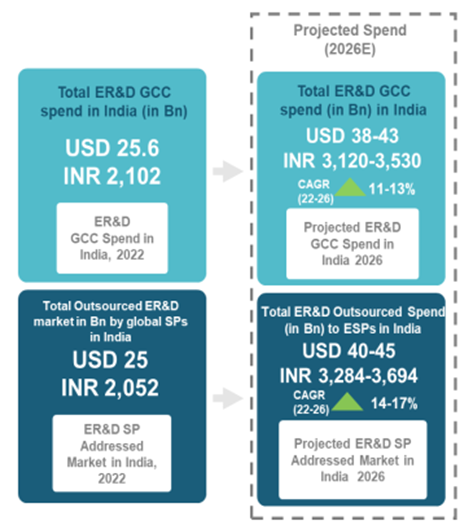

TTL is well placed to capitalize on the huge India opportunity size:

Indian Engineering Service Providers (ESPs) are defined as Indian heritage players and do not include global players with Indian centres. They account for almost a fourth of the overall outsourced ER&D spend, while more than 85% of the top 50 R&D spenders have Global Convention Centres (GCC) in India. India’s software engineering maturity and abundant digital engineering talent are drawing enterprises to outsource end-to-end product/platform development to the region. Average billing rates in India are attractive at $35K-45K (per annum per person) as against $60K-70K for Eastern Europe & $90K-110K for North America.

Indian ESPs have been growing faster than their Western European and North American counterparts owing to their ability to leverage the demographic advantage in India. The country’s robust talent pool offers supply-side options to create robust talent chains across traditional as well as digital areas.

The Indian ESP market is expected to grow at a CAGR of 14-17% (second only to Eastern Europe which has a YOY rate of 18-20%) and accounted for $25 billion (Rs. 2,052 billion), equating to nearly one-fourth of the overall outsourced ER&D spend of $105-110 billion (Rs. 8,620-9,031 billion) in 2022.

The chart below sets out the total ER&D spend addressed through Indian GCCs and Service Providers (including both IT generalists and ER&D specialists).

(Source: DRHP, Zinnov)

Currently, the Total Addressable Market (TAM) for ER&D specialists like TTL is Rs. 82,100 Cr and is set to grow at the rate of 13%-16% going forward. Management aims to sustain or surpass the industry’s growth rate.

(Source: DRHP, Zinnov)

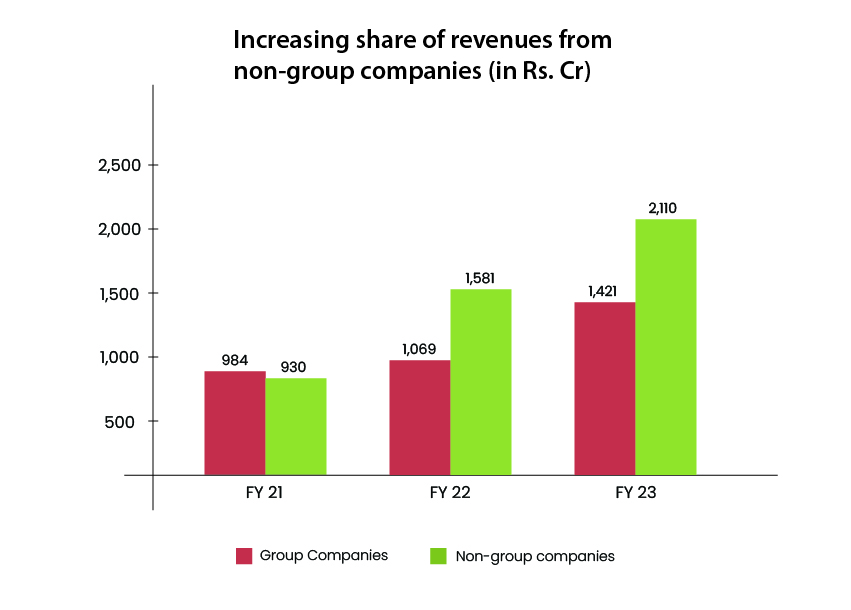

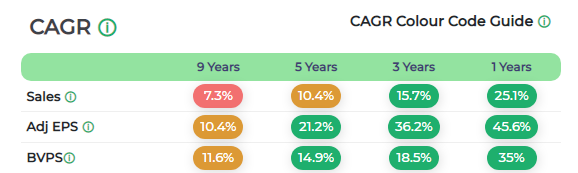

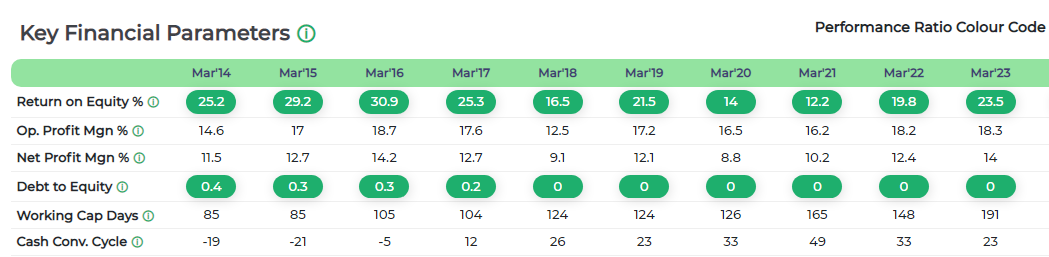

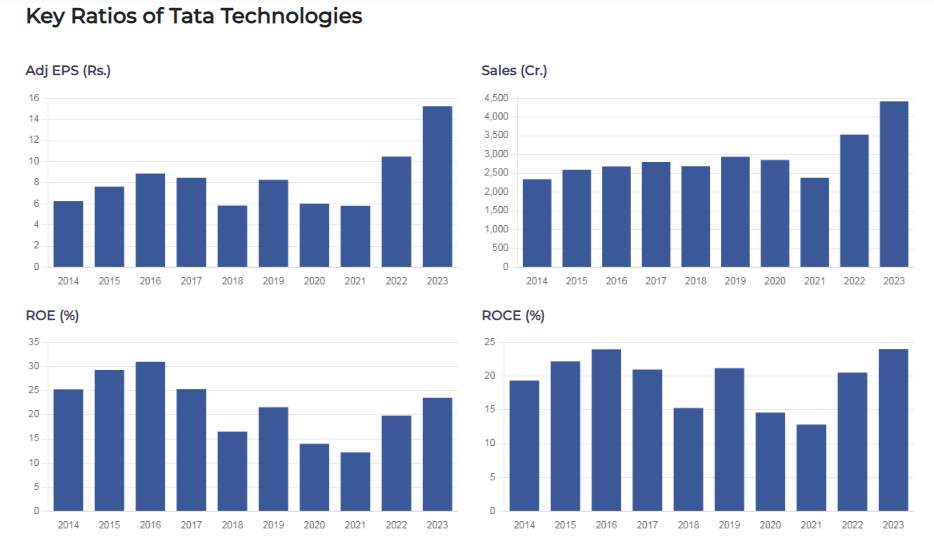

Performance:

Total revenue of TTL has grown at the rate of 36% CAGR from FY21 to FY23. Within that, revenues from group companies (Promoter and related entities) have grown at a CAGR of 20%, but non-group revenue has grown at an astonishing 51% CAGR as shown below:

(Source: Company Data, Moneyworks4me Research)

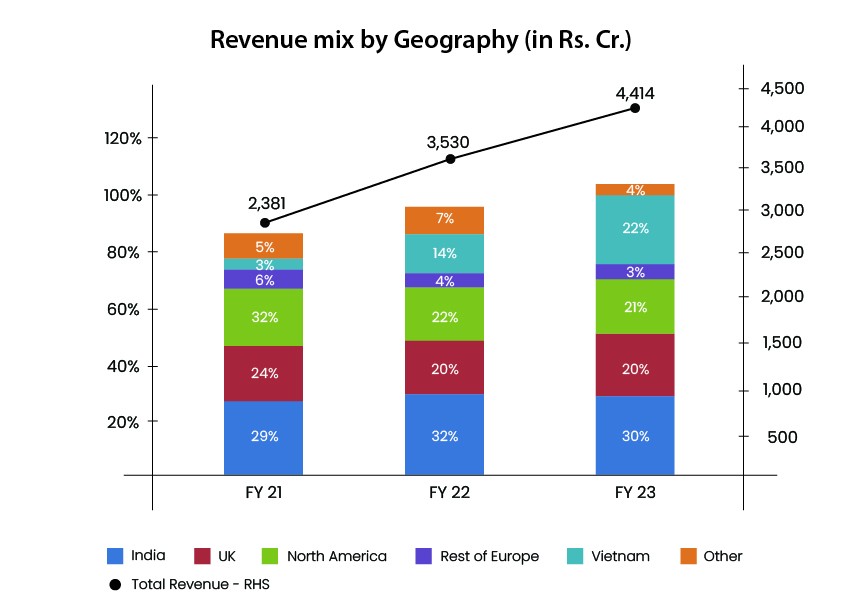

With the expertise it has developed in the automobile space over the years, business growth is visible from diversified geographies as outlined below:

(Source: Company Data, Moneyworks4me Research)

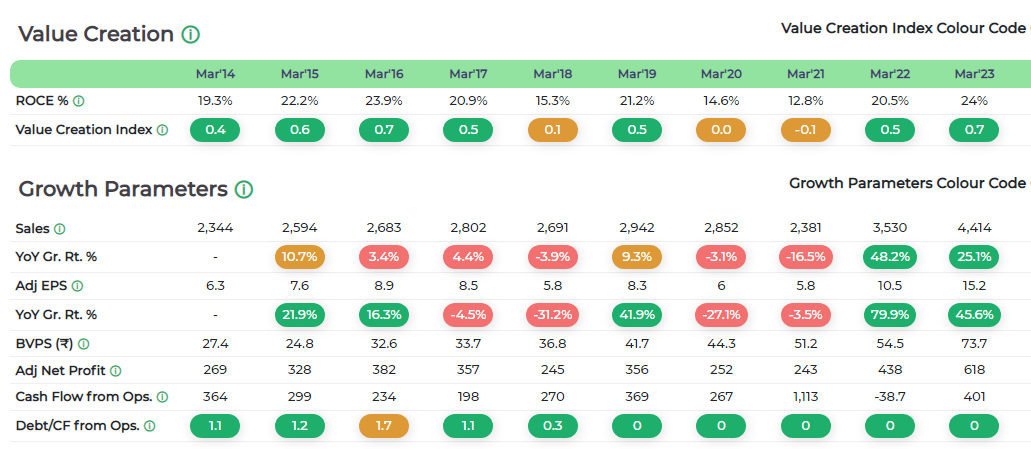

(Click here to check 10 Year X-Ray of the Company)

(Source: Company Data, Moneyworks4me Research)

(Source: Company Data, Moneyworks4me Research)

(Source: Company Data, Moneyworks4me Research)

Positives:

- EV Capability: One of TTL’s notable strengths lies in its capacity to design a complete Electric Vehicle (EV). It has successfully developed EV technology for a Vietnamese Automotive company. Given the on-going shift from Internal Combustion Engine (ICE) vehicles to EVs, TTL’s EV capabilities stand as a significant advantage.

- Strong Parentage: The Company is a part of the Tata Group, which has been recognized as the most valuable brand in India (Source: Brand Finance India). As a subsidiary of Tata Motors Limited, the company is benefited from long-term relationships with both TML and JLR. The long-standing engagements with these group companies have enabled the incubation of skills and capabilities that has assisted it in pursuing opportunities outside of the Tata Group.

Concerns:

- Dependence on the Automotive sector: The Company heavily depends on the automotive sector for revenue, making it vulnerable to economic fluctuations and industry-specific changes. Factors like economic slowdowns, EV market shifts, and geopolitical events can impact client spending and affect the company’s business. To succeed, it must adapt to technological advancements and navigate global trade policies that could hinder its global operations.

- Client Concentration risk: A substantial portion of the Company’s revenue is derived from its top 5 clients, including Tata Motors and Jaguar Land Rover Limited (JLR). Any adverse impact, such as a decline in business or reduced dealings from these key clients, could lead to a decline in revenues.

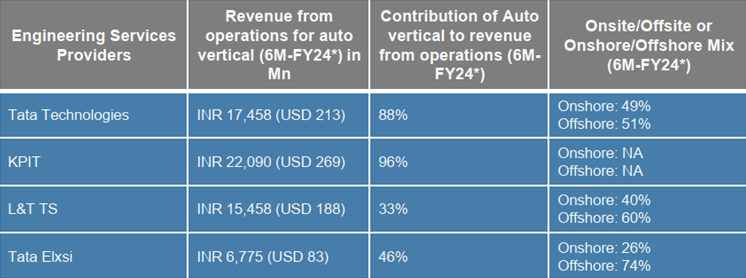

Competitors:

There are 3 listed companies that operate in the ER&D segment in India, KPIT Technologies, L &T Technology services (LTTS) & Tata Elxsi. However, LTTS & Tata Elxsi have relatively low contributions from Auto vertical as compared to TTL so KPIT is the closest comparable for TTL. Where TTL stands out in the Indian ER&D space is the superior Onshore/Offshore mix as this shows the domain expertise as well as the capability of charging higher billing rates.

Revenue and contribution from Auto Vertical and onshore/Offshore mix of Peers is provided below:

(Source: DRHP)

In terms of Peer Valuation, KPIT trades at a PE multiple of 80x while LTTS & Tata Elxsi trade at 38x & 61x respectively.

About the Management:

Warren Kevin Harris is the Chief Executive Officer and Managing Director of the Company. He holds a bachelor’s degree in engineering (technology) from the University of Wales & is a chartered mechanical engineer registered with and a member of the Institution of Mechanical Engineers. He has been associated with the Company since October 1, 2005.

Ajoyendra Mukherjee is the Chairman and Independent Director of the Company. He holds a bachelor’s degree in engineering (electrical and electronics) from the Birla Institute of Technology and Science. He was previously associated with Tata Consultancy Services Limited for almost four decades, where he held positions such as the head of business operations in Eastern India, Middle East and Africa, Switzerland, global head of CSR function, global head of energy and utilities practice and executive vice president and global head of human resources.

Opinion:

Tata Technologies operates in the exciting ER&D space where it has built its expertise over the years. The IT service sector worldwide is going through a turbulent phase with recessionary fears as well as challenges posed by Generative Artificial Intelligence (AI). Players in the ER&D space are different from traditional IT service companies as barriers to entry are high in this segment and building ER&D capabilities requires a high amount of time as well as high capital investments as against traditional IT services. Hence it makes this business stickier in nature, is sustainable and is poised to show higher growth and thus also warrants a higher valuation multiple. At PE of 28X TTM the IPO is attractively priced and investor interest will be high in the IPO. We will be actively looking to hold a position in Tata Technologies.

Recommendation: Subscribe for listing gains as well as long-term.

| IPO Activity | Date |

| IPO Open Date | Nov 22, 2023 |

| IPO Close Date | Nov 24, 2023 |

| Basis of Allotment Date | Nov 30, 2023 |

| Refunds Initiation | Dec 01, 2023 |

| A credit of Shares to Demat Account | Dec 04, 2023 |

| IPO Listing Date | Dec 05, 2023 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 30 | ₹ 15,000 |

| Maximum | 13 | 390 | ₹ 195,922 |

When will the Tata Technologies Ltd IPO open?

Tata Technologies IPO will open for subscription on Wednesday, 22nd November 2023, and closes on Friday 24th November 2023.

Should you apply to Tata Technologies IPO?

Yes, Subscribe for listing gains as well as long-term.

What is the price band of Tata Technologies Ltd IPO?

The price band for Tata Technologies Ltd IPO is Rs. 475-500/share.

What is the lot size for the Tata Technologies Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 30 shares, up to a maximum of 13 lots i.e. Rs. 1,95,000/-.

What is the issue size of Tata Technologies Ltd IPO?

The total issue size is ~ Rs. 3,042 Cr.

When will the basis of allotment be out?

Allotment will be finalized on November 30th and refunds will be initiated by December 1st. Shares allotment will be credited in Demat accounts by December 4th.

What is the listing date of Tata Technologies Ltd’s IPO?

The tentative listing date of the Tata Technologies IPO is December 5th 2023.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Recent IPO’s:

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory