The Bankex, which tracks the performance of leading banking stocks, delivered an impressive 31% CAGR between 2002 and 2012 — an exceptional decade for investors.

After such strong performance, many expected the Indian banking story to continue its upward march through the following years.

In the first part of this series, we explored the structure and business model of Indian banks. In this second part, we examine the growth drivers, challenges, and long-term prospects of the industry as it stood in the early 2010s — insights that continue to hold valuable lessons for investors today.

Setting the Stage: A Decade of Transformation

The early 2000s marked a turning point for Indian banking. Reforms such as deregulation of savings rates, guidelines for new private-sector bank licenses, and the implementation of Basel III norms were introduced to strengthen the financial system and enhance competitiveness.

According to a McKinsey report from that period, India’s banking sector was transitioning into a high-performance ecosystem, driven by financial deepening, technology adoption, and policy reforms.

An IBA–FICCI–BCG report titled “Being Five Star in Productivity” projected that India’s banking sector could become the third-largest in the world by 2025, with total assets growing from USD 1.35 trillion in 2010 to USD 28.5 trillion by that time.

Clearly, the optimism surrounding India’s banking landscape was well-founded — supported by macroeconomic expansion and demographic tailwinds.

A Look Back: Industry Performance up to 2012

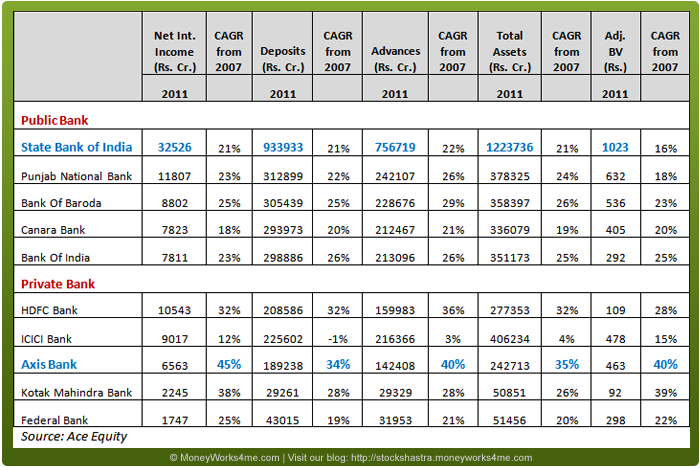

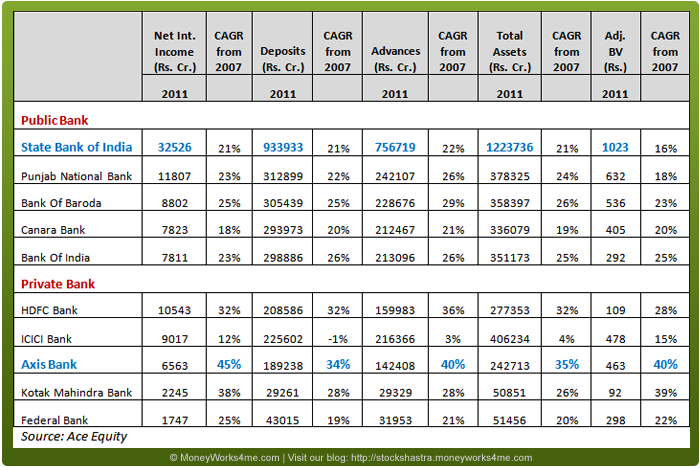

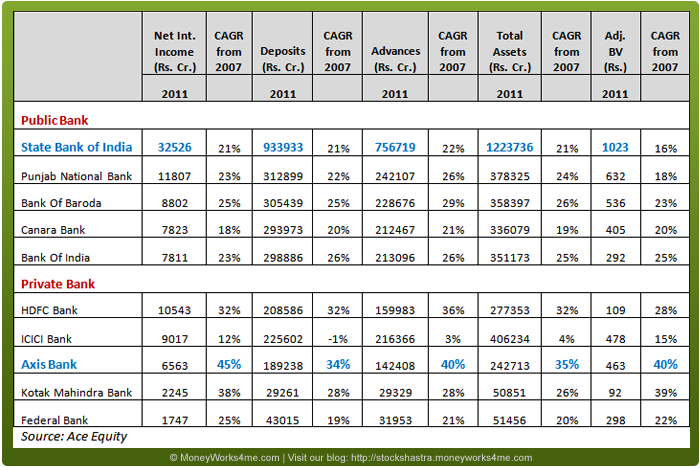

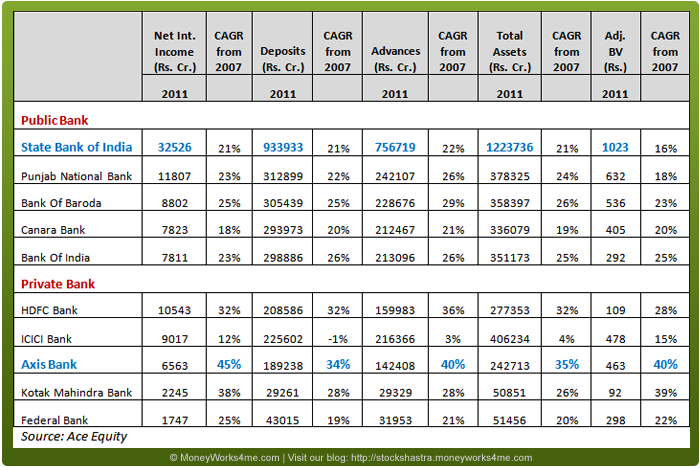

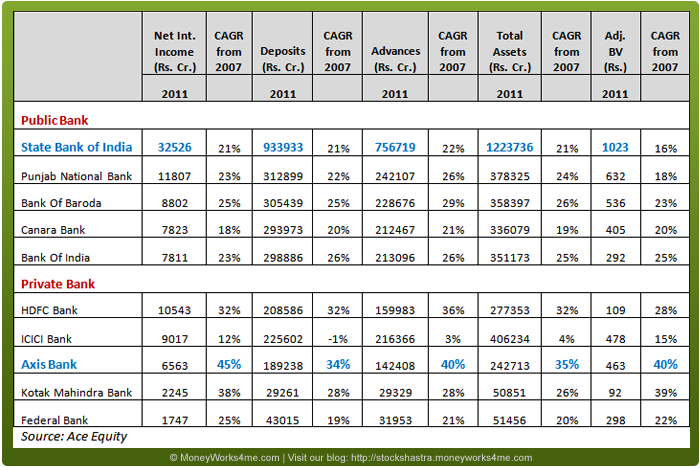

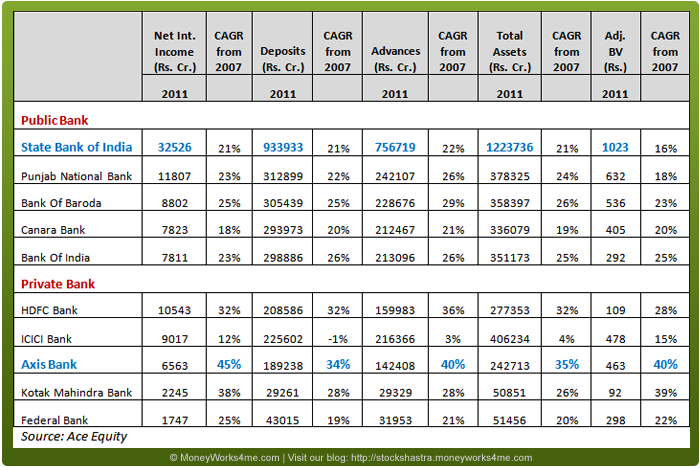

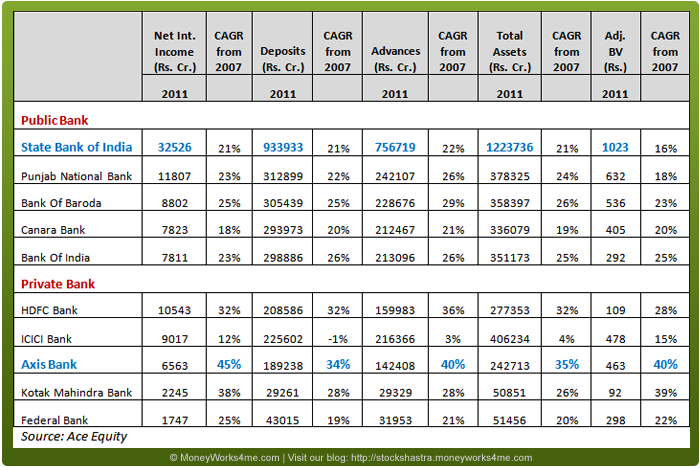

In the five years leading up to FY2011, the performance of various banking segments revealed clear trends:

- Public sector banks (PSBs) posted strong growth in deposits (21.7%), advances (23%), and business per employee (21.1%), but their asset quality and profitability lagged private peers.

- Private sector banks led in Net Interest Income (24.2%) growth and Return on Assets, supported by better efficiency and risk management.

- Foreign banks, though smaller in scale, recorded the highest business per employee and profit per employee figures.

Among the standout performers, Axis Bank led the private sector in growth across all key parameters, while Bank of Baroda emerged as a strong public-sector performer.

Key Observations

- HDFC Bank maintained the highest CASA ratio, lowest NPAs, and best five-year average ROA.

- Kotak Mahindra Bank reported the highest Net Interest Margin (NIM) and Capital Adequacy Ratio (CAR).

- SBI, the country’s largest lender, had the lowest ROA and the highest net NPA ratio, reflecting the challenges of scale and state ownership.

In summary: Private banks entered the 2010s with structural advantages — better efficiency, stronger capital, and superior asset quality — positioning them to capture greater market share in the years ahead.

Key Growth Drivers of the Indian Banking Industry (2010–2020 Outlook)

1. High Economic Growth Momentum

Banking growth closely tracks GDP. As India’s economy expanded rapidly during the 2000s and early 2010s, supported by infrastructure, manufacturing, and services growth, banks benefited from rising corporate credit demand and an expanding retail base.

2. Rising Disposable Income and Retail Credit Uptake

The period saw a shift from traditional savings-oriented behavior to higher credit adoption, especially among younger consumers.

Private and foreign banks held a significant share of customers under 40, reflecting India’s demographic dividend and rising financial aspirations.

3. Digital Banking and Mobile Channels

Through the 2000s, ATM and internet banking reshaped customer access. By 2012, mobile banking was emerging as the next wave — promising to reduce costs and extend banking services to remote areas.

Reports at the time projected that mobile banking would soon become the second-largest channel after ATMs — a prediction that has since become reality.

4. Financial Inclusion and Rural Outreach

Around 2012, over 40% of India’s adult population lacked a bank account — a massive untapped opportunity.

The RBI’s Financial Inclusion Program, coupled with microfinance and technology-driven outreach, aimed to extend banking access to rural India.

This initiative not only supported social goals but also laid the groundwork for volume growth in deposits and low-cost accounts.

Concerns and Challenges

1. Higher Capital Requirements under Basel III

As India prepared to implement Basel III norms, banks faced the need to raise additional capital buffers — including a capital conservation buffer and counter-cyclical buffer.

While private and foreign banks already maintained high CAR levels, public sector banks required capital infusion from the government to comply.

These regulations were expected to slightly reduce Return on Equity (ROE) but strengthen system stability.

2. Rising Non-Performing Assets (NPAs)

Aggressive credit expansion during the boom years led to a buildup of stressed loans, particularly in infrastructure and SME segments.

Restructured assets — loans whose terms were relaxed — also grew, weighing on profitability as provisioning requirements increased.

Improving asset quality and recovery mechanisms became a major focus area for banks through the 2010s.

3. Intensifying Competition

With new private licenses and NBFC entrants, competition in the sector was set to rise.

As products became increasingly commoditized, banks were expected to differentiate through technology adoption, customer experience, and cost efficiency rather than interest rate alone.

4. Human Capital Management

The sector also grappled with high attrition rates and the need for continuous upskilling.

Talent management, leadership training, and digital readiness became critical priorities, especially for PSBs undergoing transformation.

The Road Ahead (as Seen in 2012)

Despite the near-term headwinds of regulation, NPAs, and competition, the long-term outlook for Indian banking remained bright.

Key Structural Tailwinds

- Rising household incomes and urbanization to boost retail deposits and consumption lending.

- Financial inclusion to expand customer base and low-cost deposits.

- Mobile and digital banking to reduce operating costs and improve outreach.

- Credit demand from infrastructure and MSMEs to sustain growth.

These trends suggested that bank credit growth would continue to outpace GDP growth, supported by technology and regulatory modernization.

At MoneyWorks4Me, we assessed banks using our 10-Year X-RAY framework — covering seven critical parameters:

- Net Interest Income Growth

- Total Income Growth

- EPS Growth

- Book Value per Share (BVPS) Growth

- Return on Assets (ROA)

- Net NPA to Net Advances

- Capital Adequacy Ratio (CAR)

Only banks that scored Green on both past performance and future prospects qualified as investment-worthy at the right price.

Key Takeaway

The Indian banking industry entered the 2010s on a strong footing — supported by economic growth, digital innovation, and regulatory progress.

However, as history shows, maintaining high growth while managing asset quality and capital discipline is the true test of leadership in banking.

Investors should always look beyond short-term cycles and focus on banks with solid fundamentals, efficient operations, and prudent management — the ones that will remain Green through all seasons.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: