“Sensex falls 450 points on FII selling.” – a headline seen frequently in the newspapers when the stock market drops. Infact during the crash of 2008 millions of retail investors witnessed heartache and were left high and dry as FIIs pulled out their money like there was no tomorrow. Over the last few years the India stock market has become a favoured destination for FIIs and subsequently has also become subject to their whims and fancies.

With tremendous buying and selling power in their hands, FIIs can change the course of the market within minutes leaving retail investors baffled. Afterall if the FIIs are moving in and out of a stock there’s nothing much we retail investors can do, can we? There is no way to stop them from buying or selling! But what if we could benefit from FIIs and the money that they pour in the markets? You must be wondering is it even possible Yes, it is! And the trick here is to be one up on the FIIs and know when is the right time to enter or exit a stock. But before we get into the details of how to do this, let’s know more about FIIs.

What are FIIs & how do they affect the stock markets?

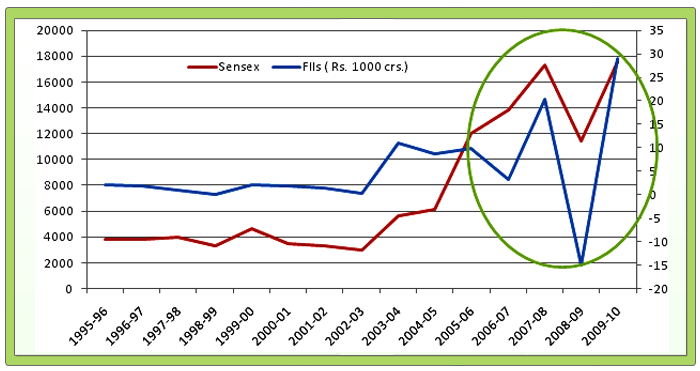

FIIs (Foreign Institutional investors) refers to entities (banks, insurance companies, mutual funds etc) registered in a country other than in which they are investing. For e.g. a US Mutual Fund which invests in the Indian Stock Market. FIIs usually pool large sums of money and invest those in securities, real property and other investment assets. As bulk of their investments are in the stock market, they affects the stock market movement significantly. To get an idea of this look at the graph below.

The chart plotted above shows that there is a positive correlation between FII investment & Sensex. Also look at the encircled region on the chart. It shows that the rise of Sensex in 2007 was largely fuelled by the money pumped in by the FIIs which led to the market touching 20,000, but in 2008, with the global economy in doldrums, the FIIs were net sellers and took the market down.

So, why do FIIs enter or exit the stock market?

Like any other investors, FIIs are on the lookout for investment opportunities which could give them better rates of return. With this being the prime focus, emerging markets like India, China, Brazil etc. have caught their eye over the last few years. These countries have been growing at a greater pace than other developed countries and subsequently offer better opportunities for the FIIs. With one of the highest GDP growth rates over the last few years, India has also experienced one of the highest Net FII inflows in the world. Other than the growth prospects there are other important parameters like political environment, laws, liquidity of their investment etc.

But then what prompted the FIIs to pull out their money in 2008?? Did the growth story go bust? With the Sub Prime Crisis in US, fears of a worldwide economic crisis ran amok. This coupled with a liquidity crunch or a preference to sit on cash led to a situation where many FIIs booked profits and pulled out their money. As more and more money was pulled out, it further depleted the investor confidence and the stock market tumbled to 8000 levels. Thus FIIs tend to exit the stock markets prompted by profit booking or negative events like liquidity concerns, fears of a crisis etc.

Thus, though FIIs are a welcome site for any stock market, they also have the potential to create chaos in the stock market

So, are the FIIs good for a developing economy like India?

Apart from the money that is brought in, FII investment is a testament of increasing global investor confidence in a particular economy and stock market.

For a country like India this money brought in by the FIIs adds to the foreign reserves which can be used to import oil, machinery etc. With increased FII investment in a country and the increased confidency about the economy, FDI (Foreign Direct Investors) follow suit. Foreign Direct Investment involves long term participation by investors to a foreign country taking part in management, joint- venture, technology exchange etc. FDI investment actually contributes to the development of a country.

How can you analyze FII investment in your stocks and benefit from it?

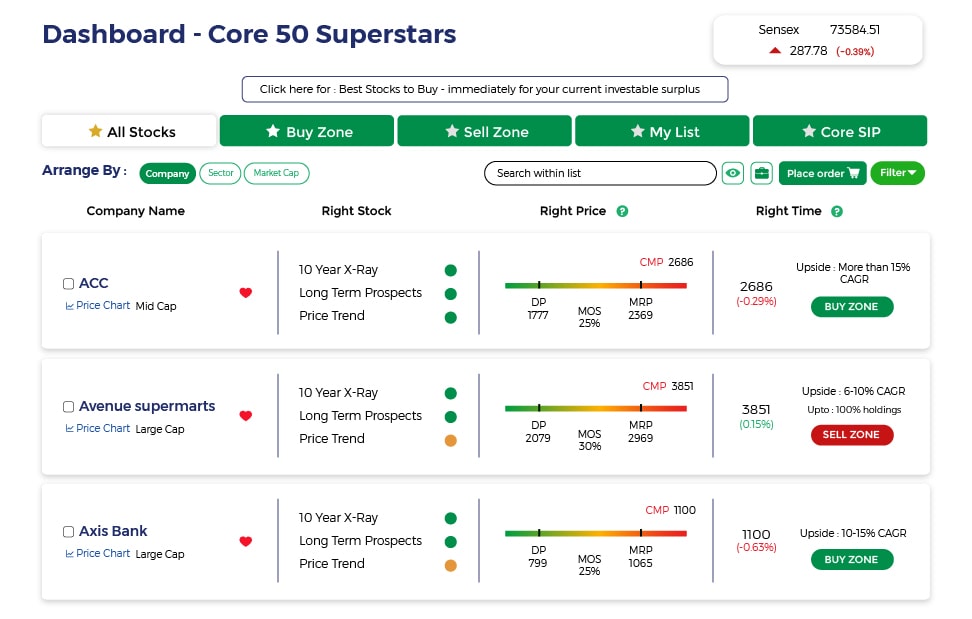

While analyzing FII investment, you must check the following things:

1. Find out the % holding of FIIs in the stocks you have invested or plan to invest

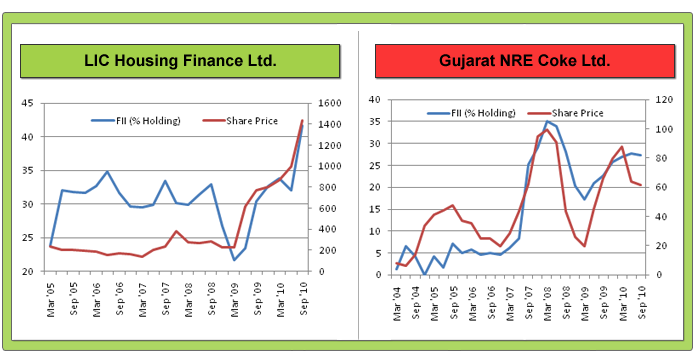

The two charts show the share prices of two companies viz. LIC Housing Finance and Gujarat NRE Coke plotted against the respective FII Holding in these stocks on a quarterly basis. A couple of noteworthy things from these graphs are

- When % holdings of FIIs increases in a stock its stocks price goes up and when it drops, its share price comes down.

- LIC Housing finance had a more or less steady contribution of FII as a percentage of total shareholding till 2007. After a fall in 2008 it bounced back again to a significantly high level by September 2010. However, in case of Gujarat NRE Coke, % of FIIs holdings has fluctuated quite a lot during the same period.

Why was the FII holding in Gujarat NRE Coke so volatile as compared to the steady holding in LIC Housing Finance?

During the crash in 2008 the FII holding in LIC Housing Finance decreased to close to 20%. Some of the FIIs exited from LIC Housing Finance, but still its percentage in total shareholding remained in mid 20s. This was the reason the stock price of LIC Housing Finance went down but did not take a nose dive. Also, LIC housing Finance was able to perform remarkably even during the downturn and has shown consistent growth in the last 5-6 years. Thus, the FIIs started investing back and its % share holding has increased to 41.07% by Sep 2010. This is an example of FII holding in a growing company which has led to greater stock price appreciation rather than adding to its volatility.

But, this was not the case with Gujarat NRE Coke. You could see from the chart that in 2007 FIIs had a total holding of above 35% but it came down drastically to 17% by the end of 2008. The performance of Gujarat NRE during 2005-10 has not been very impressive and also its high debt situation is a cause of worry. This was the basic reason of a sudden exit of FIIs which led to a drastic fall in its share price. Thus we can conclude that the FIIs invested in this company were interested in quick gains. They added to the volatility of the stock which is not good for the retail investors.

Remember, FIIs are not the cause of a growth of a company they come after the growth has actually started. So investing in a fundamentally strong company which has good future prospects too at a discounted price is the key investment mantra that you should follow.

2. Also, look for the no. of FIIs in a company. If the number is too large then it’s easier for the individual entities to move out of a stock which would make stock price of the company very volatile and risky. So, investing in a company which has smaller number of FIIs could be a safer investment option.

Now, you know how FII investments affect the price of a stock. So, how do you utilize this information to benefit in the stock market? The trick here is to find a fundamentally sound company which has had a consistent and stable FII shareholding and to add it to your watchlist. When some FIIs exit from a good stock, its price actually falls thus giving you a good chance of investing in it. However be sure to check the reason for the FIIs exiting the stock. If it is due to change in the fundamentals of the company, it is a negative sign. Thus the trick is to buy the stock when it is available at discount and exit it when it crosses it MRP. You should not be waiting for FIIs to exit. If you wait, it might be too late.

FII is thus an important economic indicator which can help us analyze a particular stock and the whole stock market in a better manner. FIIs are beneficial for Indian economy and also our stock market. But rather than getting confused by the FIIs entry and exit, its time you play the smart game and stay one step ahead.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: