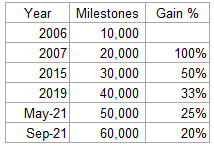

Sensex has hit 60,000 on 24th September 2021. Every 10,000 points of Sensex is some sort of milestone when it comes to equity investing. It is a celebration of wealth creation and entrepreneurial success.

Every 10,000 climb has been special as it is achieved at a faster pace than before. For recent 10,000 pts, it took just 4 months and just 20% gain.

Observation on last 30,000 moves in Sensex

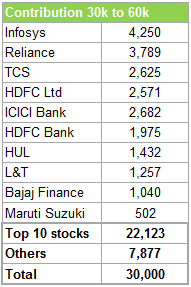

From 30,000 in 2015, Sensex nearly doubled to 60,000 in 2021. We looked deeper to see which stocks contributed to such a mammoth move in Sensex in 6 years.

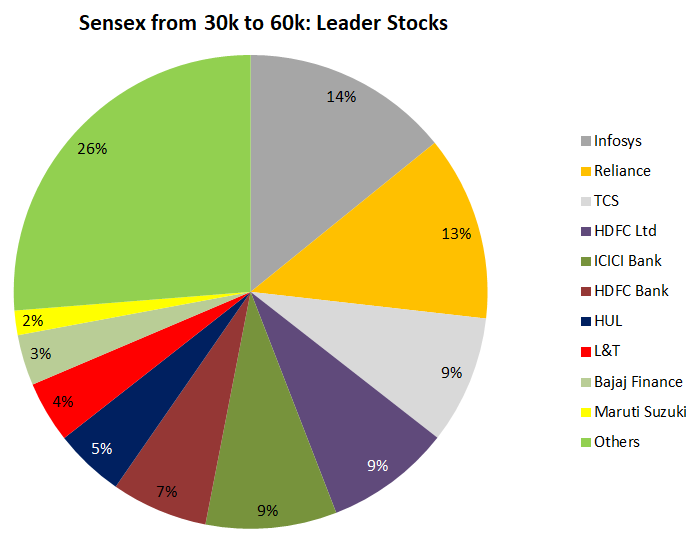

Sensex’s move from 30,000 to 60,000 has been quite concentrated by a handful of stocks leading to the bulk of the returns in the last 6 years. The top 10 stocks were responsible for 73% of the move (22,123 pts) in Sensex in the last 6 years.

The highest return has come from Infosys, Reliance, TCS, HDFC Ltd, and ICICI Bank which contributed almost 50% in total 100% return. This level of concentration means that many investors and quite a few funds were lagging Index returns for the last 6 years.

The primary reason for such polarized markets was slow economic growth which did not benefit all the sectors in the economy. However, things are starting to look up now. India’s demographics form a good tailwind for high GDP growth in the coming several years. The ongoing government reforms and low cost of capital should improve capital availability to Indian entrepreneurs, thus driving future growth. The quality of corporate balance sheets in terms of leverage and cash flow generation has also improved significantly. This makes us optimistic about the future.

Valuation

The all-time high level of Sensex does not suggest a market-wide overvaluation. This is because Sensex is driven by few stocks, which makes it concentrated. There are pockets of extreme overvaluation and undervaluation. Sensex is led by a concentrated portfolio of Top 10 stocks- is higher than its fair price, while the same is not true for all stocks.

Future winners will be different

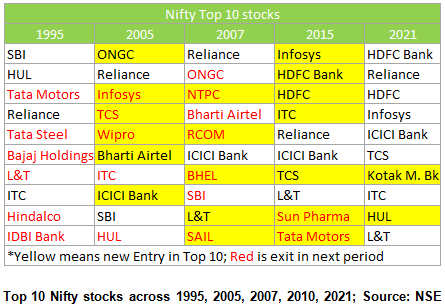

We expect different companies altogether to lead to the performance of Sensex/Nifty over the next 5 years.

The above table shows different stocks that perform from one period to another and become part of the top 10 stocks.

- 1995-2005: IT, telecom, and oil. (New entrants: Infosys, TCS, Wipro, Airtel, TCS)

- 2005-2007: Infra, Power, and Metals (New entrants: NTPC, BHEL, SAIL)

- 2007-2015: HDFC twins & Pharma (New entrants: HDFC, HDFC Bank, Sun Pharma)

- 2015-2021: Banking and FMCG (New entrants: Kotak & HUL)

This means that the past winner stocks underperformed and ranked below.

Past data reveals that out of the 50 stocks in Nifty, just thirteen companies have been a part of the index’s journey since inception. (Source: Motilal Oswal)

This means that very few companies continue to outperform Nifty. If they do not perform, they are removed. It is not possible to shortlist just a handful of companies and sit tight. You have to follow disciplined investing, stay with stocks/sectors delivering good earnings growth, and respect valuation.

We continue to advise our clients to stay invested in the market. You may switch between stocks that have a poor risk-reward scenario or wait till a reasonably priced stock comes by. We expect a pick-up in growth in economy-sensitive sectors like capital goods, real estate & allied sectors, power, banking, logistics, and infra and allied sectors. Potential winners of the next 5 years will be from these sectors.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463