Suryoday Small Finance Bank IPO Details:

IPO Date: March 17th to March 19th, 2021

Total Shares for subscription: ~1.9 Crore

IPO Size: ~Rs. 583 Cr

Lot Size: 49 shares

Price Band: Rs. 303-305/ share

Market Capitalization: ~3,200 Cr

Recommendation: Avoid completely

Purpose of Suryoday Small Finance Bank Ltd IPO

The funds will be utilized towards augmenting the Bank’s Tier-1 capital base to meet the Bank’s future capital requirements.

About the Suryoday Small Finance Bank Ltd

Incorporated in 2008, Suryoday Small Finance Bank Ltd (Suryoday SFB) is a Rs. 4,000 Cr loan book-sized Small Finance Bank (SFB) in India. It started offering SFB services in 2017 before which it operated as an NBFC. They serve customers in the unbanked and underbanked segments.

Suryoday SFB

- Offers credit products like MFI loans, Vikas Loans, Shopkeeper Loans, etc.

- Offers digital banking, NPCI payment systems, and mobile technologies along with banking through traditional channels.

- Focus on the unserved and the underserved through innovative banking practices.

- Offers diversified asset portfolio with a focus on retail operations.

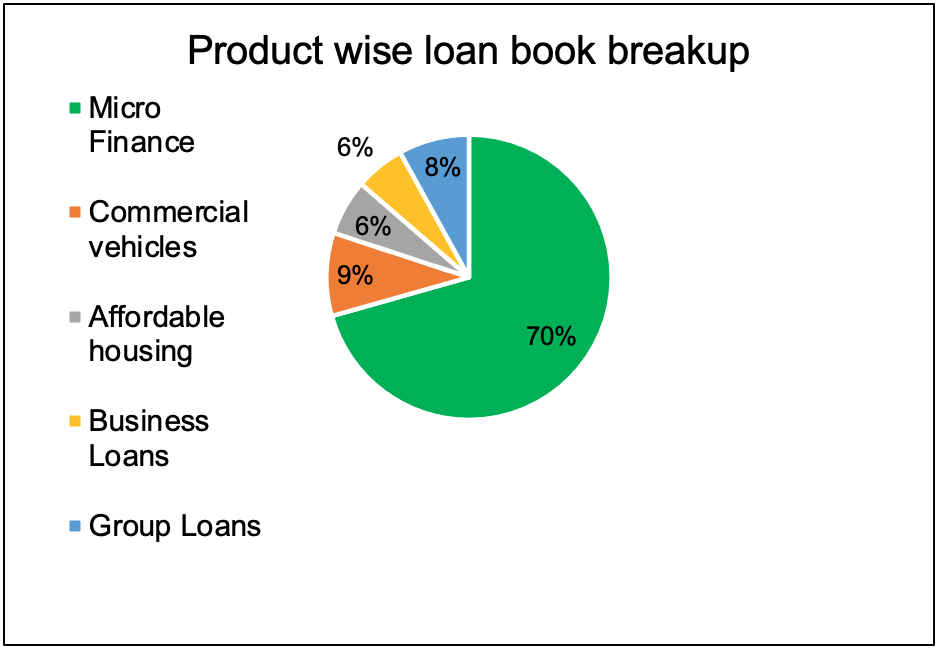

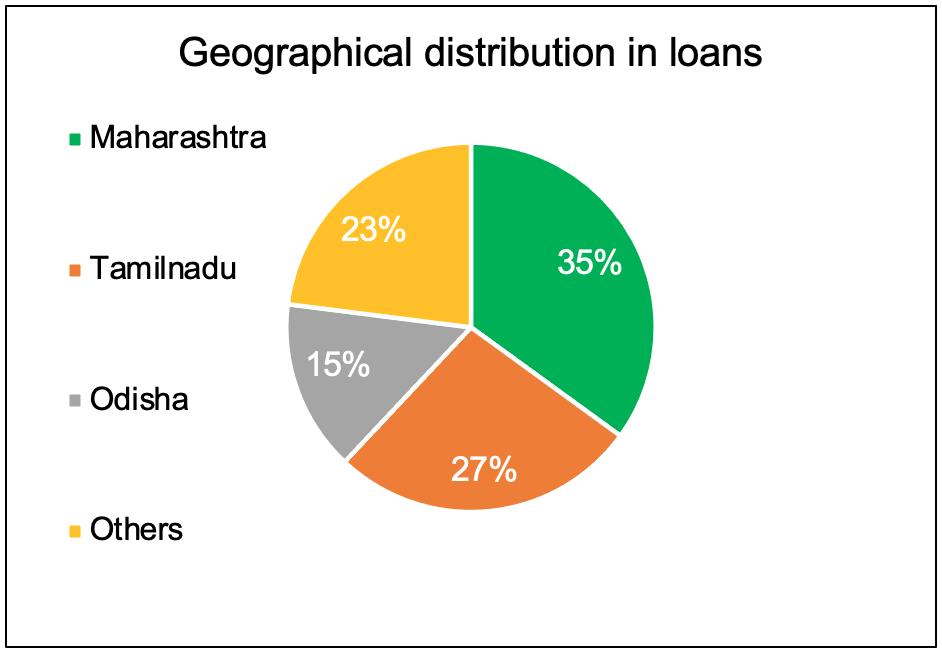

Suryoday SFB focuses predominantly on the micro-finance segment with an average loan ticket size of Rs. 25,000. ~77% of its loan book predominantly flows from Tamil Nadu, Maharashtra, and Odisha. While unsecured loans still constitute 74.6% of the bank’s loan portfolio as of December 2020.

As of July 31, 2020, the company had 482 Banking Outlets and had a customer base of 14.3 lakh. The company operates predominantly in urban and semi-urban locations. The bank has no major expansion plans in the pipeline. It expects to continue to grow using the current model of low-cost touchpoints.

Management of Suryoday Small Finance Bank:

Baskar Babu Ramachandran Is the MD & CEO of the bank. He is a first-generation entrepreneur, has several years of experience in the financial services sector, and has held leadership positions in companies like HDFC Bank, GE Capital Transportation Financial Services among others.

The other members of the senior management team have experience and relevant expertise in the banking and financial sectors, corporate laws, sales, technology, and operations and have been instrumental in scaling up business operations.

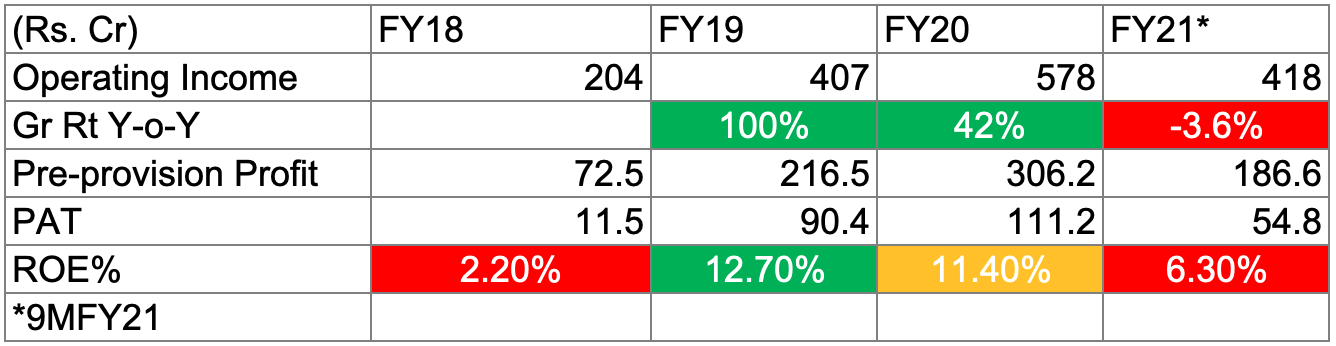

Financials of Suryoday Small Finance Bank:

The bank’s gross loan portfolio has grown at 35% from FY16 to FY20, to Rs. 3,711 crore.

Bank’s gross non-performing assets (GNPAs) were at 0.8% in the first nine months of FY21. It reported a spurt in proforma NPAs to 9.28% in the quarter ended December 2020.

Despite being a smaller player than its listed peers (loan book size is one-fourth of that of Ujjivan SFB and Equitas SFB), Suryoday SFB has been able to contain its cost-to-income ratio to less than 50% in FY19 and FY20, compared with more than 65% in case of Ujjivan or Equitas SFBs.

Strengths:

- Presence in high growth sector with under-penetration

- A small finance bank license can help it’s lower the cost of borrowing and more stability on liability profile.

Risks:

- Micro Finance runs a major risk of community NPAs

- Concentrated customer base in CASA and overall liability

- Loan book concentration in few states

Valuation

How is the valuation for Suryoday Small Finance Bank?

Reasonable:

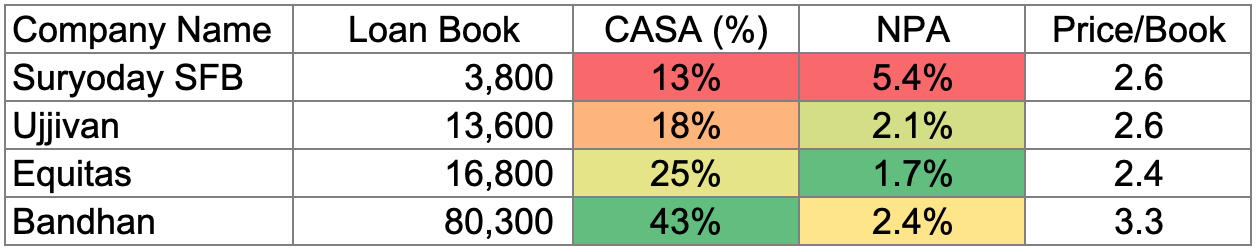

The bank is valued at 2.6 times its book value as per 9mFY21. Listed peers such as Ujjivan Small Finance Bank and Equitas Small Finance Bank, trade at a similar valuation.

MoneyWorks4me Opinion

How is the company quality?

Average:

Suryoday SFB is a regional microfinance company with 70% loans lent out as microfinance i.e. unsecured small ticket size loans to poor people.

A large population is still unbanked and in search of capital. This is where microfinance and small finance banks play a crucial role in organized lending of small-ticket loans.

Microfinance is growing fast as the market is currently under-penetrated. Players with a large scale are able to grow even faster as they have access to capital and better risk management versus smaller ones. Within that Small Finance Bank can accept deposits as well as CASA. This not only secures their funding but also provides low-cost financing for lending purposes.

Suryoday SFB is an emerging small finance bank with a little track record as a bank with evident low CASA and higher cost of borrowings. But as the bank grows with an increase in loans geographically/product-wise and CASA, it will have improving profitability and better risk management.

Currently, Suryoday SFB has a high NPA of ~9% (Net NPA 5.4%) and CASA of just 13% which may jeopardize its financing plans to pursue higher growth. We believe Bandhan Bank offers a much better risk-reward versus Suryoday SFB as it is yet to prove its business model.

We recommend AVOID on Suryoday SFB as a long-term holding as well as listing gains.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 17th March 2021 |

| IPO Close Date | 19th March 2021 |

| Basis of Allotment Finalisation Date | 24th March 2021 |

| Refunds Initiation | 24th March 2021 |

| A credit of Shares to Demat Account | 25th March 2021 |

| IPO Listing Date | 30th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 49 | ₹ 14,945 |

| Maximum | 13 | 637 | ₹ 194,285 |

| Date | QIB | NII | Retail | Employee | Total |

| Mar 17, 2021, 05:00 | 0.00x | 0.04x | 0.84x | 0.06x | 0.42x |

| Mar 18, 2021, 05:00 | 0.00x | 0.20x | 2.00x | 0.17x | 1.01x |

| Mar 19, 2021, 05:00 | 2.18x | 1.31x | 3.09x | 0.34x | 2.37x |

When will the Suryoday Small Finance Bank Ltd IPO open?

Suryoday Small Finance Bank IPO will open for subscription on Wednesday, March 17, and will close on Friday, March 19.

What is the price band of Suryoday Small Finance Bank Ltd IPO?

The price band for Suryoday Small Finance Bank IPO is Rs. 303-305.

What is the lot size for Suryoday Small Finance Bank Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 49 shares, up to a maximum of 13 lots i.e. Rs. 1, 94,285.

What is the issue size of Suryoday Small Finance Bank Ltd IPO?

The total issue size is ~1.9 Cr shares raising ~ Rs. 583 Cr.

What is the quota reserved for retail investors in Suryoday Small Finance Bank Ltd IPO?

The quota for retail investors in Suryoday Small Finance Bank IPO is fixed at 25% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 24 and refunds will be credited by March 24. Shares allotment will be credited in Demat accounts by March 25.

What is the listing date of Suryoday Small Finance Bank Ltd IPO?

The tentative listing of Suryoday Small Finance Bank IPO is March 30.

Where could we check the Suryoday Small Finance Bank Ltd IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Axis Capital Limited, ICICI Securities Limited, IIFL Holdings Limited, and SBI Capital Markets Limited.

What does Suryoday Small Finance Bank Ltd do?

Suryoday Small Finance Bank Limited is Small Finance Bank in India. It offers credit products like loans, digital banking, NPCI payment systems, and mobile technologies along with banking through traditional channels. It focuses on the unserved and the underserved through innovative banking practices. The bank offers a diversified asset portfolio with a focus on retail operations.

Who are the peers of Suryoday Small Finance Bank Ltd?

Equitas Holding, Ujjivan Small finance bank, and Bandhan Bank are some of its listed peers.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. The MoneyWorks4me PRO is priced below Rs. 5000 but provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463