In Charlie Munger’s words - If you want to succeed, learn to avoid failure. One of the best means to avoid failure is to learn from history. If you can identify why certain companies drop off from their highs, you can use that learning to avoid such mistakes in the future.

Indian companies, currently reeling under the pressure of widening current account deficit, depreciating rupee and higher interest costs, now also have FCCB’s to worry about. Suzlon hit headlines when it failed to get an extension from its bondholders for FCCB’s worth USD 221 million, which is claimed to be India’s biggest foreign currency convertible bond (FCCB) default. Though FCCB issuance has long been in practice, it became a topic of discussion recently owing to the rising defaults and approaching maturity/redemption dates of many FCCB’s (issued by Indian companies) in 2013. Logically then, this has spiked the interest of investors, industry analysts and sector experts alike.

So, first let’s see what FCCB is...

FCCB’s (foreign currency convertible bonds) are special type of convertible bonds issued in a currency different from the issuer’s domestic currency, usually with tenure of 3-7 years. A convertible bond is a mix of debt and equity instrument. A FCCB holder has the option of redeeming their investment or converting the bonds into equity at/before maturity at a market-linked pre-determined price. If the equity shares of the company do not reach the previously decided price and the bond reaches its maturity, then the principal is repaid to the bond holder just like a regular bond. Thus, the bondholders get the advantage of fixed coupon rate payments by owning bond as well as the additional option of converting the bond into equity. Let’s try to understand this with the help of an example:

Suppose a company ‘A’ issues bonds with following terms –

Issue Price of the Bond Rs. 1000 Coupon rate 2% Maturity 2 years Convertible into equity shares @ Rs. 800 per share

Now suppose an investor subscribes to 4 of these bonds. Thus the total investment is Rs. 4000. On this investment, he is entitled to get an interest @2% for 2 years. On the maturity date, i.e. after 2 years, the investor will have an option - to either claim full redemption of the amount from the company or get the bonds converted into fully paid equity shares @ Rs. 800 per share. Thus if he goes for the conversion he will be entitled to 5 (4000/800) equity shares. The choice he makes will depend on the market price of the share on the date of conversion.

If the shares of the company ‘A’ is trading at lower than Rs. 800, let’s say Rs. 500, the investor will be better off by claiming full redemption of his bonds and buying the shares from the market. In this case, he will get 8 (4000/500) equity shares as against 5 which he was getting on conversion. Similarly if the market price of the share is higher than Rs. 800, the investor will benefit by getting its shares converted.

Thus, on the day of maturity, an investor will seek full redemption if the conversion price is higher than the current market price, and will go for conversion if the conversion price is less than the current market price.

According to Prime database, during bull-run of 2005-2008, 201 companies in India raised close to Rs 72,000 crore through FCCBs. This raises a very interesting question as to why the Indian companies opt for FCCB bonds and not regular bonds. Companies issue FCCB as interest rates on them are much lower than that on a regular bond. Also, they do not require any sort of security/collateral. The reason for low interest rates being that the bondholder gets additional value in the form of the equity portion.

There was another reason for popularity of FCCBs. During 2004-2008, Indian stock market was booming and macro-economic factors promised bright future. Most companies, which opted for FCCBs didn’t envisage the scenario of paying back the loans. It was, in general assumed that the currency situation will remain more or less stable (INR was trading below 50 at that time) pointing to the fact that at redemption, lenders would most likely convert holdings to equity at the agreed prices.

Thus, from the company’s perspective, FCCBs appeared to be a cheaper source of borrowing with low interest expense on the books. They were raised to meet capital expenditure requirements and expansion plans at very competitive rates.

Repayment options of FCCBs

When companies fall short of cash while repaying its FCCBs, they are often driven to resort to measures like: raising additional debt (at higher interest rates), negotiating the conversion price of the bond to near market prices (resulting in greater equity dilution), restructuring, sale of assets (Suzlon sold a block of wind farms in Tamil Nadu), or equity offers (rights, FPO or private placement), in order to avoid defaulting on their obligation.

A recent example of a company unable to service its FCCBs, is that of Suzlon, which completed its corporate debt restructuring (CDR)when it defaulted on FCCBs (maturity due was in Oct 2012) worth $221 million. Further, it still has FCCB obligations worth USD 90 million due in July 2014 and USD 175 million due in April 2016 on its books.

Let’s see how macroeconomic factors impacted them?

During the boom period, many firms made expansions/acquisitions at high valuations. However, the global economic crisis (starting from 2008) slowed down the growth of the companies. Thus, the cash flow from the growth plans were well below expectation, adding to the already piled up debts of the company. Here’s the impact on the company:

- FCCBs turned out to be very expensive when the share prices of companies starts declining, which made the conversion price of FCCBs much higher than the current market price, as usually evident in market crash and bearish phase.

- The problem got further compounded when the exchange rate turned unfavorable as seen by rupee fall. When the FCCBs were taken, the rupee was in the range of Rs 40-44 and now it is Rs 54 to a dollar. Thus, companies need to pay almost 22-23% more if they have to buy the same number of dollars.

- Further, FCCB issue (on conversion) will result in dilution of equity shares, which will bring down the EPS and consequently the valuations for the company.

Now, what’s in it from an investor’s perspective?

Investor’s view FCCBs as an attractive investment as it provides the upside potential with conversion option of debt to equity and the downside risk is mitigated by the fixed interest rate element. FCCBs may turn out to be beneficial for the companies with robust business model and the ability to implement the same.

However, FCCBs turn out to be a nightmare, when the company’s share price declines as they have to be repaid either by raising debt at higher interest rates or through internal accruals. If the FCCBs do not get converted, it increases the debt equity ratio. If the FCCBs do get converted it leads to equity dilution. Either way, the company’s financials will be impacted.

In the case of default, FCCB's being the unsecured debt along with lack of strong bankruptcy laws in India, doesn't leave the FCCB holding company with much choice. The company can either restructure the debt or go in for a liquidation. In case of restructuring, the conversion price is lowered and debt repayment schedule is extended, which leads to dilution and fall in stock prices.

Thus, investors need to be watchful and cautious when the companies announce/are keen on the FCCB issuances. In fact, we recommend investors, to stay away from companies with very high exposures to FCCBs.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

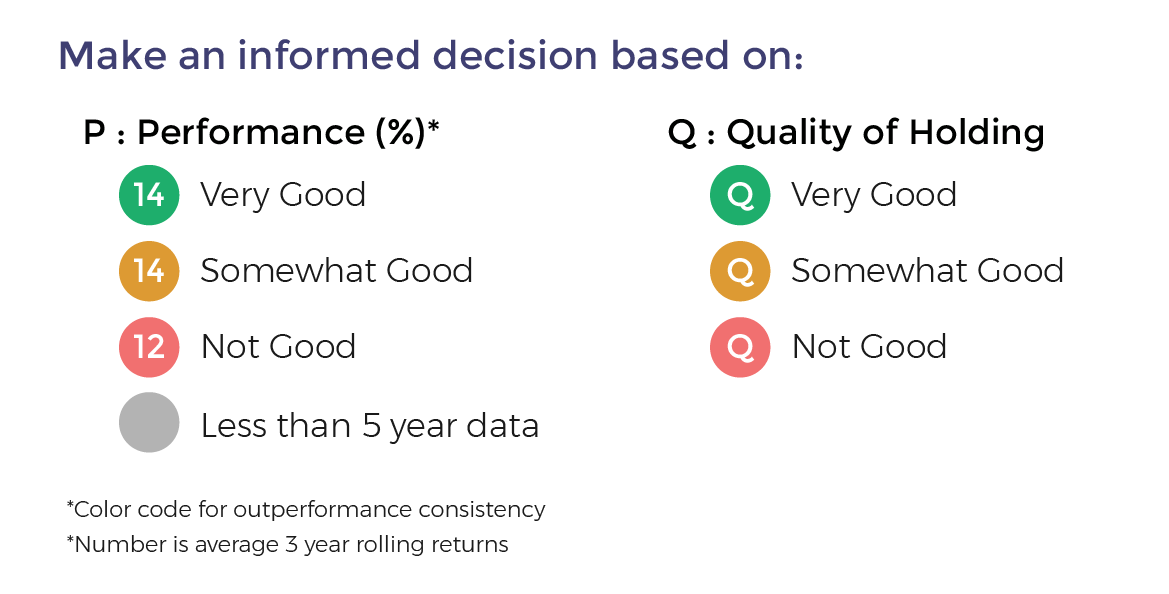

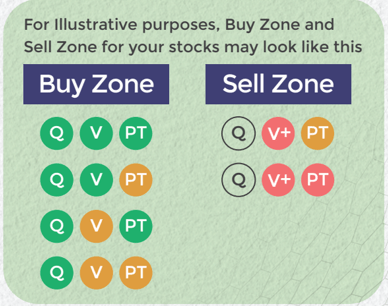

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: