You’ve probably come across headlines like “Sensex falls 450 points on FII selling.” It happens often — and every time, it leaves investors wondering: Who are these FIIs, and how do their actions move our markets so much?

During the 2008 global financial crisis, foreign investors pulled out billions from India, sending the Sensex crashing and leaving many retail investors helpless. Over the years, India has become one of the top destinations for global capital — but that also means our markets rise and fall with FII activity.

So, does that make retail investors powerless? Not really.

If you understand how FIIs behave, you can actually use their moves to your advantage.

What Are FIIs and Why Do They Matter?

FIIs, or Foreign Institutional Investors, are large entities — such as global mutual funds, pension funds, and insurance companies — that invest in Indian financial markets.

When FIIs buy, they bring in foreign currency, and when they sell, they pull money out. Their sheer scale gives them the power to influence market direction, at least in the short term.

In India, FIIs invest primarily through equities and debt instruments. A surge in FII inflows often boosts stock prices and market sentiment, while outflows can drag both down. Historically, the Sensex has shown a clear positive correlation with FII activity — when they buy, markets rise; when they sell, markets correct.

Why Do FIIs Invest in or Exit from India?

FIIs invest for the same reason any investor does — to earn attractive returns. Emerging economies like India, Brazil, and Indonesia offer faster GDP growth and higher return potential than developed markets.

Here’s what draws FIIs to India:

- High growth prospects: India’s consistent GDP growth and expanding consumption base.

- Stable political environment: Predictability in economic policy builds investor confidence.

- Liquidity and transparency: A deep, regulated market that allows easy entry and exit.

But why do they exit?

The 2008 crisis is a perfect example.

Global uncertainty, liquidity crunches, or risk aversion can cause FIIs to pull back. When they sell, they often do it across markets — not just in India. This broad withdrawal leads to a temporary dip, even if the long-term story remains intact.

In short, FIIs come when growth looks promising and leave when fear dominates.

Are FIIs Good or Bad for the Indian Market?

FIIs are both a boon and a challenge.

On the positive side:

- Their capital strengthens India’s foreign exchange reserves, improving the country’s ability to import essentials like oil or machinery.

- Their participation signals global confidence in India’s economy.

- Their presence attracts FDI (Foreign Direct Investment), which brings technology, infrastructure, and long-term development.

The challenge is volatility. Because FIIs move large sums quickly, they can amplify short-term market swings — creating both risks and opportunities for retail investors.

How FII Activity Affects Stock Prices

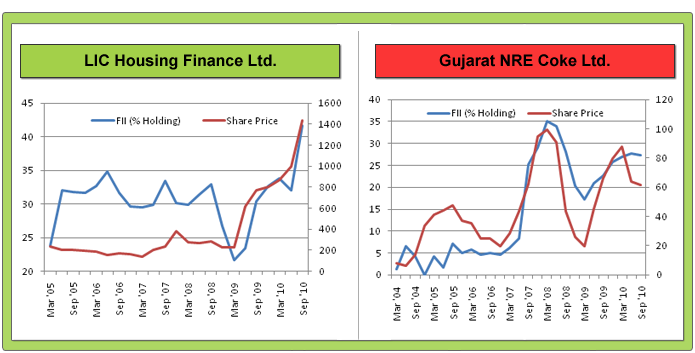

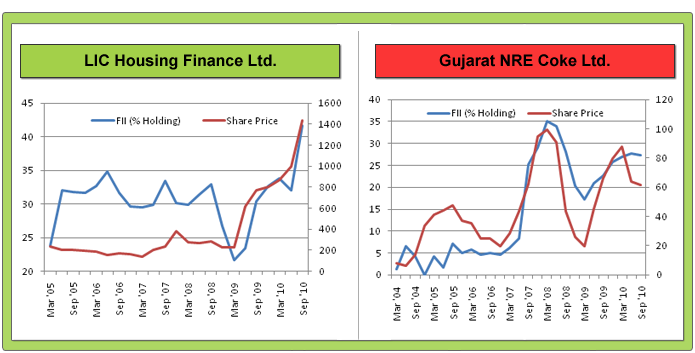

Let’s understand this with two examples: LIC Housing Finance and Gujarat NRE Coke.

- LIC Housing Finance:

Between 2005 and 2010, FIIs steadily increased their holdings in the company. Even when they trimmed positions in 2008, the decline was limited because the company’s fundamentals were strong. As growth picked up again, FIIs returned — and so did the stock price. - Gujarat NRE Coke:

FIIs once held over 35% of the stock, but exited sharply in 2008 as the company struggled with high debt and weak performance. The stock price collapsed.

The takeaway: FIIs don’t create growth; they follow it.

They invest in companies already showing strong fundamentals and exit the ones losing steam.

How to Read FII Data and Use It Smartly

Instead of reacting to headlines, you can use FII activity as a supporting signal — not a trigger — for your investment decisions.

1. Track FII Shareholding Trends

Check the percentage of FII holding in the companies you own or plan to buy.

If FIIs are gradually increasing their stake, it often reflects growing institutional confidence. However, sudden spikes could also mean speculative inflows — so always check why they’re buying.

A stable or rising FII holding in a fundamentally sound company usually supports long-term price appreciation.

2. Check the Number of FIIs Holding the Stock

If a stock has a very large number of FII investors, it may become more volatile. When even a few large investors exit simultaneously, the price can fall sharply.

A company with a smaller, stable set of institutional investors usually experiences steadier price movements.

3. Understand the Context Behind Inflows and Outflows

Not all exits are negative. Sometimes FIIs sell due to global portfolio rebalancing — not because of company-specific weakness. Similarly, inflows during hype-driven rallies aren’t always bullish if valuations are overstretched.

Always tie FII activity back to business fundamentals.

How to Use FII Trends to Your Advantage

FIIs are not the cause of growth — they are the effect of it.

They enter after strong fundamentals start showing results. So, the smarter approach for retail investors is to stay a step ahead.

Here’s how:

- Create a watchlist of high-quality, growing companies with consistent FII interest.

- Wait for temporary outflows — when FIIs book profits or rebalance portfolios, prices often dip.

- Buy during these dips, provided the company’s fundamentals are intact.

- Exit when valuations stretch far above fair value, not when FIIs start selling.

Essentially, use FII selling to find bargains — not to panic.

Key Takeaways

- FIIs influence market direction, but not company quality.

- Consistent FII inflows into fundamentally strong companies often signal stability.

- Sudden FII exits from weak companies usually reveal deeper issues.

- Follow fundamentals first, FII data second — not the other way around.

- Use periods of FII profit booking to accumulate quality stocks at lower prices.

The Bottom Line

FIIs are an integral part of India’s financial ecosystem. Their actions move markets in the short term, but over the long term, only company performance drives returns.

So, don’t get spooked by daily headlines about FII selling or buying. Instead, build your portfolio on the foundation of solid businesses, strong earnings, and disciplined valuation.

The smart investor doesn’t try to chase or outguess FIIs —they simply stay one step ahead by investing in quality before FIIs do.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: