While discussing investments with a friend of mine, he suggested I look at PPF (Public Provident Fund). He told me that it’s the best investment with guaranteed returns and a maturity after 15 years. Moreover the investments, as well as returns, are tax exempt. Before investing, I decided to research PPF in detail and here are my observations.

What is Public Provident Fund (PPF)?

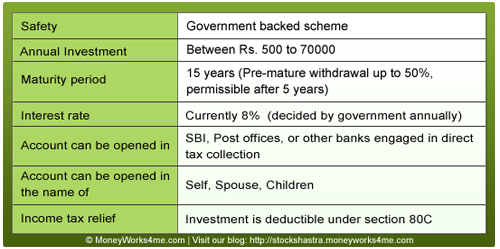

Briefly, it is a scheme wherein a person can invest money for the long term (15 years) at a rate determined by government, compounded annually.

People mostly invest in PPF as a fund secured for life-after-retirement. The main purpose of PPF investment is to meet one’s long term goals, such as children’s higher education or marriage. Mostly businessmen invest in this scheme, for two logical reasons.

- They don’t have a PF account like salaried employees, to get pension after retirement.

- PPF doesn’t come under decree of court, so even if all their assets are liquidated to meet liabilities, this investment is still safe.

Where does the corpus go?

Many of us invest in PPF, but have we ever thought where does the money collected go? If we consider government as a ‘company’ then PPF is simply a debt given to this company. For the government to honour its obligation, we are relying on the government’s ability to pay back the maturity amount after 15 years. With the recent concerns that arose in the US social security funds, it is prudent to analyse this investment option carefully.

Is the investment worthwhile? Is the government capable of giving the promised return? Or should you invest somewhere else? How safe is our investment in PPF?

Like any other company, we should look at the revenue and expenditure of the government. Let us first see how the government makes use of money. Government spends the PPF corpus on infrastructural development, subsidies given, education schemes, security/defence expenditure, health programs, social welfare schemes, interest payment on foreign loans, repaying various loans and borrowings taken, etc.

On the revenue side, the government earns from taxes (direct and indirect), various duties, money raised by government loans, interest received, external borrowing, and disinvestment in PSU etc. But tax revenue is not enough to meet its corresponding expenditure on infrastructure and subsidy etc. This difference is financed by increased borrowing. These borrowings include foreign loans and other government loans (including Govt. bonds, PPF corpus etc.)

This ‘company’/government is borrowing more to pay back the obligation of previous borrowings. This means, the government is borrowing more through PPF to payback maturing PPF and to meet the infrastructural developments which cannot be met with tax receipts. Imagine if new borrowing to this ‘company’ is stopped or restricted, then the maturing obligation will be under threat. This is close to what is going on in the US currently.

World Scenario:

The US government is running with high debt and one-third of it is owed to the citizen of the country in terms of social security and other trust funds. The money with trust funds was lent to the US government at a ‘risk-free’ rate over the years. Because of the US government’s reckless spending, now it is facing a severe problem in meeting its debt obligations. This almost led to a default by Government, followed by the recent downgrade in rating. As a result, new borrowings have become more expensive and the best option available is to increase taxes, thereby increasing the burden on citizens eventually.

With increased expenditure financed by increased borrowing, will the government be able to payback the maturity amount, after 15 years? Is this kind of financing sustainable in the long run? Would you consider lending to such a ‘company’?

In our quest to know about safety of PPF investments, we contacted a few tax consultants. Mr. R. N. Lakhotia (New Delhi) says, “Government will be in position to pay it back (PPF) after maturity.” Mr. Vijay Thorat (Pune) also has same view and says, “The condition in India is good and I don’t see any problem arising on safety of PPF Investment.”

Though our government is not involved in reckless and risky investment (which U.S government was) investors must consider that risk changes as Governments change. Also, if this can happen with world’s most stable economy (US had AAA rating prior to this!!!!) one can imagine what will happen if something was to go wrong with our economy.

Ultimately this investment doesn’t seem risk-free. Moreover there are certain concerns which make PPF a less attractive investment.

1. Risk of changing interest rate

Government can change rate of interest offered on PPF investments and there is nothing one can do about this. Initially rate of interest was 12% which dropped to 11%, then to 9.5% and now it is 8%. Going forward, the Government would be compelled to continue this trend over the long term, as the India moves towards becoming developed economy. Mr. Lakhotia says, “PPF interest rate is unlikely to come down any further.” But Mr. M.G. Kshirsagar, a practicing C.A. from Pune, believes that with tax exemptions and liquidity constraints, PPF seems like an expensive source of funds for the Government. Thus, the interest rate might reduce in future.

2. Is it really a tax-free return?

Common notion says that the government can pay back money even in bad situations, just by printing notes. But it isn’t that simple, because this will increase inflation thereby eating your returns away. Moreover RBI will not be comfortable with increased inflation.

Even otherwise, inflation in India is almost in double digits. Indian economy is growing and it will certainly be accompanied by inflation. Mr. Kshirsagar says, “PPF interest rate doesn’t have the capacity to absorb inflation in India.” So, will there be any returns in an investor’s hand, after inflation is fed?!! Practically, this might even eat away investor’s tax-exemption benefits.

3. Will your money grow?

By only investing in PPF, you are missing growth story of century, which is India. Our country is poised to grow tremendously in the next decade and this growth will be reflected in stock markets. Historically speaking, investing in a fundamentally strong company at an attractive price can give returns ranging from 15-20% per year with low risk. This means if you invest Rs. 10,000 in PPF (at 8%), it will be Rs. 21,589 after 10 years, but the same investment in equity market (at 15%) will give you a return Rs. 40,455. So Rs. 18,866 is potentially the cost of opportunity forgone. Mr. Kshirsagar also agrees that investment in SIP will give more returns than PPF.

With the government running in deficit, and with inflationary pressures, one needs to think how worthwhile is it to park your hard-earned money with Government for the long-term?

Do you really believe in bureaucrats and politicians managing your money? Will the government be able to pay interest rate of 8% and the principal back at the end of period? Even if it does, can this return beat inflation?

Also Read: Stocks Vs. FD – What’s the Better Bet?

Write in with your views….

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

The article gives a negative overture to PPF. Any individual splits (should split) her investment portfolio into debt and equity amongst other investments. PPF is probably the safest debt investment with the highest post tax returns (for an individual in the highest tax bracket). Your article should mention the fact that the PPF is currently probably the safest post tax debt investment for people in a higher tax bracket. Add to this that the investment currently also can avail of Section 80C, it could turn out to be one of the safest and best debt instrument to have in your portfolio

Other LESS KNOWN features of PPF are:

1. loan availability at 1% higher interest, at certain specific times during the 15 year period.

2. There is NO other EQUIVALENT instrument in the market.

3. One should NOT be totally dependent on this for their investment returns and equity must form a much greater part than PPF.

4. One should also consider extending the PPF account for further TWO FIVE YEAR periods, after completion of the first 15 years, based on the then prevailing terms & environment.

Gold, Silver in Demat form especially with the new NSEL (National Spot Exchange Ltd.,) features to the extent of under 10% of total investment amount for all desired asset classes is worthwhile.

It is still a great investment given the fact that it gives tax adjusted 10 plus percent. It is better than the bank rates being offered. It is the still the ideal way to build a corpus over a long period. While this cannot be the only asset class, stocks cannot give the benefits (liquidity, safety) offered by PPF. In fact, with the proposal to increase the investments to 1 lac per year, it is likely to become a very good investment avenue. The main plus point being that it is least volatile.

PPF is definitely a safer proposition than investing in equities. However, as far as liquidity is concerned, liquidity of PPF investment is much less than that offered by equities. PPF can be liquidated in phases after a fixed number of years. The only benefit that PPF seems to offer in terms of liquidity is that a loan can be taken against it. However, this can’t be defined as liquidity as such. Also, in case of premature withdrawal the amount is taxable.

Yes article is well written. We feel that PPF is still a viable option if nothing else then for asset allocation.

-SIP in equity does give 15% but how many people have patience to ride the bear market.

-It instills saving habit as it is for 15 years. People typically invest at the peak of bull market and withdraw at the bottom-Yes govt can default but just as US was saved at last minute we hope if worst come to worst Indian Govt will also save. Just wondering is such a situation arises what will happen to stock market then -Dow had tumbled 635 points after S&P had downgraded US credit ratingNeed of the hour is to become financial literate for markets will continue to be volatile.

Thanks a lot for your appreciation. Certainly, financial literacy is need of the hour. A recent report by Boston Consulting Group points out that the most likely solution that a debt ridden government could adopt is to put more money in the economy and hence inflate away the value of their debt. This would lead to higher inflation.

Please explain with the help of a chart – post 80 C tax benefit of PPF (70k) vs other 80 C products. Need to compare apples to apples. Comparing Equity MFs and PPF is not correct. Having said that, a person can invest in MF SIPs or Stocks directly even though he has has a PPF ac. Atleast at the time of maturity, one of his asset class (although low returns), will be assured, just in case equity is on the lower side that time.

We agree that diversification of investments will be beneficial to investors. The aim here is to make readers realise that the inflation-adjusted returns from PPF is low.

I agree & carry a similar view but a majority of people are not convinced. Regards, Vinod Saini

It would be very wise, if full details of the govt PPF are given here to help the few investors who are not aware of the scheme.

2.We can suggest to the readers to invest only a portion of their long term investments. In other words, govt PPF will be one of the long term products and not the sole product.——–Amar-shettar M.M. (Retired) Chief Manager, State Bank of India, Resident of Hubli – 580 023 ( Karnataka)

I feel PPF is a good investment. Stock market does not always get 15% or more.

Secondly in Direct Tax code PPF qualifies to be Emempt , Exmpt , Exempt catsagory.

i.e Principle, Interest is completely expemt from Income tax & wealth Tax.

It is very easy to operate & claimback. I have always had excelent experience wioth SBI.

Also this becomes like copulsory saving.

Regards,

Madhav Mavalankar

email : mmavalankar@yahoo.co.in

The basic assumption of equity earning 15%, while Government of the country floundering is incompatible. Companies with listed shares are bound to be affected with bad economy – may be due to defective policies and/or global reasons. Hence, taking extreme view for one while taking for granted the performance of the corporate sector is merely hypothetical.

It is the most foolish advice any one can give to young investors.

1. The savings in income tax have not been taken into account in your calculations.

2. PPF is 100% secure. It can not be attached by a court of law.

3. Power of compounding even at 8% over a period of 20-25 years is amazing. Safety of returns is assured. Equity market is risky as it is manipulated by big brokers, institutions and business houses

4. PPF is tax free when you make final withdrawal so that increases your effective returns.

5. Amt of 70000 is small but securely invested in PPF.

@fbb38951bc2093139fcae648b8644d1f:disqus @79911e501d98841d135ed61e95d24515:disqus @146af79851734fb580e23233cd1382b7:disqus @d37e2f6f5dd66d8848c06a9d4dec6ebe:disqus @e551f5f870070032b48ded9ff55af0c4:disqus @87c035f745250f1d87686d142d19248f:disqus @efe197ce4fe65e85eb1f5f182d4b13e3:disqus –

The tax adjusted returns of PPF (~10.4%) would be higher than the nominal interest rate offered (~8%), but one should also take into consideration the inflation adjusted returns. Consider the returns offered by Sensex over last 20 years, from 1168 (as on 31st march 1991) to 17527 (as on 31st march 2010) which is around 15.32% CAGR. Also in the same period CPI inflation index has moved at CAGR of 7.86%. Assuming 8% return on PPF (tax-adjusted return of 10.4%) we arrive at inflation adjusted return of roughly 2.5% only. However, the return on equity investment is 15.32% and long term equity investment (more than 12 months) is also tax-exempted. Keep in mind we are talking about investing in a standard 30 stock portfolio of Sensex companies.

The risk of equity investment does seem higher than PPF at first glance. But what if you keep a PPF mind-set while investing in stocks? What we mean by this is we should invest in stocks keeping a long term time horizon (minimum 10 years) and not get influenced much by market ups and downs. Studies have shown that over a 10 year period the possibility of losing money in quality stocks is almost nil. A lack of financial literacy and investment discipline makes us believe that stocks will definitely make us lose our money. As mentioned by bemoneyaware financial literacy is the need of the hour.

As mentioned in our letter the entire objective of the article was to become a devil’s advocate and question our traditional investment habit of putting money into PPF. We agree that diversification of investment is a must. Neither PPF nor equity investment should be the sole asset. However, if you want to create wealth over your lifetime, we suggest equity will need to form a greater part of your portfolio.