“The stock market is a device for transferring money from the impatient to the patient.”

— Warren Buffett

When it comes to building long-term wealth, Equity stands unmatched.

For investors with the right mindset — patience, discipline, and a long-term horizon — it’s the most powerful and reliable way to beat inflation and grow real wealth.

Why Beating Inflation Matters

The most common advice in financial planning is this:

“Make sure your savings beat inflation.”

But what exactly does that mean — and why is it so critical?

What is Inflation?

Inflation is the gradual rise in prices of goods and services — food, housing, clothing, healthcare, education — everything that defines your cost of living.

If Rs. 50 could buy you a hearty lunch years ago, today it might not even buy you a liter of milk. That’s inflation at work — slowly eroding your purchasing power.

In simple terms, your money loses value over time.

Are Your Savings Really Beating Inflation?

In India, inflation averages around 4–6% per year.

That means:

- Rs. 1,00,000 today will be worth only about Rs. 60,000 after 10 years,

- and just Rs. 38,000 after 20 years.

That’s nearly 60% loss of value in two decades.

Inflation is a silent tax — it eats away at your savings without you noticing.

So while your income and expenses rise every year, the real value of your money keeps shrinking — unless you make it work for you.

Why Fixed Deposits Don’t Work Anymore

Most Indian households prefer the safety of Fixed Deposits (FDs). In fact, more than half of Indian savings sit in bank deposits.

FDs offer stability — but not growth.

After accounting for inflation and taxes, FD returns often barely match or lag inflation, meaning your money’s purchasing power continues to decline.

Gold too, while emotionally comforting, has been inconsistent in beating inflation.

If your monthly expenses are Rs. 25,000 today, you’ll need far more just to maintain the same lifestyle after retirement — not because you’ll spend more, but because everything will cost more.

The solution?

You can’t simply save more — you must invest smarter.

The Inflation-Beating Champion: Equity

Equity, or ownership in businesses, is the one asset class that has consistently beaten inflation over time.

Let’s look at history.

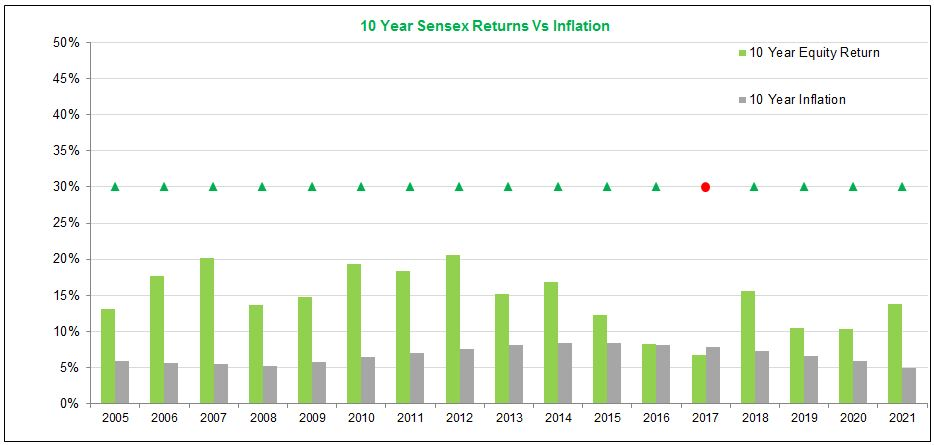

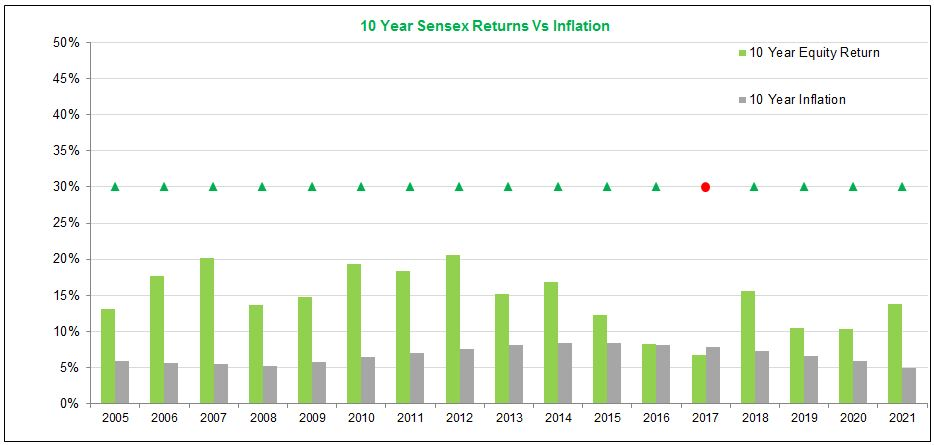

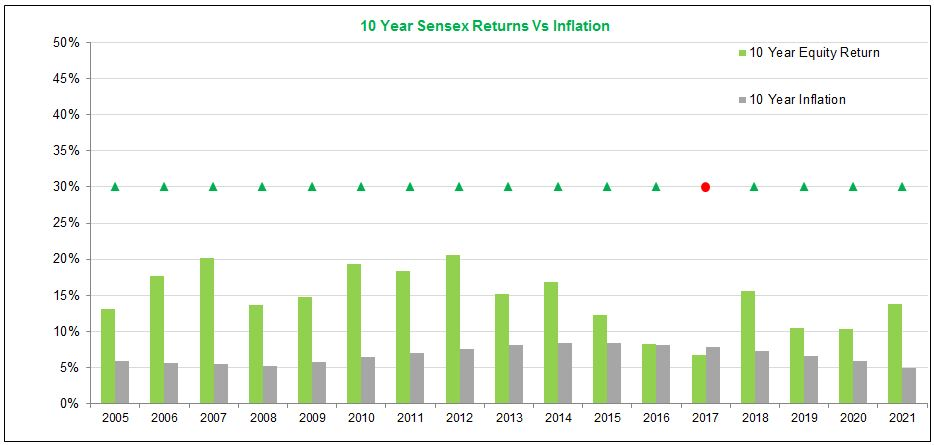

Broad equity indices like the Nifty or Sensex have delivered long-term returns of around 12–14% CAGR, while inflation has averaged 6–7%.

That’s roughly 5–6% more than inflation every year — compounded over time, this difference is enormous.

Let’s illustrate:

- Rs. 1,00,000 invested in equities today, growing 5% above inflation,

becomes Rs. 1.58 lakh in 10 years and Rs. 2.5 lakh in 20 years,

in today’s purchasing power.

That’s real growth — your wealth not only keeps pace with inflation, it outpaces it dramatically.

Why Equities Beat Inflation

Equities represent ownership in businesses, not paper assets.

Companies sell products and services whose prices rise with inflation.

Take a shampoo manufacturer:

When raw material costs rise, the company raises its prices. Consumers pay more, revenues increase, and profits grow.

Over time, these higher profits lead to higher share prices.

That’s how equity investments automatically adjust to inflation.

Simply put —

Inflation increases prices. Companies pass that cost on to consumers. Profits rise. Stock prices follow.

How Consistent Is Equity in Beating Inflation?

If you invested in the market (say, Sensex or Nifty) at the start of any year and held for 5 years:

- In 3 out of 4 cases, equities have beaten inflation.

And when they didn’t?

Holding for a bit longer — say, 6 or 7 years — always tipped the balance.

Stretch that horizon to 10 years, and equities have beaten inflation almost every single time.

The longer you stay invested, the more predictable equity returns become.

That’s why time in the market is far more important than timing the market.

Managing Volatility the Smart Way

Yes, equities fluctuate in the short term — that’s their nature.

But over longer periods, those ups and downs even out, revealing a steady upward trend driven by corporate earnings growth.

Volatility can be managed by:

- Staying invested for at least 5–10 years,

- Maintaining a diversified portfolio, and

- Avoiding emotional reactions to short-term market moves.

The short-term noise fades. The long-term wealth remains.

Asset Allocation: Finding Your Balance

Equity doesn’t mean “all or nothing.” Your allocation should depend on your goals and risk appetite.

Investor Type | Suggested Allocation | Rationale |

Young / Aggressive | 70% Equity, 30% Debt/Gold | Longer time horizon allows higher risk for better returns |

Moderate Risk Appetite | 40% Equity, 60% Debt/Fixed Income | Balance between stability and growth |

The key is to let equity do the heavy lifting for long-term wealth creation, while fixed income provides short-term stability.

Final Thoughts

Inflation quietly eats into your savings.

Equity, on the other hand, helps your money grow faster than prices rise.

So, instead of letting inflation win, make equity your ally.

Even if you start small — start now.

The best time to invest was yesterday. The second-best time is today.

Because in the long run, Equity is way too consistent to disappoint.

“The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures.”

— Warren Buffett

Stay invested. Stay patient. Beat inflation — with Equity.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: