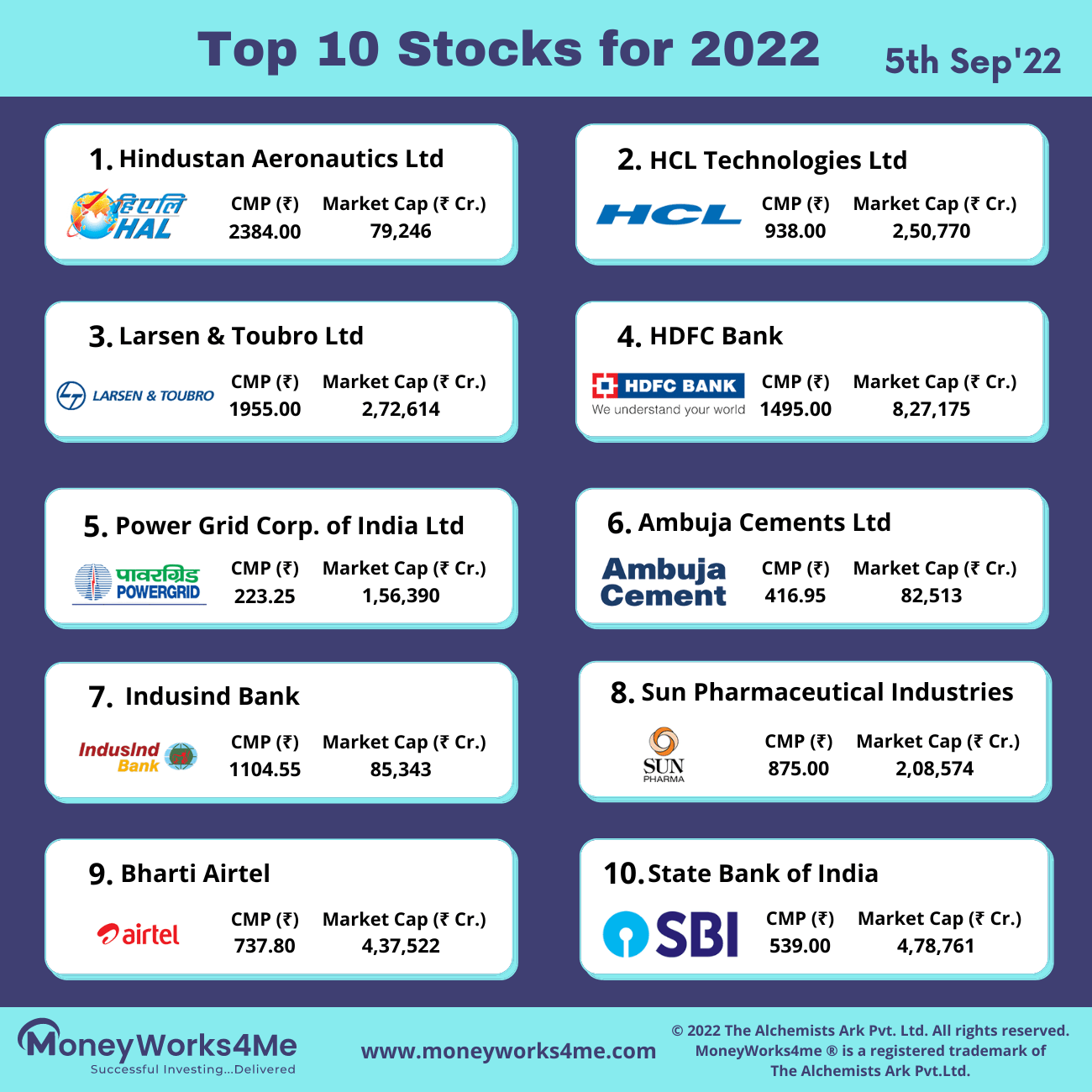

The top 10 stocks for 2022 are the stocks of companies that are scaling up a business or enjoying tailwinds in their respective sectors that will continue to grow and the stock prices will follow the same.

Which are those best Indian stocks for 2022 you can own to make a return? Let us check out the story in each of the companies one by one.

Top 10 Stocks for 2022

Here are the top stocks that can keep performing in 2022 and are worth exploring

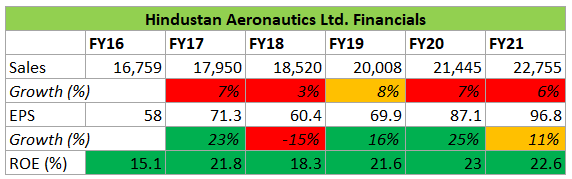

1. Hindustan Aeronautics Ltd. (HAL)

HAL is a defence public sector undertaking and was established in October 1964. The principal business of HAL is to undertake the design, development, manufacturing, maintenance, repair, and overhaul of aircraft, helicopters, engines, and other related systems like avionics, instruments, and accessories. It also engages with the ISRO to contribute to the space programmes of the country. HAL’s primary consumers are the Indian Defence Forces comprising of the Indian Air Force, Indian Army, Indian Navy along with the Indian Coast Guard. The government’s push to source defence equipment from the home country provides a tailwind for further growth.

HAL has an order book to the size of ~ 79,467 Cr which is ~3.4x TTM sales. The revenue growth is expected to be close to 10-12% CAGR and margins are expected to be stable. This bodes well for the company’s future prospects.

2. HCL Technologies Ltd.

HCL is a diversified IT/BPO services provider, primarily focused on ‘transformational outsourcing. HCL Operates in various segments of IT services for large to mid-sized corporates in the US and Europe. Indian IT services continue to remain very cost-efficient for global outsourcing. HCL has been able to see sustained growth in Enterprise due to Success in large deal wins and acquisitions to increase scale or adding more clients to the portfolio.

For the last 3 years, its sales growth is 14% CAGR and earnings growth of 11% CAGR. Covid has accelerated the demand for IT infra for all companies alike. This will ensure sales growth momentum for HCL Technologies.

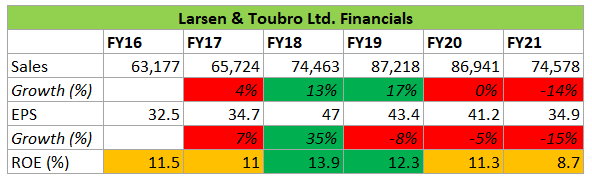

3. Larsen & Toubro Ltd.

Incorporated in 1946, L&T is one of Asia’s largest vertically integrated EPC conglomerates, with a strong market position across segments such as infrastructure, power, hydrocarbons, heavy engineering, defense engineering, electrical and automation, IT, IT&TS, metallurgical and material handling, and machinery and industrial products. L&T undertakes varied infrastructure development projects such as roads, metro rail, power, and transmission lines.

Management commentary of L&T suggests that L&T is trying to streamline its business by divesting non-core businesses to reduce drag on its cash flows. This can be a big move to reduce stress on the balance sheet by getting rid of the unproductive business and focusing on core segments where it has a unique competitive advantage.

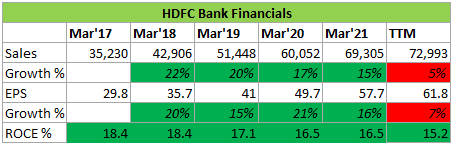

4. HDFC Bank

HDFC Bank is a subsidiary of HDFC Ltd and the largest private sector bank in India. Incorporated in 1995, HDFC Bank offers a wide range of banking services, including commercial and transactional banking in the wholesale segment, and branch banking in the retail segment, with a focus on car finance, business banking loans, commercial vehicle finance, credit cards, and personal loans. HDFC Bank has an impeccable execution track record year-on-year growth as it scaled up from a low base in the previous decade and limited impact from an economic slowdown. Granular, short-term loans in highly profitable industries are the reason for its strong track record on asset quality.

With more than 16% CAGR in income over the last 5 years and >17% growth in earnings, we expect HDFC Bank to clock a similar growth rate going forward. Currently, FII selling and slowdown in growth has caused HDFC Bank’s share price underperformance creating an opportunity for long-term investors.

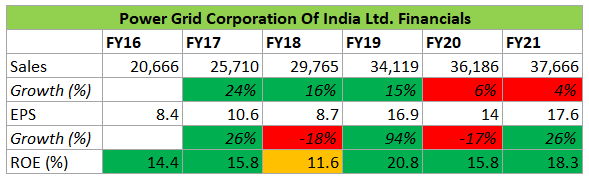

5. Power Grid Corporation Of India Ltd.

Power Grid Corporation Of India was incorporated in 1989 to set up extra-high voltage alternating current and high-voltage direct current (HVDC) transmission lines. The company moves large blocks of power from the central generating agencies and areas that have surplus power to load centers within and across regions. It is under the administrative control of the Ministry of Power, GoI. The company owns and operates an extensive nationwide network of transmission lines, which mainly comprise 400-kilovolt transmission lines and HVDC transmission systems, carrying more than 45% of the total power generated in India.

The strong project implementation capability of the company can help to ensure that projects of strategic importance, compressed implementation timelines, or projects involving difficult terrain or other complexities, can be awarded to the company on a nomination basis. In the past, the government has extended equity support for CAPEX and has also guaranteed loans availed from multilateral lending agencies. Also, the regulatory framework is structured by Central Electricity Regulatory Commission (CERC), which helps to generate stable revenue and cash flow. A large part of the asset base is on the regulated RoE structure, resulting in secured and stable cash flow. This shall reduce the immediate pressure on profitability from the increased participation of private sector players through the competitive bidding route. We believe in buying such business at or below the replacement cost to make a good return.

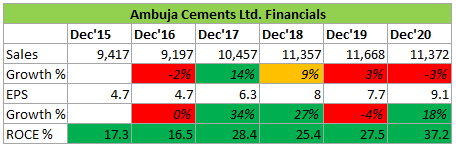

6. Ambuja Cements Ltd.

Ambuja Cements is one of India’s leading cement manufacturers. Holcim Ltd acquired a 14.8% stake in Ambuja Cements in 2006 and assumed management control of the company. Post the proposed restructuring between ACC and Ambuja Cements, effective from August 2016, ACC became a subsidiary of Ambuja Cements. Both the companies have a common line of business and have entered into a master supply agreement, which helps them operate symbiotically, optimising each other’s plant capacities and spare inventories, and thus, benefit from operational and financial synergies.

Ambuja Cements is a conservative cement company as it preserved cash from lower CAPEX versus peers in recent years due to oversupply in some regions. Cash on books gave it more cushion to handle the situation in tough years like 2020. The company has installed a capacity of 29.65 million tonnes per annum (MTPA) as of Mar’21, spread across north and central (around 40%), west (around 37%), and east (around 23%) India. It has a large marketing infrastructure, pan-India presence, and strong operational linkages with ACC (34.5 MTPA as of Mar’21). These companies together have a 12-13% capacity share in the Indian cement market. Their nationwide presence shields operations from regional price volatility and demand-supply imbalances. Also, strong cash flow and low debt levels translate into robust debt protection.

7. Indusind Bank

IndusInd Bank is the fifth largest private sector bank. Incorporated in 1994 the bank has expanded to 3000 branches. It has four divisions: corporate and commercial banking, consumer banking, global markets group, and transaction banking. Within the segments, it has a large exposure to vehicle financing ~27% of the total loan book. An uptick in auto sector sales will lead to superior growth for Indusind bank in the medium term. An increase in NPA from the Microfinance segment has led to elevated NPA for Indusind however since MFI forms less than 15% of the total loan book, NPA can be contained.

Indusind Bank’s topline has grown at 18%+ CAGR over the last 5 years however, few chunkier NPA led to sub-par earning growth. This is likely to reverse in subsequent years as the bank provides for bad loans and pursues growth with an uptick in the economy.

8. Sun Pharmaceutical Industries

Sun Pharma is one of the largest Indian pharmaceutical companies, with a leading position in the high growth chronic segments. Its product mix comprises both formulations and bulk drugs, with formulations accounting for nearly 95% of revenue. It is one of the leading global generics companies with more than 50% sales coming from the US and the rest of the world. The company is focusing on specialty segments, wherein it has acquired and developed niche products to increase its competitive advantage versus peers. Building a specialty franchise takes time but once established, it can earn a high return on equity for a sustained period.

Sun Pharma has reported subdued sales growth over the last 5 years however, of late the sales growth is picking up as specialty drugs are scaling up. It is expected to earn superior margins incrementally leading to higher earnings growth over the next 3-4 years. Return on equity is improving backed by rise in sales as well as margin expansion.

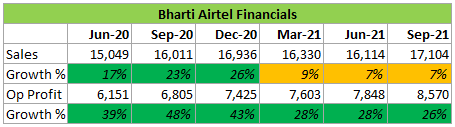

9. Bharti Airtel

Bharti Airtel is one of the leaders in the telecom industry with more than 30% market share and more than 50% profits share. Bharti Airtel has a subscriber base of more than 35 Cr with the highest Average Revenue per user thanks to a higher share of 4G subscribers and postpaid users. With an increase in demand for internet services, data consumption is going to grow exponentially. Also, it will also lead to better pricing power for telecom companies till volume growth doesn’t get affected.

Bharti Airtel’s top line is growing at high single to low double digits in the last 6-8 quarters backed by an increase in 4G subscribers and price hikes. What is more important is growth in operating profit as costs remain fixed so every additional sale trickles down to profits. We expect an increase in prices and a reduction in interest cost to increase Bharti Airtel’s value per share.

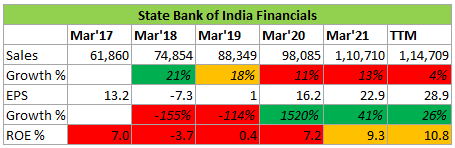

10. State Bank of India

SBI is the oldest and largest bank in India with more than 20% market share sustainably. SBI has 22,230 branches and boasts a loan book in excess of Rs. 25,00,000 Cr. It has ownership in large subsidiaries that offer different financial services such as investment banking, credit cards, life insurance, general insurance, fund management, primary dealership, broking, and factoring.

SBI had slowdown over the last 5-7 years due to slow economic growth, rise in NPA from excessive in the previous expansionary cycle. SBI has provided for bad loans and starting on a clean slate. Once again, with an uptick in the economy, the bank will benefit from growth and improvement in profitability. Its ROE is likely to increase > 12% over the next 12-24 months with a similar or higher book value growth rate if loan growth surprises on the upside.

Disclosure- Above stocks are shared for further study and shouldn’t be construed as investment advice. Current prices might be high, reach out to advisors for the right price or wait for market volatility. Our clients may or may not be holding the stocks mentioned above.

Last year we had shared a list of 10 stocks for 2021 that can earn a superior return from higher sales/earnings growth. let us review the performance of the top 10 stocks for 2021.

The top 10 stocks for 2021 have massively outperformed Nifty by 29%.

- Two stocks have delivered triple-digit returns

- Half the stocks have outperformed Nifty by a large margin.

- Three out of 10 stocks have earned negative returns

Top 30 performing stocks of 2021

The year 2021 has been a stellar year for the stock market. Strong liquidity, economic recovery, and receding Covid led to positive sentiment and re-rating of stocks. Towards the end the rally seems exhausted with constant selling pressure from FIIs, nevertheless, this year will be counted as a top-performing year for the new decade.

Let us have a look at the stocks that contributed to this party. Following is the list of the top 30 stocks that have generated maximum returns in the past 1 year.

| Sr.No. | Company Name | Returns |

|---|---|---|

| 1 | Trident Ltd | 427% |

| 2 | Poonawalla Fincorp Ltd | 392% |

| 3 | Gujarat Fluorochemicals Ltd | 299% |

| 4 | KPIT Technologies Ltd | 280% |

| 5 | Angel One Ltd | 244% |

| 6 | Balaji Amines Ltd | 238% |

| 7 | Privi Speciality Chemicals Ltd | 231% |

| 8 | Greenpanel Industries Ltd | 221% |

| 9 | Hikal Ltd | 207% |

| 10 | Persistent Systems Ltd | 205% |

| 11 | Tata Motors Ltd. – DVR Ordinary | 200% |

| 12 | Tata Elxsi Ltd | 200% |

| 13 | Tejas Networks Ltd | 198% |

| 14 | Minda Industries Ltd | 197% |

| 15 | Max Healthcare Institute Ltd | 195% |

| 16 | Transport Corporation Of India Ltd | 188% |

| 17 | Tata Power Company Ltd | 187% |

| 18 | Allcargo Logistics Ltd | 181% |

| 19 | Mindtree Ltd | 179% |

| 20 | H.G. Infra Engineering | 175% |

| 21 | Mold-Tek Packaging Ltd | 169% |

| 22 | eClerx Services Ltd | 167% |

| 23 | Praj Industries Ltd | 165% |

| 24 | Radico Khaitan Ltd | 163% |

| 25 | Mastek Ltd | 163% |

| 26 | Tata Motors Ltd | 155% |

| 27 | Century Plyboards (India) Ltd | 150% |

| 28 | Linde India Ltd | 149% |

| 29 | Grindwell Norton Ltd | 149% |

| 30 | Deepak Nitrite Ltd | 145% |

Stock Investing Faqs:

Which companies give the highest return?

We believe that stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same. Over the long term, it is observed that stock prices follow the earning trajectory of the company. Hence to generate high returns, it is important to track the earnings of the company and the stock price follows.

In stocks, what company had the best 2021?

Initially, IT and Pharma companies saw less/ no impact of the lockdown, and their sales remained intact. Later we saw infra companies and Capital Goods showing strong earnings growth. We have shortlisted 30 top-earning stocks since last year and most of them belong to these two sectors. Some of them are Balaji Amines, Persistent Systems, Tata Power, etc.

What are some Good stocks that can perform well in 2022?

Since 2020 saw a crash immediately followed by a flow of liquidity in the system, all the stocks rallied leading to a market rise by ~80% from its lows in March. The rally has been broad-based and all the stocks have participated whether they had or did not have sales growth. Currently, the expectations are of rising interest rates regime which might limit the multiple expansions. Thus, in 2022, the stocks without earnings growth might see some correction. We have shortlisted 10 stocks that can continue growing since they are backed by the earnings growth.

What is MoneyWorks4me way of stock investing?

At MoneyWorks4me we prefer to buy good quality companies at a reasonable price. We value each stock in our coverage and wait for their price to come close to a discount price or fair price.

Stocks with a strong long-term track record and good future prospects can trade at a discount to a fair price due to a temporary slowdown. At times, even great companies trading close to fair value. Buying stocks at such prices delivers consistent long-term returns.

MoneyWorks4me Superstars: Build a Portfolio of stocks that create wealth.

How does MoneyWorks4me help you identify the right stock?

It often happens that the market chases popular ideas rather than participating in tomorrow’s winners. MoneyWorks4me provides you with the right tools to identify good quality stocks at right time. With our help, you will get full access to around 20+ Sectors and 200+ companies to choose from. At MoneyWorks4me we value 200 stocks and track their progress. We help you identify when a stock is cheap and on the verge of pick up over the next 1-2 years.

Stock Screener: This tool enables you to screen stocks in a unique way.

MoneyWorks4me Stock Filter: Discover the best-performing stocks in NSE/BSE using our Stock Analysis Tool.

What does MoneyWorks4me provide to its non-subscribers?

MoneyWorks4me provides you the right tools to shortlist good stocks and analyze your favorite stocks.

1. Unique Stock Screener for India helps you filter out among 1000s of stocks and boil down to a handful for further analysis. Filter stocks based on profitability, growth, size, themes, and price.

2. Stock Analysis for Indian Stocks aka 10 year X-ray helps you scan stocks based on profitability, balance sheet strength, and growth. User-friendly format and color codes Green, Orange and Red saves time to turn over several stocks before you dig into details of specific ones.

3. Our Portfolio Manager helps you identify risks that you may have missed out on, for example, valuation risk, sector/stock concentration, downside potential, etc. The portfolio manager takes into consideration your entire assets and helps us ensure the right diversification.

4. Our Investment Shastra blogs provide insights into financial planning, investment planning, behavioral biases, and risk management. You also get a monthly outlook from our analysts who highlight interesting sectors to watch, fair value for the market, and market sentiment (bullish/bearish) to make better investment decisions.

How to Invest in Stocks Systematically & Succeed?:

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Healthcare Auto FMCG Nifty Financial Services Chemicals & Fertilizers Dividend Opportunities SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463