This article covers the following:

- Love for Gold is in Indian Genetics

- Does that mean Gold is not a good investment at all?

- How does Gold qualify as insurance?

- How much to Invest in Gold/Gold instruments?

- How to Invest in Gold?

- What exactly do these alternatives mean?

- What are the differences between each of these alternatives?

- Which one is suitable for me?

Love for Gold is in Indian Genetics

Discovered as shining, yellow nuggets, Gold has a deep-rooted significance in world history. Gold has successfully allured people from different parts of the world with its beauty and charm.

Over the years Indian’s infatuation with gold has only grown stronger with time, with India accounting for most of the gold consumed globally.

Gold, in Indian history, is more than an investment; it is a culturally significant metal that has found a place in Indian hearts and homes alike.

It is true that a vast majority of the Indian population survives on a meager income, but despite this, they find ways to buy gold and make it an integral part of their lives, irrespective of gold rates.

Gold has takers across the length and breadth of our nation, right from Delhi to Chennai and Ahmedabad to Kolkata, the same is true across the world.

There are a few reasons which have propelled gold to a pedestal in India including but not limited to religious connotations, family heirloom, gifts, status symbol, investment and marriage purposes.

As Indians, we have a different perspective of looking at gold as an investment avenue, which we inherit from our previous generations.

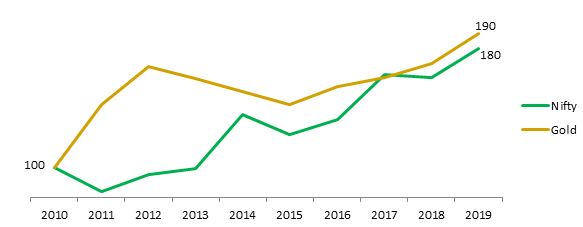

Now, let us look at returns given by Gold in the last 10 years versus Nifty.

In the above chart, Gold has given a CAGR of 6.6% whereas Nifty has given a CAGR of 6%. This gives the impression that Gold is a better investment avenue than equity.

However, it’s a mere coincidence as the long term data suggests that Equity is victorious. Sensex started in 1979.

If we compare Sensex returns since inception versus the Gold prices, it is a staggering 16% CAGR versus a mere 9% CAGR in Gold.

This concludes that Equity remains the most profitable investment class.

Does that mean Gold is not a good investment at all?

Well, the answer is neither yes/ no. Irrespective of what returns it earns, Gold should be a part of every long term portfolio. Gold acts more like insurance rather than an investment of the overall portfolio.

How does Gold qualify as insurance?

Gold acts insurance in times of distress like an earthquake, currency crises, economic risks or government failures.

God forbid, if one has to migrate to other countries at the time of crisis for unavoidable reasons, the faith in local currency could be low; Gold saves the day during such circumstances.

Even if there is no large event, just a prolonged slowdown or inflation spike in the economy can lead to contagion in financial markets thereby devaluing the local currency, bonds, etc.

In such situations, the perceived value of Gold goes up. This is true in the US as much as it is true in India.

Hence, it a single asset which is widely accepted across the world and automatically becomes more valuable from time to time.

How much to Invest in Gold/Gold instruments?

While there is no right allocation formula per se, but if we look back in the past, every 10 years there was an event that could have derailed the economy/country.

So we can say a 10% chance of a bad event, which warrants a 10% allocation to Gold. Gold must form 7-10% of your entire wealth, including real estate.

If your wealth far exceeds retirement corpus, you can consider Gold as 10% of retirement corpus.

How to Invest in Gold?

Investment in Gold can be done in 3 ways; Sovereign Gold Bond, Gold ETF, and Physical Gold.

Physical gold is the most preferable option to own Gold as one has easy access to Gold in a time of crisis.

Non-physical Gold will have a liquidation risk at the time of crisis.

Every Gold instrument will have some pros and cons. Let us understand the differences between each of them and which one is preferable depending on the type of investor.

What exactly do these alternatives mean?

Sovereign Gold Bonds (SGBs):

The Bond is issued by the Reserve Bank on behalf of the Government of India in multiples of one gram of gold and is traded on the exchange.

While these bondholders do not own actual Gold, the change in the value of a bond is dependent on the change in the value of Gold.

It generates market returns linked to Gold prices. SGBs provide interest income at the rate of 2.50% (fixed rate) p.a on the amount of initial investment.

The interest payment is done semi-annually. These bonds can be used as collateral for taking loans as they are backed by a government guarantee.

Gold ETFs:

It is an exchange-traded fund that can be bought and sold on exchanges. Like SGB, its returns are linked with the actual price of Gold in the market.

However, the difference here is that the ETF manager actually owns the physical Gold in government treasury on behalf of the investors.

To invest in Gold through ETF, one must have a trading – Demat account with any broker.

Physical Gold:

Gold which owned in the form of jewellery, bullions, coins, etc. It can be bought from a jeweller.

Owning the physical Gold incurs storage cost as it might require lockers.

What are the differences between each of these alternatives?

| Parameters | Sovereign Gold Bonds | Gold ETF | Physical Gold |

| Investing source | Issued by RBI or can be bought from Secondary markets | From Stock Exchange | From Jewellers |

| Investment Limit | Minimum 1 Gram. Maximum 4 Kg for an individual | Minimum 1 Gram. Maximum No Limit | No Limit |

| Lock-in Period | 5 Years | No | No |

| Returns | Higher than actual return on gold

(2.5% interest + change in Gold value) |

Slightly lower than actual Gold return

(because of fees on ETF) |

Same as Gold return

(Lower if owned as jewellery due to making charges) |

| Purity | High

(As per Gold bullion Standards) |

High

(as it is held in electronic form) |

Purity check is a concern |

| Redemption | Based on the average price of past 3 business days from the date of repayment | Real-time basis | Differs from jeweller to jeweller |

| Storage | With RBI or Demat account | Demat Account | Lockers |

| Safety and Security | Safe in terms of theft | Safe in terms of theft | Risk of theft |

| Liquidity | Tradable on exchange. One can redeem from the 5th year onwards. | It trades on an exchange that can be liquidated in mkt hrs. | Can be liquidated with a jeweller |

| Can it be used to take Loan | Yes | No | Yes |

| STCG Tax treatment (< 3 years ) | NA | Income tax Slab rate | Income tax Slab rate |

| LTCG Tax treatment (> 3 years) | Exempted from tax if redeemed on maturity. Before maturity, gains are taxed at 20% | Taxed at 20% | Taxed at 20% |

Which one is suitable for me?

Gold can be owned in above mentioned three ways. The choice is dependent on the requirement of the investor.

- Sovereign Gold Bond (SGB):- This is suitable for the investor with low liquidity needs and a long time horizon as the SGBs have a minimum holding period of 5 years. The investor, who has no liquidity needs for the next 5 years, can invest in SGBs. For this holding period, SGB holders are compensated with an additional 2.5% interest along with the change in the value of a bond (according to Gold prices).

- Gold ETF: – This is suitable for investors who have high liquidity needs and a short time horizon. Since Gold ETFs can be sold at any given time on exchange, it is suitable for investors who cannot commit to holding for a long time due to urgent cash needs. The returns on Gold ETFs are slightly lower than the actual Gold return as the ETF manager charges the fees for the provided service.

- Physical Gold: – This is suitable for investors who want to own gold in the long term for usage (like jewellery). This is also suitable for the investors who want to bet on Gold prices (in such cases bullion/ vedhani are preferable as they do not incur a lot of making charges). Owning physical gold possess a risk of theft. Hence, it needs to be stored in a bank locker which incurs additional storage costs. Storage cost is not a matter of concern in the other two alternatives.

If you’ve NOT identified yourself with any one of the above three, we recommend an equal allocation to all three options.

Physical Gold has its importance, SGB through illiquid earns tax-free gains while ETF is liquid to increase/reduce position in gold. ETF can also be used for regular SIP and later redeemed for consumption.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Good piece of information about gold….would like to read more n more such articles from you….