This article covers the following:

Sensex has declined 2.5% in the last month but has risen by 4.51% on a yearly basis.

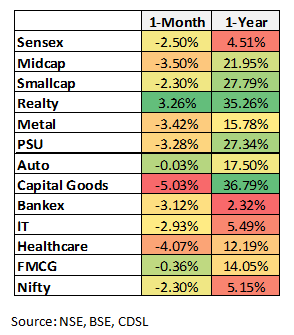

As we write this note in November, Sensex has declined 2.5% in the last month but has risen by 4.51% on a yearly basis. A few sectors which grew in the last month were Realty, Auto, and FMCG. The major performing sectors in the last one year are Capital Goods, PSU and Realty. Major events we talk about in detail below include India’s increased weight in the MSCI Emerging Market Index and bank credit growth.

Source: CDSL, NSDL, NSE

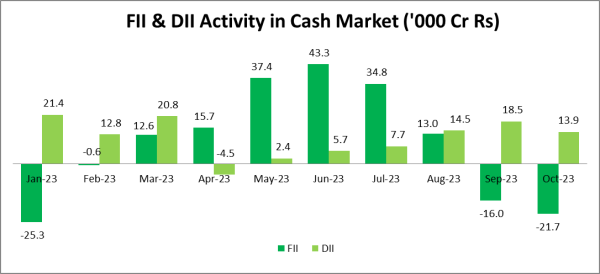

In October, foreign portfolio investors continued to exert selling pressure on the Indian markets, while domestic institutional investors continued to purchase Indian equities. FIIs continued to be net sellers with a total net sell of ₹ 21,769 Crore in October. DIIs showed a positive trend as net buyers, purchasing ₹ 13,877 Crore during the previous month.

FPIs are actively investing in the debt market despite their recent selling activity in equity markets. In October, FPIs infused ₹ 6,382 crore into the debt market (excluding the debt-voluntary Retention Route), as reported by data from NSDL.

The recent FPI selloff in the past two months can be attributed mainly to concerns about the increasing U.S. yields and the conflict between Israel and Hamas.

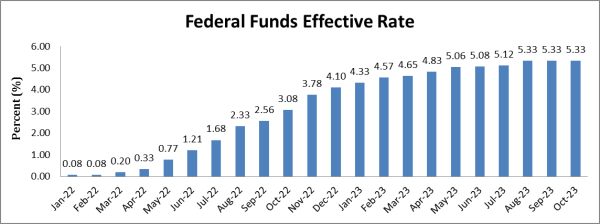

In September, the consumer price index (CPI) rose by 3.7% y-o-y, a decrease from the peak inflation rate of 9.1% in 2022 but still well above the Federal Reserve’s 2% target. The Commerce Department reported that U.S. GDP grew by 4.9% in the third quarter, surpassing the expected 4.7% growth predicted by economists.

Source: fred.stlouisfed.org

As widely expected, the Federal Open Market Committee (FOMC) has decided to keep the fed funds interest rate within the 5.25% to 5.5% range. The Federal Reserve had raised rates 11 times since starting in March 2022 but opted not to increase them in the last two meetings. The Fed will continue allowing $60 billion in Treasury securities and $35 billion in agency mortgage-backed securities to mature and reduce its $7.9 trillion balance sheet each month to combat inflation.

The FOMC aggressively raised rates to curb inflation, which has shown positive results in 2023. With inflation trending lower, many believe the FOMC may have reached the current cycle’s peak interest rate, and there’s growing anticipation that the Fed may switch from raising rates to cutting them by mid-2024.

Source: The Economic Times

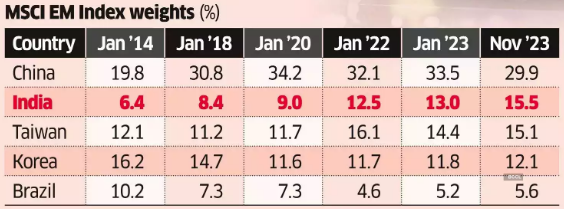

India has surpassed Taiwan in the MSCI Emerging Market Index with a weighting of 15.5% compared to Taiwan’s 15.11%. India’s weight has increased from 12.97% in January, and there’s anticipation that if South Korea moves to the developed market category, India’s weight could rise to 18.5%, attracting around $2-2.5 billion in passive fund investments. Several factors, including changes in foreign ownership limits and India’s strong growth, have contributed to its improved position in the index.

As per care ratings research, During Q2 FY24, fundraising activity by businesses experienced a marginal slowdown, and commercial paper issuances declined, primarily in response to the overall increase in interest rates. However, the growth in gross bank credit witnessed double-digit expansion, largely driven by the retail and services segments.

The research further indicates that there is a steep slowdown in net new project announcements in the first half of FY24. The value of new projects announced fell to ₹ 1.2 trillion in Q2 FY24 from ₹ 6.6 trillion in Q1 FY24. Additionally, the value of dropped projects rose from ₹ 3 trillion in Q4 FY23 to ₹ 4.2 trillion in Q1 FY24 and ₹ 4 trillion in Q2 FY24. This number needs to be monitored going ahead.

Source: RBI

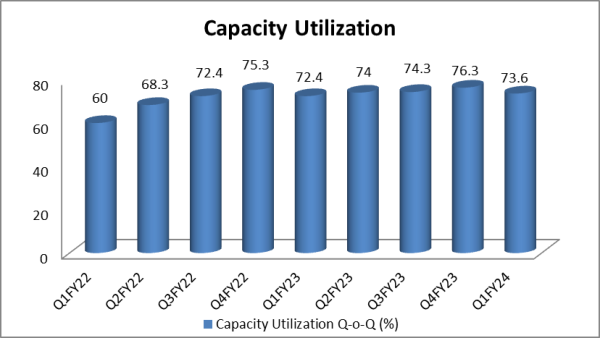

Capacity utilisation at manufacturing facilities was at a robust 73.6% in Q1 FY24, down from 76.3% in Q3 FY23. Capacity utilization is used to evaluate the extent to which manufacturing or production capacity is being effectively used. An increase in capacity utilization suggests a rise in demand for goods or services and also the necessity for new investment in additional capacity creation.

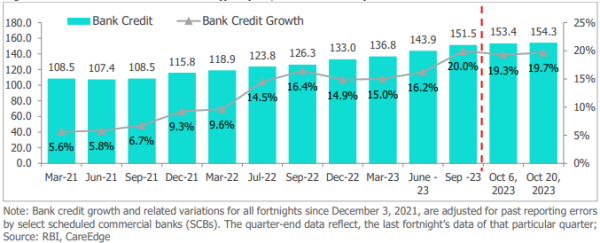

In the fortnight ending 20 October 2023, credit offtake in India increased by 19.7% YoY to ₹ 154.3 lakh crore driven by robust personal loan growth and the impact of the HDFC merger (reclassification of HDFC’s advances). Excluding the merger’s impact, credit growth was at 15.1% YoY. The outlook for bank credit remains positive, with a projected growth of 13-13.5% for FY24, excluding the merger’s impact.

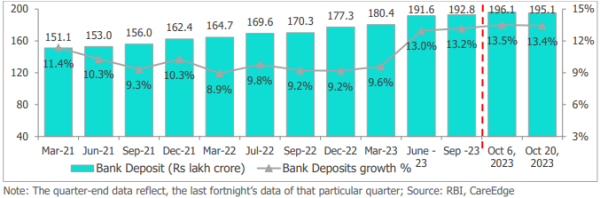

Deposits also grew by 13.4% YoY (including the merger), with 12.6% growth when excluding it. Sequentially, there was a 0.5% drop in deposits. Deposit growth is expected to improve in FY24 as banks focus on strengthening their liability base to support credit expansion.

Source: PIB

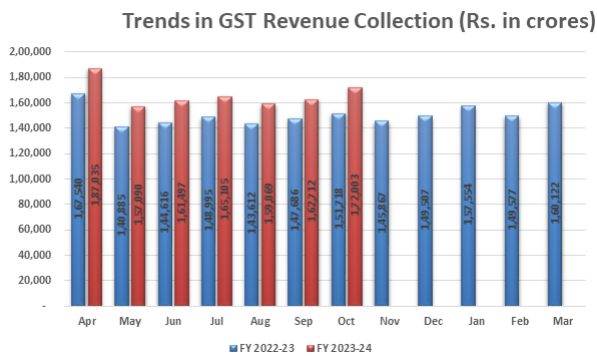

In October 2023, GST revenue collection reached a record high of ₹1.72 lakh crore, marking a 13% year-on-year increase. This increase is also seen in revenue from domestic transactions (include import of services), which is up 13% compared to the same month last year. The average monthly GST collection for the fiscal year 2023-24 is now ₹1.66 lakh crore, representing an 11% increase over the previous fiscal year.

Economic activity remains strong, and the recent improvement in the monsoon situation during September is a positive development. The prices of select food items that contributed to inflation exceeding 7% in July are now declining. The private sector is in good health as data on advance tax payments for the second quarter confirm.

However, there is a growing concern regarding the recent increase in oil prices, which could pose challenges. Additionally, the stock market faces some risks of a potential downturn, and geopolitical developments may affect investment sentiment in the latter half of the fiscal year. Nevertheless, the impact of these events on India’s underlying economic activity is expected to be relatively limited.

It’s worth noting that interest rates in many countries have reached their highest levels in the past two decades. Several nations are grappling with the consequences of this, as it increases interest costs and affects government debt and corporate earnings. India is better positioned to handle this situation than most other countries due to its de-levered balance sheets. Among major nations, India has the least amount of debt, providing it with an advantage in navigating the unpredictable global financial landscape.

Indian economy continues to be a steady ship in choppy waters

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

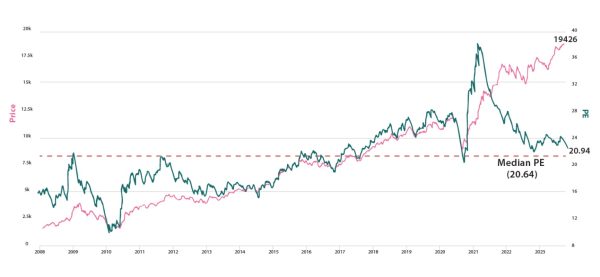

Nifty is trading slightly above long-term averages

Source: Trendlyne

On a PE basis, Nifty is trading at 20.94, above the historical median of 20.64. It basically shows positive sentiment and bullishness in the market.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlook and growth. While taking a portfolio view to diversify and make the most of the rising economy. We have been bullish on the power sector and also recommended a bottom-up idea from the healthcare segment.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory