NTPC Limited: Should you invest in this Power Major?

NTPC Limited: Company Highlights

NTPC Limited – Largest Power Generation Company in India.

Market View of NTPC Limited Stock Price (15-07-2011)

Latest Stock Price: Rs. 189.15

Latest Market Cap: Rs. 155962.96 crore (Large Cap Stock)

52 Week High Stock Price: Rs. 222.20

52 Week Low Stock Price: Rs. 165.30

Latest P/E: 17.13

Latest P/BV: 2.14

Tell me more about NTPC Limited…

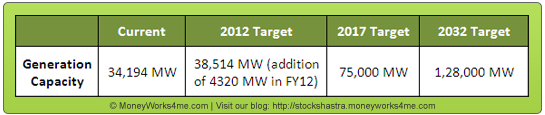

NTPC Limited, a Maharatna status Company, is the largest state-owned power generation company in India. NTPC is primarily in the business of generation and sale of bulk power and is engaged in the engineering, construction and operation of power generation plants. The total generation capacity of NTPC is 34,194 MW with 15 coal-based and 7 gas-based stations, located across the country. The company is emerging as a diversified power major with presence in the entire value chain of the power generation business. Apart from power generation, NTPC has already ventured into consultancy, power trading, ash utilisation and coal mining.

In 2010, NTPC stood 341st in the ‘Forbes Global 2000’ ranking for the world’s biggest companies.

How has the Financial Performance of NTPC Limited been? Here’s the review…

The 10 YEAR X-RAY (Click the above image) of NTPC shows that the performance of the Company over the past 10 years has not been very impressive. The company has registered good growth rates in its Net Sales from FY05, but the same has not been reflected in the EPS Growth rate, primarily because of high tax payments. Over the past 5 years, Sales of NTPC has grown at a CAGR of 15.47% whereas its EPS has grown at a CAGR of just 6.98%. In FY2009, the low growth in EPS was because of high expenditure incurred for buying fuel (Coal). The BVPS of the Company has grown at a CAGR of 8.59% over the past 5 years.

Though NTPC has managed a good 6 year ROIC average of 14.11%, its declining trend, from FY06 is a cause of concern. The Debt-to-Net profit ratio for FY11 is 4.85 and it has been above 3 for most of the years as the Company continuously requires debt for increasing its generation capacity. The Debt-to-Net profit ratio is expected to remain high considering the Company’s Plans of expanding its capacity to 75000 MW (more than double of current capacity) by 2017.

NTPC’s Efficiency Performance: –

A critical efficiency parameter in the power industry is the ‘Plant Load Factor (PLF)’ which is a ratio of actual output of a power plant compared to the maximum output it can produce. NTPC is the most efficient player in India’s Power Sector. Although the company has 17.75% of the total national capacity, it contributes 27.40% of total power generation due to its focus on high efficiency.

NTPC has always clocked good PLF rates. The All India average PLF has been in the range of 77-79% for the past few years, whereas NTPC projects have been running at a high average PLF range of 88% to 93% in the past few years.

Looking at all the above factors, we can say that the 10 YEAR X-RAY performance of NTPC has been ORANGE (‘Somewhat Good’).

What can we expect in the future? Here is the fundamental analysis of NTPC Limited….

In the Short Term

Mixed Performance in the last 4 Quarters:

After a poor performance in the first three quarters of FY 11, NTPC recorded good numbers in the last quarter. The sales growth rate has been good in all the 4 quarters when compared to respective quarters in FY10 due to higher demand and corresponding rise in generation capacity. However, the Net Profit growth rate has not been good. Except for the last quarter, Net Profit in the other quarters has fallen or has remained flat, primary reason being the high expenditure incurred on Fuel.

The last quarter was very good for the company as it was able to grow its sales by 25% and Net Profit by 37%. These growth rates were supported partly by the changes in depreciation policy and in the tax policy. Due to these changes, Profit before Tax was higher by Rs. 363 Cr. (Rs. 240 Cr. due to Tax and Rs. 123.09 Cr. due to Depreciation). However, at the same time, the taxation for the quarter was up 669% to Rs. 474.95 crore. On the whole the fourth quarter was very good for the Company.

However, in FY11, NTPC missed its target of commissioning 3150MW of generation capacity and could commission only 2490 MW.

Generation Capacity addition plans in FY2012:

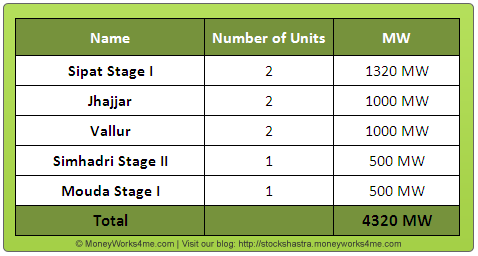

NTPC targets a generation capacity addition of 4320 MW in 2011-12. With the help of this capacity addition, the Company has set a target of generating 235 billion units of electricity in FY12 as compared to Generation of 218.84 and 220.54 billion units in FY09 and FY10 respectively. The addition is planned in the following places.

Coal Supply for the FY2012:

Coal, as a raw material, is of primary importance for NTPC as 80% of its generation capacity is coal-based. India has limited coal reserves, plus, availability of domestic coal is a challenge on account of various bottlenecks such as capacity expansion of Coal India Limited (the largest supplier of coal in India), coal block allocation, tribal land acquisition, environmental and forest clearances, etc. For FY12, the company has its agreements with coal suppliers in place; hence it will remain unaffected by the existing supply problems with coal. The company requires 160 mt of coal in FY2012, of which 144mt will be procured from Coal India Limited. NTPC has entered into import contracts for procuring most of the remaining 16 mt of coal.

Looking at the above points, we expect the short-term future prospects of NTPC to be GREEN (Very Good).

In the Long-Term

Long-Term Generation Capacity Addition Plans:

India has always been a power-deficient country and considering the ever increasing demand for power in India, huge capacity additions are required in this sector. NTPC has set a target to become a 1,28,000 MW company by year 2032. Keeping this target in mind, the Company has embarked on plans to have 75,000 MW of generation capacity by 2017. As of now, 14,088 MW of generation capacity is under construction via different projects which are under various stages of completion.

Earnings protected by regulated Earnings model:

NTPC being a central public utility (CPU) is governed by the regulated-return model. The CERC regulations for FY2010-14 provide a ROE of 15.5% on the regulated equity. So, even if fuel costs increase, the company can pass through this rise to customers to a large extent; this protects the company from cost pressures. Thus, the earnings of the Company are protected assuring good consistent margins.

Efficient Collection Mechanisms:

NTPC primarily sells power to State Electricity Boards (SEBs) whose financial health has been bad over the years. Hence there is a risk for NTPC of its bills not getting realized. However, NTPC has been able to realize 100% of its billing to customers continuously for the past 8 years thus indicating that it has efficient collection mechanisms in place. This has been possible as NTPC has entered in to a tripartite agreement with state distribution companies and RBI until 2016 which helps NTPC in full realization of its billing.

Fuel Supply Security:

Coal is an important raw material for NTPC as currently 80% of its power generation capacity is coal based and in future also, a considerable portion of generation capacity is going to be coal-based. NTPC has entered in to a Long Term Supply Agreement with Coal India Limited for supply of coal for a period of 20 years. Hence, NTPC’s projects carry negligible fuel supply risks.

Diversified Growth:

NTPC has prepared a Corporate Plan setting a target of becoming a 1,28,000 MW company by 2032. Considering the high dependency on limited reserves of Coal, and environmental concerns, the Company plans to have a well-diversified fuel mix by 2032. The fuel mix in 2032 shall comprise of 56% coal, 16% gas, 11% nuclear energy, 9% renewable energy and 8% hydro based capacity. Hence, by 2032, non-fossil fuel based generation capacity shall make up nearly 28% of NTPC’s portfolio.

Other positives for the Company:

- NTPC has tied up 1,00,000 MW under long term Power Purchase Agreements thus ensuring market for the power it generates in the coming years.

- NTPC’s comfortable funding position is its biggest strength even as private players struggle for financial closure. The Company has a comfortable cash balance of around Rs. 16,000 Cr. and SEB bonds worth Rs. 8170 Cr. which should help the company to meet its capacity expansion plans.

Long Term Demand for Power in India:

India has always been a power-deficient country. Over the years, the demand for power has always been greater than its supply. This power deficit is expected to continue in future because India is an emerging economy characterised by rapid urbanization and industrialization. The rising population of India will also lead to rise in the demand for power.

Under the Government’s “Power for all by 2012” plan, it has targeted per capita consumption of 1000 kWh by the end of the 11th Five Year Plan (2007-2012) as compared to levels of 734 kWh in 2008-09. With just a year left, it seems highly unlikely that this target will be achieved The target now set for the 12th Five Year Plan is to add 1,00,000 MW of generation capacity. This shows that huge capacity additions are required at good efficiency rates, indicating that the opportunities available in this sector are huge. NTPC being a state-owned company has huge opportunities as it plays a crucial role in the Government’s plans regarding the power sector.

Key Concerns:

Risks related to power projects:

Power Sector is a highly capital-intensive industry with long gestation periods, before the commencement of revenue generation. Since most of projects have a long time frame (4-5 years of construction period and operating period of over 25 years), the uncertainties and risks involved are high.

Delay in commissioning of projects is also a concern as it leads to delay in inflow of revenues. At the same time, power companies have to incur costs on the delayed projects, thus affecting margins.

Concerns regarding Coal:

NTPC being the most important power company in the country, was allotted coal blocks a few years back so as to assure adequate coal supply for the Company. However, recently the Government cancelled allocation of 5 out of the 7 coal blocks NTPC was earlier allotted. The blocks were de-allocated because of slow progress on the development of these blocks by NTPC. Further the Government has warned NTPC of de-allocating the remaining 2 blocks if work on these blocks is not given due attention. This de-allocation comes as a big concern for the Company as NTPC had plans of procuring 47mt of coal by 2017 from these blocks. The cancellation won’t affect NTPC in the short term, however in the long term this disruption in coal supply will have an adverse impact on the Company.

Considering the massive generation capacity addition plans, NTPC is well placed to fulfil the ever increasing demand of power in India. Hence, we can say that NTPC’s long term future prospects appear to be GREEN (Very Good).

So, should you invest in this Maharatna power company?

Robust capacity addition plans, growth from a well-diversified fuel-mix and the long-term demand for power are expected to augur well for NTPC’s long-term prospects.

Yes, NTPC is an investment worthy company, but only at the right price. Being a large-cap stock (Market cap of ~ Rs. 155962 Cr.), NTPC is considered to be a safe-bet. But, considering the nature of the power industry the company is expected to grow with a moderate growth rate. Hence, a stock like NTPC should be bought at a discount to its MRP.

Currently, its stock price is at Rs. 189.15 (as on 15th July’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Excerpt Image Credit – Polyurban (Wikimedia Commons)

Earnings protected by regulated Earnings model: – NTPC being a central public utility (CPU) is governed by the regulated-return model. The CERC regulations for FY2010-14 provide a ROE of 15.5% on the regulated equity. So, even if fuel costs increase, the company can pass through this rise to customers to a large extent; this protects the company from cost pressures. Thus, the earnings of the Company are protected assuring good consistent margins.Efficient Collection Mechanisms: – NTPC primarily sells power to State Electricity Boards (SEBs) whose financial health has been bad over the years. Hence there is a risk for NTPC of its bills not getting realized. However, NTPC has been able to realize 100% of its billing to customers continuously for the past 8 years thus indicating that it has efficient collection mechanisms in place. This has been possible as NTPC has entered in to a tripartite agreement with state distribution companies and RBI until 2016 which helps NTPC in full realization of its billing.

Fuel Supply Security: – Coal is an important raw material for NTPC as currently 80% of its power generation capacity is coal based and in future also, a considerable portion of generation capacity is going to be coal-based. NTPC has entered in to a Long Term Supply Agreement with Coal India Limited for supply of coal for a period of 20 years. Hence, NTPC’s projects carry negligible fuel supply risks.

Diversified Growth: – NTPC has prepared a Corporate Plan setting a target of becoming a 1,28,000 MW company by 2032. Considering the high dependency on limited reserves of Coal, and environmental concerns, the Company plans to have a well-diversified fuel mix by 2032. The fuel mix in 2032 shall comprise of 56% coal, 16% gas, 11% nuclear energy, 9% renewable energy and 8% hydro based capacity. Hence, by 2032, non-fossil fuel based generation capacity shall make up nearly 28% of NTPC’s portfolio.

Other positives for the Company: –

• NTPC has tied up 1,00,000 MW under long term Power Purchase Agreements thus ensuring market for the power it generates in the coming years.

• NTPC’s comfortable funding position is its biggest strength even as private players struggle for financial closure. The Company has a comfortable cash balance of around Rs. 16,000 Cr. and SEB bonds worth Rs. 8170 Cr. which should help the company to meet its capacity expansion plans.

Long Term Demand for Power in India: – India has always been a power-deficient country. Over the years, the demand for power has always been greater than its supply. This power deficit is expected to continue in future because India is an emerging economy characterised by rapid urbanization and industrialization. The rising population of India will also lead to rise in the demand for power.

Under the Government’s “Power for all by 2012” plan, it has targeted per capita consumption of 1000 kWh by the end of the 11th Five Year Plan (2007-2012) as compared to levels of 734 kWh in 2008-09. With just a year left, it seems highly unlikely that this target will be achieved The target now set for the 12th Five Year Plan is to add 1,00,000 MW of generation capacity. This shows that huge capacity additions are required at good efficiency rates, indicating that the opportunities available in this sector are huge. NTPC being a state-owned company has huge opportunities as it plays a crucial role in the Government’s plans regarding the power sector.

Key Concerns: –

Risks related to power projects: – Power Sector is a highly capital-intensive industry with long gestation periods, before the commencement of revenue generation. Since most of projects have a long time frame (4-5 years of construction period and operating period of over 25 years), the uncertainties and risks involved are high.

Delay in commissioning of projects is also a concern as it leads to delay in inflow of revenues. At the same time, power companies have to incur costs on the delayed projects, thus affecting margins.

Concerns regarding Coal: – NTPC being the most important power company in the country, was allotted coal blocks a few years back so as to assure adequate coal supply for the Company. However, recently the Government cancelled allocation of 5 out of the 7 coal blocks NTPC was earlier allotted. The blocks were de-allocated because of slow progress on the development of these blocks by NTPC. Further the Government has warned NTPC of de-allocating the remaining 2 blocks if work on these blocks is not given due attention. This de-allocation comes as a big concern for the Company as NTPC had plans of procuring 47mt of coal by 2017 from these blocks. The cancellation won’t affect NTPC in the short term, however in the long term this disruption in coal supply will have an adverse impact on the Company.

Considering the massive generation capacity addition plans, NTPC is well placed to fulfil the ever increasing demand of power in India. Hence, we can say that NTPC’s long term future prospects appear to be GREEN (Very Good).

So, should you invest in this Maharatna power company?

Robust capacity addition plans, growth from a well-diversified fuel-mix and the long-term demand for power are expected to augur well for NTPC’s long-term prospects.

Yes, NTPC is an investment worthy company, but only at the right price. Being a large-cap stock (Market cap of ~ Rs. 151716 Cr.), NTPC is considered to be a safe-bet. But, considering the nature of the power industry the company is expected to grow with a moderate growth rate. Hence, a stock like NTPC should be bought at a discount to its MRP.

Currently, its stock price is at Rs. 165 (as on 7th June’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

THIS IS A WELL RESEARCHED ANALYSIS

THIS IS A WELL RESEARCHED ANALYSIS