Investing in railway stocks in India can be a lucrative opportunity for investors seeking safe and profitable investments. The Indian railway sector plays a pivotal role in the country’s economy and is poised for substantial growth in the foreseeable future. To help you make informed investment decisions, let’s explore the top 10 railway stocks in India that you may want to consider.

Why Invest in Railway Stocks?

Railway stocks can offer several advantages to investors, such as:

Growth potential:

The Indian railway sector has a huge scope for growth and expansion, given the increasing demand for passenger and freight transportation, urbanization, industrialization, and infrastructure development. The government has also announced several initiatives and reforms to modernize and improve the efficiency and safety of the railways, such as dedicated freight corridors, high-speed rail projects, station redevelopment, private participation, etc. These can create new opportunities and revenue streams for the railway companies.

Diversification:

Railway stocks can help investors diversify their portfolios and reduce their exposure to market volatility and sector-specific risks. Railway stocks tend to have a low correlation with other sectors and can perform well even during economic downturns or crises.

Dividends:

Railway stocks can also provide regular income to investors through dividends. Many railway companies have a consistent track record of paying dividends to their shareholders, reflecting their profitability and cash flow generation.

How to Invest in Railway Stocks?

Investing in railway stocks requires careful research and analysis of various factors, such as:

Financial performance: Investors should look at the financial statements of the railway companies and evaluate their revenue growth, profitability margins, return on equity, debt-to-equity ratio, cash flow generation, etc.

Valuation: Investors should compare the current market price of the railway stocks with their intrinsic value or fair value, which can be estimated using various methods such as discounted cash flow (DCF), relative valuation (P/E ratio), etc. Investors should look for undervalued or fairly valued stocks that offer a margin of safety.

Competitive advantage: Investors should assess the competitive position of the railway companies and their ability to sustain or increase their market share, customer base, and pricing power. Investors should look for companies that have a strong brand image, operational efficiency, technological innovation, quality products or services, etc.

Growth prospects: Investors should also consider the future growth potential of the railway companies and their exposure to emerging trends and opportunities in the sector. Investors should look for companies that have a clear vision

The following are the top 10 railway stocks in India:

*Quality and Valuation as of January 24, 2024.

1. Indian Railway Finance Corporation (IRFC)

A government-owned company that provides loans to the Indian Railways.

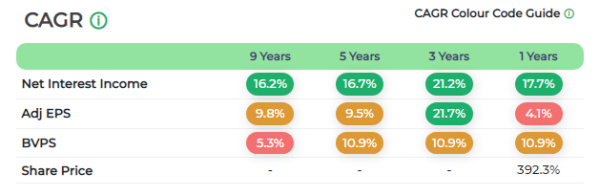

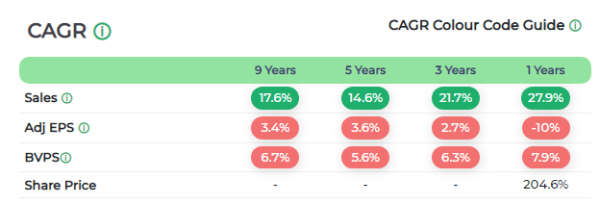

1. Is Indian Railway Finance Corporation Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Indian Railway Finance Corporation Ltd is a average quality company.

2. Is Indian Railway Finance Corporation Ltd undervalued or overvalued?

The key valuation ratios of Indian Railway Finance Corporation Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Indian Railway Finance Corporation Ltd a good buy now?

2. Indian Railway Catering and Tourism Corporation (IRCTC)

A public sector undertaking that is responsible for catering, tourism, and online ticketing services for the Indian Railways.

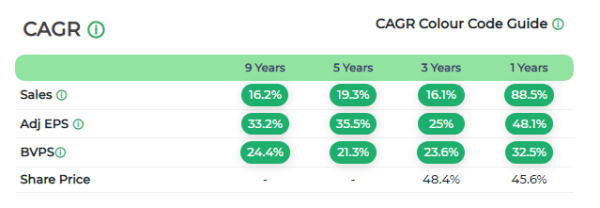

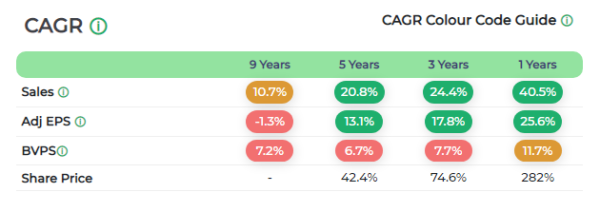

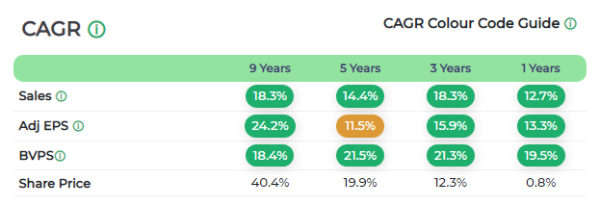

1. Is Indian Railway Catering And Tourism Corporation Ltd a good quality company?

The past 10 year’s financial track record analysis by Moneyworks4me indicates that Indian Railway Catering And Tourism Corporation Ltd is a good quality company.

2. Is Indian Railway Catering And Tourism Corporation Ltd undervalued or overvalued?

The key valuation ratios of Indian Railway Catering And Tourism Corporation Ltd’s currently when compared to its past seem to suggest it is in the Fair zone.

3. Is Indian Railway Catering And Tourism Corporation Ltd a good buy now?

3. Rail Vikas Nigam (RVNL)

A government-owned company that is involved in the construction and development of railway infrastructure.

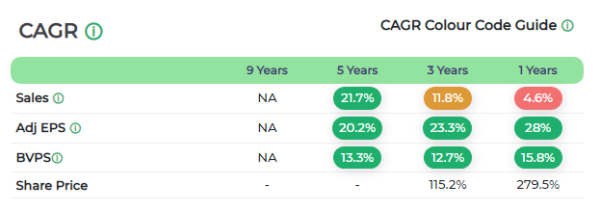

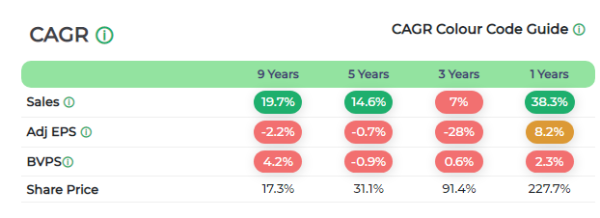

1. Is Rail Vikas Nigam Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Rail Vikas Nigam Ltd is a below average quality company.

2. Is Rail Vikas Nigam Ltd undervalued or overvalued?

The key valuation ratios of Rail Vikas Nigam Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Rail Vikas Nigam Ltd a good buy now?

4. Container Corporation of India (CONCOR)

A public sector undertaking that is responsible for the transportation of containers by rail.

1. Is Container Corporation Of India Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Container Corporation Of India Ltd is a average quality company.

2. Is Container Corporation Of India Ltd undervalued or overvalued?

The key valuation ratios of Container Corporation Of India Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Container Corporation Of India Ltd a good buy now?

5. Ircon International

A government-owned company that is involved in the construction of railway projects overseas.

1. Is Ircon International Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Ircon International Ltd is a average quality company.

2. Is Ircon International Ltd undervalued or overvalued?

The key valuation ratios of Ircon International Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Ircon International Ltd a good buy now?

6. Titagarh Railsystems Limited

A private sector company that manufactures railway wagons.

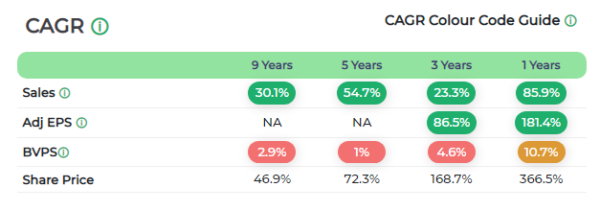

1. Is Titagarh Railsystems Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Titagarh Railsystems Ltd is a below average quality company.

2. Is Titagarh Railsystems Ltd undervalued or overvalued?

The key valuation ratios of Titagarh Railsystems Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Titagarh Railsystems Ltd a good buy now?

7. RITES Limited

A government-owned company that provides consultancy services to the railway sector.

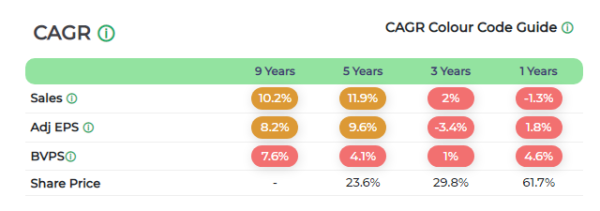

1. Is Rites Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Rites Ltd is a good quality company.

2. Is Rites Ltd undervalued or overvalued?

The key valuation ratios of Rites Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Rites Ltd a good buy now?

8. Bharat Earth Movers Limited (BEML)

A public sector undertaking that manufactures railway equipment, including locomotives, wagons, and coaches.

1. Is BEML Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that BEML Ltd is a average quality company.

2. Is BEML Ltd undervalued or overvalued?

The key valuation ratios of BEML Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is BEML Ltd a good buy now?

9. RailTel Corporation of India Limited

A government-owned company that owns and operates the optical fiber network of the Indian Railways.

1. Is Railtel Corporation Of India Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Railtel Corporation Of India Ltd is a average quality company.

2. Is Railtel Corporation Of India Ltd undervalued or overvalued?

The key valuation ratios of Railtel Corporation Of India Ltd’s currently when compared to its past seem to suggest it is in the Overvalued zone.

3. Is Railtel Corporation Of India Ltd a good buy now?

10. Nagarjuna Construction Company Limited (NCC)

A private sector company that undertakes civil engineering projects, including railway projects.

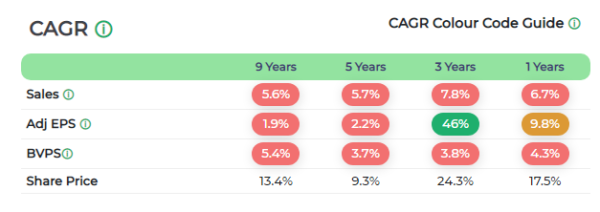

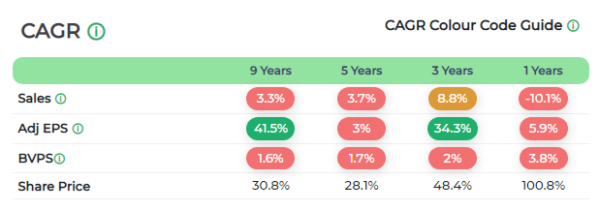

1. Is NCC Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that NCC Ltd is a average quality company.

2. Is NCC Ltd undervalued or overvalued?

The key valuation ratios of NCC Ltd’s currently when compared to its past seem to suggest it is in the Somewhat overvalued zone.

3. Is NCC Ltd a good buy now?

11. KNR Constructions

A private sector company that undertakes civil engineering projects, including railway projects.

1. Is KNR Constructions Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that KNR Constructions Ltd is a average quality company.

2. Is KNR Constructions Ltd undervalued or overvalued?

The key valuation ratios of KNR Constructions Ltd’s currently when compared to its past seem to suggest it is in the Fair zone.

3. Is KNR Constructions Ltd a good buy now?

12. Texmaco Rail & Engineering Limited

A private sector company that manufactures railway equipment, including track maintenance machinery and signaling systems.

1. Is Texmaco Rail & Engineering Ltd a good quality company?

Past 10 year’s financial track record analysis by Moneyworks4me indicates that Texmaco Rail & Engineering Ltd is a below average quality company.

2. Is Texmaco Rail & Engineering Ltd undervalued or overvalued?

The key valuation ratios of Texmaco Rail & Engineering Ltd’s currently when compared to its past seem to suggest it is in the Somewhat overvalued zone.

3. Is Texmaco Rail & Engineering Ltd a good buy now?

Conclusion

Railway stocks can be a good investment for investors who are looking for a safe and profitable investment. The Indian railway sector is a major driver of the Indian economy, and it is expected to grow in the coming years. By choosing the right railway stocks, investors can potentially generate good returns on their investment.

However, it is important to note that there are risks associated with investing in any stock. Investors should do their own research and consult with a financial advisor before making any investment decisions.

Best Stocks From:

Top 10 Stocks in India Best EV Stocks in India Screener Alpha Cases Best 5G Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Defence Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Best Manufacturing Stocks in India Best Liquor Stocks in India

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory