Warren Buffett, perhaps the greatest investor of all time, has once again delivered excellent financial results for Berkshire Hathaway for CY2009. His Annual letters to Shareholders are awaited with bated breath by many investors worldwide. His letters to the shareholders of Berkshire Hathaway have come to be regarded as one of the most important and informative bodies of work ever written in the business and investing world. And his latest letter to Shareholders, for 2010 is out now. It’s time again for investors, the world over, to lap up the words from the “Oracle of Omaha”.

Warren Buffett, perhaps the greatest investor of all time, has once again delivered excellent financial results for Berkshire Hathaway for CY2009. His Annual letters to Shareholders are awaited with bated breath by many investors worldwide. His letters to the shareholders of Berkshire Hathaway have come to be regarded as one of the most important and informative bodies of work ever written in the business and investing world. And his latest letter to Shareholders, for 2010 is out now. It’s time again for investors, the world over, to lap up the words from the “Oracle of Omaha”.

In this report, we bring to you the distilled wisdom from his latest letter – to help you get the best of this treasure. Buffett’s letters not only give lessons in business management but also reaffirm Buffett’s philosophy of investing, which has made him the World’s greatest investor. It is evident that, even today his time tested philosophy is simple:

- Buy a great business, worth owning forever.

- Buy it at a considerable discount to maximise your returns.

Buffett has outlined 4 important principles that any investor should follow.

Invest to be a Partner:

Every sensible investor should invest in companies considering himself as a part owner of the company and not as a speculator hoping to earn some quick money. This is the most important lesson one can learn. Buffett says, “Investors who buy and sell based upon media or analyst commentary are not for us. Instead we want partners who join us at Berkshire because they wish to make a long-term investment in a business they themselves understand.”

Look for Companies with

a) Predictable Growth:

Buffett has a penchant for selecting great companies for investment or acquisition. As a result, Berkshire Hathaway now has a huge portfolio of companies, which are highly profitable. Buffett pays a great deal of attention to understand the environment in which each business is operating. According to Warren Buffett, one should avoid businesses whose futures can’t be evaluated, no matter how exciting their products may be. Dramatic future growth can’t be the main criteria for investment in a particular company. One should always judge what its profit margins and returns on capital will be, as a host of competitors’ battle for supremacy in future.

b) High Return on invested capital:

According to Buffett, “The best businesses by far, for owners, continue to be those that have high returns on capital and require little incremental investment to grow.” Investors should always look for companies which earn good return on invested capital and where incremental capital generates high returns. If this criterion is met, investment in such companies will produce above-average returns in the decades ahead.

Look for a Management which

a) Gives Candid Performance Review:

Candid performance reporting is one of the most important characteristics of an efficient management. According to Buffett, a good management will never “guesstimate” and mislead investors about the expected profit growth in future and will always pass on honest expectations and important information. The management review should enable investors to evaluate the business. It should also enable them to assess the management’s approach towards ‘managing the business’ and capital allocation.

b) Eats its own cooking:

Most of Berkshire’s directors have a major portion of their net worth invested in the company. This shows the management’s dedicated involvement in operations. This arrangement does not guarantee return but it ensures a common goal for both parties involved – the Management and the Shareholders.

Depressed market…? Grab the Opportunities!

Buffett quotes, “A depressed stock market is likely to present us with significant advantages. For one thing, it tends to reduce the prices at which companies become available for purchase at attractive prices“. This is again another important lesson for stock investors. A climate of fear is the investor’s best friend as it gives massive opportunities to buy great companies at huge discounts. Be fearful when the market is greedy and greedy when the market is fearful!

“So when the market plummets – as it will from time to time – neither panic nor mourn. It’s good news for you!”

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

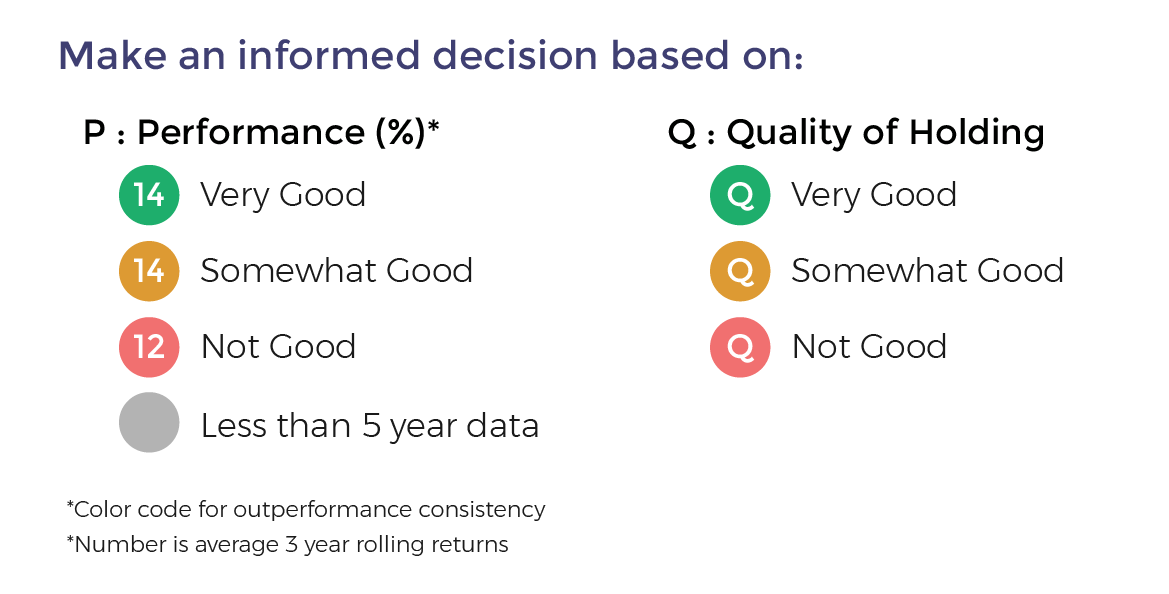

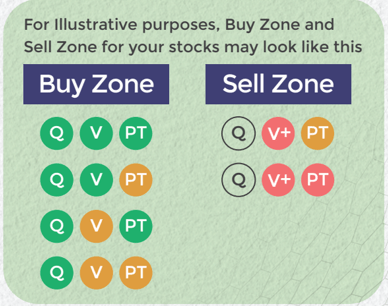

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: