Before investing in any stock, every rational investor must answer one question:

“Is this stock available at the right price?”

That “right price” is what professional investors call the Intrinsic Value — the true worth of a company based on its ability to generate future cash flows, not the hype or sentiment in the market.

What Is Intrinsic Value?

The intrinsic value of a stock is an estimate of what the company is really worth — derived from its fundamentals such as profits, free cash flows, and the economic value of its assets. It excludes market noise or short-term speculation.

Because the future is uncertain, intrinsic value cannot be calculated with perfect precision; it can only be estimated using reasonable assumptions about growth, profitability, and risk.

There are several ways to estimate intrinsic value, such as:

- Discounted Cash Flow (DCF) method

- Dividend Discount Model (DDM)

- Asset-based valuation

For established, publicly listed companies, the Discounted Cash Flow (DCF) method is considered the most relevant and widely used.

The Logic Behind the DCF Method

If you were to buy the entire company outright, the price you should pay depends on the total cash flows it will generate for you in the future.

However, Rs 100 received today is more valuable than Rs 100 received three years later.

Therefore, each future cash flow must be discounted back to its present value using an appropriate rate of return — typically the cost of equity.

The sum of all these discounted future cash flows represents the company’s Intrinsic Value.

In simpler terms:

Intrinsic Value = Present Value of All Future Cash Flows + Present Value of Terminal Value

Applying This to a Stock You Own

As a retail investor, you don’t buy the entire company — you buy a portion of it through shares. But the same principle applies.

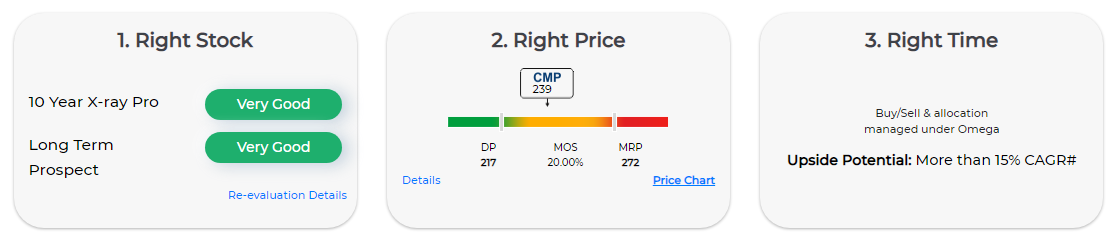

At MoneyWorks4Me, we call the fair value or intrinsic value of a stock its MRP (Maximum Retail Price) — the highest price you should pay if you want to earn your minimum expected return.

Your returns from owning a stock come from two components:

- Dividends — the annual cash income received from the company.

- Future Selling Price — the price at which you expect to sell your shares later.

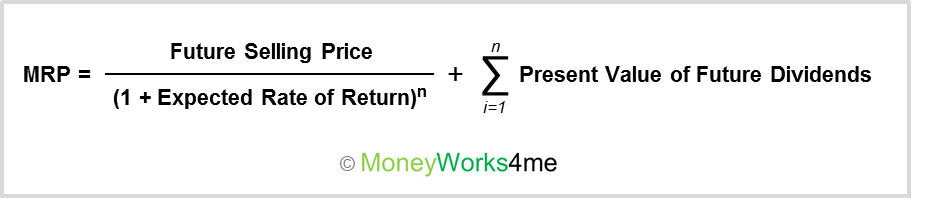

Hence, the Fair Value (or MRP) of a stock can be expressed as:

Fair Value = Present Value of Future Dividends + Present Value of Future Selling Price

Estimating the Future Selling Price

The future selling price depends on:

- Expected Earnings Per Share (EPS) of the company in, say, five years.

- Expected Price-to-Earnings (P/E) multiple that the market will assign then.

Analysts estimate future EPS based on:

- Sales growth trends

- Profit margins and efficiency (e.g., Return on Invested Capital, or ROIC)

- Competitive position and industry outlook

The expected P/E multiple can be estimated using:

- Historical market averages

- Expected growth rate of earnings

- Broader economic conditions

This combination gives you an estimate of what the stock might trade for in the future.

Estimating the Present Value of Dividends

Dividends can be projected using the company’s historical payout and growth rate.

For each expected annual dividend, you discount it back to the present using your desired rate of return (the Cost of Equity).

At MoneyWorks4Me, we treat the Cost of Equity as the minimum acceptable rate of return for each company — typically 10–15% depending on risk.

Holding Period and Expected Return

We usually assume a 5-year holding period when estimating the MRP or fair value of a stock.

This period is long enough to let the business fundamentals play out, and short enough to model with reasonable accuracy.

Thus:

MRP = Price that ensures your expected return (Cost of Equity) over 5 years

The Margin of Safety: Protecting Against Uncertainty

Even the most rigorous intrinsic value calculation involves assumptions — about growth, profitability, or valuation multiples — that can go wrong.

Moreover, markets can behave irrationally in the short term.

That’s why intelligent investors always buy stocks at a discount to their MRP, known as the Margin of Safety.

A higher margin of safety protects you against:

- Forecasting errors

- Market volatility

- Unforeseen events (regulatory changes, recessions, etc.)

The principle is simple but powerful:

Always buy below intrinsic value — the greater the uncertainty, the larger your margin of safety should be.

Key Takeaways

- Intrinsic Value represents a company’s true worth based on its future cash-generating ability.

- The DCF method is the most reliable way to estimate intrinsic value for established companies.

- Fair Value (MRP) of a stock = Present Value of Future Dividends + Future Selling Price discounted to today.

- Cost of Equity is used as the discount rate — your minimum expected annual return.

- Always invest below intrinsic value to create a Margin of Safety.

In Summary

The right price of a stock is not what the market quotes today but the price that ensures you earn a satisfactory long-term return based on the company’s fundamentals.

As Warren Buffett said:

“Price is what you pay. Value is what you get.”

At MoneyWorks4Me, we quantify that value through our MRP-based valuation framework — helping investors know the fair price of every stock and make decisions backed by data, not emotion.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: