Start Right to build a strong portfolio that enables you to:

1. Make informed investing decisions right for you.

How to Invest Successfully and Achieve your Financial Goals

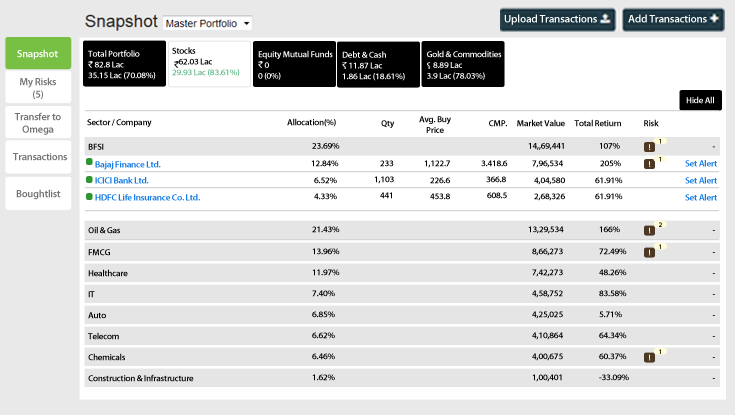

Use MoneyWorks4me effectively

2. Build and Manage your portfolio for success

Invest your current surplus right away in set of high quality stocks and continue investing your regular monthly savings as SIP in Model Core Portfolio

Add Core Stocks at attractive prices to earn higher returns.

Take buy, sell or hold actions confidently with access to our research.

Strong brands, deep distribution, switching cost, patents, low cost enables them maintain growth and profitability even in difficult conditions.

These businesses have people, processes, and systems in place to weather most challenges.

These companies are widely analyzed and attract large number of investors ensuring long term stock prices reflect company performance.

They are the last to be impacted in times of economic downturns and first to recover as they have high bargaining power and robust management.

Strong brands, deep distribution, switching cost, patents, low cost enables them maintain growth and profitability even in difficult conditions.

These businesses have people, processes, and systems in place to weather most challenges.

These companies are widely analyzed and attract large number of investors ensuring long term stock prices reflect company performance.

They are the last to be impacted in times of economic downturns and first to recover as they have high bargaining power and robust management.

Everything to build and manage a Core Portfolio

When we find a new worth covering stocks under our coverage, we introduce the same under our research and track it for you.

Core Superstars enables you to build a strong stocks portfolio of high quality large sized companies through a Model Core Portfolio and also through additional buy recommendations from the top 50 Core Superstars.

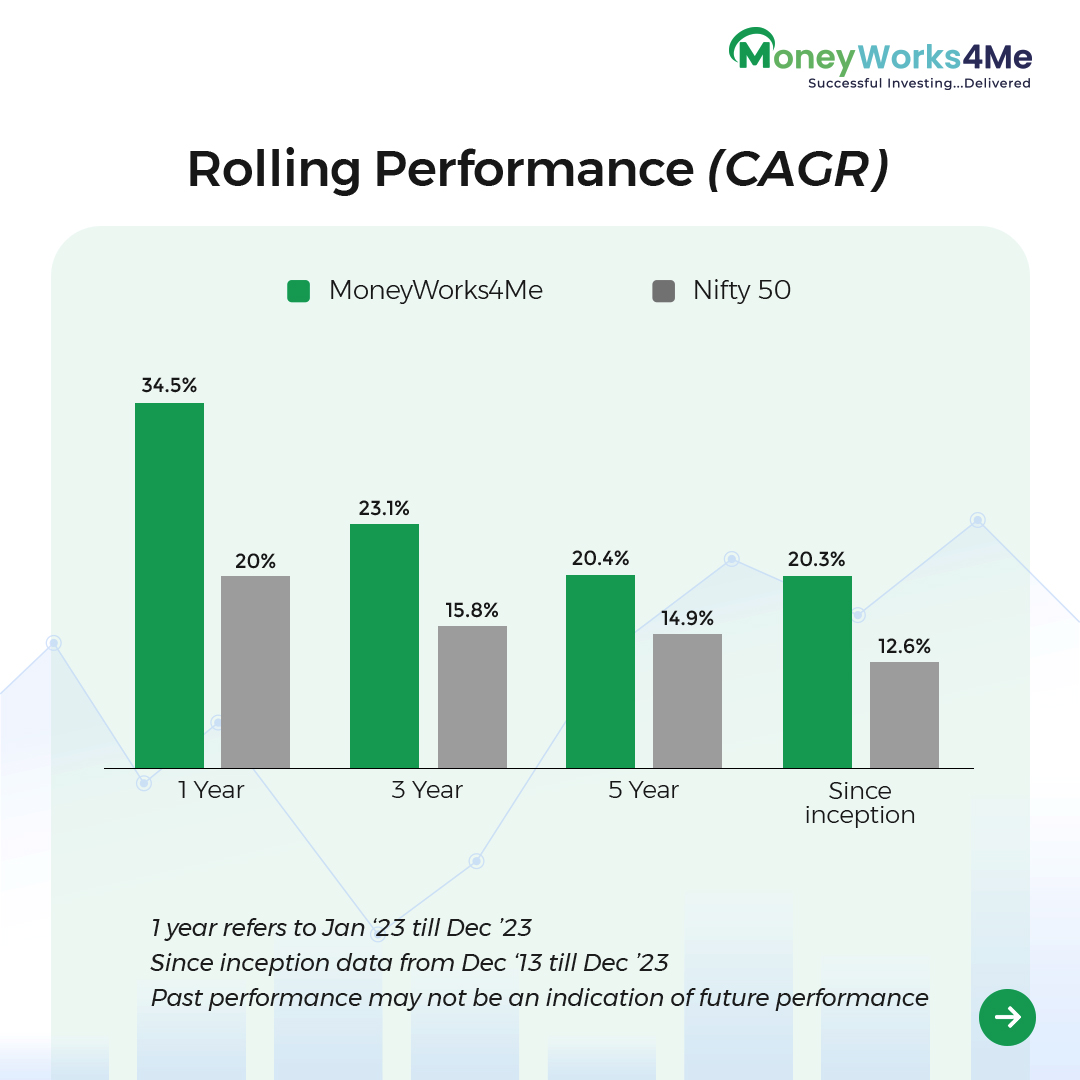

Portfolio built with Core Superstars provides robust returns in long term and has a stable foundation to withstand economic and market down turns and recover faster.

That’s because Core Superstars covers the best quality companies. Companies that are in good financial shape, have pricing power over its peers, and sell products that people buy even during deep recessions. These strong companies are structured and operate in such a way that they can withstand the economic downturns.

Bluechip companies are well known, but having this list doesn’t translate into good investments unless they are bought at a right price. And very often prices of such stocks are high to very high, making it difficult to invest in them. Some ‘stable’ bluechip companies are at times so highly priced that future returns are likely to be mediocre for a few years.

From time-to-time good companies are available at a reasonable price but this is accompanied by some ‘bad’ news and most people avoid investing in them out of fear. Such opportunities don’t feature in most model portfolios. Then again even if one does own such companies, one may lose conviction to hold on to them when they run into a tough situation.

And lastly figuring out at what price should one reduce or exit a stock and invest in another opportunity when there are no obvious performance-related triggers?

Core Superstars helps you build a strong portfolio using multiple methods

It is true that multi-cap approach tends to earn higher returns than large cap companies. But as a beginner in stocks or with smaller portfolio, succeeding is more important than earning a higher return because that ensures you becomes a committed stock investor. A poor experience at this stage can put off people from investing in stocks and that is a major loss. It is wise to own predominantly large cap portfolio as you can concentrate and learn about few stocks and experience lower volatility versus a multi-cap portfolio. As your portfolio and experience grows you can upgrade to a multicap portfolio.

Large cap performance has been substantially higher than inflation and fixed income options in all periods. The consistency in returns is much higher with more than 85% chance of a positive return over any 3 year period. Large cap generate returns in range of 7-12-15% and with an average of 12%+ p.a. in past. At 12% CAGR, your investment quadruples (4X) every 12 years. With Core Superstars philosophy of buying companies at right price can further add to returns. These are very good returns to meet your goals.

You can systematically buy stocks in Model Portfolio, or top stocks to add today. These stocks are mostly Quality at Reasonable Price with very good medium term prospects. For queries, call us at (+91)-20-67258333 or mail: besafe@moneyworks4me.com