When analyzing companies, investors often focus on revenue growth, profit margins, or capital expenditure. However, one item that silently shapes the profit and loss statement — and is often used for accounting manipulation — is depreciation.

Depreciation directly affects reported earnings, yet few investors study how it’s calculated or how easily it can be tweaked. Because companies enjoy flexibility over depreciation methods, rates, and asset lives, it becomes one of the easiest tools to artificially inflate or deflate profits.

Let’s understand how depreciation works, how it appears in financial statements, and the clever ways management can manipulate it — all while staying within accounting rules.

What Is Depreciation?

Depreciation is a systematic allocation of the cost of a fixed asset over its useful life. When a business buys long-term assets such as buildings, machines, or equipment, they don’t expense the full cost immediately. Instead, they spread it across the years the asset is used.

Example: Mr. A’s Bakery

Mr. A buys a new oven for Rs. 10,000, which he expects to use for 5 years. Instead of expensing Rs. 10,000 in the first year, he spreads this cost over five years, reducing profits by Rs. 2,000 annually. That Rs. 2,000 per year is depreciation expense.

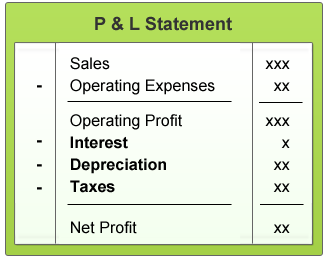

Depreciation is recorded in the Profit & Loss (P&L) statement, reducing reported profit before tax. Over time, it also lowers the book value of assets in the balance sheet.

Two Common Methods of Calculating Depreciation

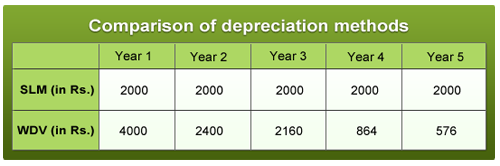

1. Straight Line Method (SLM)

Under SLM, depreciation expense is the same each year.

For the Rs. 10,000 oven used for 5 years, annual depreciation = Rs. 2,000.

This method suits assets that generate consistent benefits over time (e.g., buildings).

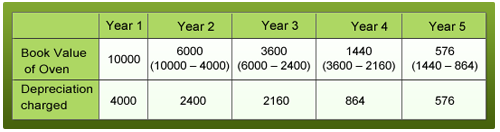

2. Written Down Value (WDV)

Under WDV, depreciation is charged at a fixed percentage on the reducing book value of the asset each year.

Example:

The depreciation charge declines over time, resulting in lower profits initially and higher profits later. WDV is considered more conservative and is used by many Indian companies.

Key Factors That Affect Depreciation Expense

- Method of Calculation (SLM or WDV)

- Rate of Depreciation (e.g., 10%, 20%, 40%)

- Useful Life of the Asset (e.g., 5 years vs 8 years)

Because management can influence all three, they can easily use depreciation as a lever to manage reported profits.

How Companies Manipulate Depreciation

Management can make a company appear more or less profitable by altering how depreciation is calculated.

Here are the most common techniques:

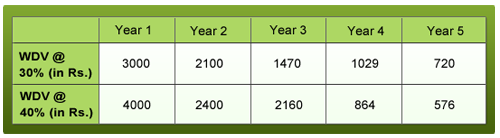

1. Charging Lower Depreciation Rates

By reducing the depreciation rate, companies immediately boost their profits.

For instance, if Mr. A applies 30% instead of 40%, annual depreciation drops sharply, leading to higher net income.

Many companies lower depreciation rates within legal limits without explicitly disclosing or justifying the reason. This creates the illusion of improved operational performance even though it’s purely accounting-driven.

2. Extending the Useful Life of Assets

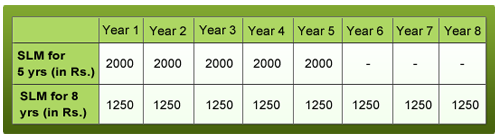

If a company increases the “useful life” of its assets, depreciation per year decreases — again, inflating profits.

Example: If Mr. A extends the oven’s life from 5 years to 8 years, his annual depreciation expense drops, making earnings look stronger.

Real-world example:

MTNL changed the useful life of its plants, cables, and apparatus in FY2003–04, which boosted its reported profit by Rs. 482 crore in just one quarter.

3. Switching Depreciation Methods (SLM ↔ WDV)

A change in method can dramatically affect reported profits.

- Jet Airways switched from WDV to SLM in 2009 and wrote back Rs. 920 crore, turning a potential loss into reported profit.

- Conversely, Nahar Industrial Enterprises Ltd switched from SLM to WDV in FY2004, increasing its depreciation expense by Rs. 37 crore.

Although accounting standards require companies to disclose any change in depreciation policy, most retail investors fail to spot these notes in the annual report.

4. Keeping Defunct Assets on the Balance Sheet

Companies sometimes continue showing obsolete or non-functional assets as active, instead of writing them off.

Example: If Mr. A’s oven breaks in year 3 but he keeps it on the books and continues depreciating it, he avoids booking a Rs. 4,000 loss.

This artificially inflates total asset value and paints a misleading picture of efficiency.

5. Revaluation of Assets

When a company “revalues” its assets upward, it increases both the asset value and the depreciation expense.

This practice is often used to window-dress financial statements or justify higher equity valuations.

Example:

If Mr. A revalues his Rs. 10,000 oven to Rs. 15,000 because of perceived market value, his depreciation expense automatically rises.

In corporate India, Alembic Ltd. revalued certain items of plant and machinery selectively, rather than revaluing an entire asset class — a red flag from a forensic accounting perspective.

Why Depreciation Manipulation Matters

Because depreciation is a non-cash expense, investors often ignore it. But it significantly affects reported earnings, return ratios (ROCE, ROE), and asset turnover.

Manipulating it allows management to:

- Smooth earnings across quarters,

- Inflate return ratios artificially, or

- Avoid showing losses during downturns.

Such flexibility, though legally allowed, can distort a company’s true economic performance and mislead investors.

Red Flags and Checklist for Investors

When reviewing a company’s annual report or financials, watch for these warning signs:

Sudden change in depreciation method (SLM ↔ WDV)

Significant variation in depreciation rate compared to peers

Increase in asset life without clear justification

Selective or frequent asset revaluations

Unusually low depreciation expense despite large fixed assets

Non-disclosure or poor footnotes explaining accounting changes

Book value of assets increasing faster than sales or profits

In Summary

Depreciation, while a legitimate accounting concept, is also a powerful profit-smoothing tool.

Because companies have discretion over the method, rate, and asset life, they can legally alter their reported profitability — sometimes to mislead investors.

To safeguard yourself:

- Always read notes to accounts for changes in depreciation policies.

- Compare a company’s depreciation rates and methods with industry peers.

- Focus on cash flow from operations (CFO) rather than just net profit.

In investing, what you don’t see in the income statement often matters more than what you do. Depreciation is one such hidden lever that can make “profit” a matter of perception.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: