Since childhood we are told, there is right time for everything in life. Right time to get education, right time to get married, right time to buy a house, but is there a right time to invest in equity?

We have often encountered investors who postpone their investments in equity. Many often cite events like elections, Budget, Global crisis, etc. to avoid committing money to equity. On the other hand, few of them feel that the markets have run up a lot and would start falling as soon as they invest, hence they would like to wait for some kind of crash.

We ran some back-testing to test long term returns even if one invested on inopportune times.

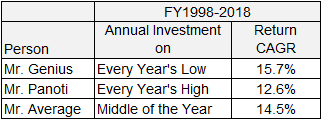

Let us say Mr. Panoti, an unlucky person, invested Rs. 1,00,000 in Sensex every year at market peak of that respective year. And Mr. Genius managed to invest only on the year’s low. While Mr. Average invested always invested in the middle of the FY, come what may. Can you guess their returns?

As you can see, Mr. Panoti’s returns have not been very inferior compared to Mr. Genius over a 20 year period. Remember we may be talking about the most unfortunate person in the world; no one is so unlucky. Also, no one is such a genius or so lucky to get every year’s low right. More reasonable assumption is that our returns will be somewhere in-between.

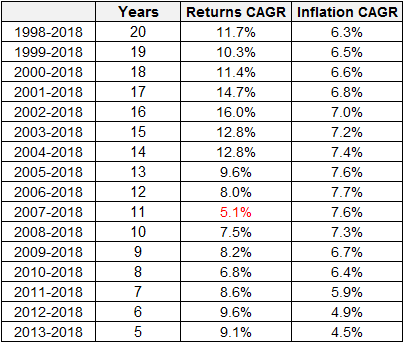

Now since this is a systematic annual investment example, one would ask what if a lump-sum is invested at a market peak.

- CAGR from starting year’s market peak.

- Equity is a long term asset with time horizon of 5 years atleast. Hence recent years are skipped.

Even one-time lump-sum investment at every year’s peak would have beaten inflation CAGR handsomely except once. This includes years like 2007-08, one of the rare corrections.

With above data we can reasonably conclude that there is no need for the right time to invest in equity.

This back-testing is done only using large cap Sensex Top 30 value. There are various ways to maximize returns. Superior stock picking or asset allocation would lead to better outcomes than this.

Though these returns look good, they haven’t come by easily. One would have had heart burns along the way with several 20-30% portfolio value drops and one large 50% ditch. However, to reduce the emotional pain one can seek help of MoneyWorks4me-Omega which moves a portion of portfolio to fixed income securities based on equity valuation.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: