Dear Readers,

Welcome to our company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

Contents:

- Pharma (Sun Pharma, Cipla)

- Logistics (Container Corp, Bluedart, Mahindra Logistics)

- Chemicals and allied (Coromandel, SRF)

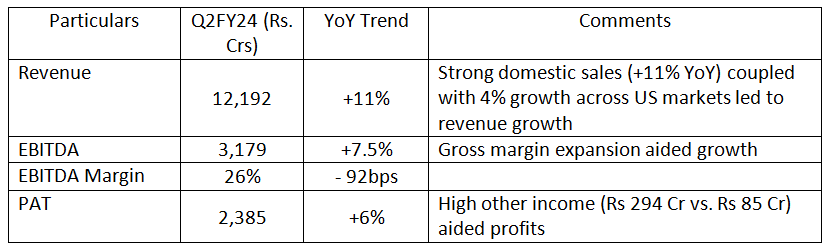

Sun Pharma

Resilient performance on the back of increased volumes, price increases, and new product launches.

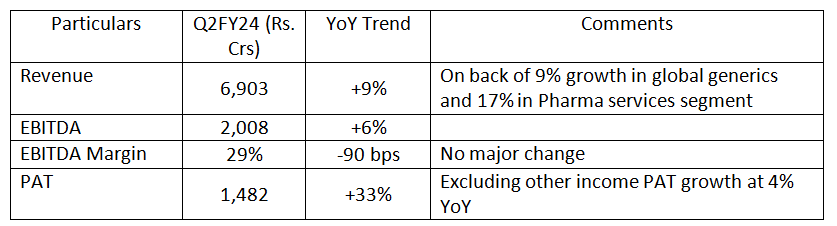

Dr Reddy’s Laboratories

Good results plan to focus on licensing and collaborating with partners to bring innovation to India and strengthen its presence in the generic business.

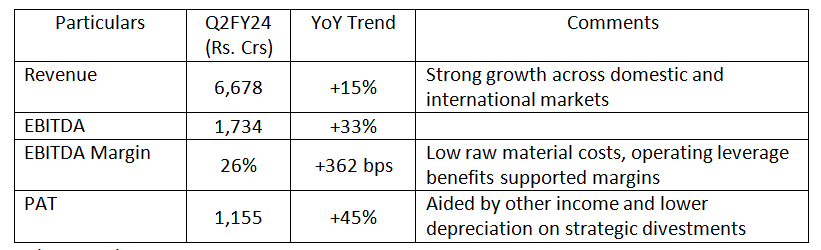

Cipla

Robust results.

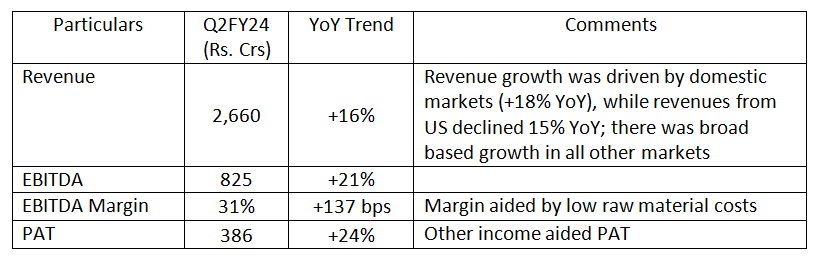

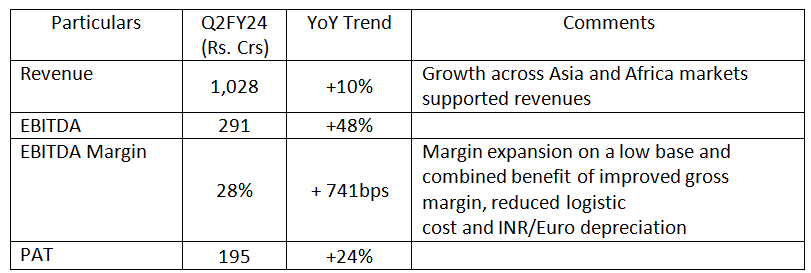

Torrent Pharmaceutical

Good results, a key factor to monitor going ahead will be domestic revenue growth.

Ajanta Pharma

Healthy performance.

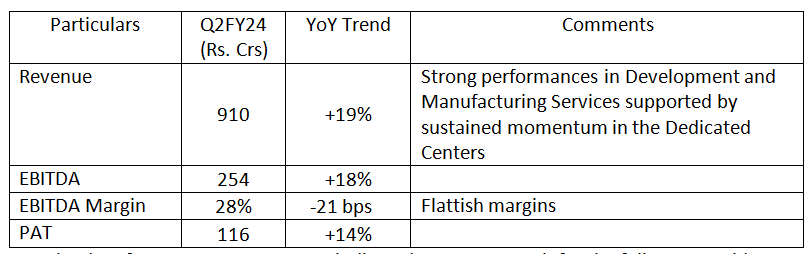

Syngene International

Sustained performance, management indicated revenue growth for the full year at mid-teens on a constant currency basis compared to earlier guidance of high-teen growth.

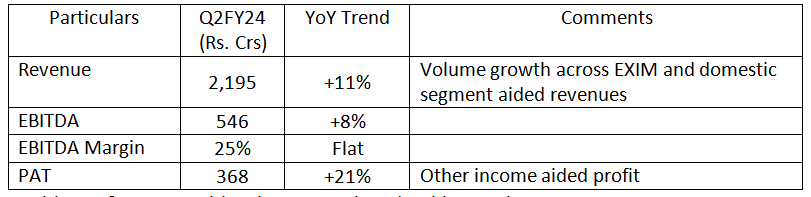

Container corporation

Healthy performance with volume growth and stable margins.

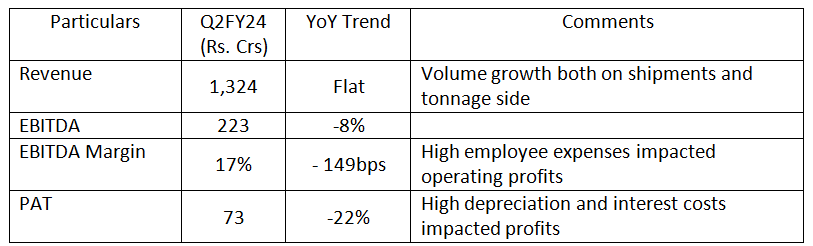

Bluedart Express

Performance has improved sequentially as revenues and profits grew QoQ.

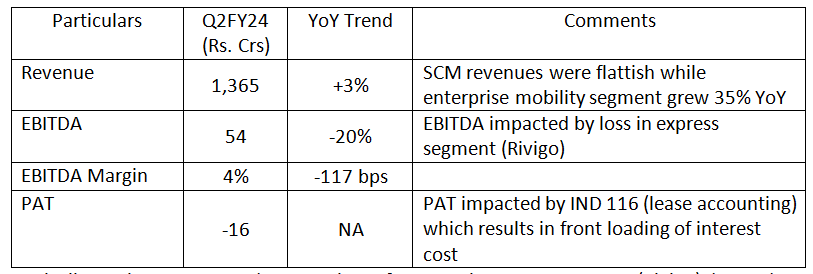

Mahindra Logistics

Optically results are not good. EBITDA loss of Rs 24 Cr in an express segment (Rivigo) dragged down performance; management expected it to turn EBITDA positive in H1FY24 but now guidance is that the same will happen at the end of FY24.

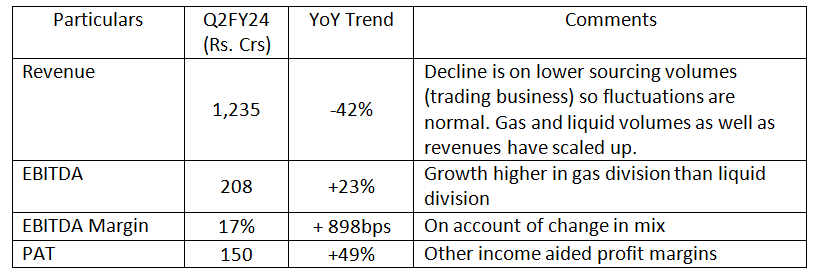

Aegis Logistics

Good results and a decline in quarterly revenues (trading business) shouldn’t be a concern.

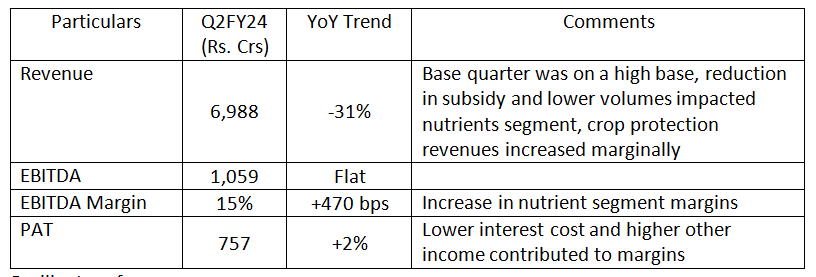

Coromandel International

Resilient performance.

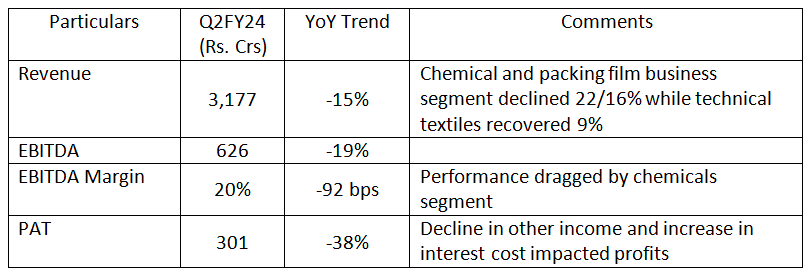

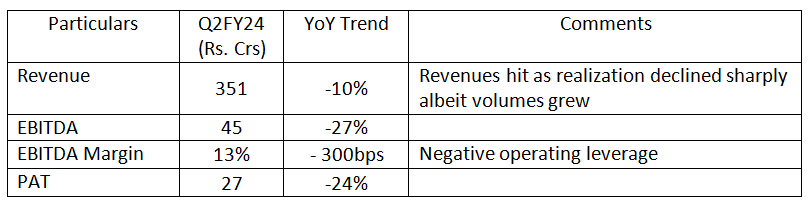

SRF

Weak results on China dumping leading to low demand and weak prices in select segments.

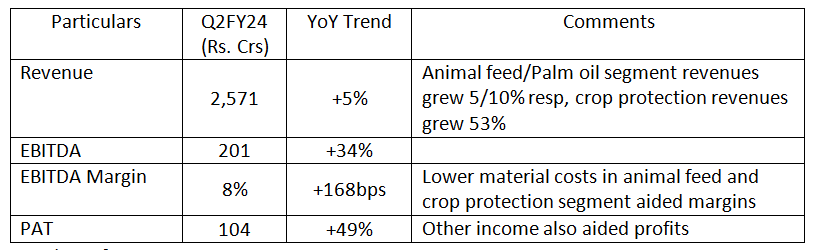

Godrej Agrovet

Steady performance.

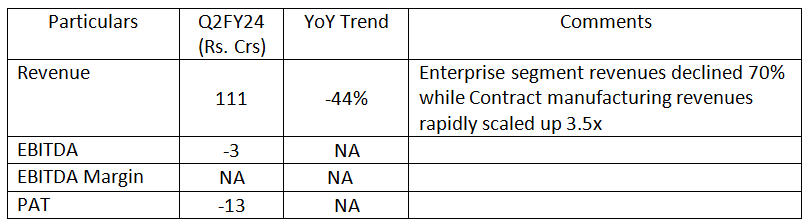

Astec Lifesciences

Poor performance; as demand-supply imbalance, price erosion, and inventory destocking impacted the enterprise segment.

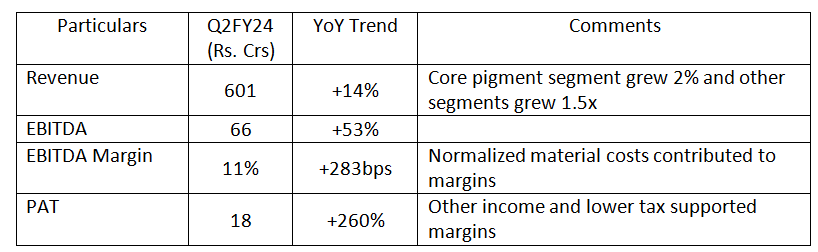

Sudarshan Chemicals

Strong results on input cost reducing and operating leverage playing out.

Rallis

Healthy results, looking at the industry scenario, the management has taken needed steps.

Nocil

Muted results on recessionary pressure in the export market, domestic volumes were flat QoQ.

Related Blog:

- Q2FY24: Weekly Result Update Part 1 – Dabur, ACC, L&T, Petronet

- Q2FY24: Weekly Result Update Part 3 – Reliance, Airtel, HCL, Maruti Suzuki, Care Ratings

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory