This article covers the following:

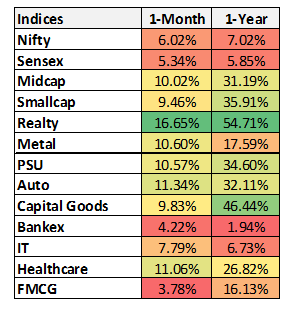

Source: NSE, BSE, CDSL

Sensex has given returns of 5.34% in the last month and has risen by 5.85% on a yearly basis.

As we write this note in December, Sensex has grown by 5.34% in November and 5.85% in the last year. Major performing sectors in the last month were Realty, Auto, and Healthcare. The major performing sectors in the last year are Realty, Capital Goods, and PSU. Major events we talk about in detail below include India Inc’s Q2 performance, strong GDP growth, and Moody’s revised China outlook.

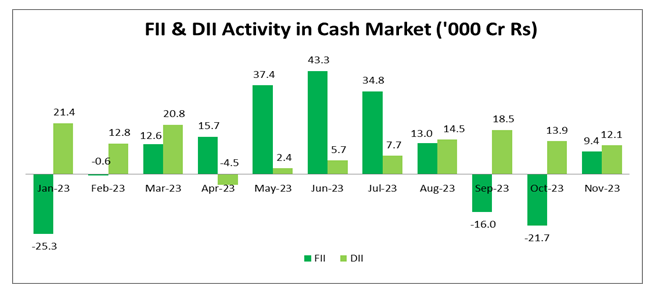

Source: CDSL, NSDL, NSE

FIIs in India have shifted their selling approach due to a drop in US bond yields and the Indian market’s resilience, prompting them to pause their selling. In November, FIIs turned into net buyers purchasing a total of ₹ 9,433 Crore in October. DIIs continued to show a positive trend as net buyers, purchasing ₹ 12,122 Crore during the previous month.

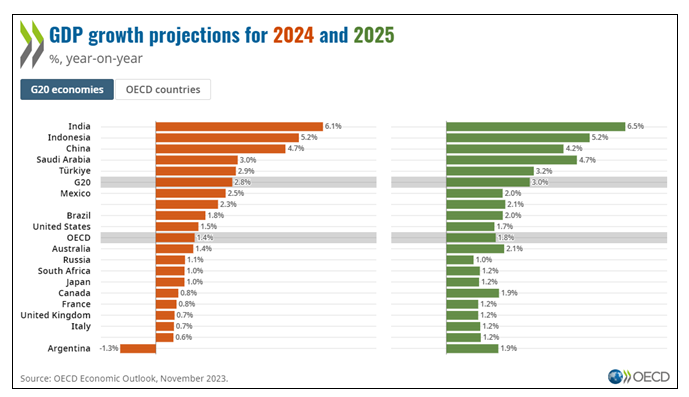

The global economy is grappling with challenges like inflation and subdued growth prospects. While GDP growth exceeded expectations in 2023, it is now slowing due to tighter financial conditions, sluggish trade, and weakened business and consumer confidence. Near-term risks lean towards the downside, including geopolitical tensions like the evolving conflict post-Hamas’ attacks on Israel, and a more significant-than-expected impact of monetary policy tightening.

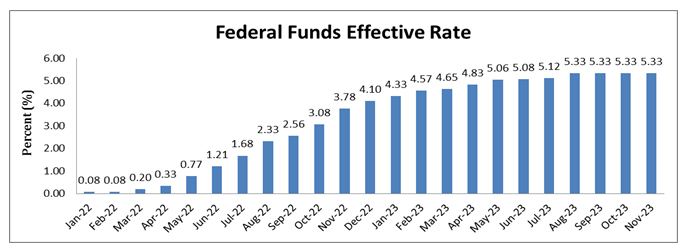

November saw a surge in stock markets after the Federal Reserve’s early-month meeting, perceived as less hawkish than expected. Chairman Powell indicated significant progress on inflation and suggested that recent financial tightening is akin to additional measures, supporting a genuine shift to a dovish Fed policy. Skeptics warn of a potential repeat of history, where investors may be falling for another false dawn during this Fed tightening cycle.

Source: fred.stlouisfed.org

Current public debt-to-GDP ratios are historically high, and governments are under increasing fiscal pressure due to factors such as aging populations and the imperative to address climate change. Projected trends suggest that without government intervention, the public debt to GDP ratio is expected to persistently rise to elevated levels.

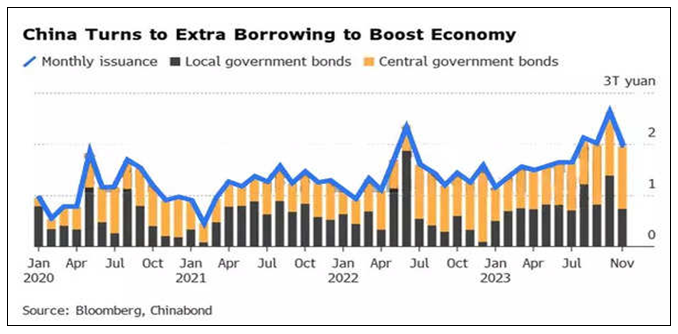

Moody’s Investors Service has revised its outlook on Chinese sovereign bonds from stable to negative, maintaining a long-term rating of A1. The decision reflects growing global apprehensions regarding the extensive debt in the world’s second-largest economy. Moody’s cites concerns over China’s use of fiscal stimulus for local governments and the escalating downturn in the property market as potential risks to the nation’s economy.

The global economy is expected to achieve a growth rate of 2.9% in 2023, with a slight decline to 2.7% in 2024. Anticipating a further reduction in inflation and an improvement in real incomes, the world economy is projected to expand by 3% in 2025. Continued robust growth hinges significantly on the fast-growing economies in Asia.

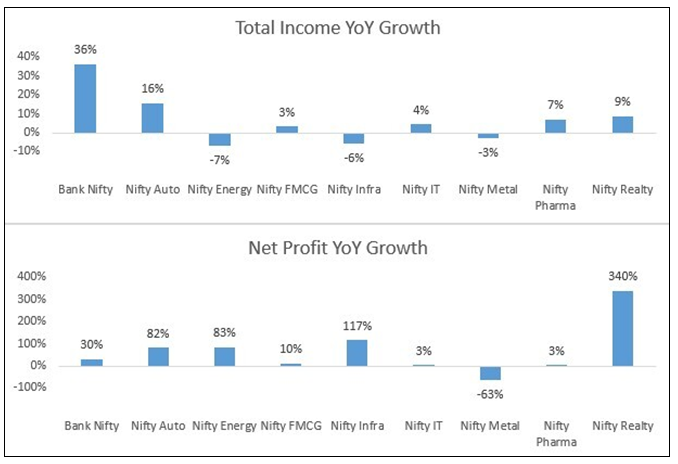

India Inc.’s quarterly performance has concluded in the last month, showcasing diverse performance. Nifty 50 witnessed a notable 9% YoY increase in total revenue, reaching Rs 11.38 lakh crore, coupled with a robust 20% YoY rise in profits to Rs 1.50 lakh crore. The Indian economy’s resilience was evident as 36 out of 50 companies reported revenue growth, and 40 companies saw increased profits.

Source: Samco Ventures

In Q2FY24, the banking sector showed solid performance with advanced growth and improved asset quality but faced margin pressure due to the rising cost of funds. Credit growth was strong in retail, MSME, and corporate sectors, while increasing term deposits led to a decline in the CASA ratio. Due to the industry-wide high credit-to-deposit ratio, banks boosting deposits are expected to have an advantage.

The auto sector performed well, driven by lower raw material costs and increased efficiency. Factors such as a 2-wheeler industry revival, growing commercial vehicle demand, and higher SUV sales contributed to the sector’s success. Companies benefited from a focus on premiumization, new orders, operating leverage, and favorable foreign exchange. Anticipated improvements in exports are expected to contribute to a strong future performance.

In Q2FY24, the Realty sector defied the typical weak seasonal trend, experiencing a notable recovery in property demand. Factors like new project launches, favourable commodity prices, and stable interest rates drove this momentum. The IT sector had a subdued September quarter with modest revenue and profit growth, attributed to delays in discretionary spending and decision-making. FMCG faced challenges in revenue growth due to rural stress and erratic monsoon but reported margin expansion due to lower input prices. The pharma sector saw positive market sentiment, while the metals sector struggled.

The overall resilient performance of the Nifty 50 in Q2FY24 reflects a promising indicator for India’s future economic trajectory, driven by green shoots in the investment cycle and increasing capacity utilization. Sectors like banking, automobiles, cement, capital goods/EPC, and pharmaceuticals are poised for sustained growth in the coming years.

Source: PIB

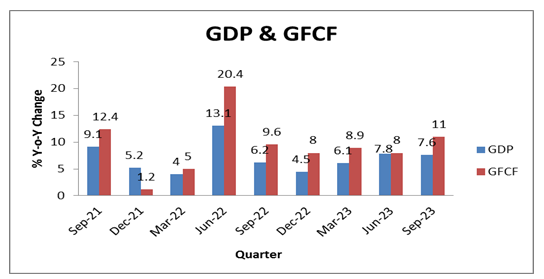

Q2FY24 saw a positive development in GDP growth, registering a rate of 7.6% YoY, higher than the 6.2% YoY recorded in last year’s quarter, Q2FY23. Notably, this figure surpassed the RBI’s estimate, indicating better-than-expected economic performance. The upswing in both output and supply was notable but appeared concentrated in select sectors. Despite disappointing consumption numbers indicative of weak demand, the growth observed in Q2FY24 was primarily driven by robust capital expenditure.

Despite global tensions, the economy is expected to remain resilient, with real GDP growth slowing to 6.3% in FY 2023-24 and 6.1% in FY 2024-25 before gradually rebounding in FY 2025-26. Slower growth will lead to moderation in inflation expectations, housing prices, and wages, bringing headline inflation down to around 4.2%. The RBI is anticipated to start reducing interest rates from mid-2024, reaching 5.5% by the end of 2025. Trade restrictions imposed in 2022, including export bans on certain rice varieties, will be lifted, aiding export growth and maintaining a manageable current account deficit.

However, downside risks persist, influenced by heightened global uncertainty and the lingering impact of domestic policy tightening. Socio-economic indicators, such as rural consumer goods sales, present disappointing dynamics, and a below-normal monsoon season could negatively affect growth.

It’s worth noting that interest rates in many countries have reached their highest levels in the past two decades. Several nations are grappling with the consequences of this, as it increases interest costs and affects government debt and corporate earnings. India is better positioned to handle this situation than most other countries due to its de-levered balance sheets. Among major nations, India has the least amount of debt, providing it with an advantage in navigating the unpredictable global financial landscape.

Indian economy continues to be a steady ship in choppy waters

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

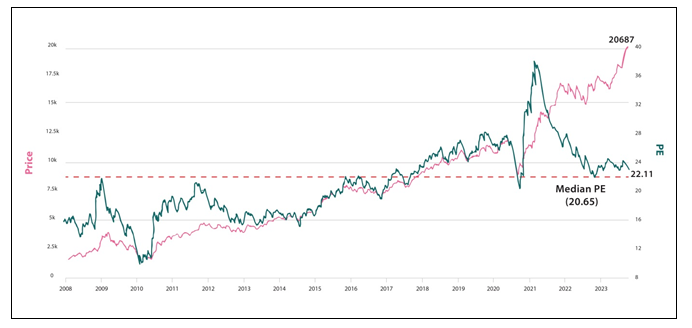

Nifty is trading slightly above long term averages

Source: Trendlyne

On a PE basis, Nifty is trading at 22.11, above the historical median of 20.65. It shows positive sentiment and bullishness in the market.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy.

Our portfolio companies have performed well this calendar year, in such bullish markets we advise you to move towards resilient companies. Please check the companies recommended in the BUY zone as per subscribed plans.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory