GR Infraprojects Limited IPO Details:

IPO Date: July 7th to July 9th, 2021

Total Shares for subscription: ~1.15 Cr

IPO Size: ~Rs. 963 Cr

Lot Size: 17 shares

Price Band: Rs. 828-837/ share

Market Capitalization: ~ 8,093 Cr

Recommendation: Subscribe for listing gains

Purpose of G R Infraprojects Limited IPO

- Offer for sale for existing investors

About the G R Infraprojects Limited

G R Infraprojects is an Integrated Road EPC company with experience in design and construction of various road/ highway projects across 15 States in India. The company has recently diversified into projects in the railway sector.

G R Infra was incorporated in December 1995 and they have gradually increased their execution capabilities in terms of the size of projects that they have bid for and executed. Their individual Promoters have more than 25 years of experience in the construction industry. Prior to the incorporation of the company, their individual Promoters were associated with M/s. Gumani Ram Agarwal, a partnership firm engaged in the construction business, which was acquired by the company in 1996.

The company has developed an established track record of efficient project management and execution experience, involving trained and skilled manpower, efficient deployment of equipment and an in-house integrated model.

Business of the Company

G R Infra’s principal business operations are broadly divided into three categories:

- Civil construction activities, under which they provide EPC services;

- Development of roads, highways on a BOT basis, including under annuity and HAM; and

- Manufacturing activities, under which they process bitumen, manufacture thermoplastic road-marking paint, electric poles and road signage and fabricate and galvanize metal crash barriers.

The in-house integrated model includes a design and engineering team, manufacturing facilities for processing of bitumen, thermoplastic road-marking paint and road signage, fabrication and galvanization unit, owned construction equipment and a fleet of transportation vehicles. As of Mar’21, their equipment base comprised over 7,000 construction equipment and vehicles and the aggregate gross block value of company’s property, plant and equipment was Rs. 1,999.92 crore.

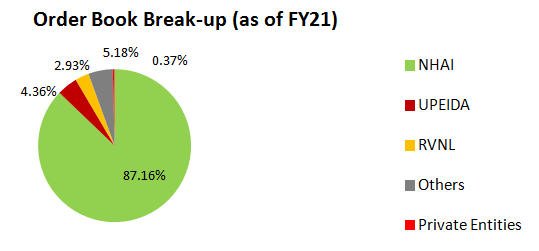

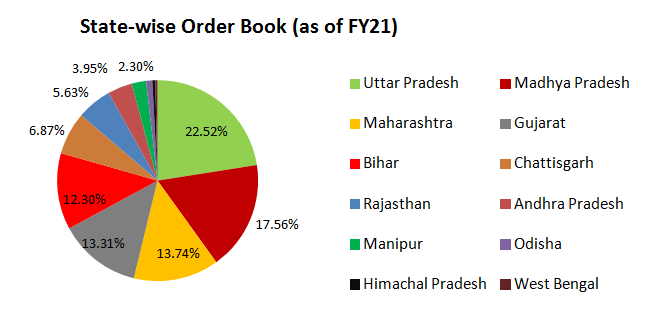

As of Mar’21, the company had an Order Book of Rs.19,025.81 crore. The Order Book primarily comprised EPC and HAM projects in the road sector across the states of Uttar Pradesh, Madhya Pradesh, Maharashtra, Gujarat, Rajasthan, Andhra Pradesh, Bihar, Manipur, Odisha and Himachal Pradesh. In addition, their Order Book also includes railway projects in Andhra Pradesh and Madhya Pradesh and an optical fibre project spread across the states of Bihar, Odisha, West Bengal, Andaman and Nicobar Islands, Jharkhand and Sikkim. They have in the past also executed projects in Haryana, Punjab, Jharkhand and Meghalaya.

Company executes a majority of their projects themselves; they also form project-specific joint ventures and consortiums with other infrastructure and construction companies. In particular, when a project requires them or their consortium partners to meet specific eligibility requirements in relation to certain projects, including requirements relating to specific types of experience and financial resources, they enter into such partnerships or consortiums with other infrastructure and construction companies.

Management of G R Infraprojects Limited:

The company was incorporated as ‘G. R. Agarwal Builders and Developers Limited’ in Dec’95. The company was promoted by Vinod Kumar Agarwal, Ajendra Kumar Agarwal, Purshottam Agarwal and Lokesh Builders Pvt. Ltd. Currently Promoters hold 46.89% of the pre-Offer Equity Share capital.

Vinod Kumar Agarwal is the Chairman and Whole Time Director on the Board. He has over 25 years of experience in the road construction industry. He looks after the strategy and policy formulation for the company and liaises with various departments of the Government and also overlooks processes in the company which includes bidding, tendering and planning.

Ajendra Kumar Agarwal is the Managing Director on the Board of the company. He has experience of over 25 years in the road construction industry. He is responsible for overseeing the overall functioning of the company, especially the operational and technical aspects, of the company. He heads the in-house design team and is actively involved in continuous value engineering using the latest specifications and methodologies. He is also the head of budgeting, planning and monitoring process.

Vikas Agarwal is the Whole Time Director on the Board. He has been associated with the company since Apr’06 and has over 15 years of experience in the road construction industry. He is responsible for overseeing the functioning of running projects of the company, as allocated by the company’s management from time to time.

Ramesh Chandra Jain is the Whole Time Director on the Board. He has experience of over 27 years in the roads construction business. He joined the company in Jan’15 and is responsible for monitoring of construction of roads, highways and bridges. He is also responsible for the bidding process for new projects. He was previously associated with the company as senior vice president – business development.

Financials of G R Infraprojects Limited:

The company has seen significant growth of their business in the last 3 fiscal years as revenues increased at a CAGR of 21.86% while the profit increased at a CAGR of 15.33%. Among the Key EPC Players, the company saw the fastest growth in operating income over a period of 5-years from FY15 to FY20 at a CAGR of 47%.

As of Mar’21, the Total Borrowings were Rs. 4,494.97 crore.

Strengths:

- Focused EPC player with focus on road projects

- Established track record of timely execution

- In-house integrated model

- Experienced Promoters with strong management team

Risks:

- Cyclical and huge dependency on Government Capex plans

- The timely cash flow is a challenge in this kind of a business model

MoneyWorks4me Opinion

How is the company quality?

Average. Infra companies exhibit high variability and also depend on timely cash flows from the government. EPC contracting has high competition and very tight return on investment. At times, delay in projects can stretch working capital cycle leading to very inferior return on equity.

Valuation

G R Infraprojects has ~2.5x order book to sales, which means healthy growth can be expected in near to medium term. At current enterprise value of Rs. 12,500 Cr and share price of Rs. ~840/share, we believe valuation are not excessive at 8x EV/EBITDA.

G R Infraprojects Limited belongs to infrastructure segment and is a key player in EPC business in the country. The sector is doing well due to government’s push towards infrastructure and focus on developing roads. This is a favourable environment for the sector as a whole including G R Infraprojects. We remain constructive on growth from infrastructure sector over next 3-5 years. There are many ways to participate in growth of infrastructure.

We track order book growth for such businesses and their execution record. Since the sector has positive tailwinds and the company has shown a good track record, we recommend Subscribe to this issue.

Note: We do not recommend buy just because IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect honest review from us on business model and valuation.

| IPO Activity | Date |

| IPO Open Date | Jul 7, 2021 |

| IPO Close Date | Jul 9, 2021 |

| Basis of Allotment Date | Jul 14, 2021 |

| Refunds Initiation | Jul 15, 2021 |

| A credit of Shares to Demat Account | Jul 16, 2021 |

| IPO Listing Date | Jul 19, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 17 | ₹ 14,229 |

| Maximum | 13 | 238 | ₹ 199,206 |

| Date | QIB | NII | Retail | Employee | Total |

| Jul 7, 2021 | 0.49x | 2.68x | 3.25x | 0.24x | 2.28x |

| Jul 8, 2021 | 2.79x | 6.31x | 7.50x | 0.75x | 5.75x |

| Jul 9, 2021 | 168.58x | 238.04x | 12.57x | 1.37x | 102.58x |

When will the GR Infraprojects limited IPO open?

GR Infraprojects limited IPO will open for subscription on Wednesday, July 7, and will close on Friday, July 9.

What is the price band of GR Infraprojects limited IPO?

The price band for GR Infraprojects limited IPO is Rs. 828-837.

What is the lot size for GR Infraprojects limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 17 shares, up to a maximum of 14 lots i.e. Rs. 1, 99,206.

What is the issue size of GR Infraprojects limited IPO?

The total issue size is ~ Rs. 963 Cr.

What is the quota reserved for retail investors in GR Infraprojects limited IPO?

The quota for retail investors in GR Infraprojects limited IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on July 14 and refunds will be credited by July 15. Shares allotment will be credited in Demat accounts by July 16.

What is the listing date of GR Infraprojects limited IPO?

The tentative listing of GR Infraprojects limited IPO is July 19.

Where could we check the GR Infraprojects limited IPO allotment?

One can check the subscription status on KFintech Private Limited.

Who are the leading book managers to the issue?

Equirus Capital Private Limited, HDFC Bank Limited, ICICI Securities Limited, Kotak Mahindra Capital Company Limited, Motilal Oswal Investment Advisors Pvt Ltd and SBI Capital Markets Limited.

What does GR Infraprojects limited do?

G R Infra’s principal business operations are broadly divided into three categories:

(i) Civil construction activities, under which they provide EPC services;

(ii) Development of roads, highways on a BOT basis, including under annuity and HAM; and

(iii) Manufacturing activities, under which they process bitumen, manufacture thermoplastic road-marking paint, electric poles and road signage and fabricate and galvanize metal crash barriers.

Who are the peers of GR Infraprojects limited?

Ashoka Buildcon Ltd, IRB Infrastructure Developers Ltd., Bharat Road Network Ltd.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 1,999 (14% of IPO lot size). The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463