Oil India Ltd – Should you invest in this stock?

Oil India Ltd. (OIL) – Company Highlights:

OIL: Second-largest public upstream Oil and Gas Company with growing global footprint and strong fundamentals

Market View of Oil India Stock (23rd June’11):

Current Stock Price: Rs. 1310.35

Latest Market-Cap: Rs. 31507.37 Cr. (Large-Cap Stock)

52 Week High Stock Price: Rs. 1635

52 Week Low Stock Price: Rs. 1061

Latest P/E: 10.91

Latest P/BV: 2.02

Tell me more about Oil India…

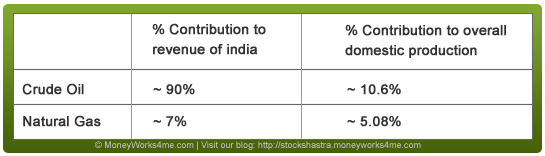

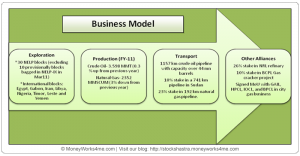

Oil India Ltd, a public sector organization, is engaged in the business of exploration, development and production of crude oil and natural gas, transportation of crude oil and production of LPG. It is the second largest oil and gas Company in India in terms of total proved plus probable oil and natural gas reserves and production. Oil India ~2.38% of India’s overall crude oil consumption.

Oil India’s exploration activities – It has over 1 lakh sq km of areas for its exploration and production activities, most of it in the North-eastern part of India and Rajasthan. It has participating interest in 30 NELP exploration blocks and operates in 12 of these blocks. NELP stands for New Exploration Licensing Policy – An initiative launched by the Government of India in 1999 to accelerate the pace of oil and natural gas exploration in India. It also has various overseas oil and gas projects in Libya, Gabon, Iran, Nigeria, Sudan, etc. The chart given below presents the business model of the company.

How has the Financial Performance of Oil India been? Here’s the review…

Oil India’s 10 YEAR X-RAY indicates that the financial performance of the company has not been consistent over a 10 year period. The growth of Net Sales and EPS has been inconsistent due to its dependence on the crude oil prices, regulatory policies etc. Despite this, the company managed to grow its Net Sales and EPS by 17.83% and 19.28% CAGR respectively over a 10 year period. The growth in Net Sales has been mainly driven by increase in crude oil demand and rising crude oil prices. The growth in Net Profit has been driven by more than 100% increase in natural gas prices and increased operating efficiency over the years. The BVPS growth has been good at a 16.76% CAGR in the last 10 years.

The company’s ROIC has been consistent over the years and has achieved 6 year average of ~24%. Though Oil & Gas industry is a capital intensive industry, the company has maintained a status of being a virtually ‘debt-free company’ over the years because it has huge cash in its balance sheet. For the year FY10-11, the company has a marginal Debt to Net Profit ratio of 0.36. It indicates that Oil India is a financially strong company.

Thus, considering all the factors we can say that the 10 YEAR X-RAY of Oil India Ltd is Orange (‘Somewhat Good’).

What can we expect in the future? Here is the fundamental analysis of Oil India…

In the Short Term

The Government of India’ Oil & Gas policies may affect profit margins

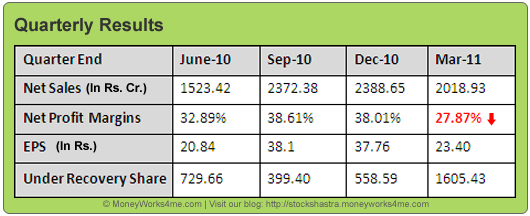

In June, 2010, the Government of India (GoI) increased the natural gas prices to $4.2/ Million British thermal unit (MBTU) from $1.9/MBTU. As a result, the company posted higher profit margins in quarter ended Sep-10 and Dec-10. Going forward, we expect that natural gas prices will remain at $4.2/MBTU. Thus, it would help to post good profit margins in coming quarters.

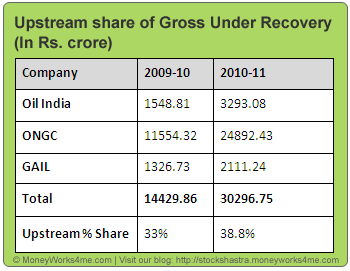

However, as far as crude oil is considered, in May 2011, the GOI has increased upstream share in gross under recoveries. Gross under cover recoveries are losses incurred by public sector oil marketing companies-IOCL, BPCL, HPCL because of lower pricing of fuel products on direction by the Government of India to curb inflation. The burden of these losses is partly borne by the government, the upstream companies like Oil India and by the oil marketing companies. The % of the loss borne by the upstream companies has been increased to ~38.8% for FY11 from 33% in FY10. This has led to decline in profit of upstream companies like Oil India (paid Rs 1605.43 Cr for under recovery) for 4Q-FY11. Additionally, the Net Sales of Oil India fell by 15.5% Q-o-Q to Rs. 2018.93 Cr. due to lower production of natural gas in last quarter of FY-11. The table given below shows the total amount paid by upstream oil companies to oil marketing companies as a share of gross under recovery.

We expect that the gross under recovery would increase in coming quarters as crude oil demand and prices continue to rise. Going forward, this rise is likely to affect the profitability of the company.

Unrest in Middle-East helped crude oil prices to rise: Crude oil prices expected to remain high due to the unrest in Middle-East

Since January 2011, there have been serious political problems in the Middle-East region. It started from Egypt and spread to Libya, which is a part of OPEC (Organization of Petroleum Exporting Countries). Being one of the main oil producing regions in the world, this political unrest led to problems in the production and supply of crude oil. This has led to sharp increase in crude oil prices. The unrest in Middle-east is expected to persist in the coming quarters leading to lower crude oil production in the region. Hence, crude oil prices are expected to remain high going forward. The rising crude oil prices would help Oil India to grow its earnings in coming quarters.

Appreciation of Rupee, a cause of concern:

Oil India has significant exposure in overseas assets and hence its earnings are highly sensitive to the fluctuation in foreign exchange rates. Appreciation of rupee hurts Oil India’s net income. With the continuation of quantitative easing in USA, the rupee is expected to appreciate against the dollar. This will negatively affect the net profit of the company in coming months.

Yes, the increase in crude oil and natural gas prices is a positive, but the increase in subsidy burden is expected to affect profitability. Hence, we can say that the Short term future prospects of Oil India are Orange (‘Somewhat Good’).

In the Long Term

Robust plan to increase natural gas and crude oil production:

Natural Gas has emerged as an alternative fuel of choice for India Considering the high growth of natural gas in India, the company is planning to double its gas production over the next five years from the current level of 2415 million metric standard cubic meters (MMSCM) in FY-2010.

In FY 10-11, the crude oil production rose marginally by 0.3% to 3.598 million metric ton (MMT) but Oil India is expecting around 3.9 MMT crude oil productions in FY12. It is continuously acquiring new oil & gas blocks in both markets domestic and overseas because it has huge cash in its balance sheet. Hence, it can be expected that these future plans will help Oil India post good growth in its revenue in future.

Exploring overseas oil and gas blocks for better revenue growth:

Oil India has participating interests in 17 exploration and development blocks in Egypt, Gabon, Iran, Libya, Nigeria, Timor Leste & Yemen and is the operator of three blocks- one block in Gabon and two blocks in Libya.

Currently, it is exploring South-East Asia, Australia, Latin America, Canada, some parts of the former Soviet Union and Africa, to invest in oil-producing assets. The company has also set aside Rs 4,000-4,500 crore to buy these oil and gas assets. Therefore, we expect that successful acquisition and exploration will fuel the revenue growth of the company.

Impressive reserve replacement ratio

Reserve replacement ratio which is reserves added divided by reserves depleted signifies the amount of proved reserves added to a company’s reserve base during the year relative to the amount of oil and gas produced. The company has consistently reported a reserves replacement ratio of over 1.0 reflecting its sound technical capabilities. We expect that Oil India will maintain its reserves replacement ratio of over 1.0 in future also as the company is continuously investing in exploration assets and exploring them with high success ratio of around 66%. In March- 11, the company has provisionally bagged 10 blocks in NELP-IX round. Out of these 10 blocks, it is operator in three of these blocks and Joint operator in two of the deep water blocks. The acquisition of these blocks may lead to new discoveries in future, which will improve its reserve replacement ratio.

De-regulation: Reforms in the retail fuel pricing

The Government of India has shown a strong indication to ease out the subsidy burden on the upstream and downstream players in the domestic oil and gas industry. In June 2010, the government of India deregulated the prices of petrol in India, which helped Oil & Gas players to grow its margins. It is expected that government will also deregulate the diesel and LPG prices in coming years, which will reduce the subsidy burden for oil and gas companies such as Oil India Ltd. Hence, going forward, if the government deregulates diesel and LPG prices, the profit margins of the company will get a boost.

So, what are the concerns??

Growth dependant on successful exploration:

The company’s growth depends on successful exploration of oil blocks. However, failure in exploration activities can lead to huge losses for the company. This was observed in the current financial year when unsuccessful exploration in Libya resulted in a loss of Rs 81 crore for the company.

Fluctuations in Crude Oil Prices and exchange rates:

The earnings of the company are very sensitive to the volatility in crude oil prices. The crude oil prices are determined by global demand and supply of crude oil which is fraught with uncertainties. If Decline in the global demand for crude oil leads to decline in crude oil prices. This affects the profitability of the company. The earnings of the company are also very sensitive to the fluctuation in currency. Therefore, any adverse fluctuation in currency will lead to losses to the company.

Considering the robust expansion plan, overseas acquisition of blocks and volatility in crude oil prices, we can say that the Long Term Future Prospects of Oil India Ltd are Orange (‘Somewhat Good’).

So, is it an investment- worthy Company?

Oil India Ltd, the 2nd largest crude oil and natural gas upstream company, has significantly expanded in domestic and as well as in global markets. Its positives include strong balance sheet (almost debt-free), robust expansion plans for natural gas & crude oil and its growing oil & gas exploration blocks. Yet, a lot of uncertainty exists because of the government policies regarding gross under recovery sharing mechanism and deregulation of diesel prices.

Oil India is a large-cap stock. Large-cap stocks are usually considered as safe-bets. But, Oil India is operating in a highly-regulated and sensitive industry. Hence, despite being a large cap stock, considering the uncertainties in the industry, only investors with some appetite for risk should invest in a stock like Oil India that too at a deep discount to its MRP. Currently, it is trading at a price of ~Rs. 1303. But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Since it is directly linked to the energy security of the country the govt will not let OIL down. So for long term it is a safe bet and can be invested at this level.