Dear Readers,

Welcome to our company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

Contents:

- Reliance

- Telecom (Airtel)

- IT (HCL, Infosys, TCS)

- Auto & Auto Ancillary (Maruti Suzuki, Tata Motors)

- Diagnostics (Krsnaa)

- Brokerage & Exchanges (Angel One, IEX, Kfin)

- Others (Zomato, Care Ratings)

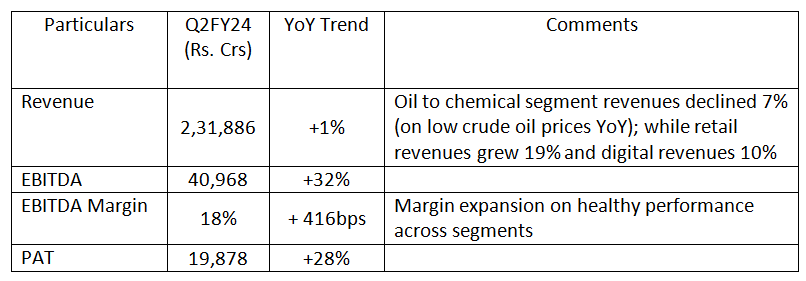

The strong performance led by the retail segment and sustained performance in other segments.

The strong performance led by the retail segment and sustained performance in other segments.

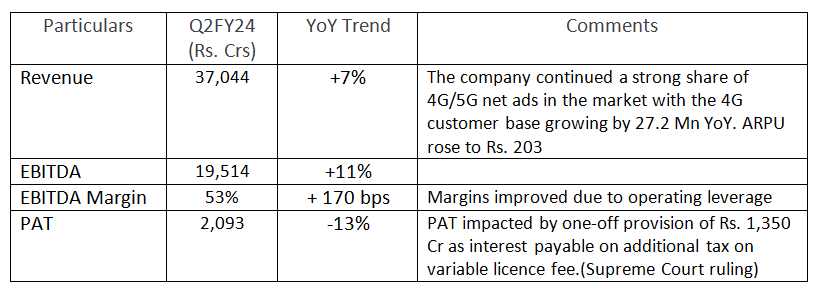

Bharti Airtel

Stable result after adjusting for the tax one-off.

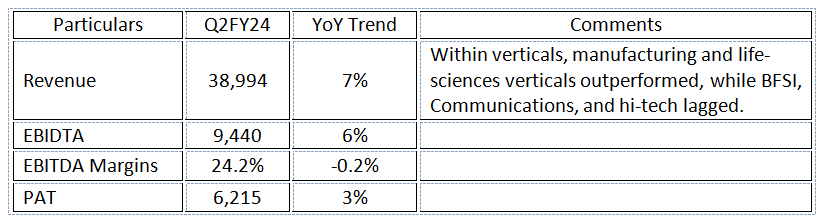

HCL Technologies

Revenue growth was tepid but margin improvement was positive. FY24 growth guidance reduced to 5-6% CC from earlier 6-8%.

Infosys

Results were muted. FY24E guidance being further reduced to 1-2.5% was a big miss.

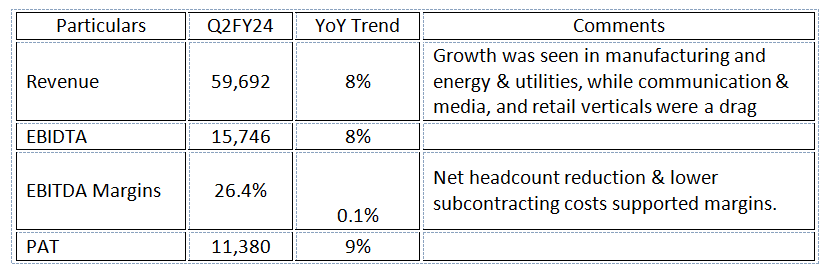

TCS

Decent results, Deal TCV growth was positive. The company announced buybacks for upto 17,000 Cr @Rs. 4,150 per share.

Maruti Suzuki

Strong results with swift improvement in margins & doubling of Utility Vehicle volumes.

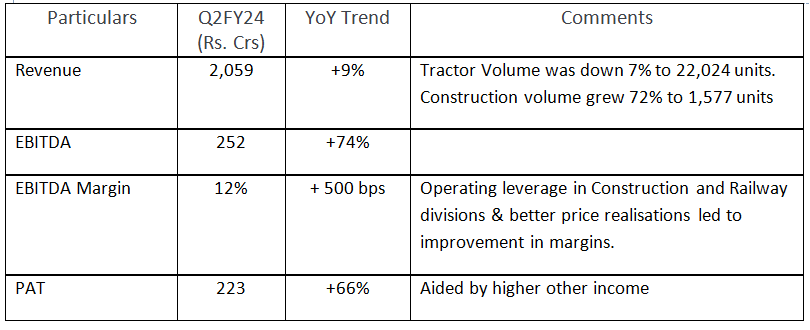

Escorts Kubota

Poor numbers in the Agri segment while the Commercial vehicle segment recovered.

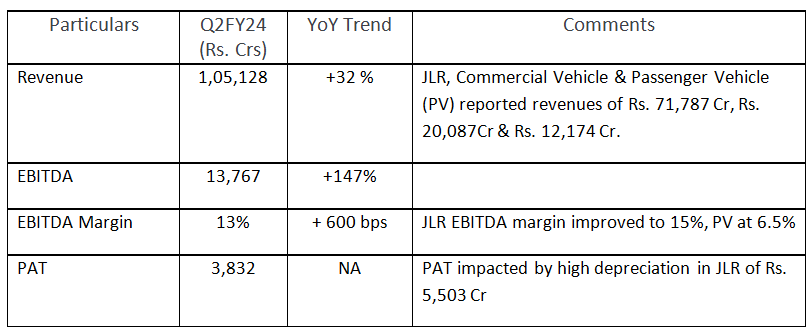

Tata Motors

Strong results led by recovery in the JLR segment which because of a better revenue mix.

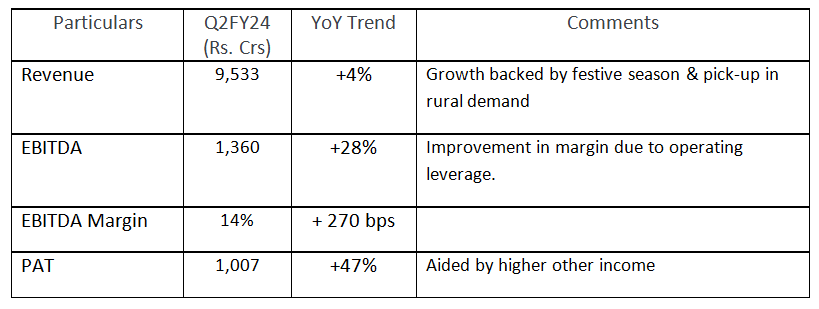

Hero Motocorp

Stable results. Management expects the 2-Wheeler industry to post double-digit volume growth in this festive.

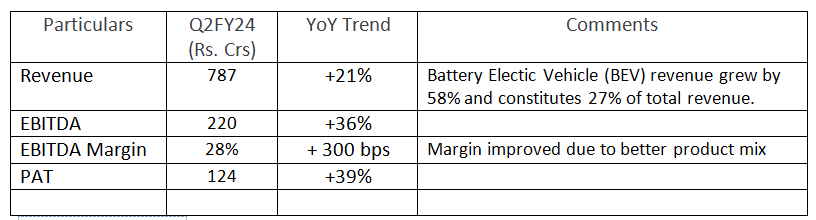

Sona BLW Precision

Stable results.

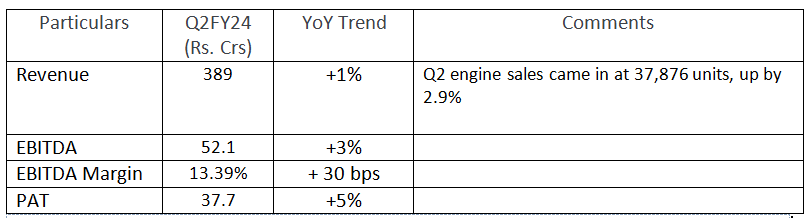

Swaraj Engines

Stable results.

Balkrishna Industries

Capex increased by Rs. 300Cr to set up mould manufacturing capacity. Decent results, however guidance was negative as the company expects FY24 volumes to de-grow marginally.

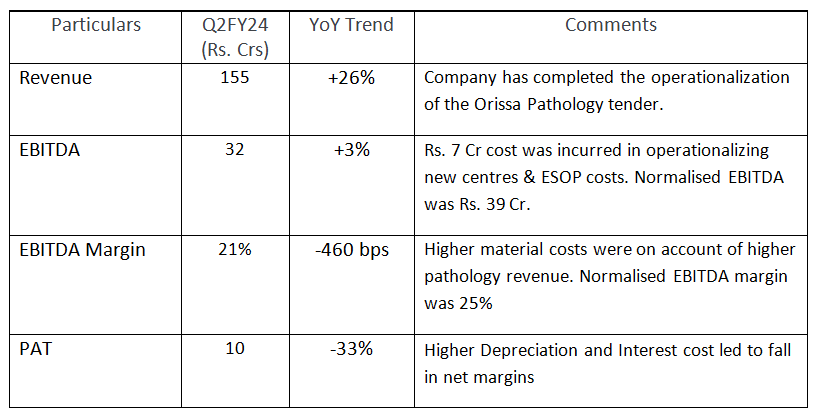

Krsnaa

Overall decent results even though they look bad optically. We expect a positive trajectory of revenues along with a 25% EBITDA margin to continue in the coming quarters.

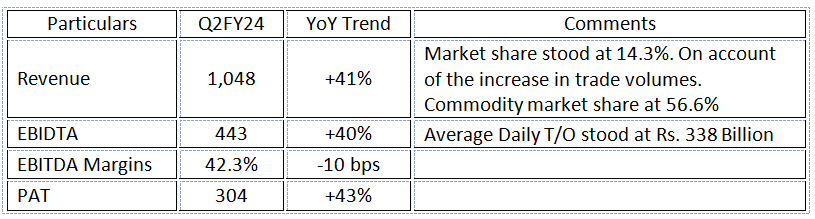

Angel One

Robust results on account of an increase in market share aided by an increase in active clients to 4.9 million.

Motilal Oswal Financial Services

Good overall results.

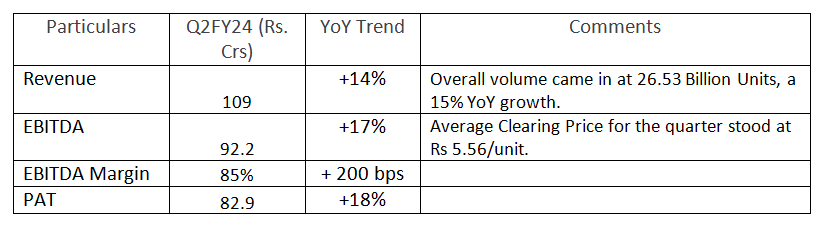

Indian Energy Exchange

Decent numbers in the Electricity segment amidst price decoupling worries. Impressive growth seen in Gas Exchange segment.

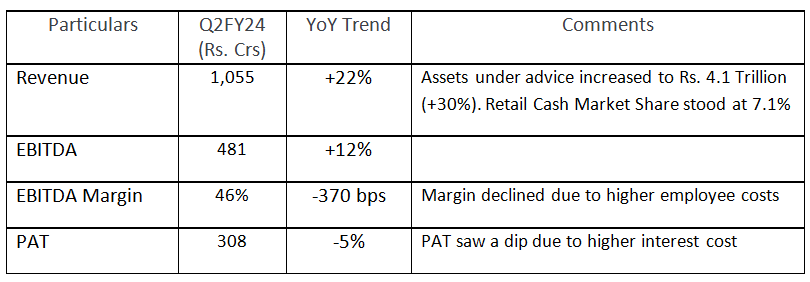

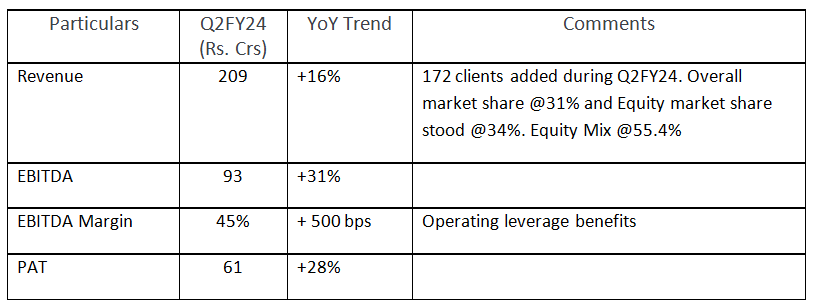

Kfin Technologies

Strong quarterly performance led by faster growth in non-domestic mutual fund businesses and better execution driving margin expansion.

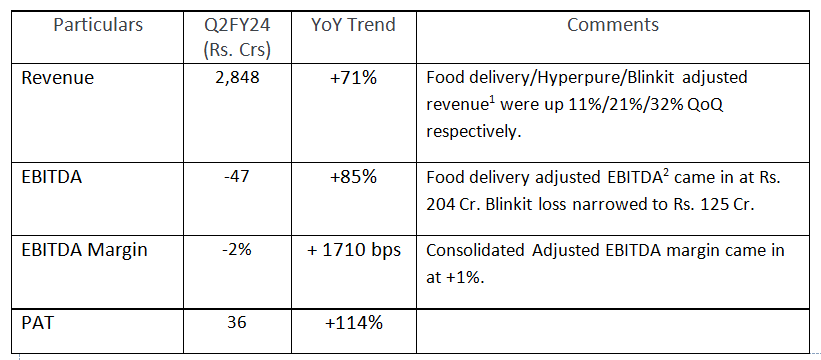

Zomato

1Adjusted Revenue= Revenue (+) Delivery costs

2Adjusted EBITDA = EBITDA (+) share-based payment expense (-) rent

Strong growth numbers across segments. Blinkit’s business turning contribution positive was a surprise.

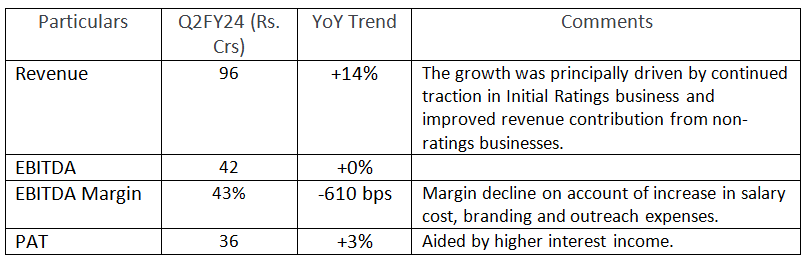

CARE Ratings

Stable results despite management indication of a steep slowdown in net new project announcements in the first half of FY24 (being the Pre-election period).

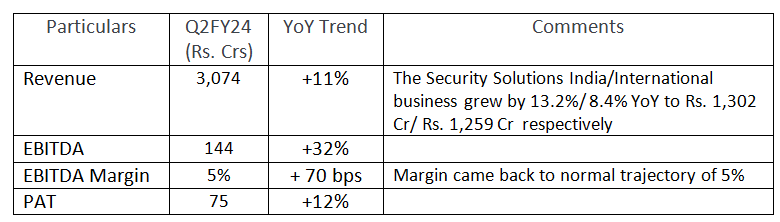

SIS Ltd

Decent results

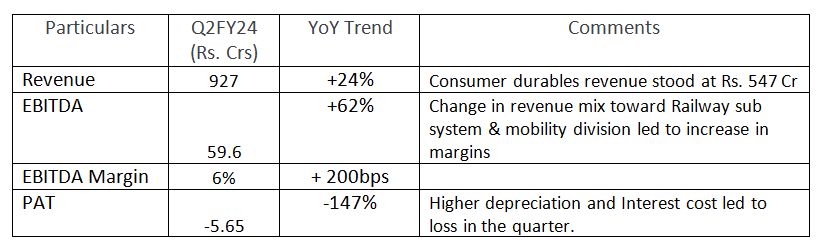

Amber Enterprises

Performance as expected, Q2 is supposed to be the seasonally weakest quarter.

Related Blog:

- Q2FY24: Weekly Result Update Part 1 – Dabur, ACC, L&T, Petronet

- Q2FY24: Weekly Result Update Part 2 – Sun Pharma, Container Corp, Coromandel, Bluedart

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory