Barbeque Nation IPO Details:

IPO Date: March 24th to March 26th, 2021

Total Shares for subscription: ~90.57 Lakh

IPO Size: ~Rs. 453 Cr

Lot Size: 30 shares

Price Band: Rs. 498-500/ share

Market Capitalization: ~1,877 Cr

Recommendation: Subscribe

Purpose of Barbeque Nation Hospitality Limited IPO

- Capital expenditure for expansion and opening of new restaurants by the Company

- To partly or fully repay the company’s borrowings

- To meet general corporate purposes

About the Barbeque Nation Hospitality Limited

Barbeque Nation Hospitality Limited is an Rs. 850 Cr business that owns and operates Barbeque Nation Restaurants in fine dining space. They also own and operate Toscano Restaurants and You and Barbeque (“UBQ”) by Barbeque Nation.

Barbeque Nation’s ‘over the table barbeque’ concept is unique in Indian restaurants. Value-oriented price, unlimited servings in a pleasant and casual dining environment has done well for the company as it scaled up business from 85 outlets to 147 in the last 4 years with a turnover of Rs. 850 at the end of FY20.

Presence

As of Dec’2020, the company had 164 restaurants owned and operated by them which include 147 Barbeque Nation Restaurants across 77 cities in India, 6 International Barbeque Nation Restaurants across 4 cities outside India, and 11 Italian Restaurants across 3 metro cities in India. Out of all Italian restaurants, 9 are operated under the brand name “Toscano” and 1 each under the brand names “La Terrace” and “Collage”, respectively. International Barbeque Nation Restaurants are as 2 in Dubai, 2 in Abu Dhabi, 1 each in Kuala Lumpur, and in Muscat.

Barbeque Nations had close to 90 Restaurants in FY17, thereafter it added around 20 restaurants per year. Prior to Covid-19 lockdown mature restaurants were earning steady profit margin (~12-13%) but newer restaurants did not reach an optimum level of operations to earn higher margin (~2-3%)

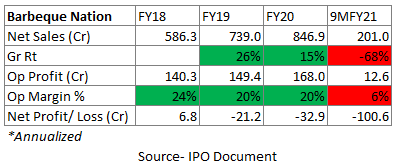

Financials of Barbeque Nation Hospitality Limited:

The revenue of the company has grown at a CAGR of 20% from FY18 to FY20. The company has consistently maintained 13%+ operating margins in normal years. (20%+ after accounting policy change)

The company has strong operating cash flows and less receivable given the cash and carry nature of the business.

Impact of Covid-19

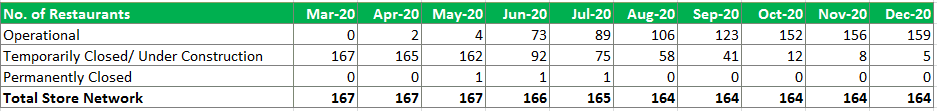

As a result of COVID-19, the company had to temporarily close a number of restaurants across India commencing from March 2020 and have experienced reduced restaurant-level operations, including reduced operating hours and restaurant closures. The company launched a delivery product “Barbeque-in-a-Box” in June 2020 in addition to two other products, “Grills in a Box” and “Meals in our Box”.

As of date, their restaurants in 77 cities across India have reopened, often with limited operations. The majority of their restaurants have opened for dine-in guests; however, the capacity may be limited, based on local regulations. In addition, the COVID- 19 pandemics have directly impacted their same-store sales in the restaurants.

The company has undertaken various cost optimization efforts such as seeking rent relief from their landlords, renegotiating their commercial terms, temporarily reducing senior management salaries, and realigning restaurant operating costs and structures. As of December 2020, it had 7,298 full-time employees versus 9,620 full-time employees as of February 2020.

Management of Barbeque Nation Hospitality Limited:

Sayaji Hotels Ltd., Sayaji Housekeeping Services Ltd., Kayum Dhanani, Raoof Dhanani, and Suchitra Dhanani are the Promoters of the company.

Kayum Dhanani is the Managing Director of the company. He has been a Director of the company since November 2012. He has been associated with Sara Suole Pvt. Ltd. since 2005, which is involved in the business of manufacturing, processing, and selling leather goods including, soles, shoes, and other leather accessories.

Rahul Agrawal is the Whole-time Director and Chief Executive Officer of the company. He has been a Director of the company since December 2020. He joined the company in July 2017.

Strengths:

- Stable profitability in mature stores

- High growth prospects with an increase in outdoor eating habits and casual dining experience.

Risks:

- Fragmented Industry and heavy competition can stagnate growth

- Any dent on brand reputation can lead to a large impact on business

MoneyWorks4me Opinion

Casual Fine Dining is a growing market in India with more people moving towards organized and popular food chains due to increased disposable income and hygiene awareness. Covid-19 has weakened quite a few small operators making their business unviable. This bodes well for organized sector growth in the near future.

However, the restaurant business still remains highly fragmented with 60% dominated by unorganized players. Repeat business is tough to come by if customers have numerous options. This makes Same-Store Sales Growth (SSSG/Organic growth) difficult. Companies in this sector are growing through adding new restaurants instead of organic ways. Fine dining restaurants usually tie-up with Corporates for regular footfalls.

Barbeque Nations has grown by adding new restaurants in Tier-I and Tier-II cities. Its recent SSSG has been in the range of 2-5% versus sales growth of 20%+. New acquisition and restaurant addition led to 20%+ Growth in sales.

Barbeque Nation has managed reasonable profitability with ~22% pre-tax ROE on the mature restaurants. Its high PBT margin of 10-12% has bode well for overall profitability. Currently margins at depressed due to new restaurant and suboptimal utilization of mature restaurant from lower footfalls.

Barbeque Nation’s cost structure is high due to higher rental (Lease) and higher raw material costs versus cheaper Jubilant Foodworks. After adjusting for accounting change on leasing, operating margins are around 15% more or less similar to peers.

Capital investment into each restaurant is very high for Barbeque Nation but sales per restaurant are lower versus Dominos or McDonalds. Hence it has a lower ROCE versus Peers.

However, the cash conversion of the company is quite good close to 100% of operating realized in cash flows.

Covid-19 has impacted its sales as Barbeque Nations largely depends on dine-ins versus delivery in other restaurants. This is the reason why it has priced its IPO less aggressively versus listed peers.

Valuation

Barbeque Nation is priced at 2x EV/Sales. Assuming the operating margin of the matured restaurants adj for rent is ~15%, the company is valued at 22x EBITDA on mature restaurants and ~1x Price to sales of newer restaurants. This amounts to a P/E of around 37x on mature restaurants on normalized earnings.

Using cash flow measure, the company is valued ~ 27x free cash flow (ex-growth CAPEX). Alternatively, Jubilant Foodworks recently bought a 10% stake in Barbeque Nations for Rs. 92 Cr, about half the market value asked in IPO. However, one may argue it was due to the strategic benefits Jubilant Foodworks brings to the table.

Considering the sound business model, industry tailwinds, high cash conversion, and not so aggressive valuation we recommend SUBSCRIBE to this issue.

We would wait for the performance to recover from Covid-19 restrictions. The relatively modest valuation reflects a likely delay in financial performance.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 24th March 2021 |

| IPO Close Date | 26th March 2021 |

| Basis of Allotment Finalisation Date | 1st April 2021 |

| Refunds Initiation | 5th April 2021 |

| A credit of Shares to Demat Account | 6th April 2021 |

| IPO Listing Date | 7th April 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 30 | ₹ 15,000 |

| Maximum | 13 | 390 | ₹ 195,000 |

| Date | QIB | NII | Retail | Employee | Total |

| Mar 24, 2021, 05:00 | 0.37x | 0.07x | 6.14x | 0.41x | 1.33x |

| Mar 25, 2021, 05:00 | 0.37x | 0.10x | 9.66x | 0.70x | 1.98x |

| Mar 26, 2021, 05:00 | 5.11x | 3.10x | 13.13x | 1.02x | 5.98x |

When will the Barbeque Nation Hospitality Ltd IPO open?

Barbeque Nation Hospitality IPO will open for subscription on Wednesday, March 24, and will close on Friday, March 26.

What is the price band of Barbeque Nation Hospitality Ltd IPO?

The price band for Barbeque Nation Hospitality IPO is Rs. 498-500.

What is the lot size for Barbeque Nation Hospitality Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 30 shares, up to a maximum of 13 lots i.e. Rs. 1, 95,000.

What is the issue size of Barbeque Nation Hospitality Ltd IPO?

The total issue size is ~ 90.57 Lakh shares raising ~ Rs. 453 Cr.

What is the quota reserved for retail investors in Barbeque Nation Hospitality Ltd IPO?

The quota for retail investors in Barbeque Nation Hospitality IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on April 1 and refunds will be credited by April 5. Shares allotment will be credited in Demat accounts by April 6.

What is the listing date of Barbeque Nation Hospitality Ltd IPO?

The tentative listing of Barbeque Nation Hospitality IPO is April 7.

Where could we check the Barbeque Nation Hospitality Ltd IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Ambit Private Limited, Axis Capital Limited, IIFL Holdings Limited, and SBI Capital Markets Limited.

What does Barbeque Nation Hospitality Ltd do?

Barbeque Nation Hospitality Limited operates Barbeque Nation Restaurants in fine dining space. They also own and operate Toscano Restaurants and You and Barbeque (“UBQ”) by Barbeque Nation.

Who are the peers of Barbeque Nation Hospitality Ltd?

Although the business model wise Barbeque Nation is the only type listed in India. But its peers in the restaurant business are Burger King, Jubilant Foodworks, and Westlife Development Limited.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. The MoneyWorks4me PRO is priced below Rs. 5000 but provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463