As year-end approaches, newspaper and media compare returns of every asset like Equity, fixed deposits and gold. What purpose does this comparison serve?

People invest for meeting financial goals. People invest to grow as conservatively as possible. People invest knowing risks in advance. People invest for 10-20 years. People invest because there is no other option as inflation eats up savings. So how does yearly analysis matter? Will yearly analysis change any of the above facts?

Fixed income is low return but extremely safe! Gold is volatile but moderately high returns. Equity generates high returns over long periods but extremely volatile from year to year. Knowing these characteristics in advance, we diversify across the asset class. Bulk of the risk is taken care by diversifying across asset classes.

Now how exactly does it matter if one of the assets disappoint in any year? Feeling sorry about poor equity return in a particular year is worrying about something which we already know and taken care of. We knew this would happen in advance and we already took care of it by diversifying, isn’t it?

No one would know in advance what equity would do this year. Hindsight is always 20/20. But if equity were to do well this year, you would have invested 100% in equity but did you? You didn’t, because you knew somewhere you won’t be right.

Extending the same logic to funds and stocks, we recommend not to concentrate in few of them, you diversify. Likewise, you must own 20+ stocks. We know in advance that we won’t be 100% right, hence to contain fallout, we diversify. Does it really matter if one fund actually disappoints? Does it matter if one of the stocks disappoints? We took care of larger risks, right?

Extending the same logic to funds and stocks, we recommend not to concentrate in few of them, you diversify. Likewise, you must own 20+ stocks. We know in advance that we won’t be 100% right, hence to contain fallout, we diversify. Does it really matter if one fund actually disappoints? Does it matter if one of the stocks disappoints? We took care of larger risks, right?

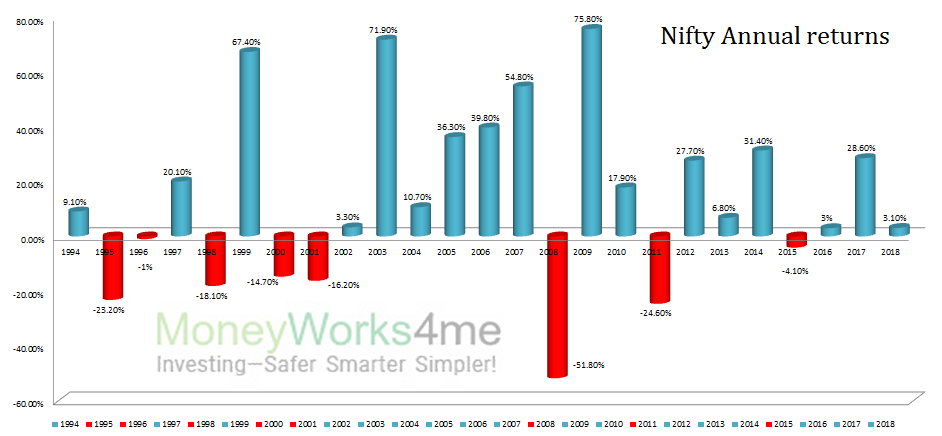

One has to take risk to earn better returns. Risks need to be accepted or else can returns be any superior? Not earning positive return on equity every year is one such risk. Losing money on couple of individual stocks is another. However, just like playing our childhood board game Snakes and Ladders, if you play investing game long enough (10 Yr+), you will come out victorious.

One may choose to save a lot and invest just in safe assets like Fixed Income. Or one may think of breaking investments into two by investing into Equity (50%) & Fixed Income (50%). How does it help you ask, you need to save just 50% of current savings to reach same corpus you would reach by Fixed income alone over 20 year period. Now that’s a lot of capital getting freed up for current lifestyle needs. (Assumption Equity Return 13%, Fixed Income 6%). We think that this huge advantage of Equity more than compensates one or two years of negative returns.

Best Stocks From: Top 10 Stocks for 2024 Best EV Stocks in India Screener Alpha Cases Best Solar Energy Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Sugar Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Top Media Stocks in India Top Fertilizer Stocks in India

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: