Dear Readers,

Welcome to our company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

Contents:

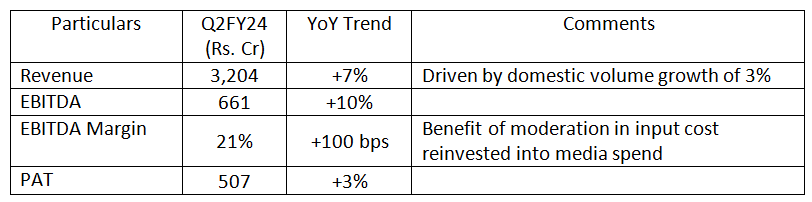

Marico Ltd

At par result. Saffola brand revenue declined on impact of price cut in edible oil. Saffola food franchise continues to grow strongly at 25% YoY.

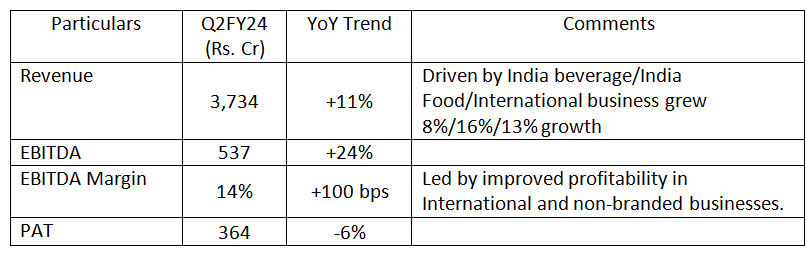

Tata Consumer Products Ltd

Strong result. Company has expanded it’s sales & distribution network reach to 3.8 million outlet. Now it plans to invest more in rurban area.

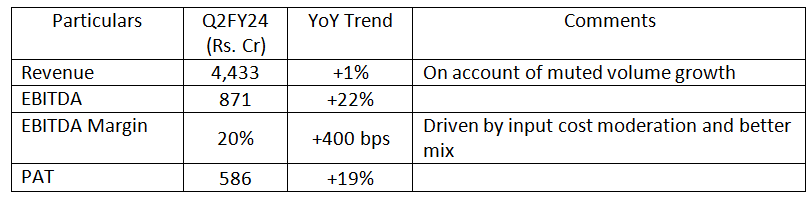

Britannia Industries Ltd

At par result. Company retained the input cost moderation leading to improvement in margin.

Dabur India Ltd

Robust performance. Mid-single-digit growth in healthcare and HPC business, while the food and beverages business declined by 7% YoY on account of uneven rainfall.

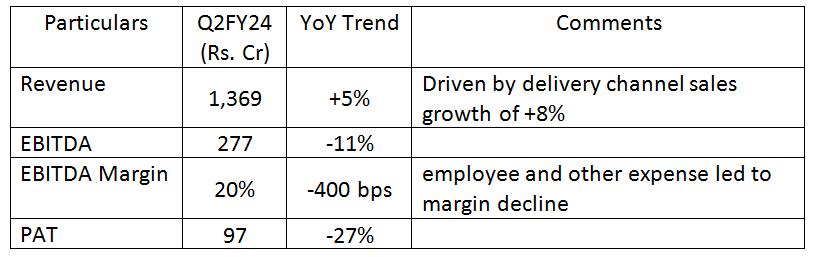

Jubilant Foodworks Ltd

At par result. Same store sales growth decline by -1% YoY but sequential improvement in average daily sale per store.

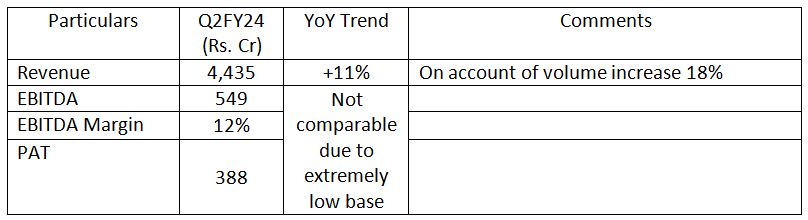

Sapphire Foods India Ltd

Subdued result. Same store sales growth for KFC was flat YoY while it declined by 20% for Pizza Hut India.

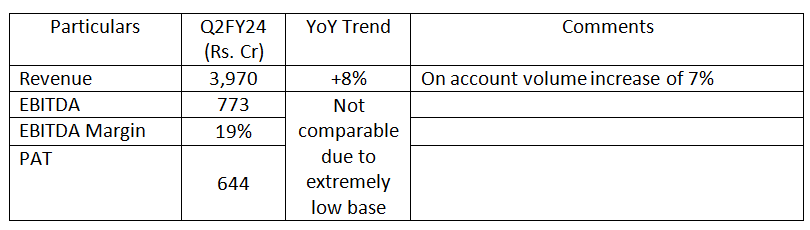

ACC Ltd

At par result. Muted realization/ton. Management guided capex of Rs. 2,500 Cr in FY24.

Ambuja Cement (Standalone)

At par Result. Volume growth impacted by heavy rains in Himachal Pradesh and muted demand in eastern region.

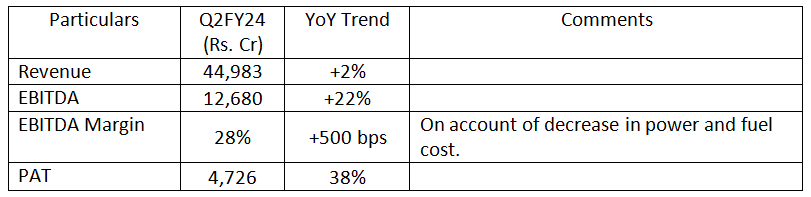

NTPC Ltd

Strong performance. Thermal Plant factor load (PLF) for H1FY24 stood at 76.6% as compared to national average of 68.8%. NTPC added 1,570 MW of commercial capacity in H1 FY24, including 110 MW from renewable sources.

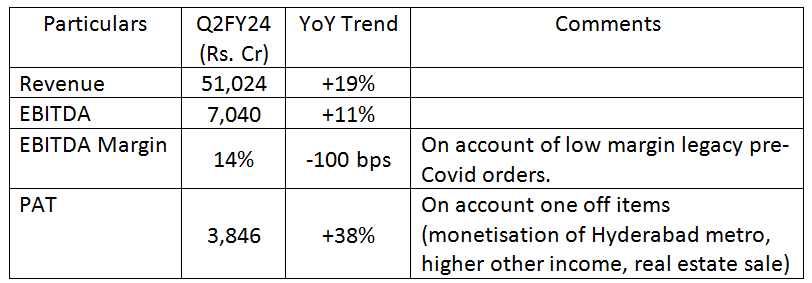

Larsen & Toubro Ltd

Strong performance on back of strong order book growth of 72% and continuous improvement in net working capital.

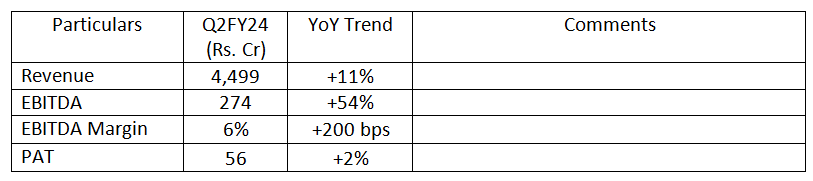

KEC International Ltd

Strong Performance on back of order intake of Rs. ~9,000 Cr majorly in Transmission, Distribution and Civil Business. Management expects EBITDA margins to continue to improve over the next few quarters.

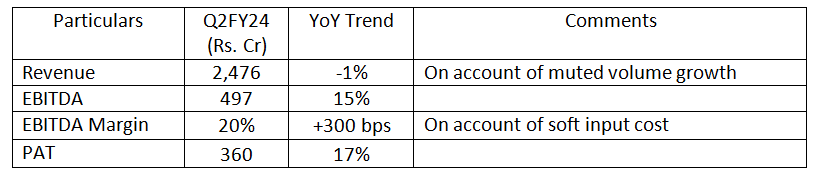

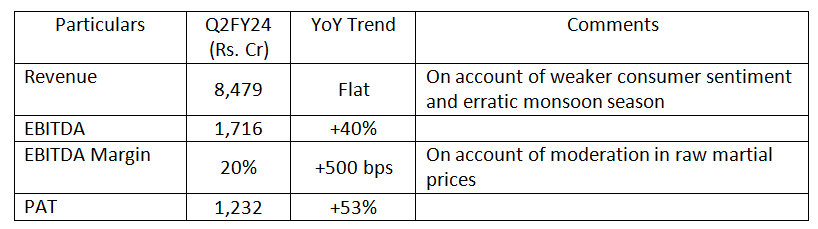

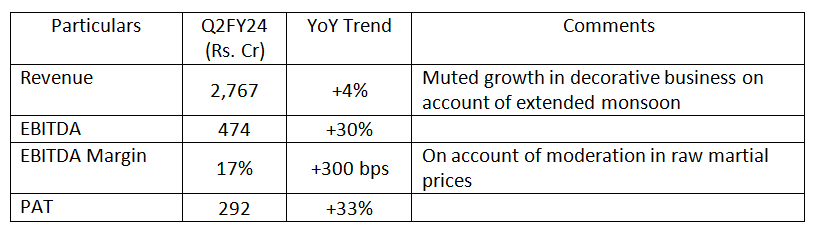

Asian Paints Ltd

At par result. Board approved equity dividend of Rs. 5.15 per share.

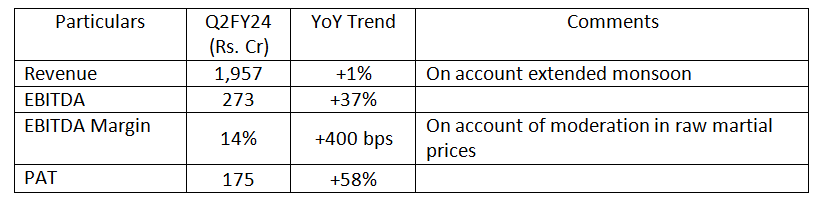

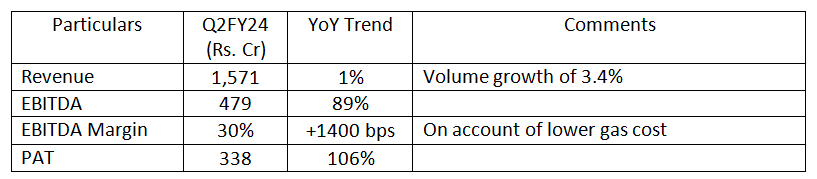

Kansai Nerolac Paints Ltd

At par result.

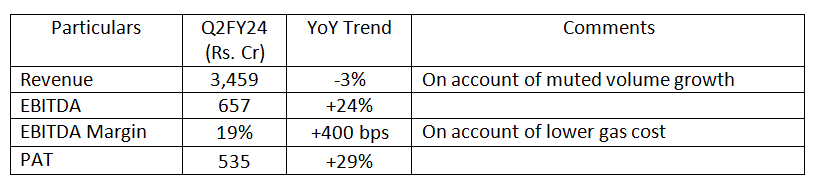

Berger Paints India Ltd

Mahanagar Gas Ltd

A good set of results. EBITDA/SCM remained well above historical level which led to strong earnings growth. Management has guided for a capex of Rs. 800 Cr for FY24.

Indraprastha Gas Ltd

Subdued result.

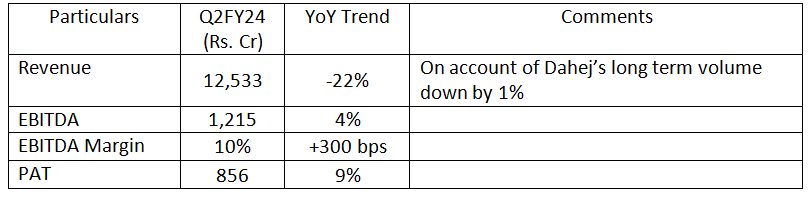

Petronet LNG

At par result. Management approved the capex of Rs.~21,000 Cr towards PDHPP plant.

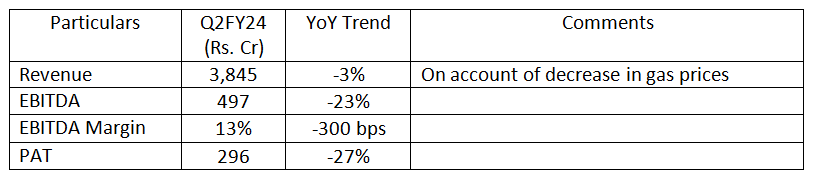

Gujarat Gas

Subdued result. Volume for Q2FY24 stood at 9.3 million metric standard cubic meters per day (mmscmd).

Relaxo Footwears Ltd

At par result. The volume increase is offset by a fall in average realization per pair which stood at Rs. 147 compared to Rs. 169 in Q2FY23.

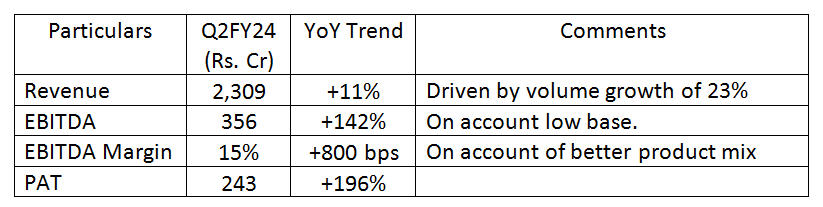

Supreme Industries

Robust result. Management guided for a consolidated EBITDA margin of ~15% for FY24.

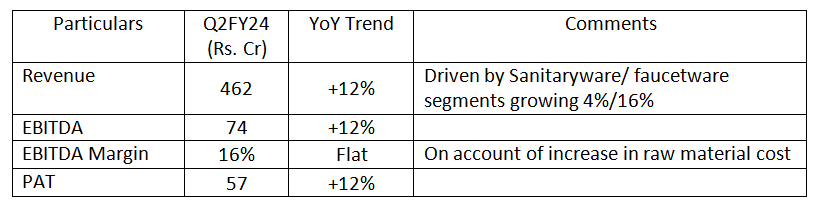

Cera Sanitaryware Ltd

A good set of results. Management guided for revenue growth of ~17-19% YoY In FY24.

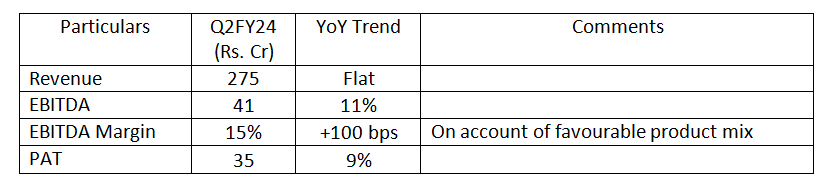

Symphony Ltd

A good set of results. Domestic revenue grew 1% despite the non-seasonal quarter.

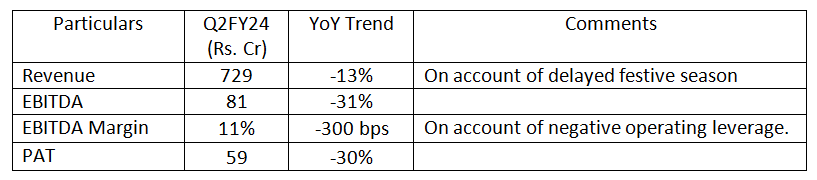

TTK Prestige

At par result. High competition at the bottom of the pyramid may lead to market share losses.

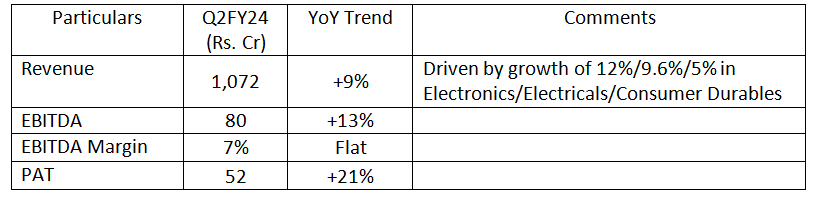

V-Guard Industries Ltd

Good set of result. Gross margins expanded on back of softening in raw material prices.

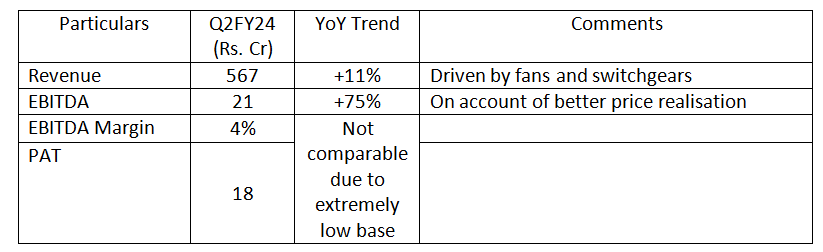

Orient Electric Ltd

Muted result. PAT Rs. 18 Cr including Rs. 15 Cr from the profit on sale of land.

Related Blog:

- Q2FY24: Weekly Result Update Part 2 – Sun Pharma, Container Corp, Coromandel, Bluedart

- Q2FY24: Weekly Result Update Part 3 – Reliance, Airtel, HCL, Maruti Suzuki, Care Ratings

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory