Mankind Pharma Limited IPO Details:

Estimated Market Cap 43,264 Cr

IPO Date: 25th April to 27th April

Total shares: 4.00 Cr

Price band: ?. 1026- ?. 1080 per share

IPO Issue Size: ~ ?. 4326.36 Cr

Lot Size: 13 shares and multiples thereof

Purpose of IPO: Offer for sale by existing shareholders

About Mankind Pharma:

Mankind Pharma is engaged in developing, manufacturing, and marketing a diverse range of pharmaceutical formulations across various acute and chronic therapeutic areas, as well as several consumer healthcare products. According to companies, DRHP Mankind is India’s fourth-largest pharmaceutical company in terms of Domestic Sales and second-largest in terms of sales volume for the Financial Year 2022.

Mankind Pharma has a strong focus on the domestic market, with revenue from operations in India accounting for 97.60 % of its total revenue in the financial year 2022. The company has developed 36 brands in the pharmaceutical business and boasts one of the largest networks of medical representatives in the Indian pharmaceutical market.

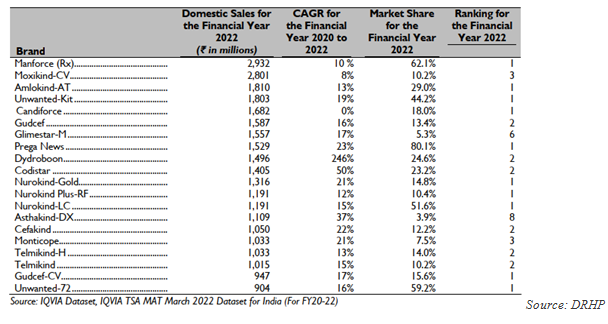

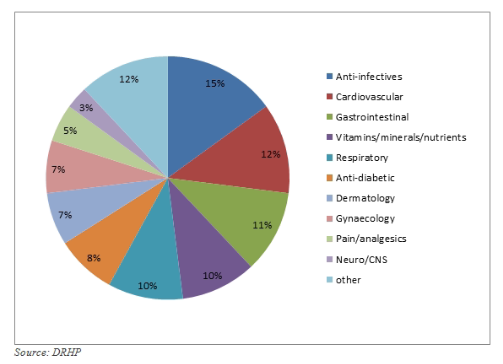

Portfolio of the company in key therapeutic and Revenue breakup from domestic Sales

Company’s highest-selling pharmaceutical brands

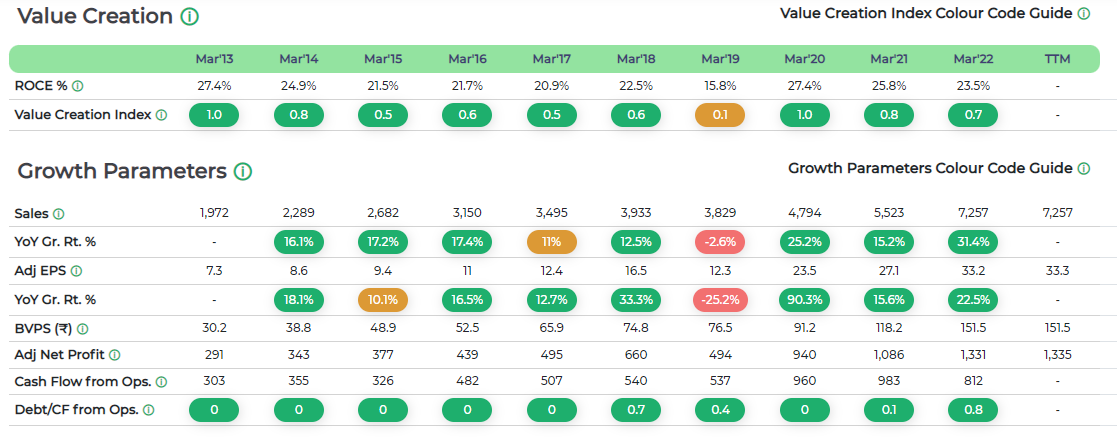

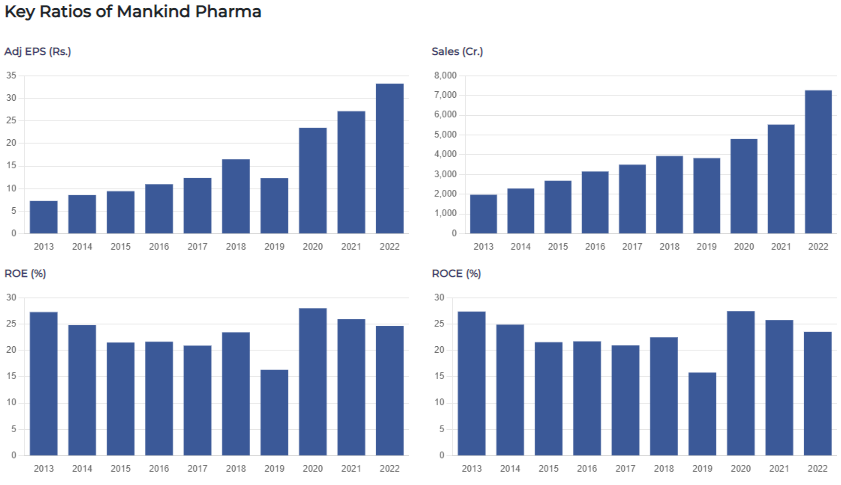

Financial:

Financial:

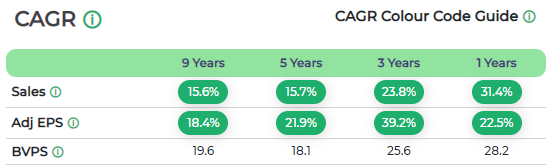

Mankind Pharma has shown consistent revenue growth over the years. The company's revenue has grown at a CAGR of 15.7% over the last five years.

[caption id="attachment_18605" align="aligncenter" width="1117"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

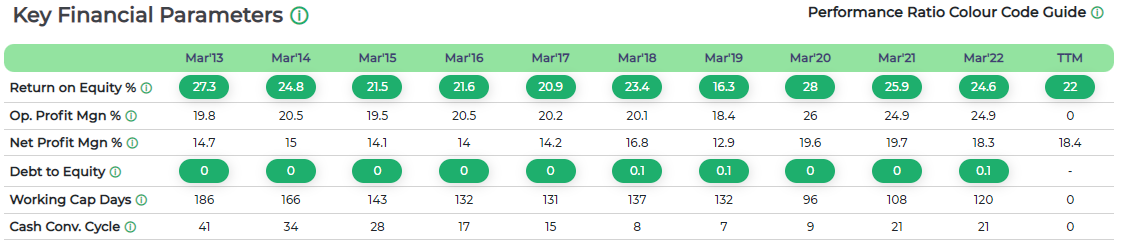

The company's return on equity (ROE) has also been consistently above 20% over the last five years.

[caption id="attachment_18606" align="aligncenter" width="1125"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

Sales growth is well complemented by EPS growth, which indicates that the company is becoming more efficient in generating profits from its sales. This could be due to a variety of reasons, including cost-cutting measures, price increases, or an increase in sales of higher-margin products.

[caption id="attachment_18607" align="aligncenter" width="557"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

Key Financial Ratios and Trends:

[caption id="attachment_18608" align="aligncenter" width="744"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

Management:

Ramesh Juneja is the Chairman and a Whole-Time Director of our Company. He is a founder and Promoter of our Company. He has been associated with our Company since its incorporation as a Director and Promoter. He does not hold any formal educational qualifications. He has experience of over 31 years in the pharmaceutical industry.

Rajeev Juneja is the Vice-Chairman and Managing Director of our Company. He is also a Promoter of our Company and has been associated with our Company since December 22, 1992. He does not hold any formal educational qualifications. He has experience of over 29 years in the pharmaceutical industry.

Sheetal Arora is the Chief Executive Officer and a Whole-Time Director of our Company. He is also a Promoter of our Company and has been associated with our Company since September 21, 2007. He holds a bachelor’s degree in commerce from the Srikrishnadevaraya University, Anantapur. He has experience of over 14 years in the pharmaceutical industry.

Positives:

- Mankind Pharma has a promising business model with a focus on domestic markets and significant potential for future growth.

- The company has a diversified portfolio with strong market positions in key therapeutic areas, including antibiotics, gastrointestinal, and respiratory segments.

- Mankind Pharma has successfully built and grown a consumer healthcare franchise with strong brand recognition, including brands like Manforce Condom, Prega News, and Gas-O-Fast.

- The company has wide market coverage, focusing on affordability and accessibility.

Risks:

- Mankind Pharma may face increased competition and pricing pressures in the future, which could result in a loss of market share and declining revenues and profits.

- The pharmaceutical and consumer healthcare industry is heavily regulated, and companies must obtain and maintain numerous approvals, licenses, and registrations in order to operate.

- Mankind Pharma generates a significant portion of its revenue from India and relies on third-party distributors and retailers for the sale and distribution of its products, which could impact its ability to effectively market and distribute its products.

Valuation:

Of the many Pharma IPOs since 2015, only half of them are trading above their offer price some of which are Syngene, Alkem, Laurus, Tatva Chintan with listing TTM PE from 20-45X. Based on the price band, the company is being listed at Rs 43,000 crore at the upper end of the price band. This implies a price-to-earnings (P/E) ratio of around 31x to 32x based on TTM earnings.

ChrysCapital bought a 10% stake in Mankind Pharma in 2018 for about 2200 Crores which valued the company at around 22,000 crores at 6X P/S and 33 times FY18 Earnings. The current listing is happening at the same valuation when the revenues have doubled over the last 5 years. Based on our Proprietary valuation tool, the stock is expected to list near our fair value estimate.

MoneyWorks4Me Opinion

The key drivers for growth in the pharmaceutical market include rising income levels, government initiatives promoting healthcare access, increasing life expectancy, and the growth of lifestyle diseases. Mankind Pharma has significant revenue generation potential in segments such as diabetes and cardiovascular diseases, which are expected to drive growth in the pharmaceutical market. The increase in health insurance coverage is also expected to drive growth by providing greater access to healthcare products and services.

Mankind Pharma has acquired a formulation brands business which has enabled it to enter new fields like oncology and transplants. Additionally, it’s expanding its portfolio into anti-diabetes and heart failure therapy. Furthermore, Mankind has acquired an asthma treatment brand from Dr Reddy's Laboratories, allowing it to break into new chronic therapies. However, the company has not provided any details on their impact on its earnings.

Considering the aforementioned growth drivers, Mankind Pharma appears to be well-positioned to benefit from the favourable environment in the pharmaceutical industry. Its diversified portfolio, established consumer healthcare franchise, and significant manufacturing and R&D capabilities, the company is poised to capitalize on the rising demand for healthcare products and services. Additionally, the company's focus on affordability and accessibility, wide market coverage, and successful brand recognition bodes well for its future growth prospects.

Recommendation: Aggressive investors can Apply

Mankind Pharma is expected to do well over the next few years as it wins more clients & orders. Even if the valuation is stretched (already assumes very good execution and growth in the next 2 years), we would recommend aggressive retail investors can apply for 1-2 lots. One may choose to sell on the listing day if the price gain is more than 15%-20%.

Important points to consider:

- IPOs in a popular sector often gets oversubscribed and retail investor is fortunate if he receives even 1 odd lot (Rs 15,000) in IPO allotment. Since this investment amount is small for our average investor, we recommend SUBSCRIBE in good companies with favorable prospects over the medium term.

- However, do not consider large investments in IPO stocks post-listing as they get listed at even higher valuation; additionally, they may overpromise for IPO success but under-deliver in reality.

- Conservative investors who wish to own a portfolio of Core companies must avoid investing in expensive or mid-small cap IPO.

Mankind Pharma Ltd IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | Apr 25, 2023 |

| IPO Close Date | Apr 27, 2023 |

| Basis of Allotment Date | May 03, 2023 |

| Refunds Initiation | May 04, 2023 |

| A credit of Shares to Demat Account | May 05, 2023 |

| IPO Listing Date | May 08, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 13 | ? 14,040 |

| Maximum | 14 | 182 | ? 196,560 |

Mankind Pharma Ltd IPO Subscription Status:

| Date | QIB | NII | Retail | Total |

| Day 1 April 25, 2023 | 0.08x | 0.33x | 0.11x | 0.15x |

| Day 2 April 26, 2023 | 1.86x | 1.02x | 0.25x | 0.88x |

| Day 3 April 27, 2023 | 49.16x | 3.80x | 0.92x | 15.32x |

Mankind Pharma Ltd IPO Faqs:

Mankind Pharma Limited IPO - Apply or avoid?

Mankind Pharma is expected to do well over the next few years as it wins more clients & orders. Even if the valuation is stretched (already assumes very good execution and growth in the next 2 years), we would recommend aggressive retail investors can apply for 1-2 lots. One may choose to sell on the listing day if the price gain is more than 15%-20%.

When will the Mankind Pharma Ltd IPO open?

Mankind Pharma Ltd IPO will open for subscription on Tuesday, 25th April 2023, and closes on Thursday 27th April 2023.

What is the price band of Mankind Pharma Ltd IPO?

The price band for Mankind Pharma Ltd IPO is Rs. 1026-1080/share.

What is the lot size for Mankind Pharma Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 13 shares, up to a maximum of 14 lots i.e. Rs. 1,96,560/-.

What is the issue size of Mankind Pharma Ltd IPO?

The total issue size is ~ Rs. 4,326.36 Cr.

What is the quota reserved for retail investors in Mankind Pharma Ltd IPO?

The quota for retail investors in Mankind Pharma Ltd IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on May 3rd and refunds will be initiated by May 4th. Shares allotment will be credited in Demat accounts by May 5th.

What is the listing date of Mankind Pharma Ltd’s IPO?

The tentative listing date of Mankind Pharma Ltd IPO is May 8th 2023.

Where could we check the Mankind Pharma Ltd IPO allotment?

One can check the subscription status on KFintech Pvt Ltd.

What does Mankind Pharma Ltd do?

Mankind Pharma is engaged in developing, manufacturing, and marketing a diverse range of pharmaceutical formulations across various acute and chronic therapeutic areas, as well as several consumer healthcare products.

Who are the peers of Mankind Pharma Ltd?

Listed company peers for Mankind Pharma are Glenmark Pharma, Alembic Pharma, Ajanta Pharma, Granules India, etc.

What if I do not get the allotment?

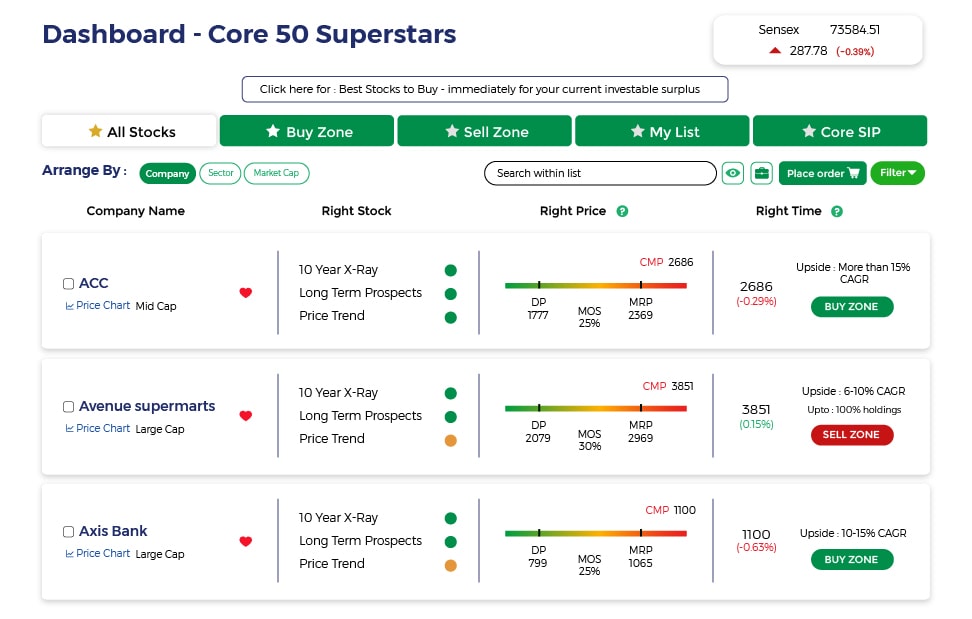

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Download APP

Download APP

Comment Your Thoughts: