ITC Ltd. – Will it continue to grow strongly?

ITC Ltd.: Company Highlights

ITC Ltd. – A multi-business conglomerate

Market View of ITC Ltd (as of 23/12/2011)

Latest Stock Price: Rs. 203.95

Latest Market Cap: Rs. 157424.86 Cr. (Large Cap Stock)

52 Week High Stock Price: Rs. 216.10

52 Week Low Stock Price: Rs. 150

Latest P/E: 28.53

Latest P/BV: 8.40

Tell me more about ITC Ltd…

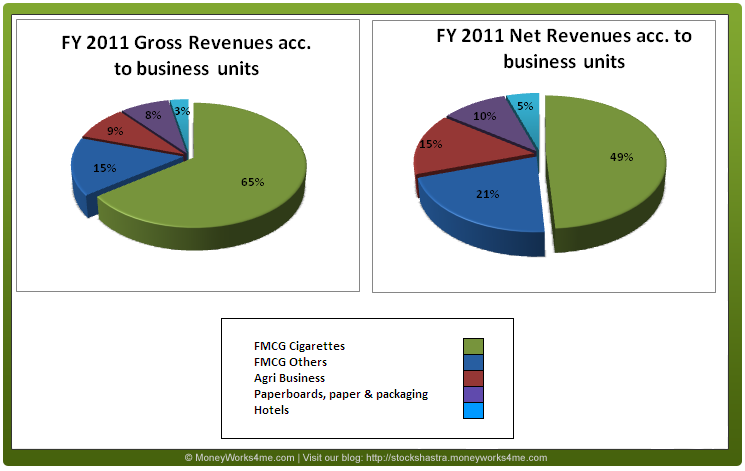

The table given below gives the 5 broad business segments of the companies

How has the Financial Performance of ITC Ltd. been? Here’s the review….

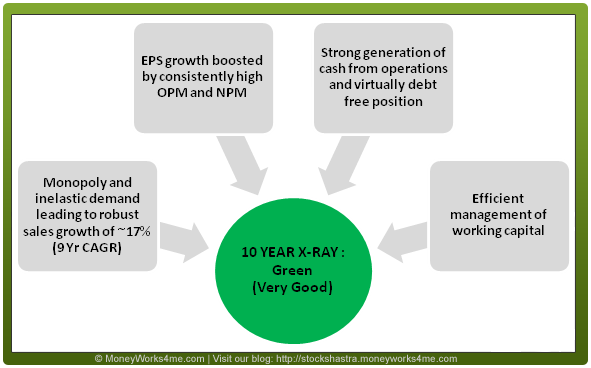

The 10 YEAR X-RAY of ITC Ltd. shows that the financial performance of the company has been very good for the last 10 years except for a bit of a slowdown in FY 2009. With a monopolistic position in the cigarette business (the major revenue contributor) and the addictive nature of the product leading to inelastic demand, Net Sales have registered a growth of more than 12% for most of the years.

The 10 YEAR X-RAY of ITC Ltd. shows that the financial performance of the company has been very good for the last 10 years except for a bit of a slowdown in FY 2009. With a monopolistic position in the cigarette business (the major revenue contributor) and the addictive nature of the product leading to inelastic demand, Net Sales have registered a growth of more than 12% for most of the years.

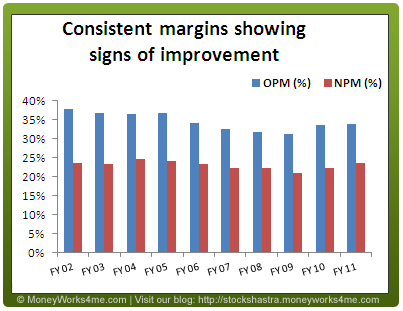

Also, with this leadership position and a strong brand image, it has been able to pass on excise duty hikes by the government to the consumers and thus maintained its margins. In fact, cigarette EBIT margins have gone up from 21% in FY 2002 to close to 28% in FY 2011. Over the years ITC has also diversified into other businesses. This has led to a slight reduction in Operating Profit and Net Profit margins over the years; however, with the other FMCG businesses showing good performance over the last 2 years and getting close to breaking even, margins have shown improvement in the last 2 years and are expected to improve further. ITC has thus shown good, consistent growth in EPS over the last 10 years and is expected to continue it going ahead. With the retention of close to 50% of its profits over the last 6 years, Book value per share has also shown good growth except in FY 2010 when the company paid out a special dividend. The cigarette business is a strong cash generator while cash consuming businesses like Lifestyle retailing, Personal care, Foods, etc are slowly moving towards breaking even. This combined with very efficient working capital management has helped ITC’s strong cash generation.

The company has also managed its funds efficiently which is indicated by the Return on Invested Capital which stands at ~32% on an average over the last 6 years. The company is a virtually debt-free company which is a big positive. Working capital days are on the higher side largely due to a large amount of cash in books (~Rs. 2240 Cr. as of FY 2011).

Thus, considering all these factors, we can say that the 10 YEAR X-RAY of ITC Ltd. is Green (Very Good).

In the Long term:

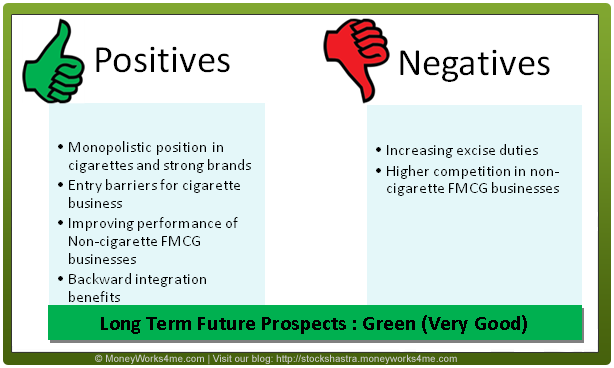

Cigarette business expected to continue domination:

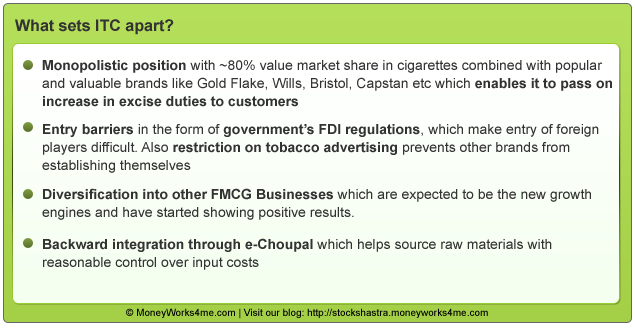

ITC dominates the cigarette market with close to 80% market share in terms of value and around 70% market share by volume. The nearest competitor is Godfrey Phillips with a 10% value market share and VST Industries with a 5% market share. It owns some of the most popular and valuable brands like Wills Filter, Gold Flake Filter, Classic, India Kings, Scissors, Capstan and Bristol present across the different cigarette segments. Leadership position and strong brands have enabled the company to pass on the excise duty hikes carried out by the government to its customers. Over the past eight years, ITC has raised its gross realization per stick by 10.8% CAGR, ahead of excise duty increase of 7.1% CAGR.

Further, because of its presence across different segments, ITC has made conscious efforts to upgrade customers to high margin products improving its profitability.

Improving the performance of Non-cigarette FMCG businesses:

In FY 2010-11, the non-cigarette FMCG business (which includes packaged food, personal care, lifestyle retailing, stationery, safety matches and agarbatti) contributed 21% of ITC’s net revenues. This business has emerged as ITC’s largest revenue engine, clocking a growth of 35% CAGR. In 2010-11, the division clocked revenues of Rs. 4,482 Cr., up from Rs. 3,014 Cr. in 2008-09. More importantly, the company has been cutting its losses in the non-cigarette FMCG business to Rs. 297 Cr. in 2010-11 from Rs. 483 Cr. in 2008-09. The reasons behind this have been a favorable product mix, higher realizations and a combination of smart sourcing and cost-saving across the supply chain.

Typically, ITC enters any new category at the premium end, builds its brands, and then rolls out the mass range. It has followed a similar strategy for its non-cigarette FMCG businesses and this has yielded impressive results. The food business recorded its maiden profit last fiscal and the stationery product business is also close to being profitable. The personal-care business is also reducing losses despite the growing investment in new product launches and marketing. Going ahead, we expect these businesses to contribute significantly to ITC’s financial performance at the same time helping it create a bigger and stronger distribution network.

Paper & Agribusiness presence provides backward integration benefits:

ITC’s agribusiness and paper business provides backward integration benefits for its other businesses while also contributing to profitability.

In the agribusiness part, ITC is involved in trading of agricultural products and is an active trader and exporter of commodities such as tobacco, wheat, soya, and coffee. ITC procures almost 50% of all the tobacco produced in India. The agri-products business of ITC is based on the company’s competencies created via association with the farmer, developed over the years via its e-Choupal program. It is now avoiding highly volatile products or products where the frequent risk of government intervention is high and is instead concentrating on products like tobacco, wheat, soya, and coffee. This helps the company in sourcing raw materials (for FMCG business) with relatively higher control over input prices.

The paper and paperboard business of the company caters largely to industrial use and spans across a wide spectrum of applications such as packaging, graphic, communication and writing paper. ITC has a (value) share of 26% in the paperboard segment. This division provides inputs to the company’s FMCG businesses. It produces 65% of the total cigarette tissue in India contributing significantly to ITC’s requirement. It also provides finished products to the company’s stationery business along with packaging solutions for its FMCG business.

Hotels business expected to show better performance going forward:

ITC operates the second biggest hotel chain in India, with over 3000 rooms in the luxury segment and 2400 rooms in the Fortune segment. FY 2009 saw ITC’s hotel operations suffer in-line with the broader industry performance due to the global economic downturn. Occupancies and Average Room Rates (ARRs) both declined significantly.

However, things have started to improve with both occupancy and ARRs improving albeit still at single-digit growths. ITC’s businesses have also begun to improve with this. Further, ITC is set to launch four new properties over the next 2-3 years, which include a new property in Chennai (600 rooms), Kolkata (300 rooms), Bangalore, and Delhi. Fundamental drivers of hotel business in India are strong, and the industry is well exposed to higher discretionary spends as well as increasing the propensity to travel for business/ leisure. Thus, going forward hotels business is expected to show better performance

FMCG Sector poised to triple in the next decade:

The Indian FMCG industry is estimated to be over Rs. 1,30,000 Crs. in size and accounts for 2.2% of the GDP of the country. The industry has tripled in size over the last 10 years and has grown at approximately 17% CAGR in the last 5 years, driven by robust macroeconomic conditions, rising income levels increasing urbanization and favorable demographic trends. These drivers are expected to continue to favorably impact the industry which is estimated to further triple in size in the next ten years to 4,00,000 Crs. by 2020 (Source: CII, FMCG Roadmap to 2020). Relatively low levels of per capita consumption of many FMCG products, the growing population of working women and increased government spending on education are some of the other key factors that augur well for the sector’s growth prospects.

Concerns:

- Higher tax rates could dampen profitability and eventually demand: India levies one of the highest taxes in the world on cigarettes. There is little hope that taxes on cigarettes will be reduced/abolished anytime soon. If the taxes are increased further, it may lead to lower margin and could lead to lower volumes in case ITC decides to pass on the increase to customers.

- Advertising regulations could impact volume: In a bid to curb smoking, the Government has recommended for pictorial warnings on cigarette packs. Now, it has further suggested a different set of ‘gory’ pictures to be put up on the packs from December 1, 2011. This could reduce the volume uptake for cigarettes

- High competition in other FMCG businesses: The other FMCG business segments such as personal care, foods, lifestyle retailing are still in the red and will face higher competition than cigarettes. In products like soap, the competition is expected to be even stiffer with leaders like HUL trying to protect their market share. This could affect earnings.

Thus, considering all these factors, we can say that the Long Term Future Prospects of ITC Ltd. are Green (Very Good).

So, is it an investment-worthy company?

The company’s cigarette business growth story remains intact thanks to the almost inelastic demand. Further, it has diversified into non-FMCG sectors like hotels, IT, paper, agriculture, etc.; with most of these businesses expected to turn profitable in the next couple of years the company could witness enhanced growth going forward.

Yes, ITC Ltd. is an investment-worthy company, but only at the right price. Being a large cap stock (Market cap of ~ Rs. 157424.86 Crs.), ITC Ltd. is considered to be a low-risk stock as compared to mid and small cap stocks. Also, being an FMCG stock it is more or less immune to recessionary pressures. Hence, it can be bought at a relatively lesser discount to its MRP.

Currently, it’s the stock price is at Rs. 203.75 (as on 22nd Dec 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purposes and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while making investment decisions.

I have been a consistent share holder over the years. The management of ITC has displayed unique decision making ability with a degree of risk taking. They have diversified beyond compare with any other FMCG and their marketing expertise has earned them reasonable shares in new products (Britannia is losing share whereas ITC is gaining ground).

A sound Company with a very good management team. A very good long term investment for regular income and capital growth.