Manappuram Finance: Is the Stock worth its weight in gold?

MAGFIL – Company Highlights

MAGFIL: India’s largest listed gold loan company

Market View of MAGFIL Ltd Stock (31st Mar’11)

Current Stock Price: Rs. 132.40

52 Week-High Stock Price: Rs. 189.90

52 Week Low Stock Price: Rs. 66.50

Latest P/E: 23.68

Latest P/BV: 3.22

Tell me more about MAGFIL

MAGFIL, a Kerala based non-banking financial company, is engaged in providing loans against household used jewellery pledged by its customers. Jewellery is regarded amongst the safest form of asset lending, with both physical custody and beneficial ownership with the lender

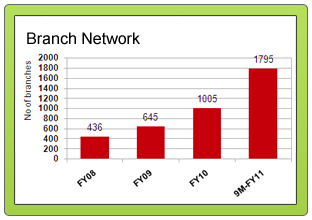

The company had a Total Asset under management (AUMs) of Rs. 65.2 bn as on December 31, 2010 (including assigned portfolio). Gold loans form a huge part, approx. 98% of MAGFIL’s revenue. It grants small loans (Ticket size of Rs. 15,000 – Rs. 30,000) over short durations. It has an extensive branch network of 1,795 branches spread across 19 states of India (as of December 31, 2010). The branches are mainly concentrated in the Southern region of India viz. Kerala, Tamil Nadu and Andhra Pradesh;this region accounts for 85-90% gold loan market of India. The company has a credit rating history of investment grade rating since 1995.

How has the Financial Performance of MAGFIL been?

The operating income of MAGFIL has grown by 61% approx. in the past ten years from Rs. 6.67 Cr in FY01 to Rs. 476.60 Cr. in FY10. The EPS has shown consistent growth (10 yr. CAGR of 50%), except in the years FY03 and FY08 where it showed de-growth. The BVPS has also risen significantly at 43% over the last ten years.

MAGFIL has maintained a high Net Profit to Total Fund ratio, above 2%, over the last 9 years. This indicates that the management of the Company has utilised its funds efficiently. The asset quality also has been stable with Gold loan Net NPA at 0.14% in Q3FY11 (from 0.11% in Q2FY11), indicating that the company has low default risk. However the provisioning for NPAs was higher during the quarter as MAGFIL provided Rs. 12.5 Cr. (0.25% of standard assets) for standard asset provisioning as mandated by RBI.

The capital adequacy ratio (CAR) of the company stood at an healthy 32.5% as on Q3 FY11 as compared to 15.5% a year ago, indicating that the company is well covered for its risk.

Thus, the 10 YEAR X-RAY of the company is Green (Very Good).

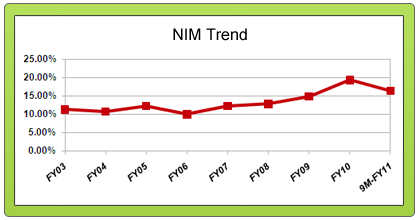

Sustainable Net Interest Margins (NIMs)

The short durations of loans helps MAGFIL to easily manage its NIMs (difference in the interest income and interest expenses) as both the assets and liabilities get re-priced over shorter periods. Also, MAGFIL’s credit rating (A1+ for short term loans) and its visibility amongst banks (with respect to raising loans) has improved. This has helped it reduce its cost of raising funds, leading to an increase in NIMs. As a result, MAGFIL reported NIMs of 13–15% over FY07-FY09, which are sustainable even in the long-term given its high pricing power.

What can we expect in the future? Here is the analysis of MAGFIL…

In the Short Term

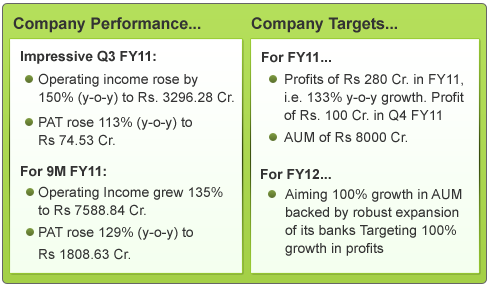

Q3FY11 continues to show strong growth..

The growth in profits was driven by the record growth in Asset under Management (AUM) which have shot up to Rs 6,498 Cr., an increase of 188% over Q3 of the previous year

The company has raised Rs 1000 Cr. during the quarter as capital through Qualified Institutional Placement at a price of Rs 168/- per share at a premium of Rs 166/- per share. This has increased the CAR of the company , further enabling it to grow its loan book and capitalize on the growing opportunities.

The company has opened 402 branches during the quarter. The average business per branch has increased to Rs.3.59 Cr. as against Rs. 3.51 Cr. during the previous quarter ending September 30, 2010.

Slight decrease in NIMs

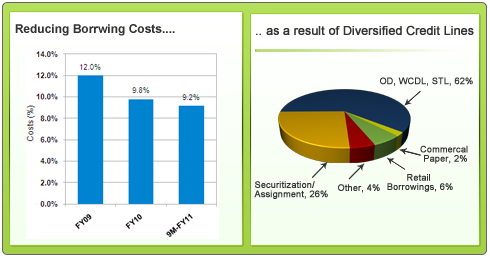

Highers credit ratings and Priority sector loans have helped the company in reducing borowing costs significantly in the past three years. However, the company’s cost of funds will increase in the short term on account of two reasons:

1. Recently, the RBI has changed guidelines regarding agricultural loans:

Loans sanctioned to NBFCs for lending to individuals or other entities against gold jewellery, cannot be classified as Agri. loans

Investments made by banks in securitised assets originated by NBFCs, where the underlying assets are loans against gold jewellery cannot be classified as loans to agricultural sector.

Thus, the loans availed by MAGFIL will no longer be classified as priority sector lending, leading to ~ 100 bps increase in cost of borrowing. It will lead to a decrease in margins by 40 bps.

2. The company had voluntarily reduced its rate of interest by 3%, from 24% to 21%.

Hence, where the company has robust targets for FY11 and FY12, its NIM are expected to be affected slightly. Thus, we can expect the short term prospects of the company to be Orange (‘Somewhat Good’).

In the Long Term

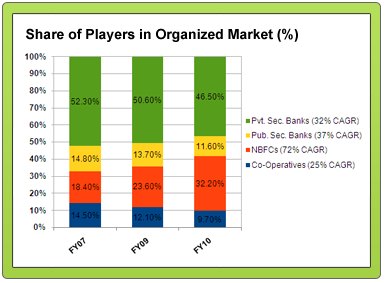

Increasing share of NBFCs in the underpenetrated Gold Loan Market

The size of private gold holdings by Indian households is expected to be around 20,000 tonnes, of which only 10% has been used for gold loans. In spite of rapid growth in the gold loan segment in the last three to four years, its penetration in India remains under 1%. Thus, there is a huge untapped potential for gold loans.

Also, the gold loan market is largely unorganized and dominated by pawnbrokers and money lenders, charging an exorbitant interest rate of 36% p.a. These can be substituted by cheaper, gold-secured loans from NBFCs. In fact, the share of organized market is growing rapidly with emergence of specialized NBFCs.

MAGFIL with longstanding expertise in gold loan financing is well placed to tap the huge market potential.

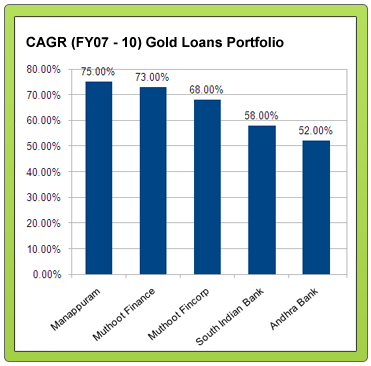

MAGFIL – Fastest growing player

Gold-backed lending represents a potential goldmine for non-banking finance companies (NBFC). MAGFIL, has been able to clock highest growth rate amongst different players in the last four years.

Strong pricing power to ensure profitability

A fairly large percentage of the Indian population is still deprived of banking services, despite huge initiatives taken by the commercial banks in India. They are charged exorbitantly high rates by moneylenders. MAGFIL provides loans to this segment.

As the borrowers do not have access to commercial banking services, MAGFIL wields a very strong pricing power. The lending rate for MAGFIL is usually around 24-25%, which is significantly higher than what commercial banks charge but significantly lower than what local moneylenders would charge.

HUJ – robust risk management strategy

The risk management strategy of MAGFIL is based on HUJ, viz., Household Used Jewelry. If the collateral does not satisfy any of the three criteria, it is not accepted as collateral.

The whole business of model of MAGFIL revolves around the emotional value attached to HUJ. Since there is sentimental value attached to the collateral, the chances of defaulting on the loan are very low. MAGFIL uses various methods like traces of sweat, use of nitric acid etc. to judge whether the jewelry is used or not. No loans are granted against gold coins or biscuits

This helps MAGFIL in mitigation of the inherent risks of the business and contain the NPAs in gold loans at just 0.1-0.3% over the last four years of its growth

Reduced Borrowing costs

Higher credit ratings have helped the company to reduce its cost of borrowings. ICRA has recently upgraded its short-term rating to ‘A1+’ and long-term ratingto ‘LA+’.

These ratings, enable the company to raise loans from various sources like Commercial Papers (CPs) and short-term debentures at cheaper rates, thereby reducing overall cost of funding.

Speedy disbursal in comparison with banks

The turnaround time at MAGFIL for a customer is roughly 30 minutes, something which is probably unbeatable by the banks due to procedural bottlenecks. Loans are usually availed for medical and financial emergency and hence the speed of loan disbursal is always of essence. Also, MAGFIL is able to hire local staff at cheaper cost. These factors give MAGFIL a certain edge over banks.

Branch expansion to slow down going forward

MAGFIL has grown its branch network at an aggressive pace over the last few years. Over the past

four years, MAGFIL has more than quadrupled its distribution network. However, the management has indicated that the pace of branch addition will slow down considerably in FY12. The company plans to add 500 branches in FY12 as against 1000 branches opened in FY11.

Key Concerns

- Uncertainity regarding regulations

Any change in banking regulations related to gold loan NBFC can damage the business. Proposed securitization guidelines from RBI can impact NBFC funding profile.

- Concentration of portfolio in one sector, one region

MAGFIL derives 98% of revenues from the gold loan business. Also, it is expected to remain concentrated in South India, for the next few years despite aggressive growth plans in the northern and western states.

- Low Market Share

MAGFIL caputures only about 7% of the entire Gold Loan market, with market leader Muthoot Finance enjoying a 20% market share. Also, the company has grown its market share by a mere 3% in the past four years. With strong competition from other NBFCs like Muthoot and banks entering the market, this can be a cause of concern.

- Decrease in gold prices

If the gold prices fall, borrowers will be asked to put up margin money immediately. If that doesn’t happen, than the company can auction the jewelry immediately. However, steep fall in prices may affect the margins.

Thus, the long term future prospects of the company is Green (Very Good).

So, is it an investment- worthy Company?

There is a huge untapped market for gold loans in India and NBFCs have grown significantly at a rate of 72% in the past four years. The low market share does pose a concern, but with its strong branch network, robust risk management strategy and unique position, MAGFIL is well poised to take advantage of this growth.

Yes, Manappuram General Finance and Leasing Ltd. is an investment worthy company, but only at the right price. Currently, it is trading at a price of Rs….. . But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

what about Muthoot capiatal ….they too are equally enterprising and agressive. Also thier finance fundaments are way above Mannapuram folks.

Muthoot Capital Services is engaged in providing loans and leasing and hire purchase activity. Muthoot finance, another of the group companies is engaged in the same business as Manappuram i.e. providing loans against gold. Muthoot finance is currently the market leader in this segment. You are right in saying that they’re equally aggressive in their expansion plans. Muthoot Finance will shortly be coming out with its IPO.

Good analysis. Reading it stock looks attractive for long term investment. This should be proven in your previous analysis of other stocks to have greater level of confidence .

Thanks for the appreciation. Yes, it is an investment worthy stock, but only if its available at a discount to its correct price (MRP). To give you an example of a stock that we analysed and has done well is Havells.To read the Havells proof story click on the following link: http://bit.ly/eiZNoY

There is a probability that the diversification plan of MAGFIL mentioned in the news article is its de-risking strategy, as the company is currently present only in one business i.e.Gold loan business. VP Nandakumar, Executive Chairman of Manappuram Finance, and main promoter of Manappuram Group is from a banking background and has been an entrepreneur for decades in the financial sector. However, the company has no prior experience in the businesses outlined in the article and there is no clear guidance as yet. It remains to be seen how the company can leverage these new businesses if and when it decides to enter them.