Stock investing can seem complicated at first — numbers, charts, jargon, and constant news can feel overwhelming. But in reality, investing sensibly is far simpler than most people think. It’s not about predicting short-term price movements, but about owning good businesses and staying invested for the long term.

This guide will walk you through the essentials — what stocks are, how to choose them, how to know when to buy or sell, and how to build a strong portfolio that helps you meet your financial goals.

1. Is Investing in Stocks Really Difficult?

Most beginners assume investing is risky or complex. In truth, it’s only risky when you invest without understanding the basics. Once you know how to evaluate a business and its value, investing becomes logical and rewarding.

Stock prices move every day because of demand and supply — traders react to news, rumors, and emotions like fear or greed. But these short-term fluctuations don’t matter to a long-term investor. What matters is the company’s ability to earn profits consistently over time.

A sensible investor focuses on three things:

1. Owning the right businesses – those with proven, sustainable models.

2. Buying at the right price – close to or below fair value.

3. Staying invested long enough – allowing compounding to do its work.

Investing isn’t about predicting; it’s about participating in good businesses and letting time multiply your returns.

2. How to Start Investing in Stocks the Right Way

Before you invest, it helps to understand what success looks like. Investing success means growing your savings at a rate higher than inflation, helping you meet future goals comfortably.

The simple wealth-building formula is:

Wealth = Surplus × (1 + Returns) ^ Years Invested

This means wealth creation depends on:

· The amount you invest (your surplus),

· The returns you earn, and

· The number of years you stay invested.

You don’t have control over market returns, but you do control how early you start, how consistently you invest, and how long you stay invested.

The Golden Rules of Sensible Investing

1. Stay invested – Compounding needs time; avoid panic selling.

2. Be realistic – Expect moderate, inflation-beating returns, not overnight riches.

3. Diversify – Split your investments between equity and debt based on your risk profile.

For most beginners, 50–60% in equities and the rest in debt or safer instruments is a good starting point.

3. How to Choose Stocks for Your Portfolio

Finding the right stocks is not about chasing tips or “next big” stories. It’s about following a process. Every stock you buy should meet three basic conditions:

1. It belongs to a great business – one that earns consistently and has a competitive edge.

2. It is available at a reasonable price – not overvalued or driven by hype.

3. It fits well in a diversified portfolio – not too concentrated in one sector.

You don’t need to own dozens of companies. Around 20 quality stocks across sectors is enough for healthy diversification.

Avoid impulsive decisions. The market will always tempt you with fast-moving stocks, but consistency beats excitement in the long run.

4. Where to Invest — Identifying the Right Companies

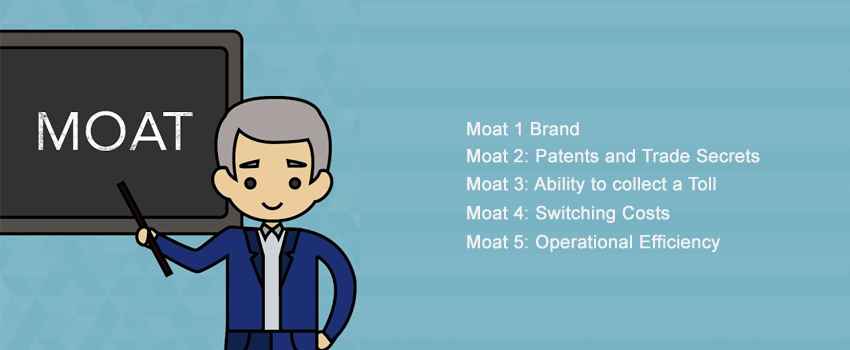

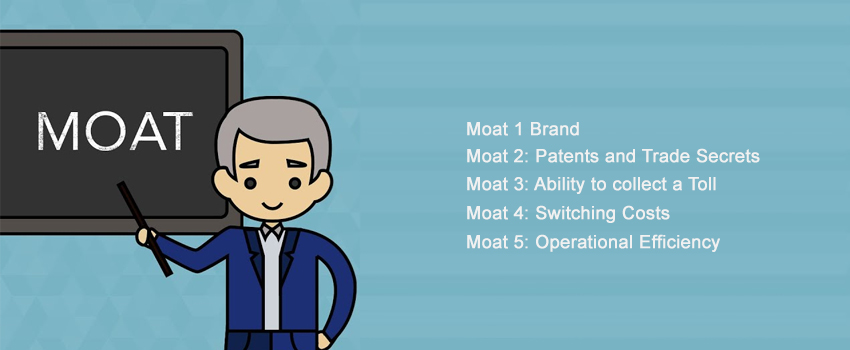

Every great company shares one core trait: it has a sustainable moat — a durable competitive advantage that protects its profits over time.

Here are the five common types of moats:

1. Brand Power – Customers trust and prefer the brand (like Colgate or Nestlé).

2. Patents or Secrets – Exclusive rights or unique recipes (like pharma or Coca-Cola).

3. Toll Advantage – Earning every time users access something essential (like Google Ads).

4. High Switching Costs – Customers find it difficult to switch (like Microsoft Office).

5. Operational Efficiency – The ability to sell at low prices yet remain profitable (like D-Mart).

A company with a wide, lasting moat tends to deliver steady profits, even during tough times.

Also, always check if the management is competent and ethical. You can’t build long-term wealth with companies that manipulate numbers or take shortcuts.

5. How to Evaluate a Company’s Performance

A company’s financial track record reveals whether it deserves your trust. You don’t need to be an accountant to analyze it — just track six key parameters over the past 10 years:

1. Earnings per Share (EPS): Shows profitability per share. Consistent growth signals a strong business.

2. Net Sales: Indicates revenue growth. A healthy company grows sales steadily every year.

3. Operating Cash Flow: Confirms that profits are real and backed by cash.

4. Book Value per Share (BVPS): Shows how much a company reinvests for future growth.

5. Return on Capital Employed (ROCE): Measures how efficiently the company uses its capital. Aim for 13% or higher.

6. Debt-to-Cash Flow Ratio: Reveals repayment ability. A ratio below 3 is ideal.

If a company grows EPS, Sales, and BVPS by 12%+ annually, maintains ROCE above 13%, and manages debt prudently — it’s a potential long-term winner.

6. What Is the Right Price to Buy a Stock?

Every stock has a fair value, also called Intrinsic Value — what the business is truly worth based on its future cash flows.

At MoneyWorks4Me, this is estimated using the Discounted Cash Flow (DCF) method — projecting future earnings, discounting them to today’s value, and comparing them with the current price.

If the current price is below the fair value, it’s undervalued — a buying opportunity.

If it’s far above fair value, it’s overvalued — best avoided.

This way, you base your decision on value, not emotion or momentum.

7. Understanding Margin of Safety (MOS)

Even the best valuation is an estimate. Markets can behave unpredictably. That’s why every sensible investor keeps a Margin of Safety (MOS) — the cushion between a stock’s fair value (MRP) and the price you pay.

For example, if a stock’s fair value is Rs. 100 and you buy it at Rs. 80, your MOS is 20%.

The MOS protects you from errors in judgment and unforeseen risks.

In short, buy good companies at fair or discounted prices and let time do the rest.

8. When Should You Sell a Stock?

Selling is often harder than buying. Many investors either hold too long or sell too soon. Here are two clear principles to guide your decision:

1. Sell when the business weakens – If the company’s fundamentals deteriorate or management loses credibility, exit early.

2. Sell when valuations run ahead of reality – If the price is far above fair value and future returns look muted, book profits.

MoneyWorks4Me uses the concept of Upside Potential — the expected annualized return (CAGR) over the next few years based on the stock’s fair value.

· Above 15% = Good opportunity

· 10–15% = Reasonable hold

· 6–10% = Time to trim

· Below 6% = Consider selling

This keeps decisions objective and emotion-free.

9. How Many Stocks Should You Own?

Diversification reduces risk without diluting returns. Studies show that holding 16–32 stocks captures almost all the diversification benefit — beyond that, volatility hardly reduces further.

At MoneyWorks4Me, we follow a structured allocation:

· 7% to high-quality, steady growth companies.

· 5% to above-average, cash-generating companies.

· 3% to cyclical or smaller companies with higher volatility.

This mix typically leads to a 20–25 stock portfolio that balances growth and stability.

To reduce concentration risks:

· Limit exposure to any one sector to 25%.

· Avoid letting any stock exceed twice its original allocation after price run-ups.

· Keep small-cap exposure under 20% if you’re moderately risk-tolerant.

10. A Smart Way to Buy and Sell — in Tranches

Even with the best valuation, timing the market perfectly is impossible. The practical way to handle this is by buying and selling in tranches (installments).

For example, if you plan to buy Rs. 1 lakh worth of a stock, divide it into 3–4 parts. Buy the first portion near its fair value, and add more if the price dips further. This helps you average out the cost and reduce regret.

Similarly, sell in tranches as a stock rises above its fair value. This disciplined process minimizes emotional decisions and helps you stay invested longer — which is where real wealth creation happens.

The Bottom Line

Investing in stocks is not about predicting markets — it’s about understanding value, buying great businesses at fair prices, and holding them patiently.

At MoneyWorks4Me, we believe sensible investing is simple, not easy. It demands discipline, not constant action.

Stay invested, let compounding work, and use sound judgment instead of emotion. Over time, this approach will not only grow your wealth but also give you peace of mind along the journey.

Comment Your Thoughts: