Some of us have reached a point in our life where we are earning a steady, reasonably large income. Our savings have started growing at a steady pace. This is a point when most of us ask “What should I do with this surplus money?” It’s not a very good question because most of us are likely to answer by either giving in to things that give us instant gratification (e.g. buy a bigger car, foreign trip) or social pressures (e.g. buy a house). And if we avoid these options, we end up putting the money in FD or mutual funds as a stop-gap solution before we find out what we really want to do with our money.

The empowering question to ask is ‘How should I manage my surplus money?’ And the answer should be “I must manage my surplus money in such a way that I meet most if not all of what I may be required to do and many of the things that I wish to do; without having to work for it.” That’s right; good investment planning helps grow your savings so that it becomes large enough for you to be able to afford these things without having to work for it. Isn’t this what you would want in your life? You may still work, but it will be your choice. This is called Financial Freedom. Right now most of us are not there (else you won’t be reading this); we need to work to meet our current and future needs. But we can get there by managing our money, by investing it in a way that it grows into a large enough corpus to fund our needs and at least a few of our wants/dreams/luxuries.

The obvious benefit of thinking like this is that you know there are multiple things claiming a share of your savings; that you need to prioritize them and plan how to meet most of them.

Is it really possible?

Your first reaction may be that it’s not possible; that you don’t and won’t have the money to meet this goal of financial freedom. Well, let’s just say that if you have time on your side you are very likely to have the money you need to be provided you allow the magic of compounding to work for you.

Your first reaction may be that it’s not possible; that you don’t and won’t have the money to meet this goal of financial freedom. Well, let’s just say that if you have time on your side you are very likely to have the money you need to be provided you allow the magic of compounding to work for you.

You can use the MoneyWorks4me Financial Planning Tool to make your plan (we guarantee it is much easier than you think) and know how much money you need to invest on a monthly basis in addition to your current lumpsum savings to achieve all the goals you planned for. See the FPT video to understand how to do this.

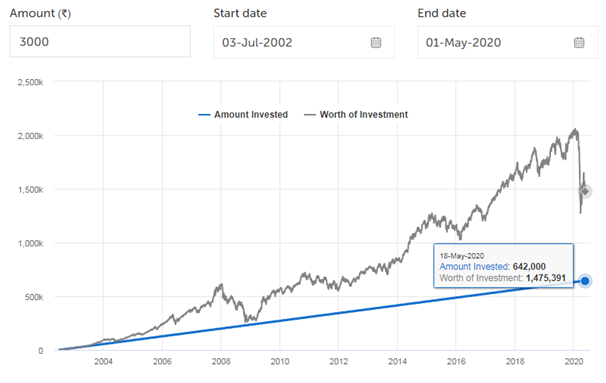

Here are two graphs that will convince you how your savings grow over time at different rates of returns. You can see that even with reasonable inflation-beating returns your money grows into a large sum thanks to compounding.

A small investment of 1 lakh in the Nifty Index, would be worth almost 8 lakhs today (peak of 12lacs before covid19 correction), a 12% CAGR return, higher than what you would have made by investing in any other asset class.

Similarly, a small monthly investment of 3000 per month since 2002, would now be worth almost 15 lakhs today (Peak of 20 lacs before COVID 19 correction).

These graphs follow the Wealth Building Formula: Wealth = Surplus (1+returns)^years invested

So what does this formula tell us about growing our savings into a large corpus? Three things:

- You need to invest most/all the surplus you have

- Earn healthy higher-than-inflation returns consistently

- Stay invested for really long, decades

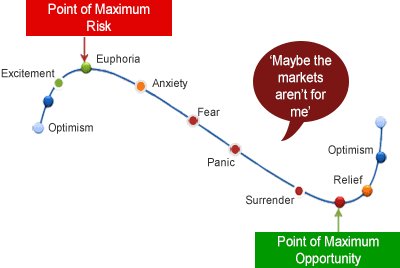

Points 1 & 3 are pretty obvious. But why are we not aiming for very high returns? The answer (given in the above blog in details) is that very high returns requires you to take a serious risk which in real life leads to situations where most of us will not have the stomach to invest our entire surplus and ride through the volatility that accompanies such risks i.e. we will exit when things get rough. A decent, healthy higher-than-inflation returns make it possible to maximize 1 & 3, and thus grow your savings to a high level largely through compounding.

Even this is not easy to do because a large portion of your savings and a large amount of money is involved, causing anxiety in decision making especially when markets become volatile.

So how do you manage your money?

There are two obvious ways of doing things:

There are two obvious ways of doing things:

- Do-it-Yourself or DIY where you do whatever is required to make sound investment decisions.

- Do-it-for-me or DIFM where you rely on an expert to do whatever is required

When you appreciate that what is at stake is not just your current and future savings but your financial freedom, you will find both these are unsuitable. You are unlikely to find the time to explore, understand, and keep up-to-date with a very large body of knowledge and information that is required to make investment decisions. However, the DIFM way may make you uncomfortable about leaving it all to others, even experts, and having so little control over your investments.

You want more involvement and control along with the guidance of an expert investment advisor. However for this to work you should be willing to put in some quality time managing your investments. Yes, you do not want to do the research and analysis that the DIY way requires. But you should be willing to use a framework and a process; well-processed information and easy-to-use tools, that make decision-making systematic and predictable. And more importantly, it enables you to engage productively with your investment advisor.

What is the first step in Managing your Money to achieve financial freedom?

The first step is to know what financial freedom means for you specifically. You have achieved Financial Freedom when you meet most if not all of what you may be required to do and many of the things that you wish to do; without having to work for it.

The first step is to know what financial freedom means for you specifically. You have achieved Financial Freedom when you meet most if not all of what you may be required to do and many of the things that you wish to do; without having to work for it.

So first, you need to know what all you are required to do i.e. if you did not do these things you would be unhappy. This mostly includes things you have to do as part of the roles you play – son, daughter, parent, husband, etc. To cut the long story short, essentially money for children’s education, marriage, your own retirement kind of stuff; so that you free from your responsibilities.

The second is the list of things you want, wish, and dream of doing. Most people don’t know what they really want in their life, want to own, to achieve, to do, to become before they die, kick the bucket. Essentially your Bucket List.

Now plan for it

Once you have these things listed down you need to figure out how much money you are going to need to do them when you plan to do them and what does that means in terms of the savings and investments you need to make.

Once you have these things listed down you need to figure out how much money you are going to need to do them when you plan to do them and what does that means in terms of the savings and investments you need to make.

You can use the MoneyWorks4me Financial Planning Tool for free to get useful and quick answers. All you will need to do is enter a few bits of information to know what you need to do to achieve these goals individually and collectively. You will know how much to invest in Debt and Equity for both your current Lumpsum savings & investments as well as for your monthly saving through SIP.

Before you start making investments, read this blog to learn about some smart things you can do that will help you to meet your goals.

What are the steps in executing your investment plan:

- 4 essential things to do before you invest?

- Determine how much to invest in different asset classes like equity, debt, gold, etc –the asset allocation most suitable for you

- Build your equity portfolio

- Invest in the right fixed-income assets

- Invest in gold

- Manage your multi-asset portfolio: Rebalance and Reshuffle it

4 essential things to do before you invest

As you would have read in the blogs above there are three things you need to set aside money for before investing. And they are:

- Health insurance to cover any medical expenses for yourself and family

- Life insurance-term plan to cover the income you are likely to earn in the future say 20 years (in case of your death or otherwise inability to earn this)

- An emergency fund of 6 to 12 months of your expenses in case you are in-between jobs for whatever reasons

The two insurances are expenses while the third is money you put in a Fixed deposit (in the top 3 banks and no less).

The 4th essential thing that follows the above is estimating the money available for investing-your investable surplus. First, check how much investable surplus you generate every month. From your total monthly income, you subtract your monthly expenses (include the money you have to spend on your life and health insurance). Some expenses we incur once or twice in the year eg vacation, convert this into a monthly amount. Any EMIs will also have to be provided for thus reducing the monthly surplus.

Now to estimate your lumpsum investable surplus. After setting aside your emergency fund, the savings are all an investable surplus. However, if you have any big planned expenses in the next 5 years you need to set aside money for this, again invest in an FD. You will see that in the MoneyWorks4me Financial Planning these expenses (happening in the next 5 years) are always put in the Debt or fixed income asset. The money that you can invest in Equity is money you don’t require in the next 5+ years and even longer.

What to invest in?

As a retail investor you should invest in multiple assets for the right reasons:

As a retail investor you should invest in multiple assets for the right reasons:

- Equity (stocks and mutual funds) to earn high (well over inflation rate returns but it carries risk

- Debt Funds/FD (fixed-income funds): to keep a portion of your money safe and if possible earn returns slightly better than inflation. (not all Debt funds are low risk, but you need to choose the low-risk funds/options when investing. Investing in debt funds with higher risk eg credit risks to earn higher returns goes against the very purpose of the allocation to Fixed Income assets)

- As insurance in times of distress like an earthquake, currency crises, economic risks, or government failures.

|

Asset class |

Direct Stocks |

Mutual Funds | Index Funds | Liquid Funds | Long-term Debt |

| Category | Equity | Equity | Equity | Debt | Debt |

| What? | Stocks/Shares ownership in a company | A portfolio of stocks (Some have debt instrument too) | A portfolio of stocks that is based on a particular index (e.g. Nifty 50) | Very low-risk fixed-income assets that invest in very short-term debts and Govt. securities | Long term debt, Govt. securities that give better than FD- returns |

| When to invest? | When fundamentally sound stocks are available at a discount from its fair value | When available with a good Potential Upside i.e. future returns | When there’s no better opportunity in Direct Stocks & Mutual Funds | When the market gets expensive | Always a fixed portion to be invested |

| Why? | To earn high returns on a long term basis. No cost investment in Stocks (except the Demat brokerage) | To complement Direct stock investment. Different investment styles work under different market conditions | Low-cost diversification. More predictable returns. Easy-exit when a better opportunity in equity is available | To temporarily park funds and earn close to after-tax FD-returns. When the markets move lower, then use it to buy more equity | To provide for Security need |

| Limitations? | Short-term drawdown at stock-level | High cost, Risks that a Fund Manager takes, Not as easy to exit as stocks | No customization, Not many options available in India | Low returns | Low returns |

| Volatility | Very High | High | Medium to High | Low | Low |

| Invested for? | Long-term | Medium to Long-term | Medium to | Short-term | Long-term |

| Long-term |

You can read more details on this at “What are Different Asset Classes?“ “Why invest in Gold, how much and where?“

Real estate as an asset class for investment is suitable for people with high net worth typically greater than 10 cr. Physical Real estate has the limitation of requiring a large investment at one go as well as can pose liquidity challenges i.e. difficulty in selling it when you want to at the price you want. There are alternate ways of investing in equity eg through REIT which enables you to invest without the above two challenges. However, currently, there are limited options for retail investors in India and they are not yet proven.

How much to invest in each asset class?

There are certain well established and time tested rules that govern how much of your surplus you should invest in different asset classes. This is known as asset allocation in investing parlance. This is determined by your Risk Profile i.e. your ability and willingness to take the risk. Your ability to take risk depends on your income, expenses, age, responsibilities, total net worth, etc. Your willingness to take risks is determined by your temperament, how much risk or loss you are able to handle beyond which you are likely to take incorrect decisions out of fear or inability to handle the pain and discomfort.

There are certain well established and time tested rules that govern how much of your surplus you should invest in different asset classes. This is known as asset allocation in investing parlance. This is determined by your Risk Profile i.e. your ability and willingness to take the risk. Your ability to take risk depends on your income, expenses, age, responsibilities, total net worth, etc. Your willingness to take risks is determined by your temperament, how much risk or loss you are able to handle beyond which you are likely to take incorrect decisions out of fear or inability to handle the pain and discomfort.

This requires you to answer a Risk Profiling Questionnaire which then informs you what asset allocation suit you. Usually 3 categories Conservative, Moderate and Aggressive with a Debt: Equity allocation of 60:40, 50:50 and 40:60 respectively.

| Asset Allocation | |||

| Aggressive | Moderate | Conservative | |

| Equity | 60 | 50 | 40 |

| Debt | 40 | 50 | 60 |

Why not invest the entire investable surplus in equity since it earns the highest returns?

Investing in equity earns the highest returns over the long term but carries risk. Stock prices are volatile i.e. they can and will fall and sometimes will fall quite sharply. This will lead to a fall in the portfolio causing you discomfort, pain, distress, and panic depending on the amount of correction. A 100% equity portfolio will fall as much as the market and maybe even more. So a 25% correction would mean a drop of 25 lacs in a 1cr equity portfolio. Even though this is a loss on paper, most investors even HNIs find it very difficult to stay invested through such losses if all their money is in equity.

Now in addition to this suppose one of your planned goals happens during the period of this steep market correction. You will have to sell a portion of your portfolio to fund this which means you incur a real loss. This can be traumatic especially if you have invested in your portfolio for some years.

So how does one overcome the problems posed by steep market corrections?

By allocating a portion of your investable surplus to Fixed Income assets popularly known as Debt Funds, Bonds, Fixed Deposits, etc. So if you allocate 50:50 to Debt and Equity then in the above example of a 25% fall in the market would probably result in about 12.5% drop in your portfolio; 12.5 lacs on your 1 cr portfolio. The 50% allocated to Debt would earn you some returns say 6% i.e 3lacs on your 50 lacs resulting in you seeing a 9.5lacs drop in your portfolio. This will cause you some pain but not distress or panic, thus ensuring you stay invested. And even if you have a goal that needs funding you don’t have to sell your stocks but can fund it from your Debt investment eg breaking an FD.

By allocating a portion of your investable surplus to Fixed Income assets popularly known as Debt Funds, Bonds, Fixed Deposits, etc. So if you allocate 50:50 to Debt and Equity then in the above example of a 25% fall in the market would probably result in about 12.5% drop in your portfolio; 12.5 lacs on your 1 cr portfolio. The 50% allocated to Debt would earn you some returns say 6% i.e 3lacs on your 50 lacs resulting in you seeing a 9.5lacs drop in your portfolio. This will cause you some pain but not distress or panic, thus ensuring you stay invested. And even if you have a goal that needs funding you don’t have to sell your stocks but can fund it from your Debt investment eg breaking an FD.

What should be your asset allocation according to your age?

How to build a better Equity Portfolio?

The objective of your investment in equity is to earn healthy high returns by taking manageable risks. You cannot avoid risk when investing in Equity but by having reasonable returns expectations you manage it at a level where you stay invested. You can build your equity portfolio by investing in:

The objective of your investment in equity is to earn healthy high returns by taking manageable risks. You cannot avoid risk when investing in Equity but by having reasonable returns expectations you manage it at a level where you stay invested. You can build your equity portfolio by investing in:

- Direct Stocks

- Actively Managed Mutual Funds

- Index funds and ETFs

Each has unique benefits and challenges:

| Key benefits of investing in Stocks | |

| Flexibility and Control |

|

| Lesser Cost | Lower overall cost compared to mutual funds.

|

| Key Challenges | |

|

|

| Key benefits of investing in Mutual Funds | |

| Diversification |

|

| Small Ticket Size |

|

| Key Challenges | |

|

|

| Key benefits of investing in Index Funds | |

| Diversification

& Sync with Market |

|

| Low Fees |

|

| Key Challenge of investing in Index Funds | |

|

|

You have two major challenges when building your equity portfolio:

- How do you select the ‘best’ stocks and mutual funds?

- How do you ensure you have the right mix i.e the selected stock and mutual funds together make your portfolio stronger/better?

Let’s first learn how to select the best/right stocks followed by a mutual fund (includes Index Funds/ETF)

Wealth creation by investing in stocks Possible?

1. Choose the Quality-at-Reasonable-Price way of investing in stocks!

1. Choose the Quality-at-Reasonable-Price way of investing in stocks!

Quality-at-Reasonable-Price, QaRP is a way of investing most suited for retail stock investors. This method ensures you invest exclusively in quality companies at reasonable prices. This reduces the chances and extent of a fall in your net worth and thereby dramatically increases your chances of staying invested. Wealth is the outcome of staying invested and compounding the growth of your investment.

There are other ways of investing in stocks. However, they demand higher risk-taking ability and higher tolerance to volatility and less than what most of us have. You can invest in these through suitable mutual funds.

2. How to identify Quality Companies?

Quality-companies are those that have delivered profitable results even during tough market and economic conditions.

- Look for a proven track record over 10 years as it usually has at least one tough period.

- Only companies with some moat-competitive edge can deliver this performance.

- Look at the key ratios and if most of them are good you have found a Quality Company.

Moneyworks4me has simplified this through a color-coded 10-Year XRay of companies. You can see this for free on registration.

3. How to assess Reasonable Price?

Reasonable price is very subjective and hard to prove. Not just for stocks but for many products and certainly for all services. Consumers solve this problem by using an ‘anchor’, a price they use for comparison. However, we do it every time we buy something-vegetable, fruits, hotel rooms, etc. In India, MRP serves as a good anchor for packaged products. MoneyWorks4me uses the same concept and provides the fair and full value or MRP of 200 top stocks.

Reasonable price is very subjective and hard to prove. Not just for stocks but for many products and certainly for all services. Consumers solve this problem by using an ‘anchor’, a price they use for comparison. However, we do it every time we buy something-vegetable, fruits, hotel rooms, etc. In India, MRP serves as a good anchor for packaged products. MoneyWorks4me uses the same concept and provides the fair and full value or MRP of 200 top stocks.

Anchors used when assessing a stock price:

- Using 52 weeks high or low, P/E or P/BV are examples of one type of anchor. These are all driven by market prices and may not have a correlation to the performance of the company.

- Fair value, Intrinsic value, etc. are anchors based on the current and future performance of the company. They have their basis in sound theory but influenced by assumptions.

Remember:

- Reasonable is not Cheap. Some quality companies almost always trade at very high P/E and P/BV. However, sometimes they are pretty close to fair value and hence reasonably priced.

- Cheap is not always reasonable. Sometimes stocks are cheap for a reason and remain low for long thus giving very poor returns to the investor.

4. Build a portfolio of about 20 stocks based on QaRP way of investing

You should not risk your money on only a few stocks but build a portfolio of about 20 stocks. It will take some time to build this portfolio as you are very unlikely to find 20 such stocks at one go.

You can check the risk in your portfolio by uploading it to the MoneyWorks4me Portfolio Manager.

5. You need unbiased and transparent advice for better decision making

You need data, analysis, tools, and advice to make sound stock investing decisions. More importantly, you need these to be unbiased and transparently presented so that you can act on it confidently. No researcher or advisor can be right all the time, but their willingness to be transparent is crucial for you to trust them. Select one carefully.

You need data, analysis, tools, and advice to make sound stock investing decisions. More importantly, you need these to be unbiased and transparently presented so that you can act on it confidently. No researcher or advisor can be right all the time, but their willingness to be transparent is crucial for you to trust them. Select one carefully.

If you want to learn more about how to invest in stocks and create wealth read “How To Invest In Stocks – The Complete Guide To Stock Market Investments“.

How To Select The Best Mutual Funds In 2020

There are roughly 350 Equity Mutual Funds in the market. Selecting the right ones can be pretty complicated. Since we cannot handle the complicated stuff, we resort to simpler measures even if they are incorrect and inadequate. The current method for selecting a fund based on the highest past returns is popular because of this very reason.

There are roughly 350 Equity Mutual Funds in the market. Selecting the right ones can be pretty complicated. Since we cannot handle the complicated stuff, we resort to simpler measures even if they are incorrect and inadequate. The current method for selecting a fund based on the highest past returns is popular because of this very reason.

This way of looking at returns is like driving a car looking at the rear-view mirror. It’s misleading, inadequate and risky.

Misleading, because it has the biases of when you started and how the markets are doing at the time of measuring the performance.

It’s inadequate because it does not tell us how much risk the fund manager is taking and whether the fund is likely to perform in the future, the period we are interested in.

It’s risky because funds that give the highest returns today have stocks that are overvalued and likely to correct or stagnate.

How to Choose Best Equity Mutual Funds to Invest?

Finding a good Mutual Fund to invest in requires you to answer 3 essential questions:

Finding a good Mutual Fund to invest in requires you to answer 3 essential questions:

- What is the Right Fund?

- What is the Right Time to buy?

- What is the Right Allocation?

What is the Right Fund?

To assess whether a fund is investment-worthy, you need to check it on three important attributes and be able to compare it with its peers:

Quality of Holdings:

Quality of holdings is an assessment of how safe is the stocks that the fund owns. It is critical that your financial goals are met through your investments in mutual funds and for that, you need to select funds whose goals match yours.

Quality of holdings is an assessment of how safe is the stocks that the fund owns. It is critical that your financial goals are met through your investments in mutual funds and for that, you need to select funds whose goals match yours.

It is quite possible that in the race to stand out amongst its peers in terms of returns, a fund might hold riskier stocks, as higher risks stocks may generate higher returns. However, it can backfire in terms of higher drawdowns-bigger losses when the market corrects.

This may not be acceptable to you. And this can be tricky to find out because funds usually play it reasonably safe when it comes to their top 10 holdings, but all the risks could be sitting below that.

That where you find if a fund has a portfolio of companies that are (i) low on quality (ii) cyclical (iii) poor corporate governance (iv) turn around or (v) small sized.

Consistency of Returns:

As an investor, we are more interested in a fund earning consistent returns that compounds rather than swings from very high to low/very low.

As an investor, we are more interested in a fund earning consistent returns that compounds rather than swings from very high to low/very low.

We also need a way of looking at returns that do not have the limitations of using past returns i.e start and end date bias; especially because we could enter and exit at any time.

For this, you need to look average rolling returns and rolling Alpha of a fund over at least 3/5/7 years’ time period. This tells how well a fund performed with different start and end dates on an absolute scale as well as compared to its benchmark.

Average rolling returns for the period 3/5/7 tends to smoothen out the very good or very poor performance that could be largely due to the market volatility/movement.

Expense:

Mutual funds charge fees for managing a portfolio and generating higher returns than the benchmark. A fund that earned higher excess returns may well deserve charging higher fees i.e. expense ratio. But it’s not worth paying high expense ratio if a fund that doesn’t generate high excess returns.

Mutual funds charge fees for managing a portfolio and generating higher returns than the benchmark. A fund that earned higher excess returns may well deserve charging higher fees i.e. expense ratio. But it’s not worth paying high expense ratio if a fund that doesn’t generate high excess returns.

We have seen that in the past, large-cap funds haven’t generated very high excess returns vs the expense ratio they have charged their investors. So either these funds reduce their charges to remain attractive to investors and prevent them from investing in large-cap index funds.

SEBI is coming heavily on reducing expense ratios for mutual funds that are managing large AUMs. Upon observing a direct plan expense ratio of many leading funds, their expense ratio is very close to each other hence holds less relevance today versus the above two parameters.

You can get answers to all the above questions on Moneyworks4me.com for free. MoneyWorks4me has color-coded equity MF as green, orange, or red on all the 3 attributes and also on an overall basis.

What is the right time?

Look at Valuation and Investing Strategy:

Look at Valuation and Investing Strategy:

A fund may be the right fund to invest in, but you would like to buy it only when you expect to get at least higher-than-FD returns in the near future. Most industry players tell you not to time the market and do a SIP. However, that is not right when you have lumpsum money to invest (lumpsum investing returns almost always beats SIP returns).

Suppose a fund has bought stocks at cheaper prices and held them for some time. Currently, these stocks could be well over the fair price. The fund may continue holding onto them-showing great past returns. Now, should you invest in this fund? It is risky (valuation risks) for a new investor to enter at such elevated valuations. In the 2nd half of 2017, this was the case for most mid and small cap funds.

We recommend assessing the fund’s future upside potential and investing lumpsum in those that are likely to give returns well over FD returns. So if a fund is holding a lot of over-valued stocks that it runs the risks of giving returns which are less than FD over the next 3 years. You need to avoid these and find other alternatives or wait.

What is the Right Allocation?

Investment Strategy or Process/Style:

Investment Strategy or Process/Style:

Every fund has its own investment process like Growth investing, Value investing, Quality investing, etc. Some investment processes work well in rising markets while others work well in falling markets.

For example, it’s recommended to avoid growth funds if markets have already run up a lot. At the same time, it might not be preferable to buy value funds if markets overall are undervalued because you could get high-quality stocks at reasonable prices.

You may find the Right Fund and the price/time may be suitable to invest in it. A fund is right for you if it suits your risk profile and investment horizon. E.g. a sector fund may be right only if you have an aggressive risk profile, while a value fund will be right if you have a very long term, 10+ year horizon.

After checking the above you need to select 4/5 funds with different investment strategies and invest equally in them.

Though these parameters may not identify ‘Mutual Fund of the year’, it definitely helps in avoiding the wrong funds and short-listing good funds that make sense in your portfolio and are likely to give higher than FD returns.

One may seek the help of a professional fiduciary adviser to find the mix of funds that together can give you the best risk-adjusted returns.

From what you have seen so far you will have concluded the following:

- There are different investment strategies/process/styles of building an equity portfolio- Growth, Value, Quality (at any price), Quality-at-Reasonable-Price (QaRP), Momentum, Small Cap, etc. None of these work under all market and economic conditions and hence will have their periods of under-performance.

- For your Direct Stocks portfolio, QaRP is most suitable for retail investors. Using this build a portfolio of around 20 stocks. You need a fiduciary investment advisor with stock research capabilities to guide you in building this portfolio.

- For other styles of investing use the Mutual Fund route. Invest in 4/5 funds.

- Invest in mutual funds (from among those following the same style) based on relatively better quality, consistency of performance, and lower expense ratio and the one with a higher upside over the next 3 years.

- In India currently, you do not have any Index fund based on Investing Process so we have to figure out which index funds make sense in our portfolio and when hopefully in the following section.

Now how do you ensure you have the right mix in your Equity Portfolio?

You will not be able to do this very easily without a proper tool. The MoneyWorks4me Portfolio Manager is built to help investors check if they have the right mix in their equity portfolio. So this section tells you what to do and you can do it by uploading your portfolio on the site

You will not be able to do this very easily without a proper tool. The MoneyWorks4me Portfolio Manager is built to help investors check if they have the right mix in their equity portfolio. So this section tells you what to do and you can do it by uploading your portfolio on the site

You will build your Direct Stock portfolio of about 20 stocks as and when you get the opportunities i.e quality stocks at reasonable prices. Maintain this portfolio on the site

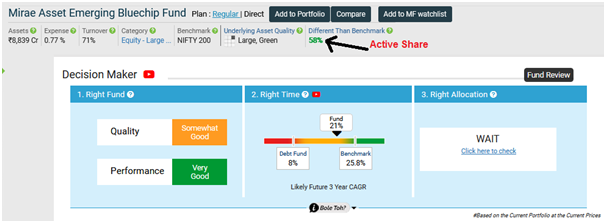

After you have shortlisted a fund with a different investment process than QaRP worth investing in you need to check if it right for you. A fund is right for you only if it makes sense in your portfolio. You invest in mutual funds to diversify and reduce risk and/or enhance returns. Since you already have a portfolio, you need to check whether adding a fund helps you diversify. This can be done by checking how different the fund’s portfolio is from your existing one. This is called Active share (%). High active shares number (greater than 50%) indicates that the fund portfolio is significantly different from your existing one and hence will add to diversifying it. You can do this simply by checking the MoneyWorks4me Decision Maker (see image below) and you will get to know how different is the fund portfolio from your current one.

If you say invest in a mutual fund and add this to the above PM, the active share is computed on your total equity portfolio.

If you are invested in a number of mutual funds you can use the tool MoneyWorks4me Funds Portfolio Analyzer also called Sher-ya-Billi to get an assessment of your portfolio. This report will tell you

- Have the right number of funds?

- How is the Funds’ Portfolio Quality

- Are the fund’s portfolios similar or different?

Using the above tools you know how to ensure you have a diversified portfolio of direct stocks and mutual funds. But how do you know for certain it is right? For that you need to know the risk you are carrying in your portfolio and manage it better.

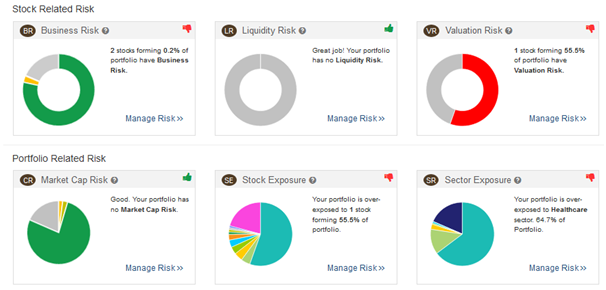

7 types of risk that affect your portfolio

At Stock-level:

- Business Risk-the company you are invested in is risky -unreliable performance, business model etc and hence unsuitable for a retail investor

- Valuation Risk-the current market price of the stock is high and well above its fair price and hence there is a risk that the price may correct

- Liquidity Risk-the stock has low trading volumes and hence there is a risk of not being able to sell your

You can read more about these “What are the Different Risks at the Stock-level?”

At Portfolio-level you can encounter 4 risks:

- Asset Allocation Risk: When your Equity-allocation is higher than what your risk Profile recommends, you are carrying the Asset Allocation Risk.

- Market Cap Risk: Small caps stocks are inherently riskier than large cap stocks. The exposure to such stocks should be governed by your risk profile. If you have a Moderate Risk Profile, you should not invest more than 20% in small caps.

- Sector Exposure: When you invest a significant portion of your portfolio, typically more than 25%, in a single sector, or in multiple sectors that are highly correlated, your portfolio is subjected to the Sector Exposure Risk. A large exposure to a single sector, or correlated sectors, could result in a drastic fall in your portfolio market value.

- Stock Exposure: A higher investment in one stock has a disproportionately large impact on portfolio performance. Investing typically more than 10% of your portfolio in a single stock exposes your portfolio to that particular Stock

You can read more about these at “What are the Different Risks at the Portfolio-level?“

You can get a real-time analysis of the risk in your portfolio once you have uploaded it on the MoneyWorks4me Portfolio manager. This is how the report will look like:

Why Invest in Fixed income assets

The objective of investing in Debt assets or Fixed Income assets is to ensure your money is secure while earning inflation+ returns. Simply put this is money that you give to banks as FD, or invest in Debt Funds where you give money to the AMC. Banks or AMCs then lend the money to various entities on different terms and earns interest.

The objective of investing in Debt assets or Fixed Income assets is to ensure your money is secure while earning inflation+ returns. Simply put this is money that you give to banks as FD, or invest in Debt Funds where you give money to the AMC. Banks or AMCs then lend the money to various entities on different terms and earns interest.

There are 5 main types of risks when investing in Fixed Income assets.

- Interest rate risk– If interest rates trend upwards, the bond value will decline. This will result in the erosion of the value of your assets. Alternatively, if the interest rate goes down, funds with longer duration can generate better returns.

- Credit default risk – Debt funds invest in bonds issued by various companies. Some of these companies may default on their payments in bad times. This will result in a loss of investment value

- Liquidity Risk– This risk stems from the inability to quickly buy/sell and asset so as to prevent or minimize a loss A Debt Fund scheme should be ‘liquid’ enough so that it can comfortably manage large value redemptions without adversely impacting the NAV of the scheme.

- Inflation Risk– Debt instruments have a fixed rate of interest as returns. Inflation eats into your returns as it grows steadily at a compounded rate. If the inflation rate is greater than the interest rate you get (after tax), you will have a negative real rate of return.

- Concentration Risk– he higher the holdings in a certain bond, the higher the risk. Here’s an example: Let’s say you have 10% exposure in one security. In case there is a default recorded, the Net Asset Value of the fund might decrease by 10%.

In an FD the interest is fixed for the term of the deposit and the bank is required to pay that return irrespective of the changes in the interest rate. Thus, the biggest risk in an FD is interest rate risk, your funds being locked in at a lower rate for a long tenure.

Another big risk is credit risk. Till recently FDs in banks were insured for Rs 1 lac which has now been raised to Rs 5 lacs. But any amount above this, there is no guarantee whether the money will be returned to you safely, except the competence and reputation of the bank.

Other risks in FDs include liquidity (inability to liquidate locked in FDs and inflation risks (earning less than inflation returns. in a Debt fund, the returns depend on how the fund manager/AMC manages the fund; of course, there are guidelines as to what they can and cannot do. However, the fund manager may sometimes take additional risks in order to earn that 1-2% extra returns. For example, investing in bonds issues of shady companies, higher concentration to a particular group.

Debt Funds:

These Mutual Funds invest mainly in Debt instruments like Bonds i.e. where the returns are not dependent on any company performance. However, since they essentially provide loans to different entities, they do run the risk of defaults. Debt Funds differ based on whom they loan money to and for how long. It is safe to say that if a Debt Fund offers or delivers higher returns, the fund manager has lent money to entities with higher risk. There are no free lunches.

These Mutual Funds invest mainly in Debt instruments like Bonds i.e. where the returns are not dependent on any company performance. However, since they essentially provide loans to different entities, they do run the risk of defaults. Debt Funds differ based on whom they loan money to and for how long. It is safe to say that if a Debt Fund offers or delivers higher returns, the fund manager has lent money to entities with higher risk. There are no free lunches.

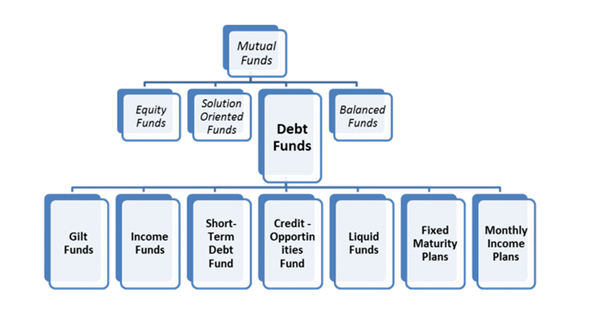

Debt funds are classified as:

Gilt funds invest in Government Securities with different maturities. E.g. A long-term Gilt Fund holds Government Bonds from 15 to 30 years. Since the investment is in Government Bonds, these Funds carry almost zero default risk, but high-interest rate risk.

Liquid and Ultra Short Term funds invest in Government Securities and Corporate Bonds & Debentures, across varying maturities. They are sensitive to interest rate movements, albeit less than Gilt Funds.

Liquid Funds invest in highly liquid money-market instruments with maturities of 91 days or less. They provide a good option for investors to park their surplus idle cash in a low-risk instrument and also get higher returns than a bank account.

Short-term Debt Funds Invest in money-market instruments, with 2-3 years’ maturities. The Fund Manager usually holds Bonds to maturity for accrual income.

Credit-opportunities Funds Invest in Corporate Bonds & Debentures of 2-3 years’ maturities. However, the credit rating of these instruments is lower than that in Short-term Debt Funds. These allow investors to earn slightly higher returns.

Monthly Income Plans (MIP) invest majority (75-80%) of their portfolio in Fixed Income Securities and the remaining (20-25%) in Equities. The Debt investments provide a MIP Fund with stable returns, and the Equity portion allows it to get higher returns than regular Debt Funds. However, this also makes MIPs riskier than regular Debt Funds.

Fixed Maturity Plans (FMPs) are Close-ended schemes with a fixed tenure (similar to a bank FD, where investor’s money will be locked in for a period). It invests in Fixed Income Securities with maturities matching the scheme tenure, thus reducing re-investment risk. FMPs with three-year maturity qualify for long-term capital gains tax with indexation, making them attractive to individuals in the high-income tax brackets.

You can read more about these at “What are the different types of Debt and Balanced Mutual Funds?“

So what do you invest in?

Quite frankly the options to earn higher than FD returns mean taking a risk that is best avoided. Problems like Vodafone, DHFL, IL&FS, and the winding up of 6 debt funds by Franklin Templeton due to liquidity problems during the Covid19 lockdown make investing for higher returns in Debt funds unattractive to retail investors.

Quite frankly the options to earn higher than FD returns mean taking a risk that is best avoided. Problems like Vodafone, DHFL, IL&FS, and the winding up of 6 debt funds by Franklin Templeton due to liquidity problems during the Covid19 lockdown make investing for higher returns in Debt funds unattractive to retail investors.

Since safety is the highest priority it is recommended that you invest half the allocation to debt in an FD with the Top 3 banks in India viz SBI, HDFC, and ICICI Bank. The remaining allocation to Debt is best put in a Liquid Fund investing mainly in government securities which will earn FD like returns. Alternately, you can invest in Gilt funds when interest rates are in a downward trend.

But this means that the Debt portion of the allocation earns only FD returns. Is there an alternative?

Yes, there is an alternative-Smart Asset allocation. But before we go there you need to understand an important part of Asset Allocation that is Rebalancing.

Rebalancing when the market corrects: Now suppose after you have done the asset allocation for your portfolio and six months later the market corrects sharply say 25%. What happens to your portfolio?

Going back to the example of a 1cr portfolio with 50-50 allocation to debt and equity…While you started with 50 lacs each in Debt and Equity, the 25% correction in equity means your equity portfolio is now 37.5 lacs and your debt portfolio is 53 lacs (6% – 6 months), a total of 90.5 lacs. Essentially, the Debt to Equity ratio is now 58:42.

Rebalancing means you move money from one asset to another to restore the original asset allocation.

If you decide to rebalance your portfolio back to 50:50 you will need to invest about 7.75 lacs inequity and reduce your Debt portfolio to 45.25 lacs. Now in a market that has corrected 25%, it does not take too much imagination to know that you will be able to buy good stocks at attractive prices. And this means better returns in the future! So following the discipline of asset allocation enables you to buy stocks when they are available at good discounts.

What happens when the market has gone up substantially?

You rebalance back to the recommended asset allocation. So if the market goes up by 25% your 50 lac equity portfolio will increase to 62.5 lacs. Your 50 lac debt portfolio which grows at say 6% will become 53 lacs (6 months). Your total portfolio will be 115.5 lacs and the Debt: Equity will be 46:54. On rebalance, you will book profit by selling 4.75 lacs worth of equity and putting it in a Debt asset. So following the discipline of asset allocation will ensure booking some profits

You rebalance back to the recommended asset allocation. So if the market goes up by 25% your 50 lac equity portfolio will increase to 62.5 lacs. Your 50 lac debt portfolio which grows at say 6% will become 53 lacs (6 months). Your total portfolio will be 115.5 lacs and the Debt: Equity will be 46:54. On rebalance, you will book profit by selling 4.75 lacs worth of equity and putting it in a Debt asset. So following the discipline of asset allocation will ensure booking some profits

So how often should you rebalance your portfolio?

Usually, once a year is recommended.

And how does smart asset allocation work

In the conventional asset allocation, your portfolio is rebalanced to the debt-equity ratio dictated by your risk profile as explained above. In smart asset allocation, when the market corrects and falls below fair value levels and high quality stocks are available at attractive discounts the asset allocation is changed to increase equity eg from 50:50 for moderate it could go to 40:60. You can move a portion from Liquid funds to Equity. When the market goes back to fair value levels or above you move some money back to Liquid funds by selling some equity and you restore your original asset allocation. If the market goes substantially above fair value then using smart asset allocation can reduce the allocation to equity.

In the conventional asset allocation, your portfolio is rebalanced to the debt-equity ratio dictated by your risk profile as explained above. In smart asset allocation, when the market corrects and falls below fair value levels and high quality stocks are available at attractive discounts the asset allocation is changed to increase equity eg from 50:50 for moderate it could go to 40:60. You can move a portion from Liquid funds to Equity. When the market goes back to fair value levels or above you move some money back to Liquid funds by selling some equity and you restore your original asset allocation. If the market goes substantially above fair value then using smart asset allocation can reduce the allocation to equity.

If you manage this correctly, a major portion of your funds allocated to debt should be invested very safely in FD (Top 3 banks) and Government securities- GILT bonds and the rest parked in a Liquid Fund. With smart asset allocation, you can invest a portion of the Liquid Funds in high quality stocks or an Index fund or a Bluechip/large Cap fund when the market offers attractive discounts instead of risky debt funds. By doing this you will earn higher than FD returns on the Debt portion without having to invest in risky debt assets.

However, remember this should be done under guidance from a competent advisor.

How to ensure we have the right Equity: Debt mix when we have goals maturing at different times?

You should start by finding out the amount needed to be saved to achieve your financial goals. Equity returns can be extremely volatile in the short term, thus all goals to be achieved within the next 5 years should be fully funded by debt. For long term goals, 80% of funds can be allocated to equity and 20% to debt funds.

You should start by finding out the amount needed to be saved to achieve your financial goals. Equity returns can be extremely volatile in the short term, thus all goals to be achieved within the next 5 years should be fully funded by debt. For long term goals, 80% of funds can be allocated to equity and 20% to debt funds.

Alternatively, you can easily calculate this with the help of MoneyWorks4me’s Financial Planning Tool.

How does one decide the mix Stocks: MF: Index?

There is no model allocation. The mix between Stocks:MF: Index would depend on an individual’s preference. All three have equal risk as they belong to the equity asset class.

There is no model allocation. The mix between Stocks:MF: Index would depend on an individual’s preference. All three have equal risk as they belong to the equity asset class.

Index funds should be limited to 20-25% as returns may be slightly lower than the MFs/stocks portfolio. The allocation to Stocks: MF will depend on your ability to stomach volatility. A stock portfolio will be more volatile than an MF portfolio and can cause investors to take irrational decisions like not booking losses frequently, the inability to stay invested, etc.

When does it make sense to invest in index funds? Which ones?

The best time to invest in an index fund would be during corrections. You can accumulate your monthly SIPs in a liquid fund and invest in the index whenever there is a 15-20% correction. However, most individuals do not have the discipline to invest in times of correction. Thus, doing a monthly SIP for a small amount seems like a good option.

The best time to invest in an index fund would be during corrections. You can accumulate your monthly SIPs in a liquid fund and invest in the index whenever there is a 15-20% correction. However, most individuals do not have the discipline to invest in times of correction. Thus, doing a monthly SIP for a small amount seems like a good option.

There are two criteria’s when choosing an index fund – choose the one with the highest liquidity and the lowest expense ratio.

Investing in Gold

Irrespective of what returns it earns, Gold should be a part of every long term portfolio. Gold acts more like insurance rather than an investment of the overall portfolio.

How does Gold qualify as insurance?

Even if there is no large event, just a prolonged slowdown or inflation spike in the economy can lead to contagion in financial markets thereby devaluing the local currency, bonds, etc. In such situations, the perceived value of Gold goes up. This is true in the US as much as it is true in India.

Even if there is no large event, just a prolonged slowdown or inflation spike in the economy can lead to contagion in financial markets thereby devaluing the local currency, bonds, etc. In such situations, the perceived value of Gold goes up. This is true in the US as much as it is true in India.

Hence, it a single asset which is widely accepted across the world and automatically becomes more valuable from time to time.

How much to Invest in Gold/Gold instruments?

Gold must form 7-10% of your entire wealth, including real estate. If your wealth far exceeds retirement corpus, you can consider Gold as 10% of retirement corpus.

How to Invest in Gold?

Investment in Gold can be done in 3 ways; Sovereign Gold Bond, Gold ETF, and Physical Gold.

Investment in Gold can be done in 3 ways; Sovereign Gold Bond, Gold ETF, and Physical Gold.

Physical gold is the most preferable option to own Gold as one has easy access to Gold in a time of crisis. Non-physical Gold will have a liquidation risk at the time of crisis.

You can read the details at “Why invest in Gold, how much and where?“

How to withdraw money from the portfolio when you need the money?

Ideally, you should have already set aside emergency funds, 6 months’ worth of expenses, and 25% allocation to debt funds. This should help you take care of any liquidation needs.

Ideally, you should have already set aside emergency funds, 6 months’ worth of expenses, and 25% allocation to debt funds. This should help you take care of any liquidation needs.

Despite all the above, if you still need to liquidate your equity portfolio, you can follow the following steps when liquidating a portfolio:

Sell stocks with business risk (the company is highly leveraged leading to inability to service debt in the current slowdown)

- Sell stocks that are overvalued

- Sell stocks that unlikely to outperform in the next 1-2 years

- Reduce allocation to stocks that are over-concentrated in your portfolio

- Finally, reduce remaining stocks in equal proportion to achieve your required liquidity.

In conclusion

Before you start saving for financial freedom, you should have adequate health and life insurance. You also need to set aside 6-12 months expenses as emergency funds

To achieve financial freedom, you need to define your future financial goals clearly and determine the amount required to achieve these goals. Once this is done, you need to remain steadfast on your financial plan – Saving and investing monthly. Reassess your financial plan every year or on a substantial change in your goals. Remember to fund all financial goals to be achieved within 5 years through debt. Longer-term goals can be funded through 80% equity and 20% debt.

Right asset allocation will play a crucial role in achieving your goals. Gold, which acts as an effective hedge for your portfolio in times of distress should be at least 10% of your net worth. Debt/Fixed Income assets should be as per the asset allocation recommended for you. When investing in this portion, the safety of your money is the most important concern, not returns. You should put at least half of your allocation to Fixed Income/Debt into the safest investment like FD in one of the largest banks or Government Bonds/Gilt securities. The remaining can be put in very safe Liquid Funds. You can under the guidance of a competent investment advisor invest a portion of the Liquid Fund to invest in very high-quality Bluechip stocks or funds when the market offers an attractive discount. However, when the markets are at fair value levels you must restore the Debt: Equity level as per the recommended asset allocation.

The Equity portion of your allocation could be split between index funds, direct stocks, and mutual funds according to your comfort. For investment in stocks follow an investment process or strategy that will enable you to stay invested and let compounding do its magic. For Retail investors, Quality-at-Reasonable-Price is most suited.

Investments in equity mutual funds or Index funds should complement your Direct Stocks portfolio/process. This will ensure real diversification. When selecting a mutual fund whose investment process complements your portfolio select the one with a strong portfolio, consistent return performance on the basis of a rolling return, low expense ratio, and upside potential that is attractively higher than FD.

Lastly, you cannot invest in a portfolio and forget about it. Nor must you keep watching it every day and try to fine-tune it with the hope of improving it. Let it be driven by process preferably under the guidance of a fiduciary investment advisor.

Why Moneyworks4me:

Most investors agree on the need and benefit of investment advice and know that they should use investment or financial advisory service. But very few do and those who do, don’t relate in a manner that works for both of them, certainly not the investor. The proof that this is working for investors would be that they invested adequately in equity as per their recommended asset allocation and stay invested for long. In contrast, most investors enter and exit from their equity investments at precisely the wrong time.

Why does this happen? It happens because most investors are not able to judge whether their advisor is doing the right things and right for them. And hence they are not able to have confidence and conviction on the investment advice; something that is crucial to invest substantial amounts in equity and stay invested even through the volatile and tough market and economic conditions.

And as they say “you can’t buy nor borrow conviction. You have to earn it through your experience”. But for many people, this experience is bad and traumatic and worse without learning how to invest. So It becomes a catch 22 situation.

How does Moneyworks4me Investment advisory service; Omega do it differently?

What has been explained in this entire document is the way of investing practiced at MoneyWorks4me. However, we know that investors need to build conviction about this and us if they have to follow this and reach their financial goals of the future.

MoneyWorks4me through its Platform shares with you a reliable investment process and easy-to-understand –and-use information and tools with real-time data, analysis, and insights. This unmatched transparency and sharing ensure investors are on the same page literally as our advisors and make a collaborative relationship possible; makes DIWM way of working possible and productive for both investors and our advisors.

If you liked what you read and would like to put it in to practice Create Free Account at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463