India Pesticides Limited IPO Details:

IPO Date: June 23rd to June 25th, 2021

Total Shares for subscription: ~2.7 Crore

IPO Size: ~Rs. 800 Cr

Lot Size: 50 shares

Price Band: Rs. 290-296/share

Market Cap: ~Rs. 3,409 Cr

Recommendation: Subscribe for listing gains

Purpose of India Pesticides IPO

- Meeting general corporate purposes

About the India Pesticides Limited

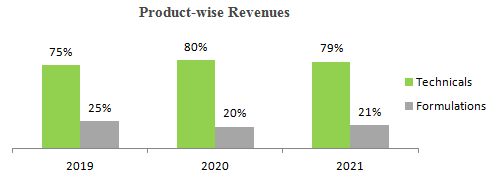

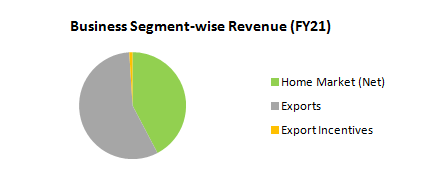

Incorporated in December 1984, India Pesticides Limited is one of the leading agrochemicals manufacturers in India. The company was originally incorporated as ‘India Pesticides Private Limited’ at Bareilly, Uttar Pradesh by Anand Swarup Agarwal and the Family Trust who are Promoters of the company. The company operates in two business verticals; Technicals and Formulations. It manufactures herbicide, fungicide Technicals, and Active Pharmaceuticals Ingredients (APIs).

It is the sole Indian manufacturer of several Technicals i.e. Folpet, Thiocarbamate, and Herbicide. The company also manufactures 30+ formulations of insecticides, fungicides, and herbicides. The company has 2 manufacturing facilities in Uttar Pradesh. As of March, 2021, their aggregate installed capacity of their manufacturing facilities for agro-chemical Technicals was 19,500 MT and Formulations was 6,500 MT. They have also commenced construction of 2 manufacturing units which are proposed to be used for herbicide Technicals.

India Pesticides is focused on R&D and capabilities include 2 well-equipped in-house laboratories. Their R&D efforts have led to development of processes to manufacture 3 generic off-patent Technicals since FY18. And they are currently developing processes for certain Technicals, including 2 fungicides, 2 herbicides, 2 insecticides and 2 intermediates.

Business of India Pesticides Limited

The business verticals of India Pesticides Limited include:

- Technicals – Fungicide Technicals, Herbicides Technicals;

- Formulations – Formulations of insecticides, fungicide and herbicides, growth regulators and Acaricides;

- APIs – substances used for manufacturing drug products

The customer base of the company comprises of number of multinational, regional and local companies that includes crop protection product manufacturing companies such as ASCENZA AGRO, S.A., Conquest Crop Protection Pty Ltd, Sharda Cropchem Ltd, Syngenta Asia Pacific Pte. Ltd., Stotras Pty Ltd and UPL Ltd. They have strong and long established relationships with most of their customers and many of these have been associated with the company for over 10 years.

However, they are dependent on a limited number of customers for a significant portion of their revenues. In FY19, FY20 and FY21, their top 10 customers represented 54%, 59% and 57%, respectively, of their revenues. Their largest customer represented 30%, 17% and 19% of their total revenues for the same period.

Management of India Pesticides Limited

Dheeraj Kumar Jain is the CEO of the company. He has more than 25 years of experience with the company and has been responsible for product development, international business development and project engineering.

Satya Prakash Gupta is the CFO of the company. He has over 27 years of experience in the field of finance. Ajeet Pandey is the Company Secretary and Compliance Officer of the company.

Ajai Kumar Sinha is the General Manager in Formulation Marketing and B.T. Hanumantha Reddy is the General Manager in Manufacturing.

Financials of India Pesticides Limited

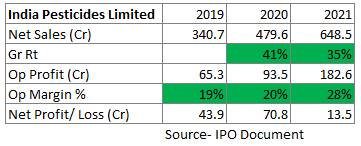

Over the period FY19-21 revenues have grown at a CAGR of 38% while operating profit grew at a CAGR of 67% on a low base.

The company has incurred significant amount of capex to increase their manufacturing capacity. They have invested Rs. 7.23 crore and Rs. 30.84 crore and Rs.41.92 crore in FY19, FY20 and FY21 respectively.

India Pesticides has demonstrated consistent growth in terms of revenues and profitability over the last 3 years. The Net worth has increased from ₹ 187.02 crore in FY19 to ₹ 389.48 crore in FY21. As of March, 2019, 2020 and 2021, the debt position and the long term debt to equity ratio was 0.09, 0.06 and 0.02 respectively.

Strengths

- Diversified portfolio of niche and quality specialized products

- Strong R&D and product development capabilities

- Strong sourcing capabilities and extensive distribution network

- Experienced promoters and strong management team

Weakness

- Customer concentration

- Heavy dependence on monsoon

| IPO Activity | Date |

| IPO Open Date | Jun 23, 2021 |

| IPO Close Date | Jun 25, 2021 |

| Basis of Allotment Date | Jun 30, 2021 |

| Refunds Initiation | Jul 01, 2021 |

| A credit of Shares to Demat Account | Jul 02, 2021 |

| IPO Listing Date | Jul 05, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 50 | ₹ 14,800 |

| Maximum | 13 | 650 | ₹ 192,400 |

| Date | QIB | NII | Retail | Total |

| Jun 23, 2021, 17:00 | 0.00x | 0.19x | 2.51x | 1.29x |

| Jun 24, 2021, 17:00 | 2.31x | 0.91x | 5.88x | 3.79x |

| Jun 25, 2021, 17:00 | 42.95x | 51.88x | 11.30x | 29.04x |

When will the India Pesticides IPO open?

India Pesticides IPO will open for subscription on Wednesday, June 23, and will close on Friday, June 25.

What is the price band of India Pesticides IPO?

The price band for India Pesticides IPO is Rs. 290-296.

What is the lot size for India Pesticides IPO?

Retail investors can subscribe to the IPO minimum lot size is 50 shares, up to a maximum of 13 lots i.e. Rs. 1, 92,400.

What is the issue size of India Pesticides IPO?

The total issue size is ~ Rs. 800 Cr.

What is the quota reserved for retail investors in India Pesticides IPO?

The quota for retail investors in India Pesticides IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on June 30 and refunds will be credited by July 1. Shares allotment will be credited in Demat accounts by July 2.

What is the listing date of India Pesticides IPO?

The tentative listing of India Pesticides IPO is July 5.

Where could we check the India Pesticides IPO allotment?

One can check the subscription status on KFintech Private Limited.

Who are the leading book managers to the issue?

Axis Capital Limited and JM Financial Consultants Private Limited are the leading book managers to the issue.

What does India Pesticides do?

It is the sole Indian manufacturer of several Technicals i.e. Folpet, Thiocarbamate, and Herbicide. The company also manufactures 30+ formulations of insecticides, fungicides, and herbicides.

Who are the peers of India Pesticides?

Dhanuka Agritech Ltd, Bharat Rasayan Ltd, UPL Ltd, Rallis India Ltd, PI Industries Ltd.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 1,999 (14% of IPO lot size). The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463