KIMS (Krishna Institute of Medical Sciences Limited) IPO Details:

IPO Date: June 16th to June 18th, 2021

Total Shares for subscription: ~2.6 Crore

IPO Size: ~Rs. 2,144 Cr

Lot Size: 18 shares

Price Band: Rs. 815-825/share

Market Cap: ~Rs. 6,600 Cr

Recommendation: BUY for listing gains

Purpose of KIMS IPO

- To make repayment/ prepayment of borrowings availed by the firm and its subsidiaries

- Meeting general corporate purposes

About the KIMS

KIMS (Krishna Institute of Medical Sciences Limited) was incorporated as Jagjit Singh and Sons Private Limited in July 1973. It is one of the largest corporate healthcare groups in AP and Telangana in terms of the number of patients treated and treatments offered. They operate 9 multispecialty hospitals under the “KIMS Hospitals” brand, with an aggregate bed capacity of 3,064, including over 2,500 operational beds as of Mar’21.

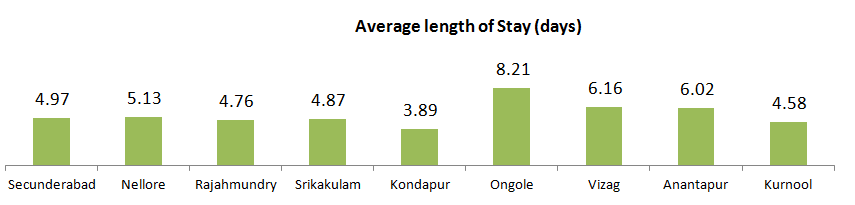

Their flagship hospital at Secunderabad is one of the largest private hospitals in India at a single location (excluding medical colleges), with a capacity of 1,000 beds. They have expanded their hospital network in recent years through their acquisitions of hospitals in Ongole in FY17, Vizag and Anantapur in FY19, and Kurnool in FY20.

Business of KIMS

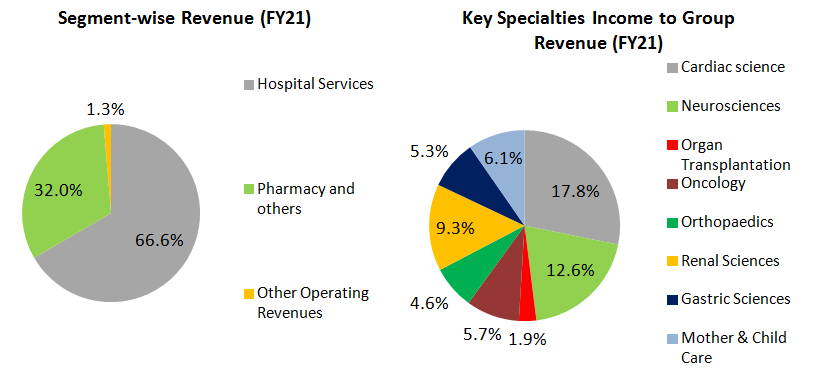

KIMS offers a comprehensive range of healthcare services across over 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopedics, organ transplantation, renal sciences, and mother & child care.

KIMS provides multi-disciplinary integrated healthcare services, with a focus on primary secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary, and quaternary healthcare in Tier 1 cities. KIMS has approached its network expansion with financial prudence and all of its significant capital investments are carefully deliberated.

Currently, their network consists of hospitals strategically located to serve the healthcare needs of AP and Telangana across urban Tier 1 cities such as Secunderabad and Hyderabad and more rural Tier 2-3 areas such as Vizag, Nellore, Rajahmundry, Srikakulam, Ongole, Anantapur, and Kurnool. Their hospitals are also situated well to capture patient in-flow across AP and Telangana and from the neighboring states of Karnataka, Odisha, Tamil Nadu, and parts of central India. The affordability and quality of healthcare services provided by them and their track record of building long-term relationships with medical professionals including their doctors, has enabled their growth and helped them build their ‘KIMS Hospitals’ brand.

Hospital-wise Key Financial and Operational Metric as of FY21

Management of KIMS

The company was incorporated in July 1973 and until 2003, it was owned, managed, and controlled by Jagjit Singh and certain of his family members, who together owned the entire shareholding of the company.

Dr. Bhaskara Rao Bollineni is the Promoter and MD of the company. He has over 27 years of experience in cardiothoracic surgery and has in the past held various positions with Apollo Hospitals, Austin Hospital, University of Melbourne, and Mahavir Hospital and Research Centre.

Dr. Abhinay Bollineni is the Promoter and Executive Director of the company. He played a key role in establishing KIMS Kondapur in 2014.

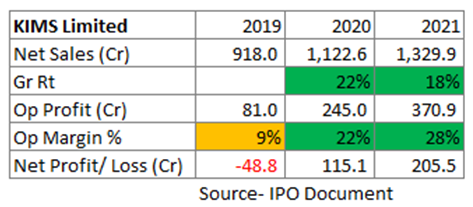

Financials of KIMS

Over the period FY19-21 revenues have grown at a CAGR of 20.4% while operating profit grew at a CAGR of 100% on a low base.

In FY20, the CAPEX per bed was ₹ 63.5 Lakhs for hospitals in Tier 1 cities and ₹ 22.1 Lakhs for hospitals in Tier 2-3 cities, compared to the industry average of ₹ 50-80 Lakhs in Tier 1 cities and ₹ 10-50 Lakhs in Tier 2-3 cities. The company’s ability to keep the CAPEX / bed at these levels has been instrumental in providing quality and affordable healthcare services. They expect to remain disciplined with expansion. In FY21, their CAPEX per bed was ₹ 69.1 Lakhs for hospitals in Tier 1 cities and ₹ 22.1 Lakhs for hospitals in Tier 2-3 cities.

Strengths

- Regional leadership has driven clinical excellence at affordable pricing

- Disciplined approach to acquisitions resulting in successful inorganic growth

- The experienced senior management team

MoneyWorks4me Opinion

Is business good bad or gruesome?

Average. Hospital is a moderate ROCE and high growth business. Less number of beds per million, increasing affordability and insurance availability are key reasons for sustained growth in hospitals as a sector.

In past, we have seen that hospitals need large investments to set up hospitals in prime locations as well as facilities with a minimum number of beds for better cost-efficiency. Besides, it also has a high cost of doctors and caretakers which limits profit margin.

We believe that hospitals with more surgeries in a day, large facility and a high number of surgeries per doctor are likely to earn a steady return on capital for a sustained period. In hospitals, average occupancy and length of stay are key parameters to determine efficiency and hence return on capital. According to our analysis, Narayana Health and Apollo Healthcare are good companies in this space.

Krishna Institute of Medical Sciences is an emerging regional player. Current numbers look impressive but it has to be looked at in the context of valuation one has to pay for owning such a business.

In the current market, valuations are high and hence IPO is taking advantage of optimistic sentiment in the market.

We believe at 17X EV/EBITDA, the prices are high but they can be considered as entry price and later added when prices are favorable in the future.

We recommend BUY on Krishna Institute of Medical Sciences in IPO listing. We will like to see the sustainability of operating metrics and recommend higher allocation in the future.

Recommendation: BUY for listing gains

P.S. Our IPO calls are mostly to take advantage of IPO allotment in sectors that are in favor. We would not recommend a large allocation soon as we are yet to see company performance and execution post listing hence we don’t recommend buy immediately after listing unless we are convinced about the business model or price.

| IPO Activity | Date |

| IPO Open Date | Jun 16, 2021 |

| IPO Close Date | Jun 18, 2021 |

| Basis of Allotment Finalisation Date | Jun 23, 2021 |

| Refunds Initiation | Jun 24, 2021 |

| A credit of Shares to Demat Account | Jun 25, 2021 |

| IPO Listing Date | Jun 28, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 18 | ₹ 14,850 |

| Maximum | 13 | 234 | ₹ 193,050 |

| Date | QIB | NII | Retail | Employee | Total |

| Jun 16, 2021, 17:00 | 0.14x | 0.02x | 1.00x | 0.27x | 0.27x |

| Jun 17, 2021, 17:00 | 0.32x | 0.09x | 1.95x | 0.66x | 0.56x |

| Jun 18, 2021, 17:00 | 5.26x | 1.89x | 2.90x | 1.06x | 3.86x |

When will the KIMS Hospitals IPO open?

KIMS Hospitals IPO will open for subscription on Wednesday, June 16, and will close on Friday, May 18.

What is the price band of KIMS Hospitals IPO?

The price band for KIMS Hospitals IPO is Rs. 815-825.

What is the lot size for KIMS Hospitals IPO?

Retail investors can subscribe to the IPO minimum lot size is 18 shares, up to a maximum of 13 lots i.e. Rs. 1, 93,050.

What is the issue size of KIMS Hospitals IPO?

The total issue size is ~ Rs. 2144 Cr.

What is the quota reserved for retail investors in KIMS Hospitals IPO?

The quota for retail investors in KIMS Hospitals IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on June 23 and refunds will be credited by June 24. Shares allotment will be credited in Demat accounts by June 25.

What is the listing date of KIMS Hospitals IPO?

The tentative listing of KIMS Hospitals IPO is June 28.

Where could we check the KIMS Hospitals IPO allotment?

One can check the subscription status on KFintech Private Limited.

Who are the leading book managers to the issue?

Axis Capital Limited, Credit Suisse Securities (India) Private Limited, IIFL Holdings Limited, Kotak Mahindra Capital Company Limited

What does KIMS Hospitals do?

KIMS offers a comprehensive range of healthcare services across over 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopedics, organ transplantation, renal sciences, and mother & child care. Their flagship hospital at Secunderabad is one of the largest private hospitals in India at a single location (excluding medical colleges), with a capacity of 1,000 beds.

Who are the peers of KIMS Hospitals?

Apollo Hospitals, Fortis Healthcare, Shalby, Narayana Hrudayalaya

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 1,999 (14% of IPO lot size). The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463